Just When You Think the Worst Is Over…

- The next phase of the 2023 bank crisis

- Crypto catalyst: Victory in court

- Let’s not pop the Champagne yet, but…

- Hawaiian Electric: It’s not (totally) our fault

- Mailbag hodgepodge

![]() The Next Phase of the 2023 Bank Crisis

The Next Phase of the 2023 Bank Crisis

The bank crisis of last spring is over, right?

The bank crisis of last spring is over, right?

Right?

After all, bank failures haven’t made headlines for months now. The second-, third- and fourth-largest bank failures in U.S. history? They’re, well, history.

“The crisis is not over. It’s in a quiet stage, which is entirely in keeping with prior financial crises,” says Paradigm macro maven Jim Rickards.

“The crisis is not over. It’s in a quiet stage, which is entirely in keeping with prior financial crises,” says Paradigm macro maven Jim Rickards.

“Complex dynamic systems don’t necessarily fail all at once. They fail in part, enter a quiet period and then re-emerge to fail on an even larger scale. Some crises have as many as three quiet phases.”

Let’s rewind to the global financial crisis of 2007–2009. It proceeded in several distinct phases, both quiet and turbulent…

Let’s rewind to the global financial crisis of 2007–2009. It proceeded in several distinct phases, both quiet and turbulent…

February 2007–December 2007: Turbulence. It begins with HSBC reporting higher-than-expected loan losses on subprime mortgages . By the end of the year , Citi needs a rescue from wealthy Arab sheikhs.

January 2008–February 2008: Quiet.

March 2008–July 2008: Turbulence. Bear Stearns fails in March, JPMorgan Chase taking over its carcass. Then Fannie Mae and Freddie Mac fail in July and Congress passes bailout legislation.

August 2008: Quiet.

September–October 2008: Tsunami-level turbulence. Lehman Bros. fails, Goldman Sachs and Morgan Stanley convert to commercial banks to access the Federal Reserve discount window, money market funds are backstopped, AIG fails, the Fed announces an alphabet soup of rescue schemes, interest rates are slashed , Congress passes bank bailouts.

November–December 2008: Quiet again, apart from a lot of finger-pointing.

January–March 2009: Mild turbulence and resolution. The automakers are bailed out … but by March the Federal reserve triples the size of its first “quantitative easing” program and the Financial Accounting Standards Board eases corporate accounting rules to make the banks’ balance sheets look better. The stock market bottoms, the crisis is over.

Similar quiet periods show up in the previous financial crisis of the late 1990s…

Similar quiet periods show up in the previous financial crisis of the late 1990s…

June 1997–November 1997: Turbulence. The “Asian contagion” begins when Thailand breaks the peg between the Thai baht and the U.S. dollar. Bank runs quickly spread to Malaysia, Indonesia and South Korea.

December 1997–March 1998: Quiet.

April 1998-July 1998 Minor turbulence: In the United States, the merger of Citi and Solomon Bros. causes credit spreads to widen and liquidity to tighten.

August 1998: Hurricane-level turbulence: Russia defaults on its debt, swap spreads blow out, the hedge fund Long Term Capital Management loses $2 billion.

September 1998: Tsunami-level turbulence and quick resolution: LTCM owes so much money to so many counterparties that the Federal Reserve and 14 major banks organize a $4 billion rescue. No taxpayers were harmed in this rescue, but without it, “the world was only hours away from sequentially closing every stock and bond market in the world,” says Jim. And he would know, since he was in the room negotiating the deal on LTCM’s behalf.

So you get the idea. Now let’s look at the present crisis through this turbulence-and-quiet template…

So you get the idea. Now let’s look at the present crisis through this turbulence-and-quiet template…

March 2023-May 2023: Turbulence. Silicon Valley Bank and Signature Bank go down over three days in March. A few weeks later, the FDIC takes over First Republic Bank, with many of its assets taken over by JPMorgan Chase.

June 2023-Present: Quiet.

When does the quiet period end? “History shows these phases don’t last much more than three months,” Jim says. “We’re at the three-month mark now. This at least suggests that September and October could be an extremely volatile period.”

Indeed. In addition, September and October are typically the weakest months of the year for the stock market — and financial crises have a way of rearing their ugly heads at that time, as happened in 2008 and 1998. (Oh, and 1929.)

It will certainly be an interesting backdrop for this year’s Paradigm Shift Summit at the Bellagio in Las Vegas. Of course, Jim will be one of our speakers — as will all the top Paradigm Press editors. And it won’t be all doom and gloom. I imagine James Altucher will have a thing or two to say about opportunities in the AI space. And trading authority Alan Knuckman will aim to top his recommendation to the audience last year — an option trade that doubled in three months.

Yours truly will lead a panel on investing in natural resources featuring Jim Rickards, Byron King and this year’s special guest speaker — the leading authority in North America on investing in energy and mining.

Thing is, if you’re thinking about joining us, we’re nearly full up. For that reason, the invitation page we’ve been linking to the last several days will go dark at midnight tonight. Click here while the page is still live.

![]() Crypto Catalyst: Victory in Court

Crypto Catalyst: Victory in Court

The big market story today is in crypto — and it’s propelled Bitcoin to its highest level in nearly two weeks.

The big market story today is in crypto — and it’s propelled Bitcoin to its highest level in nearly two weeks.

A federal court just handed down its ruling in Grayscale Investments’ lawsuit against the Securities and Exchange Commission — and it sided with Grayscale.

Grayscale is keen to launch the first Bitcoin ETF — but the SEC rejected its application. Grayscale sued the SEC in June of last year — and now it’s won the case in the D.C. Circuit Court of Appeals.

The decision clears the way for Grayscale to convert its Grayscale Bitcoin Trust (GBTC) — currently a closed-end fund backed by Bitcoin futures — into an ETF backed by Bitcoin itself. The decision also makes it more likely BlackRock and Fidelity will introduce their own Bitcoin ETFs.

The news sent Bitcoin shooting 6.5% higher to $27,404 — although it’s already pulling back. GBTC shares are up 16.5% on the day.

Meanwhile, the U.S. stock market is on track to notch three straight days in the green.

Meanwhile, the U.S. stock market is on track to notch three straight days in the green.

The S&P 500 is up more than three-quarters of a percent at last check to 4,469 — down only 2.6% from its year-to-date high set on July 31. On the other hand, it’s also down 6.8% from its record high set on the first trading day of 2022.

The Nasdaq’s gain on the day is even stronger, the Dow’s somewhat weaker. Precious metals continue to rally — gold at $1,934 and silver at $24.65. Crude is holding above $80.

![]() Let’s Not Pop the Champagne Yet, But…

Let’s Not Pop the Champagne Yet, But…

Maybe, just maybe, we’ve reached “peak ESG.”

Maybe, just maybe, we’ve reached “peak ESG.”

As you might already know, ESG stands for the “environmental, social and governance” criteria by which publicly traded companies are evaluated by money managers, rating agencies and outfits like Bloomberg.

Among the main drivers of the trend since 2020 have been the huge asset managers who wield power via the mutual funds and ETFs they manage. “Together, BlackRock, Vanguard and State Street control 15–20% of most large U.S. public companies through their huge index-tracking products and investment funds,” points out the Financial Times — “so their influence is enormous.”

But during the 2023 proxy season, Vanguard threw its support behind only 2% of ESG shareholder resolutions — criticizing them as “overly prescriptive.” Last year, Vanguard backed 12% of such proposals.

BlackRock reported its numbers last week, and it too is supporting fewer resolutions — only 7% in the last year compared with 22% the year before and nearly half in 2021.

![]() Hawaiian Electric: It’s Not (Totally) Our Fault

Hawaiian Electric: It’s Not (Totally) Our Fault

The Hawaiian Electric saga has become as fascinating — and infuriating — as the Maui fire is horrifying.

The Hawaiian Electric saga has become as fascinating — and infuriating — as the Maui fire is horrifying.

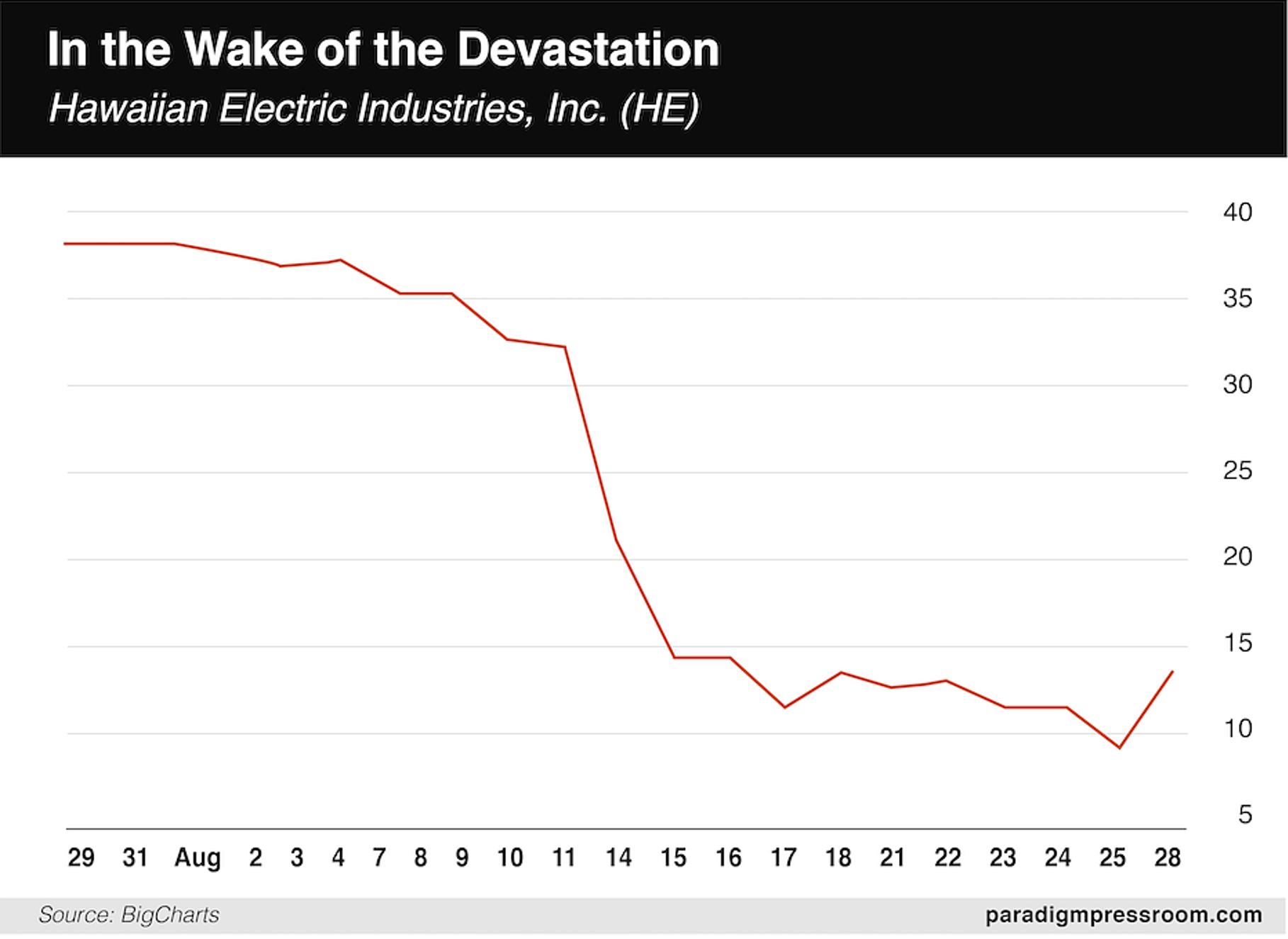

Last Thursday, Maui County sued the publicly traded Hawaiian Electric Industries (HE) — saying the company’s power lines started the fire that (to date) has killed 115 people.

Yesterday, the company pushed back: HE said yes, power lines brought down by high winds probably started the first fire in Lahaina the morning of Aug. 8… but the power had been shut off for hours when a second fire broke out in the afternoon. “We were surprised and disappointed that the County of Maui rushed to court even before completing its own investigation,” says CEO Shelee Kimura.

Not surprisingly, the trajectory of HE’s share price this month has been sharply downward. But check out the 40% bump yesterday when HE basically said there’s ample blame to go around.

That said, HE is still in a world of trouble. The investigation has been hampered in part by HE hauling away damaged power poles and other gear from near a Lahiana substation — before anyone from the Bureau of Alcohol, Tobacco, Firearms and Explosives showed up.

“Those actions may have violated national guidelines on how utilities should handle and preserve evidence after a wildfire,” reports The Washington Post.

Of course, the conduct of governments in this episode has been equally despicable.

Of course, the conduct of governments in this episode has been equally despicable.

Last week The Associated Press reported how the only paved road out of Lahaina was barricaded. “One family swerved around the barricade and was safe in a nearby town 48 minutes later, another drove their four-wheel-drive car down a dirt road to escape.”

The sentence “Only those who disobeyed survived” has gone viral in recent days.

And that’s piled on top of still other failures…

Still, it’s hard to imagine HE won’t end up in bankruptcy — not unlike Pacific Gas and Electric did in 2019 after a wave of fatal wildfires in California. PG&E emerged from Chapter 11 about 18 months later.

![]() Mailbag Grab Bag

Mailbag Grab Bag

On the subject of the “Long Cramer” ETF that Tuttle Capital Management will soon shut down, a reader writes…

On the subject of the “Long Cramer” ETF that Tuttle Capital Management will soon shut down, a reader writes…

“I first encountered Matt Tuttle in 2017 when an RIA Network I was looking to join ended their three-day pitch with a presentation by Tuttle and his, also delisted, U.S. Equity Rotation Strategy ETF. I was so unimpressed that after the presentation, I made it clear that if membership in the Network was contingent on using Tuttle's funds, I was a ‘hard no.’

“You got to give him credit, though: He keeps on throwing financial excrement up on the wall hoping that someday, something may stick.”

“Yes, that’s the big ‘asymmetric upside’ question,” a reader writes after we revisited the question of what’s holding gold back.

“Yes, that’s the big ‘asymmetric upside’ question,” a reader writes after we revisited the question of what’s holding gold back.

“The short answer is: I am! As long as I own one ounce of the stuff, the forces of darkness will conspire to keep it down.

“Seriously, though, the banksters will do anything to smash the dollar prices of precious metals.

Real money is kryptonite to their fiat currency regimes and powers.

“They’ll fight with everything they’ve got, until they spit their last breath — while buying and hoarding gold by the ton.

“So I’m hanging on...”

Dave responds: You’re not the first reader to tell us you suspect gold will take off at supersonic speeds the moment you sell!

It’s worth remembering — and it’s all too easy to forget! — that the purpose of holding gold is not to achieve capital gains at all times and under all circumstances. It’s to keep your portfolio balanced in the event of consumer price inflation — in which case its price performance tends to exceed the inflation rate.

Certainly that was the case during the gold bull markets of the 1970s and the 2000s.

And if it’s going to take the better part of a decade for the Fed to get inflation back to its 2% target — as the historical evidence suggests — gold will likely do the same through the 2020s.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets