Silver Squeeze 2024

![]() Silver: Bad News (Maybe), Good News (Definitely)

Silver: Bad News (Maybe), Good News (Definitely)

It seems “silver squeeze” is a thing on social media this week.

It seems “silver squeeze” is a thing on social media this week.

Understandable, given the enormous jump on Friday from $32 an ounce to nearly $34. Today it’s up to $34.55.

No doubt there are short sellers out there — betting on lower silver prices. And as the price rises, some of them will be squeezed — forced to cover their shorts, thus pushing the price still higher.

That number is somewhat overstated, according to one observer — but it’s still astonishing.

“The risk of an explosive silver short squeeze is further amplified by the astonishing ratio of 408 ounces of ‘paper’ silver — ETFs, futures and other derivatives — for every single ounce of physical silver,” writes Jesse Colombo at his Substack page.

“In a violent short squeeze, holders of ‘paper’ silver could be forced to scramble for the extremely scarce physical silver to fulfill their contractual obligations. This would cause the price of ‘paper’ silver products to collapse, while physical silver prices would skyrocket to jaw-dropping levels, potentially reaching several hundred dollars per ounce…”

Colombo’s piece was picked up by ZeroHedge. It’s not getting as many pageviews as election-related content… but is still impressive.

Of course, this isn’t the first time there’s been talk of a silver squeeze.

Of course, this isn’t the first time there’s been talk of a silver squeeze.

Remember the start of the “meme stock” craze in early 2021 — young people piling into dogmeat stocks like GameStop and AMC? They were doing so in part to punish the Wall Street pros who were shorting those stocks.

There was a brief abortive movement to squeeze the silver shorts then, too. The price jumped from under $25 to just over $30 in the space of a few days — and then it was over. Two months later, it was back below $25.

If silver is going to take off, there will have to be reasons other than a short squeeze. Fortunately, there are plenty.

If silver is going to take off, there will have to be reasons other than a short squeeze. Fortunately, there are plenty.

Over time, we’ve described the fabulous supply-demand factors at work. We’ll briefly recap here.

On the demand side, silver has emerged as a major component in the current designs of solar panels. By one estimate, solar accounts for 35% of total silver demand.

On the supply side, the silver price has been so beaten down for so long that the industry just hasn’t invested in new production. Why bother, right?

Result: Silver demand has outstripped supply for the last four years.

All of these facts were fodder for cocktail-party chatter last week at the London Bullion Market Association’s annual conference in Miami. “I have never seen a better outlook for silver,” said Michael Krebs, CEO at Coeur Mining.

That’s saying something — Krebs got his start at Coeur nearly 30 years ago. He’s seen it all, including the frenzy that drove silver to $50 in 2011.

Among the conference attendees, the consensus was that silver is poised to deliver better performance than gold or platinum or palladium during the next year — reaching $45 an ounce.

Longer term, we have every reason to expect even more. As Paradigm commodities guru Alan Knuckman is fond of reminding us, $50 silver in 2011 adjusted for inflation would be $70 silver now.

![]() But Don’t Overlook Gold…

But Don’t Overlook Gold…

Here’s an overlooked factor helping to drive gold to record levels — the Federal Reserve’s interest rate cuts.

Here’s an overlooked factor helping to drive gold to record levels — the Federal Reserve’s interest rate cuts.

“Gold has been hitting new highs as investors adjust for today’s era of lower interest rates and look for ways to manage risk,” says Paradigm’s income-investing pro Zach Scheidt. “Lower interest rates tend to put pressure on the economic value of the U.S. dollar.”

Of course, there are all the other factors we cite more often. “Uncertainty surrounding the election, the federal deficit (and ballooning debt level), geopolitical tension and economic challenges are weighing on investors’ minds,” Zach adds.

Last week we mentioned how the gold rally of 2022–24 has been a strange one — driven mostly by central bank buying. Both wealthy investors and mom-and-pops were selling gold the whole time.

That changed starting in May — when money finally started flowing back into the precious metals ETFs like GLD.

And that flow is just beginning. “One thing to keep in mind is that traditional money managers still have a very small allocation to precious metals,” Zach says. They are advising America’s wealthiest investors to keep money in more speculative areas of the market.

“This is important because as these money managers slowly start allocating more to precious metals, their buy orders could have a profound effect on the price of gold.”

In the near term, Zach remains confident that gold can hit $3,000 at year-end — a number that seemed audacious when he made his $3k gold forecast at the start of the year and the Midas metal was barely $2K.

All that said, gold is “due for a break soon, whether that means a pullback or some sideways consolidation,” says Paradigm chart hound Greg Guenthner. “The cat’s out of the bag! Everyone and their third cousin is now hip to gold’s explosive potential.” (More from Greg below…)

For the moment, however, gold is reaching higher into record territory — the bid up nearly $19 to $2,737.

For the moment, however, gold is reaching higher into record territory — the bid up nearly $19 to $2,737.

We noted silver’s jump earlier — to levels last seen when it was climbing down from the 2011 high of $50.

The major U.S. stock indexes continue to take a breather, the S&P 500 down a quarter percent to 5,839.

Always in search of “reasons” for every little move in the stock market, the media has settled on “rising rates weighing on sentiment” (CNBC). Sure, why not? The yield on a 10-year Treasury note is up to 4.21%, another three-month high. Mortgage rates are also the highest since July.

All else being equal, longer-term rates should be falling in sympathy with the Fed cutting shorter-term rates. But we can’t say it often enough — the most dangerous word in all of investing is “should.”

What does the bond market know that the stock market hasn’t figured out yet? We’ll know in the fullness of time…

Crude is powering higher for no obvious reason — up $1.84 at last check to $72.40. Here it seems the media has settled on “renewed optimism over Chinese demand” (OilPrice.com). And with that, oil is back above its 50-day moving average.

No news of significance from the BRICS summit in Russia yet — Chinese president Xi Jinping arrived only a few hours ago. But we’re keeping tabs…

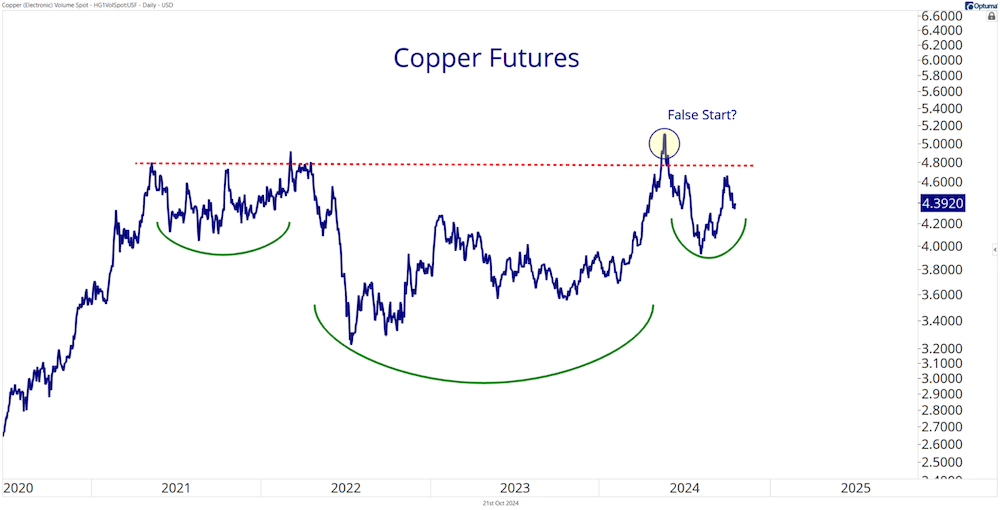

![]() Copper Coiled…

Copper Coiled…

Let’s not overlook copper. It’s not a precious metal, but the profit opportunities are there nonetheless.

Let’s not overlook copper. It’s not a precious metal, but the profit opportunities are there nonetheless.

Last spring, copper was setting new highs. “At the time, copper was successfully holding its $5 breakout and industry pure plays were exhibiting impressive momentum,” recalls Paradigm trading pro Greg Guenthner. “Southern Copper Corp. (SCCO) was tagging new highs to begin the second quarter and had already racked up year-to-date gains of 25%.

“Copper failed to hold above its 2021–2022 highs and quickly lost that magical $5 level. Instead of consolidating its multiweek rally, everything began to fall apart. It was a rough summer to be a copper bull. By mid-August, the metal had coughed up all of its earlier gains, dropping more than 20% from its peak.”

That was then, this is now: Greg annotates a chart of copper to illustrate how the red metal is repairing the damage from a “false start” breakout…

“Copper bottomed out in August and has since clawed its way back from the dead,” says Greg “Yes, it still has work to do. And we’ve had to deal with some choppier action lately due to the will-they-or-won’t-they stimulus plans out of China that have rattled the markets.”

Today the will-they trade has pushed copper to $4.29. “Copper futures could find legs again on a breakout above $4.75,” Greg tells us, “which would probably set up another $5 test. Plus, industry bellwether SCCO continues to look constructive at these levels.”

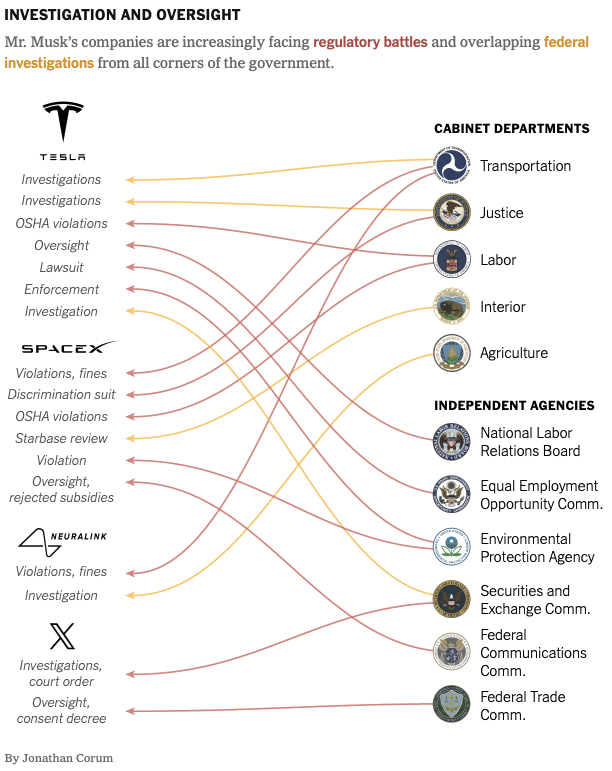

![]() The Musk Investigations, Illustrated

The Musk Investigations, Illustrated

Who says The New York Times isn’t good for anything?

Who says The New York Times isn’t good for anything?

We’ve previously chronicled some of the tangles that government contractor Elon Musk is having with one or another government agency. In August of last year, we took note of the bizarre circumstance under which the Justice Department was going after SpaceX for its compliance with government arms-trafficking laws.

As I said later that week, “It’s hard to shake the thought that there’s an orchestrated campaign to go after Musk on a variety of fronts and find something that sticks.”

But don’t take it from me. Take it from the NYT’s graphics department…

“His companies have been targeted in at least 20 recent investigations or reviews,” the paper reports, “including over the safety of his Tesla cars and the environmental damage caused by his rockets.”

Now we know…

![]() From Japan, the “Smartphone Blanket”

From Japan, the “Smartphone Blanket”

We know some people look upon their smartphones as a kind of security blanket. But..

We know some people look upon their smartphones as a kind of security blanket. But..

[As advertised by Japan’s largest furniture and home accessories chain…]

The Japanese furniture and home-goods giant Nitori is advertising a “Smartphone Blanket.”

According to the SoraNews24 site, “This blanket is so comfortable it’s been dubbed the ‘blanket that ruins people’ because once you’re in it, you won’t want to go anywhere or do anything other than stare at your phone.

“While it first made its debut in Japan last year as a wearable blanket without sleeves, it became so popular that it quickly sold out and was impossible to get during the depths of winter. This year, the chain has updated the blanket with new design features that make it even warmer and more comfortable than before.”

The base model runs 3,990 yen — $26.42 at today’s exchange rate. This year, you can also get a version with sleeves.

To be clear, you don’t have to have a smartphone with you to enjoy the blanket. The marketing photos include a woman reading a magazine, for instance.

But clearly Nitori knows its market, so “Smartphone Blanket” it is.

Also, the notion of “ruining people” with the ultimate in comfort appears to be a thing in Japan. In our voluminous archives, we find an item from early 2023 about the Wearable Beanbag —

As SoraNews24 described it, “designers seek to provide customers with comfort levels so supreme they won’t ever want to move, leading to their ultimate ruin.”

I dunno — maybe something’s lost in translation?