ETH Shock 2024

![]() Team Biden Surrenders to Crypto

Team Biden Surrenders to Crypto

This month, Donald Trump vowed to “end Joe Biden’s war on crypto”... and became the first U.S. President to accept campaign donations in Bitcoin.

This month, Donald Trump vowed to “end Joe Biden’s war on crypto”... and became the first U.S. President to accept campaign donations in Bitcoin.

“Trump also hosted a roundtable in Mar-a-Lago with some of the nation’s largest Bitcoin miners, and committed to support Bitcoin mining both in Washington D.C. and on the global stage,” says an article at Bitcoin Magazine.

On the other hand: “For the past four years, the Biden administration has taken a hostile stance toward the Bitcoin and crypto industry.”

For example?

- “Biden compared crypto traders to ‘wealthy tax evaders’

- The Biden administration has also proposed a 30% tax on electricity used for Bitcoin mining

- President Biden vetoed legislation that would have allowed highly regulated financial institutions to custody Bitcoin and cryptocurrencies

- His administration published an economic report highly critical of Bitcoin and proof-of-work mining…

“… while promoting a central bank digital currency (CBDC),” underscores Bitcoin Magazine.

(The president, of course, would endorse CBDCs — or what Paradigm’s macro expert Jim Rickards first called “Biden Bucks” in June 2022.)

But since Trump is clearly courting the crypto vote, Team Biden is now doing likewise…

But since Trump is clearly courting the crypto vote, Team Biden is now doing likewise…

Exhibit A: According to a leaked private email, U.S. Congressman Ro Khanna (D-CA) is “set to host a Bitcoin and blockchain roundtable in Washington D.C. in early July,” the article says, with the intended outcome to “keep Bitcoin and blockchain innovation in the United States.”

Khanna further touts the roundtable as “the most significant meeting between policymakers and innovation leaders in blockchain to date.”

Exhibit B: “The Biden Administration is in talks to accept crypto donations through Coinbase Commerce, following Trump who also started [accepting] donations through Coinbase,” says Bitcoin Magazine.

Exhibit C? On Tuesday, Biden’s Securities and Exchange Commission (SEC) waved a white flag…

As poorly worded as this X-tweet is (heh), the gist is the SEC is no longer at odds with Ethereum’s status.

To clarify, the SEC admits ETH is not a security.

For more on the second-place crypto today, we turn to Paradigm editor and bleeding-edge crypto enthusiast Chris Campbell.

“In a report titled ETH 2030 Price Target and Optimal Portfolio Allocations, VanEck outlined potential scenarios that have Ethereum's price eclipsing $150,000 per token by the end of this decade,” Chris says.

“In a report titled ETH 2030 Price Target and Optimal Portfolio Allocations, VanEck outlined potential scenarios that have Ethereum's price eclipsing $150,000 per token by the end of this decade,” Chris says.

“Bold? Yes. BUT…

“The prediction reveals the supply and demand dynamics poised to supercharge Ethereum's value in the years ahead.

“Two years ago, Ethereum upgraded to a lesser-known deflationary burn mechanism which destroys ETH used for transaction fees.

“The more Ethereum is used, the more Ethereum is burned.

“Ethereum hasn’t really seen a raging bull market with this burn mechanism in place.

“Adding fuel to this potential fire…

“Since the recent approval of Ethereum ETFs on May 23, over $3 billion worth of ETH has been siphoned off centralized exchanges and into cold storage,” Chris notes.

“Since the recent approval of Ethereum ETFs on May 23, over $3 billion worth of ETH has been siphoned off centralized exchanges and into cold storage,” Chris notes.

“This follows $500 million exiting exchanges in a single April week, leaving just 10.6% of the total circulating supply readily available on trading platforms –- the lowest levels in six years.

“When (not if) the ETFs soak up more of this dwindling supply, the stage is set for a buying frenzy exacerbated by Ethereum's burn mechanism,” he says.

“That’s the case VanEck is making.

“They’re not the only ones…

“K33 Research forecasts up to 1 million ETH, worth over $3 billion at current prices, could be absorbed by U.S. ETFs upon launch. This would represent 1% of total supply.

“But that’s not all…

“Another compounding factor is the appeal of staking and ‘re-staking’ Ethereum for yield rewards,” Chris continues.

“Another compounding factor is the appeal of staking and ‘re-staking’ Ethereum for yield rewards,” Chris continues.

For some background: Back in 2022, Ethereum switched from a proof-of-work model to a proof-of-stake “mining” model.

“Part of ETH 2.0,” said Paradigm’s James Altucher at the time, “is that a validator of transactions risks losing its staked coins if it validates a fraudulent transaction.

“So some stakes will eventually get burned because of this.”

Chris adds: “When coupled with demand from newly launched ETFs, Ethereum appears poised for a self-perpetuating supply shock cycle.

“Ethereum's scarcity tailwind strengthens further if the SEC ultimately permits ETFs to stake and earn yield, generating fresh incentives for accumulation by wealth managers.”

Chris’ key takeaway?

“While VanEck's $154K prediction seems outlandish today,” he says, “Ethereum's confluence of dwindling supply, soaring institutional demand and deflationary burn mechanics could…

“... as they say in crypto: Melt faces.”

After months of research, Paradigm’s crypto team has compiled a list of their Top Six cryptos.

And five of them trade for less than $4…

That means almost anyone can invest today — and potentially be set up for life-changing wealth in the next 12–18 months.

Click here now to understand the sheer profit potential ahead.

![]() Market Turbulence: Incoming

Market Turbulence: Incoming

“No one could have predicted five years ago that Nvidia would increase by 35X and become bigger than Amazon and Apple,” says Paradigm’s AI pioneer James Altucher.

“No one could have predicted five years ago that Nvidia would increase by 35X and become bigger than Amazon and Apple,” says Paradigm’s AI pioneer James Altucher.

“Right now, Nvidia is in an enviable position developing the chips necessary for running AI. They’ve practically cornered the market.

“Anyone building AI technology is stuck using Nvidia’s hardware because of an early lead Nvidia secured in developing these high-end graphics processing units (GPUs).

“Nvidia’s success has also made them a target,” James says.

“Nvidia’s biggest customers — large tech companies like Microsoft, Facebook, Google, Amazon and Apple — are all working to develop their own GPUs so they don’t have to rely on Nvidia long-term.”

All to say, it won’t always be “sunshine and rainbows” for Nvidia.

Which is why James is recommending subscribers at Altucher’s Investment Network — where James first recommended buying NVDA shares in September 2023 — to sell half their position and let the rest ride.

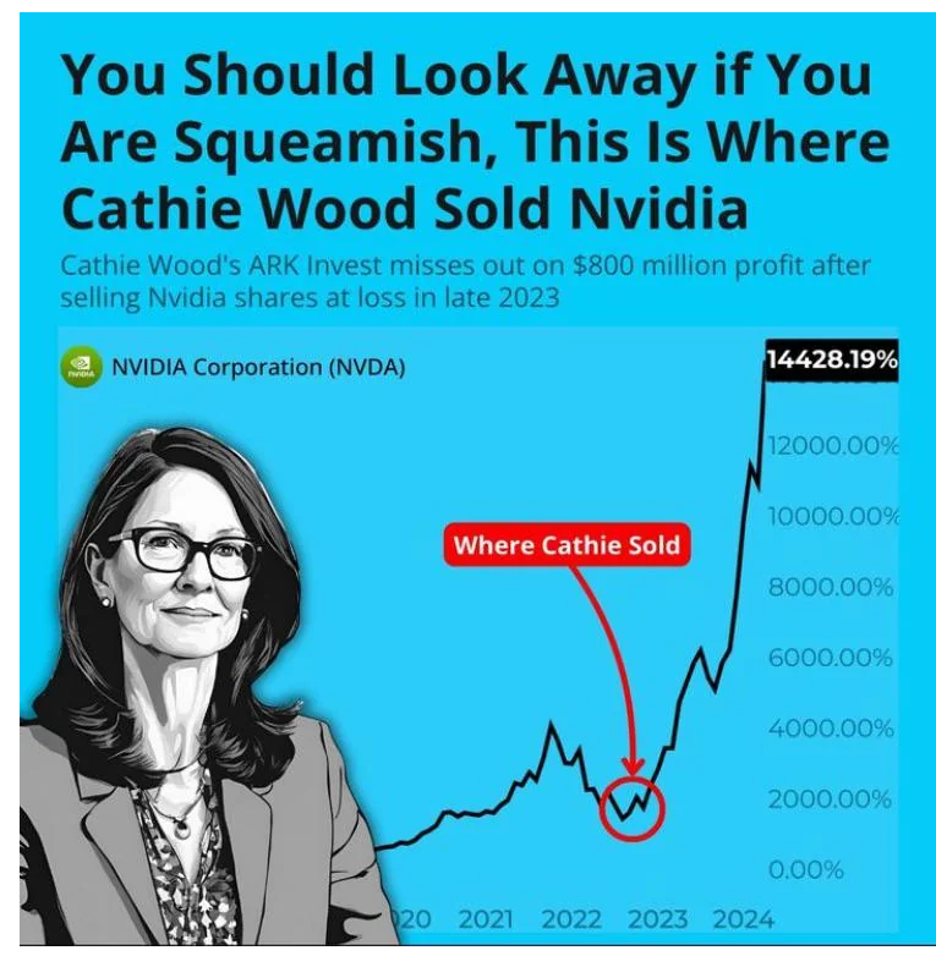

(Ahem, unlike Cathie Wood’s Ark Invest Innovation ETF which all but completely cashed out of Nvidia last year… in a case of bad flippin’ timing.)

James concludes: “We’re sitting on a nice triple-digit return here (200%)...

“So let’s make the smart money management move today and lock in some of our hard-earned profits.”

If you’re not a subscriber at Altucher’s Investment Network, you should know AI 2.0 will change fortunes forever.

To capitalize on this once-in-a-generation “Wealth Window,” view James’ three AI wealth-building strategies… before the “Wealth Window” descends on June 25, 2024.

Turning to the stock market today, all three major U.S. indexes are in the red.

Turning to the stock market today, all three major U.S. indexes are in the red.

The Dow is down the least, a mere fraction of a percent to 39,125. As for the S&P 500 and Nasdaq — each are down about 0.20% to 5,460 and 17,675 respectively.

All of which concurs with what Paradigm’s trading pro Greg “Gunner” Guenthner said yesterday: “I do think leading stocks need a break sooner rather than later.” Most notably? NVDA is down 3.5% at the time of writing.

“Feels closer to a blow-off event than simply the middle of an ongoing rally,” he adds. “While it’s true that conditions like these can last a lot longer than we might think, I have to believe the trend is getting extremely stretched here. Breadth is simply too narrow… too many 52-week lows popping up… too many 1999 parallels…

“To be clear: I’m not predicting a crash — I’m not overly bearish at the moment.” However, Gunner does forecast market volatility this summer.

Commodities, too, are hanging out in the red. Crude, for instance, is down 0.75% to $80.67 for a barrel of WTI. Meanwhile, Mr. Slammy’s at it again? Gold’s down 1.60% to $2,331.40 per ounce while the price of silver’s down almost 4%, below $30.

The crypto market’s wilting today: Bitcoin is down 2% to $63,500. Ethereum? Down 1.25% to $3,475.

And the National Association of Realtors (NAR) reports May existing-home sales in the U.S. slipped 0.7% from April and about 2.8% annually. Meanwhile, the median existing-home sales price increased 5.8% year-over-year to a record-high $419,300.

More on U.S. housing in a moment…

![]() Cracks in the Foundation

Cracks in the Foundation

“The housing market is crumbling in 2024,” says Paradigm’s macro expert Jim Rickards.

“The housing market is crumbling in 2024,” says Paradigm’s macro expert Jim Rickards.

“Few Americans remember the early 1980s when mortgage rates were 13% but inflation was 15%,” he says. “That combination yielded a low real rate of negative 2.0%.”

Meaning, while interest on your mortgage might have been an eye-watering 13%, interest on your savings account in the early 1980s was 2% higher.

“Those days are gone,” Jim emphasizes. “Today, using the five-year adjustable-rate mortgage rate minus recent CPI, real interest rates are positive 3.30% — or 4.10% if you use the 30-year fixed mortgage rate.”

And that’s just one of the variables working against homebuyers in 2024…

- “Real incomes are also flat to down,” Jim notes. Plus? “Income is consumed by inflation in non-discretionary spending (food, gasoline, home heating, etc.) so that little to nothing is left over to fuel new home sales

- Many prospective homebuyers might be able to manage a monthly payment but cannot easily scratch together a 20% down payment for a conforming mortgage

- Job creation and unemployment are also misunderstood and misreported,” says Jim who defers to the Bureau of Labor Statistics’ household survey, finding the “economy lost 400,000 jobs in May.”

Meanwhile, if anyone’s expecting a soft landing for homebuyers in the near future, Jim says: “The Federal Reserve has shown no sign of cutting its policy rate until late this year at the earliest.

“If inflation and interest rates do come down,” Jim says, “it will not be for the reasons the housing bulls imagine. It will be because the U.S. has moved into a recession. At that point, inflation won’t matter much because the Fed will cut rates to fight higher unemployment and recession.

“The upside case for new housing,” Jim concludes, “is the least likely outcome in the current economic environment.”

[Shameless plug: For a more granular look at U.S. housing, follow up with our highlight issue tomorrow.]

![]() Hertz Hijinks

Hertz Hijinks

In a case of rental-car hijinks, a Hertz customer was charged for a traffic violation that happened before he even picked up his rental.

In a case of rental-car hijinks, a Hertz customer was charged for a traffic violation that happened before he even picked up his rental.

At Calgary Airport, where a customer rented a car on May 15 for six days, a clerical error recorded his pick-up time at 10:30 a.m… instead of his 10:30 p.m. reservation.

This time discrepancy led to two expensive snafus.

First, he was billed for an additional day.

Perhaps more galling, he was charged $436.50 for a red-light violation that took place hours before the customer even arrived at the airport.

“I sent Hertz a scan of my AA boarding passes,” the customer says at FlyerTalk forum, “which show that I was en route [and] did not even arrive at Calgary until shortly before 10 p.m.

“They refunded the extra day charge, but that was all.

“I'm sitting on this big traffic ticket,” he says, “as well as various small charges connected with the extra day.

“No further response to my emails, and unable to reach anyone by telephone.”

Ouch. That… Hertz.

![]() “The Big B” to “The Lazy B”

“The Big B” to “The Lazy B”

“Being a Seattleite all my life, back in the day (’60s and ’70s), Boeing was THE company here,” says a longtimer about Tuesday’s Boeing-centric episode.

“Being a Seattleite all my life, back in the day (’60s and ’70s), Boeing was THE company here,” says a longtimer about Tuesday’s Boeing-centric episode.

“Generations of machinists and engineers proudly worked and produced a quality product at ‘The Big B’ where an old saying went ‘If it ain’t Boeing, I ain’t going.’

“Then they bought McDonnell Douglas. What happened? Management brought in MDC idiots who infiltrated the atmosphere with a profit-before-anything attitude.

“Then both city and state legislators just couldn’t keep their hands off those profits and just had to get more and more taxes and fees.

“The final nails in the coffin: moving the corporate headquarters to Chicago and some manufacturing to South Carolina.

“Boeing has forever changed, and their impact here has already been reduced.

“Sadly, it’s living up to its latest nickname: ‘The Lazy B.’”

Emily: Lazy? When literal lives are at stake…

In a fantastic report from Maureen Tkacik at The American Prospect, she nails Boeing as “an institution [in] a perpetual state of unlearning all the lessons it had absorbed over a 90-year ascent to the pinnacle of global manufacturing.”

On that unfortunate note, we bid you a good weekend. We’ll talk more Monday…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets