This Is No Ordinary Gold Rally

![]() They’re Still Stacking Gold

They’re Still Stacking Gold

The gold rally of 2022–24 has been a strange one, for sure.

The gold rally of 2022–24 has been a strange one, for sure.

By and large, everyday retail investors have missed out.

The World Gold Council tracks inflows and outflows to gold ETFs like GLD — the main vehicle through which Joe Average gets exposure to precious metals.

Only since May has investor money been flowing into the gold ETFs. Before that, money had been flowing out for three straight years — even as gold rallied from $1,800 to over $2,350.

So what drove the rally if mom-and-pops weren’t buying?

We can’t underscore this phenomenon often enough: It’s central banks around the world that are loading up on gold and driving the price higher.

We can’t underscore this phenomenon often enough: It’s central banks around the world that are loading up on gold and driving the price higher.

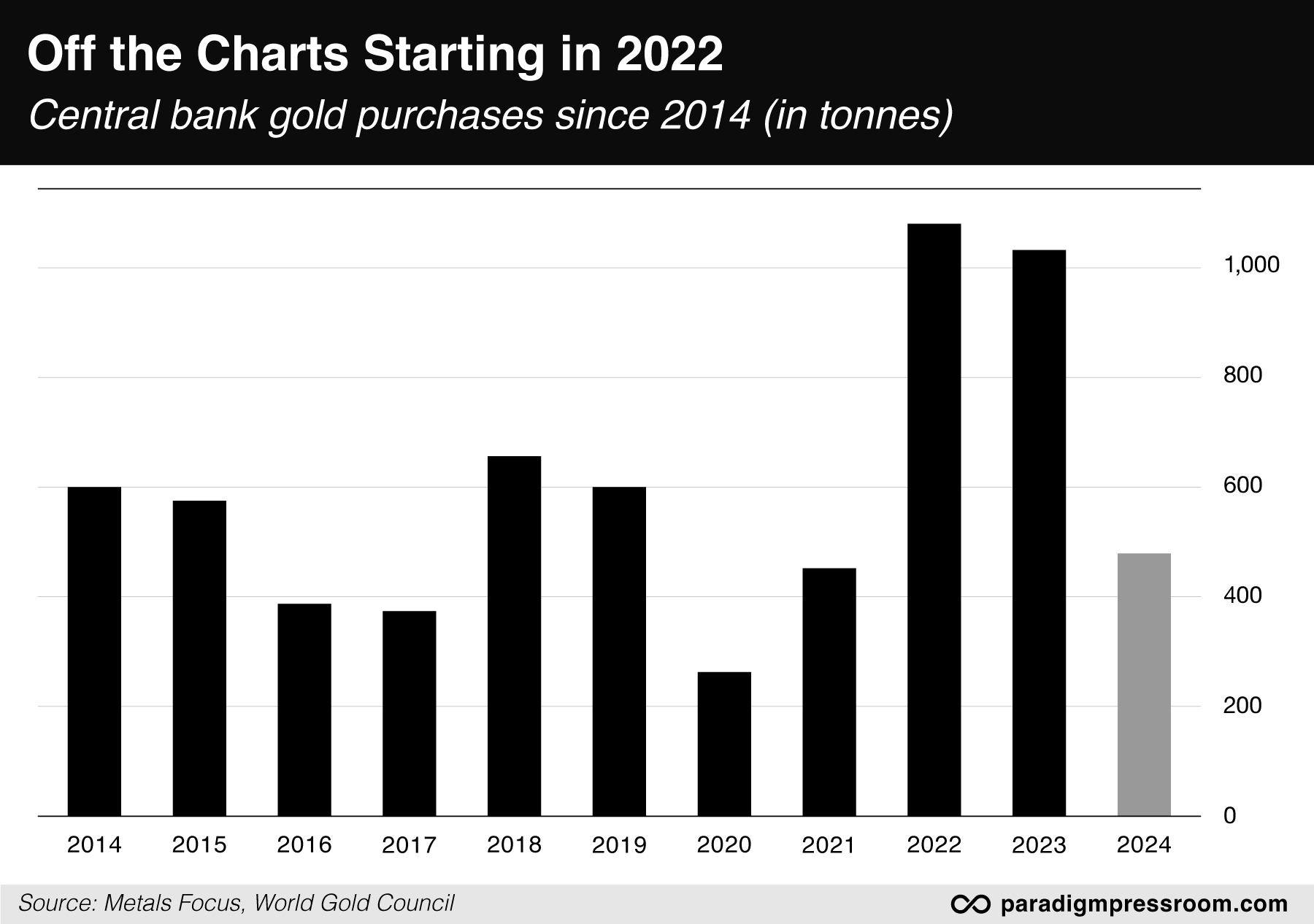

The World Gold Council also tracks gold buying and selling among central banks. Throughout the 1990s and 2000s, central banks around the world steadily emptied their vaults. But in 2009, central banks became net buyers of gold.

The buying proceeded at a measured pace until 2022 — when it went off the charts. 2023’s buying was nearly as furious. And if the buying during the first half of this year continues, 2024 will nearly equal 2023’s levels.

We also can’t underscore the reasons behind this phenomenon often enough. The fact the buying frenzy started in 2022 was no random occurrence.

When Russia invaded Ukraine, Washington froze $300 billion in dollar-based assets held by the Central Bank of Russia. All of a sudden, supposedly “safe” assets like U.S. Treasuries looked very risky indeed.

Even U.S.-friendly governments are wary of Washington’s financial jackboot: “The international reach of U.S. sanctions makes the U.S. the economic policeman of the planet,” said the French finance minister in 2018, “and that is not acceptable.”

In that context, gold serves as a unique safety valve. As Paradigm macroeconomics authority Jim Rickards keeps emphasizing, “Gold is a physical non-digital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

“Central Bankers Make Rare Comments in Favor of Bigger Gold Stash,” says a Bloomberg headline from Monday.

“Central Bankers Make Rare Comments in Favor of Bigger Gold Stash,” says a Bloomberg headline from Monday.

The London Bullion Market Association hosted an annual confab this week in Miami. On hand are three central bankers who delivered unusually candid remarks about central bank gold accumulation.

Said an official from the Banco de Mexico: “Given the context that we are facing right now — lower rates, your political tension, U.S. election, a lot of uncertainty — maybe the share of gold in our portfolios could be increasing as well.”

Chimed in an executive from the Central Bank of Mongolia: “In Mongolia’s case, I expect that the reserves will continue to grow, and I also expect that the share of gold in our reserves will likely increase in the future.”

“I completely agree as well,” said a leader of the Czech National Bank.

Maybe these central bankers didn’t realize that reporters from Bloomberg and Reuters were in the room. Or maybe they did — and they wanted to send a subtle message that they’ll keep loading up on gold as long as they don’t think the “economic policeman of the planet” can be trusted.

Gold has held the line on $2,600 for four weeks now — a healthy consolidation after a furious run-up from $2,400 in the previous four weeks.

Gold has held the line on $2,600 for four weeks now — a healthy consolidation after a furious run-up from $2,400 in the previous four weeks.

The fact gold is approaching record levels this morning at $2,686 despite a monster rally in the U.S. dollar is setting the table for a big year-end run.

Our Zach Scheidt’s forecast of $3,000 gold at year-end looked fanciful in January when the Midas metal was still under $2,000 — but now that target looks totally achievable.

[Limited-time opportunity: While 99% of investors try to profit from gold using bullion, gold coins or plain-old gold ETFs… Jim Rickards is saying do NOT buy another ounce of gold... or another share of a gold ETF… until you watch this message.

Jim’s just uncovered something huge in one of America’s most barren land masses — and it’s prodding him to make a major update to his gold thesis starting today. Click here to see Jim’s urgent report from the field.]

![]() So Much for the Semi Sell-Off

So Much for the Semi Sell-Off

The freakout over semiconductor stocks lasted exactly two days.

The freakout over semiconductor stocks lasted exactly two days.

As you’ll recall from yesterday’s edition, chip stocks took a totally unwarranted dump on Tuesday when the big Dutch chipmaker ASML issued disappointing quarterly numbers and a dour outlook going into 2025.

Nearly every chip stock took a hit — even AI darling Nvidia, even though ASML’s report acknowledged that “there continue to be strong developments and upside potential in AI.”

Nonetheless, the waves of fear reverberated throughout the tech sector both Tuesday and yesterday.

Well, that was then and this is now: “Taiwan Semiconductor Manufacturing Co. raised its target for 2024 revenue growth after quarterly results beat estimates,” says Bloomberg, “allaying concerns about global chip demand and the sustainability of an AI hardware boom.”

Key point: TSMC is a major customer of ASML, the company that started the whole downdraft on Tuesday.

TSMC shares are up 12.6% at last check. Nvidia, meanwhile, is up 2.8% to record levels — more than erasing Tuesday’s sell-off.

As for the major stock averages, they’re all up a quarter-percent or better on the day. At 5,859 the S&P 500 equals its record close on Monday.

As for the major stock averages, they’re all up a quarter-percent or better on the day. At 5,859 the S&P 500 equals its record close on Monday.

In the commodity complex, we mentioned how gold is flirting with record highs. Silver, meanwhile, is flat at $31.66. Silver just can’t catch fire the same way as gold and neither can the gold stocks — at least right now. Crude is flat, a little over $70, after the Energy Department released the weekly inventory numbers.

Bitcoin is catching its breath after its latest runup, trading a little below $67,000. Here’s some more Bitcoin chart porn in addition to what we shared on Tuesday…

![]() Loose Change: Economic Numbers, SpaceX Sues

Loose Change: Economic Numbers, SpaceX Sues

The big economic numbers of the day are a mixed bag…

The big economic numbers of the day are a mixed bag…

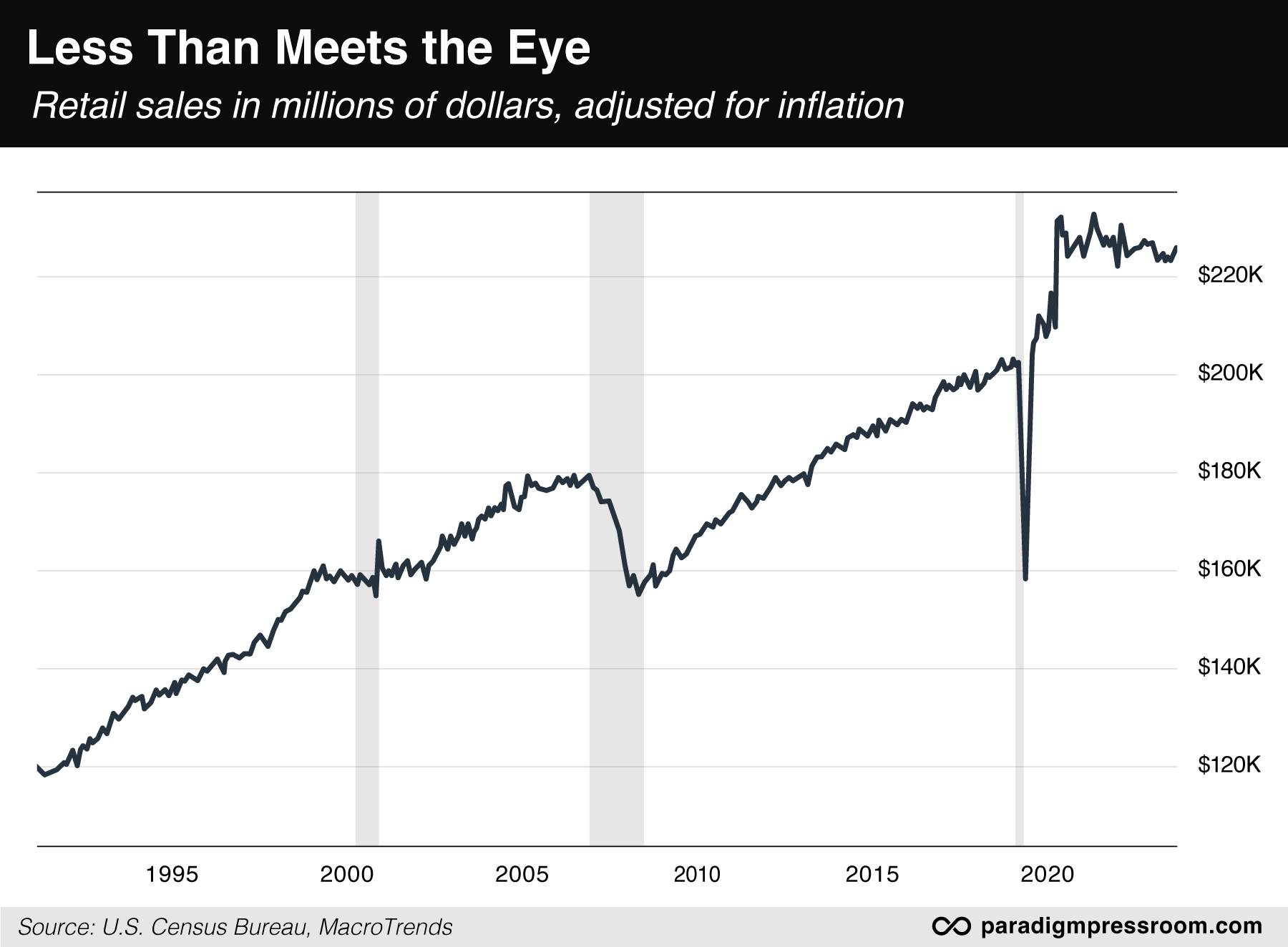

Retail sales jumped 0.4% in September, better than expected. If you factor out auto sales (they’re volatile month-to-month) and gasoline sales (lower prices translate to lower sales) the jump is an even stronger 0.7%.

However… over time these figures can become distorted because they don’t factor in inflation. Once you do that, you see retail sales have oscillated in a range since early 2021 — essentially going nowhere.

Meanwhile, industrial production took a 0.3% tumble in September — and August’s increase was revised down. All told, 77.5% of America’s industrial capacity was in use during September — the weakest figure since January.

Some of that can be blamed on Hurricanes Helene and Milton but the fact remains that this “capacity utilization” figure is still mired beneath the long-term average going back to 1972.

A follow-up from Monday: SpaceX is suing the California Coastal Commission.

A follow-up from Monday: SpaceX is suing the California Coastal Commission.

That’s the regulatory body that rejected SpaceX’s request for more rocket launches not because of the environmental impact but because commissioners frown on some of Elon Musk’s social media commentary.

“Rarely has a government agency made so clear that it was exceeding its authorized mandate to punish a company for the political views and statements of its largest shareholder and CEO,” says the company in its 284-page suit.

We think Musk is by and large a free-speech phony… but in this instance, he’s not wrong.

![]() As if Anyone Reads the Terms of Service…

As if Anyone Reads the Terms of Service…

Add Uber to the list of companies hiding behind their terms of service to evade litigation.

Add Uber to the list of companies hiding behind their terms of service to evade litigation.

In August we chronicled how Disney tried to block a wrongful death lawsuit involving an incident at Disney World on the grounds that several years earlier, the deceased woman’s husband had waived his right to sue the company… when he signed up for a Disney+ streaming subscription.

In that instance, Disney realized it was a bad look and agreed to let the case proceed in court.

Now comes the story of a couple from New Jersey — Georgia and John McGinty — who were seriously injured in 2022 when their Uber ride crashed. State judges turned away the couple’s lawsuit on the grounds that they’d waived their rights to sue when clicking on the Uber app’s “confirm” button.

According to the BBC, “The most recent time the terms were agreed to was when their daughter, then 12, had accepted them prior to ordering a pizza on Uber Eats.”

Wonders Mrs. McGinty, “How would I ever remotely think that my ability to protect my constitutional rights to a trial would be waived by me ordering food?"

Because the court sided with Uber, Uber issued a statement thus: "Our Terms of Use are clear that these types of claims should be resolved in arbitration. It’s important to highlight that the court concluded the plaintiff herself, not her daughter, agreed to Uber's Terms of Use on multiple occasions."

Ouch. Something to think about the next time you sign up for anything and encounter a wordy pop-up screen…

![]() Mailbag: Small Modular Reactors and “Long Boring Videos”

Mailbag: Small Modular Reactors and “Long Boring Videos”

“For what it’s worth, small modular reactors are not as cutting edge as folks might imagine,” a reader writes after yesterday’s edition.

“For what it’s worth, small modular reactors are not as cutting edge as folks might imagine,” a reader writes after yesterday’s edition.

“‘Wyoming was home to the first portable land-based nuclear power plant in the United States from 1962–1968,’ writes Cowboy State Daily. It was transported by air to Ellsworth Air Force Base, South Dakota, and built below Warren Peak near Sundance, Wyoming.

“‘It provided 1.25 megawatts of power for three large radar domes at the now-defunct Sundance Air Force Station.’”

“I wonder if anyone is looking at using thorium instead of uranium?” another inquires.

“I wonder if anyone is looking at using thorium instead of uranium?” another inquires.

“Reference a book SuperFuel: Thorium, The Green Energy Source for the Future by Richard Martin, Palgrave MacMillan, 2012.

“Keep up the good reporting!”

Dave responds: Alas, our energy expert Byron King is on the road today, so I can’t hit him up for an instant answer.

I’m well aware thorium has its advocates — and to the best of my limited knowledge the main reason it never took off is that, well, unlike uranium it can’t be turned into a weapon.

But that doesn’t address the question of why it wouldn’t be feasible now. We’ll aim to follow up next week.

“You mentioned packetized media yesterday and cited John Robb saying people ‘scan torrential information flows instead of reading or watching long-form books and broadcasts to uncover new, novel or interesting information.’

“You mentioned packetized media yesterday and cited John Robb saying people ‘scan torrential information flows instead of reading or watching long-form books and broadcasts to uncover new, novel or interesting information.’

“I agree. This would invalidate Paradigm Press's approach to the long videos to hawk a new service or to convey information. Personally, I will not watch the videos because I don't have an hour and they don't allow me to scan.

“Paradigm Press should reconsider its approach to videos.

“I always read your column and it takes precedence to all the others.”

Dave: If you saw this week’s edition of the Paradigm Press Concierge email, our executive publisher Matt Insley asked the pointed question, “How is Paradigm Press failing you?”

I don’t want to steal Matt’s thunder ahead of next week’s Concierge Weekly… but as long as you brought it up, many of the replies were along the lines of your own critique.

We’re already doing some small tweaks to make the experience a little less exasperating — and we’re considering other bigger steps as well.

For the longest time, A/B testing has demonstrated that longer copy generates more sales than shorter copy: “The more you tell, the more you sell.” But we’re always mindful that that can change — and maybe the onset of Robb’s “packetized media” is the turning point.

And yes, we’re always going to be selling something. As I’ve said more than once, that’s the only way we stay in business and retain our editorial independence at the same time.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets