Elon Musk Just Caved

- Censors reclaim Twitter (or, whatever, X)

- You can’t mine lithium without lithium mines

- Inflation picking up again? Say it ain’t so!

- So this is what the end of globalization looks like

- Mailbag: Gold and Hawaii

![]() The Censors Reclaim Twitter (or X or Whatever)

The Censors Reclaim Twitter (or X or Whatever)

There’s just no other way to spin it: Elon Musk has caved under pressure.

There’s just no other way to spin it: Elon Musk has caved under pressure.

Among the better hot takes we’ve seen: “This has the foul odor of censorship, or worse,” says Rep. Thomas Massie (R-Kentucky). “What the hell is ‘accurate political discourse’”?

And from our acquaintance Scott Horton, director of the Libertarian Institute: “That’s a nice rocket company you’ve got there. It’d be a shame if it lost all its Pentagon contracts.”

As we mentioned on Monday, the federal government has put Musk’s SpaceX in a no-win position: The Justice Department is suing SpaceX for observing the strict regulations governing the hiring practices of companies that are Pentagon/CIA contractors.

The rollout of the new policy at X-formerly-Twitter comes a few weeks after the head of its “Threat Disruption” team announced he’s looking for new hires…

The rollout of the new policy at X-formerly-Twitter comes a few weeks after the head of its “Threat Disruption” team announced he’s looking for new hires…

Yeah, so much for Musk’s protestations that he’s a “free speech absolutist.” Then again, we were always suspicious on that score ever since he made his play to buy Twitter last year. Our suspicions were confirmed beyond all doubt last spring.

And yet the feds still won’t let up on Musk.

And yet the feds still won’t let up on Musk.

“Manhattan federal prosecutors are investigating Tesla’s use of company funds on a secret project that had been described internally as a house for Chief Executive Elon Musk,” reports today’s The Wall Street Journal, citing the usual “people familiar with the matter.”

“The U.S. Attorney’s Office for the Southern District of New York has sought information about personal benefits paid to Musk, how much Tesla spent on the project — which called for a spacious glass structure to be built in the Austin, Texas, area — and what it was for.” The SEC is also looking into the matter.

The paper is quick to point out the investigations “are in their early stages and may not lead to formal allegations of wrongdoing.”

It’s hard to shake the thought that there’s an orchestrated campaign to go after Musk on a variety of fronts and find something that sticks.

But to what end? He’s already demonstrated he’s folding like a lawn chair when it comes to free expression at X. What more do they want?

Something sinister is afoot, which is why we’ve made Musk our Bullet No. 1 twice this week. Any guesses why? Shoot us a line and we’ll make it the focus of our mailbag section tomorrow.

![]() You Can’t Make Lithium Without Lithium Mines

You Can’t Make Lithium Without Lithium Mines

This won’t be good for the feds’ “green energy” ambitions: We might be staring down a global lithium shortage by 2025.

This won’t be good for the feds’ “green energy” ambitions: We might be staring down a global lithium shortage by 2025.

Earlier this month we spotlighted a report from S&P Global forecasting a staggering increase in demand for most of the critical minerals that go into electric vehicle batteries. Demand for lithium, cobalt and nickel could grow a staggering 23-fold between 2021 and 2035.

Now comes a report from the research firm BMI that says “global lithium supply is expected to enter a deficit relative to demand by 2025.”

That’s mostly because demand in China is exceeding supply — even though China is the world’s third-biggest lithium producer. “We expect an average of 20.4% year-on-year annual growth for China’s lithium demand for EVs alone over 2023–2032.”

[Oh, you mean so that Chinese companies can continue sucking up generous government subsidies to build electric crapmobiles that no one ever actually drives? But we digress…]

In case you’re wondering, there’s only one operational lithium mine in the United States, in Nevada. Elsewhere, the not-in-my-backyard phenomenon has prevented any development.

And to be sure, mining lithium in an ecologically sound way is hideously expensive — which is why hypocritical American policymakers are content to let Australia, Chile and China foul up their ecologies instead. Sooner or later, reality will smack those policymakers with a clue-by-four.

![]() Inflation Picking up Again? Say It Ain’t So!

Inflation Picking up Again? Say It Ain’t So!

Oops, the Federal Reserve’s favorite inflation measure is moving in the wrong direction.

Oops, the Federal Reserve’s favorite inflation measure is moving in the wrong direction.

The Commerce Department is out with “core PCE” — the inflation reading the Fed looks at most closely when setting interest-rate policy. When Fed officials talk about their 2% inflation target, this is the number they have in mind.

The number spent most of this year oscillating between 4.6–4.7% before falling in June to 4.1%. This morning we got the July reading and… er, um, it ticked up to 4.2%.

That said, the number came in more or less as expected… so it’s not moving the needle on expectations for interest rates. Futures trading this morning suggests an 89% probability the Fed will leave rates alone at its next meeting on Sept. 20, with maybe a 50-50 likelihood of one more increase before year-end.

The next meaningful data point for sussing out Fed policy comes tomorrow with the Labor Department’s August jobs report. If the number of new jobs comes in unexpectedly high, the odds of a rate increase in September are sure to jump… and stocks are likely to sell off, at least in the short term.

In the meantime, the major U.S. stock indexes are setting up for their fifth straight session in the green.

In the meantime, the major U.S. stock indexes are setting up for their fifth straight session in the green.

At last check, the Dow and the S&P 500 are both up about a third of a percent, the Nasdaq up nearly two-thirds of a percent. At 4,530, the S&P is set to end August down a mere 1.3% from its year-to-date high set at the end of July.

“The mega-caps are almost all back above their respective 50-day moving averages,” observes Paradigm chart hound Greg Guenthner, “and we're seeing other positive signs throughout the market.”

Precious metals are hanging tough, gold at $1,942 and silver at $24.50. Crude is up nearly 2% to $83.21 — an impressive bounce off support at $77 last week, and buttressing the case for a run up to $90 before year-end.

![]() This Is What the End of Globalization Looks Like

This Is What the End of Globalization Looks Like

“China-U.S. Trade Down 9.4% Year-Over-Year Through First Seven Months of 2023,” says the crawl I see out of the corner of my eye on China’s state-run CGTN network.

“China-U.S. Trade Down 9.4% Year-Over-Year Through First Seven Months of 2023,” says the crawl I see out of the corner of my eye on China’s state-run CGTN network.

That’s a vivid number to illustrate how the globalization that marked the post-Cold War decades is reversing here in the 2020s.

Fact is the world is splitting into trading blocs — a trend that will only accelerate after the BRICS nations welcomed six new members last week, led by Saudi Arabia.

The trend goes by various names such as friend-shoring or near-shoring. In his most recent book Sold Out, Jim Rickards refers to trade among cooperative countries as a “college of nations.”

“Instead of the globalization we have experienced since 1991,” he says, “trade and investment will be conducted going forward in a members-only club.

“The U.S.-led club will consist of the U.S., Canada, Australia, Japan, Taiwan, the U.K., the EU and certain other countries with shared values,” he says. In other words, what used to be called “the Western democracies.”

“A separate club,” says Jim, “will be led by China, Russia, Central Asian nations and some other countries in Africa and Southeast Asia.

“A third block of countries, including some important economies, will be in a position to trade with both clubs. These will include Brazil, India, Argentina and Turkey among others.” Note that two of the original BRICS still aim to keep a foot in both worlds.

What does this new arrangement mean in practical terms?

What does this new arrangement mean in practical terms?

Jim serves up this example: “Trading relations will exist in which the Netherlands provides semiconductor manufacturing equipment, Taiwan and South Korea will manufacture high-end semiconductors and computers can be manufactured in Vietnam and India financed by U.S. investment. China will be excluded from this commerce. The U.S. dollar will remain as a key trading and reserve currency.

“At the same time, China will improve its own semiconductor skills and will sell chips to Russia and Iran. Russia will sell strategic metals to China and nuclear technology to Iran and Saudi Arabia. This will be financed by Chinese capital, but it will be denominated in a new BRICS currency linked to gold.”

Not all at once, of course, but that’s how it’s shaping up. “The two trading blocs will exist side-by-side with some interactions, but most trade and investment will be contained within each bloc.”

Compared with the globalized system that we were used to until recently, supply chains will be less efficient — but more resilient. “Costs will be greater for both blocs because access to cheap labor (for the West) and ample capital (for China) will be greatly curtailed.

“At the same time, the new system will be more robust because the U.S. will be less dependent on Chinese manufacturing and China will not have access to the most sophisticated chips.”

![]() Mailbag: Gold… and Hawaii

Mailbag: Gold… and Hawaii

“I might be overthinking this, but you touched on something really big in your closing comment on Wednesday,” writes one of our regulars.

“I might be overthinking this, but you touched on something really big in your closing comment on Wednesday,” writes one of our regulars.

“Hopefully this is a fun distraction if nothing else:

“Suppose gold’s ascent (in dollar price terms) is more of a rebound resulting from the manipulations being put to an end, rather than an inflation-offsetting move.

“I know, that would mean the banksters were actually held accountable for once! Not likely to happen, but still a useful thought experiment IMHO.

“If the manipulations have been as egregious as evidence suggests, gold/silver prices could have a l-o-n-g way to go and the upward pressure will be enormous.

“We should probably expect lurches and gap-ups in dollar price action, even if the process is (mostly) gradual.

“Consider how powerful of a signal those moves would be — and the effects on all things priced in fiat currency.

“You made a great point: The purpose of holding gold isn’t to achieve capital gains or yield.

“But real, sound money has been suppressed so badly for so long that some sort of big correction seems inevitable. Ditto re: accompanying volatility.

“What if consumer price inflation isn’t the scenario that sets it off?

“I know, I think too many wild thoughts. Thanks as always for humoring me.”

After we described the travails of Hawaiian Electric and the serial failures across both government and the private sector on Maui (also in Wednesday’s edition), a reader writes…

After we described the travails of Hawaiian Electric and the serial failures across both government and the private sector on Maui (also in Wednesday’s edition), a reader writes…

“It seems to be a pattern: Do as you are told and die. Disobey and live. Remember the announcements over the speakers in the World Trade Center on 9/11. Stay in your offices and wait. Those people died. Many who disobeyed and left early got out.

“Second point: How about cars partially melting at 1,500 degrees and some surrounding vegetation untouched? Not normal. Some point to a DEW as the only explanation. Your thoughts?”

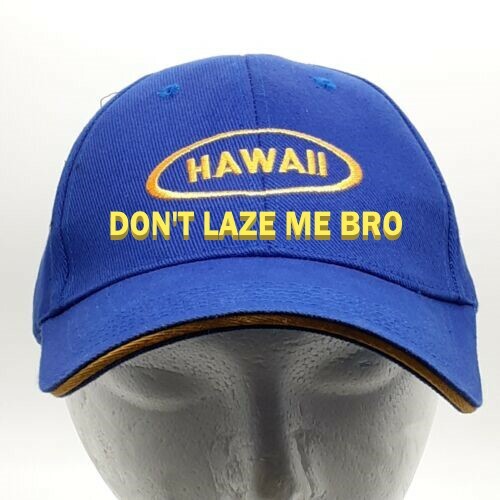

Dave responds: You mean, a “directed energy weapon”? As it happens, I had a grim chuckle this morning at the sight of this…

But as with 9/11, there’s ample evidence of negligence and incompetence to explain what happened without going off the deep end.

In fact, the more people who go off the deep end, the less likely it is anyone will face accountability. Aren’t the facts no one denies damning enough?