Financial Censorship

- “Most massive attack against free speech in United States history”

- The downside of SCOTUS’ student debt decision

- How long could the stock market’s rally run?

- Two can play the sanctions game

- “This topic really irks me!”... and Forever Stamps

![]() “The Most Massive Attack Against Free Speech in United States History”

“The Most Massive Attack Against Free Speech in United States History”

In what is too often a dirge of human failure and folly, we begin our 5 Bullets this holiday-shortened week with genuinely good news.

In what is too often a dirge of human failure and folly, we begin our 5 Bullets this holiday-shortened week with genuinely good news.

Well, OK, it’s not good news in the eyes of the censorious corporate media…

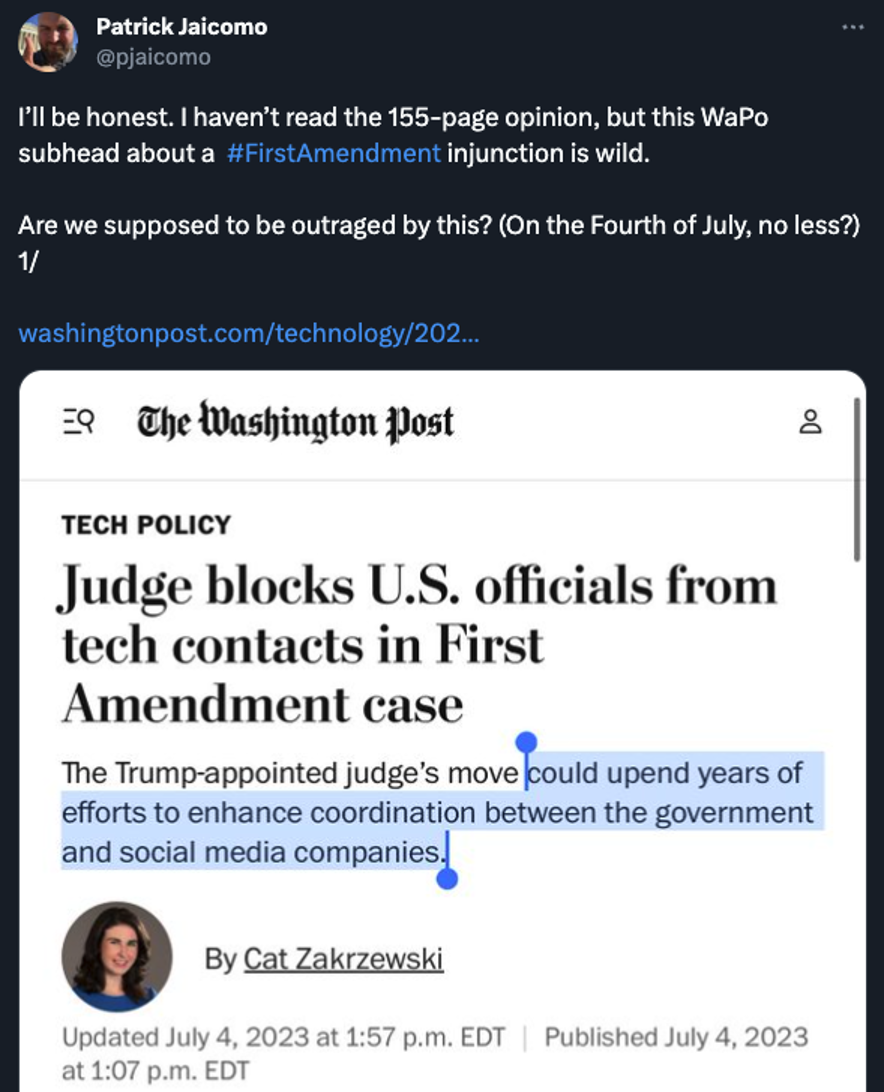

A more down-the-middle spin comes from the essential Consortium News site and its editor-in-chief Joe Lauria: “A U.S. federal judge on Tuesday issued a temporary injunction against a number of government agencies preventing them from talking to social media firms for ‘the purpose of urging, encouraging, pressuring or inducing in any manner the removal, deletion, suppression or reduction of content containing protected free speech.’

“Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana ruled that the agencies couldn’t identify specific social media posts to be taken down or ask for reports about the social media company’s efforts to do so.”

Doughty’s language was blunt: "If the allegations made by plaintiffs are true, the present case arguably involves the most massive attack against free speech in United States' history.”

Still, we have to check our enthusiasm: Lauria spots a gaping loophole in the judge’s order.

Still, we have to check our enthusiasm: Lauria spots a gaping loophole in the judge’s order.

“Exceptions could only be made when dealing with crime, national security threats or foreign or domestic attempts to influence elections,” he points out. “That would seem to leave the determination of national security and foreign influence up to the government agencies themselves, without the apparent need of an investigation or evidence.”

Hmmm…

The ruling comes in the case of Missouri v. Biden. We told you about it last year — the attorneys general of Missouri and Louisiana suing the Biden administration for its habit of leaning on social media companies to censor posts about COVID and other hot-button issues, always on the grounds of “disinformation.”

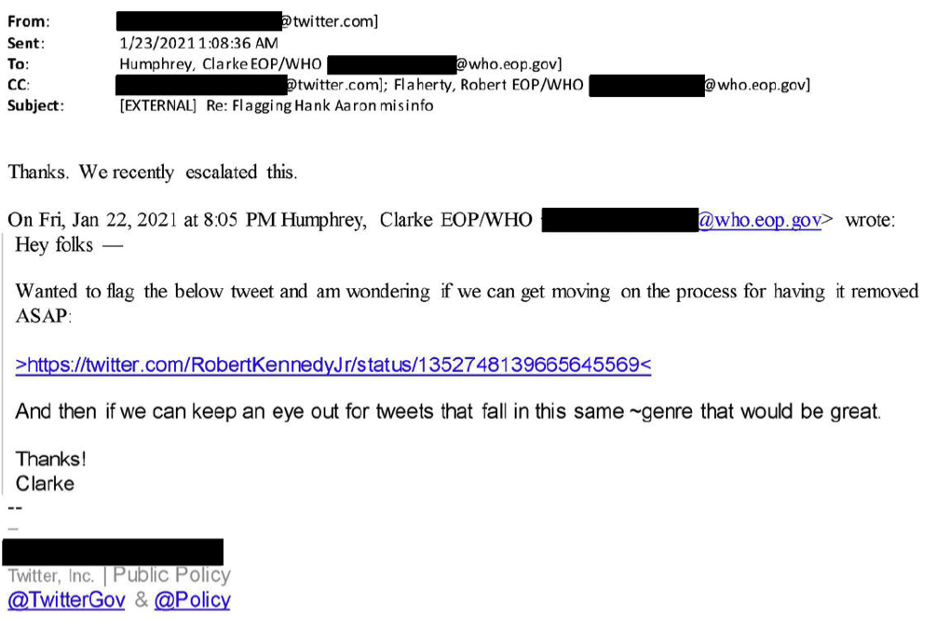

The documents the feds have coughed up during the process of discovery are shocking. For instance, this “request” direct from the White House for Twitter to delete a tweet by Robert F. Kennedy Jr.

To be sure, the administration is almost certain to appeal Doughty’s ruling. If you want to dive deeper into the story, Lauria’s write-up is a fine place to start.

We bring up this subject because it’s only a short step from social media censorship to financial cancellation, Canadian trucker style.

We bring up this subject because it’s only a short step from social media censorship to financial cancellation, Canadian trucker style.

As it happens, none other than RFK Jr. is keenly aware of the connection.

“The financial censorship of political enemies is something we’re used to seeing under authoritarian regimes,” he tweeted in May.

“No one was surprised when Russia froze more than 100 bank accounts tied to opposition leader Alexei Navalny. But Canada did it too, locking more than 200 accounts of people protesting vaccine mandates.

“It’s not outlandish to imagine that even here in America, your bank account could one day be frozen because of your politics, or comments you’ve made on social media…

“The ability to save and spend without political interference is a prerequisite for the exercise of meaningful dissent, and I will defend it accordingly. This is not a right- or left-wing issue. It is about protecting democracy from powerful established interests.”

Your editor doesn’t trust the promises of politicians. But the fact Kennedy is even bringing up the issue is something else that goes in the plus column.

Speaking of court rulings to cheer…

![]() The Downside of the Student Debt Decision

The Downside of the Student Debt Decision

In a way, I feel bad about the whole Supreme Court student loan ruling — even if it’s the right outcome.

In a way, I feel bad about the whole Supreme Court student loan ruling — even if it’s the right outcome.

Because ironically, the Supreme Court just bought a few extra years of life for the higher education cartel to continue hollowing out whatever’s left of the middle class.

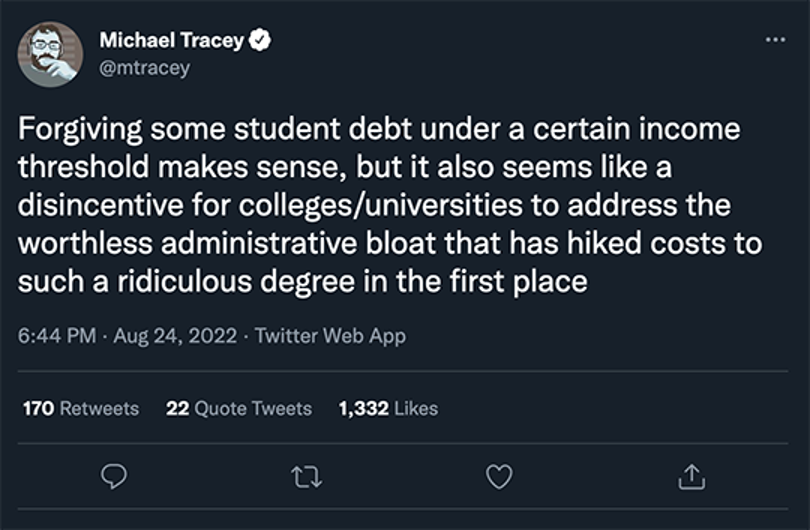

It comes back to a phenomenon spotlighted last year — when Joe Biden first floated the forgiveness plan — by the independent journalist Michael Tracey.

If you disagree with the first part of his sentence, don’t let that get in the way of absorbing the second part.

It comes back to the old economic maxim: “Whatever you subsidize, you get more of it.”

For more than a decade, I’ve been lamenting how federal subsidies for higher education have fueled demand for higher education.

For more than a decade, I’ve been lamenting how federal subsidies for higher education have fueled demand for higher education.

First-order result: According to a Georgetown University analysis of government figures, college costs grew 169% from 1980–2019 — while the average earnings of workers ages 22–27 grew a mere 19%. And yes, both of those figures are after you adjust for inflation.

Second-order result: The bureaucratic bloat to which Mr. Tracey refers — the legions of associate deans, vice chancellors and assistant provosts whose jobs didn’t exist 30 or 40 years ago.

To say nothing of the deluxe dorm suite accommodations far removed from the linoleum floors, cinder block walls and shared shower stalls of days gone by. Plus “expensive theaters, gyms, immaculate landscaping, state-of-the-art vending machines,” said a fellow responding to Tracey’s tweet.

And Joe Biden wanted to blow another $430 billion of money Uncle Sam doesn’t have to keep the whole scam going.

And Joe Biden wanted to blow another $430 billion of money Uncle Sam doesn’t have to keep the whole scam going.

See, the scam was in danger of falling apart a year ago. Why the hell would you drop five figures a year on an “education” in which — as was the case on many campuses in early 2022 — you’re taking crappy Zoom classes while confined to your dorm room, even though the entire student body is vaxxed and boosted?

Forgiveness would have been an enormous bailout for the system — encouraging more reckless borrowing, leading to still higher tuition.

The good news is the Supreme Court decision will have the effect of keeping a lid of sorts on spiraling college costs.

The bad news is that higher education is still ruinously expensive — and a hopelessly broken system that might have finally collapsed under the weight of student loan forgiveness instead has a new lease on life.

![]() Market Miscellany

Market Miscellany

The stock market’s 2023 rally “could last well into the second half — and possibly through much of 2024,” suggests Paradigm income-investing specialist Zach Scheidt.

The stock market’s 2023 rally “could last well into the second half — and possibly through much of 2024,” suggests Paradigm income-investing specialist Zach Scheidt.

He cites the following factors…

- “Investors have been pessimistic and still have cash on the sidelines

- “The economy has been resilient and more stable than expectations

- “The new bull market is broadening out and more stocks are participating

- “Inflation is still high, but steadily pulling back

- “Consumers still have pent-up savings and confidence is returning.

“Of course, there are still concerns that my team and I are watching carefully. But as long as other investors are willing to look past these concerns and buy stocks, the overall market will continue to trend higher.”

At the top of that list of concerns would be the Federal Reserve…

With three weeks before the Fed’s next meeting, “Jay Powell is preparing the market for another rate hike of 0.25% on July 26,” says Paradigm macro maven Jim Rickards, “which will bring the Fed’s target rate to 5.50%, up from 0.00% in March 2022.”

With three weeks before the Fed’s next meeting, “Jay Powell is preparing the market for another rate hike of 0.25% on July 26,” says Paradigm macro maven Jim Rickards, “which will bring the Fed’s target rate to 5.50%, up from 0.00% in March 2022.”

Later today, the Fed will release the heavily massaged “minutes” from the last meeting, when they opted to forgo an increase for the first time since the rate-raising cycle began in March last year.

Assuming no surprises today, Jim says the Fed will soon fall prey to its own flawed assumptions: “With unemployment at the lowest levels since the late 1960s and inflation stubbornly high, the Fed will continue to prioritize fighting inflation with rate hikes even if it means recession and higher unemployment down the road.

“But the Fed has the cause and effect badly mangled. There is no correlation between unemployment and inflation. The Fed may quickly find they’ve created the worst of both worlds — higher unemployment and persistent high inflation, a condition known as stagflation.”

The stock market is treading water on this first full trading day of the second half.

The stock market is treading water on this first full trading day of the second half.

At last check, the Nasdaq was microscopically in the red, while the Dow was down a little over a third of a percent. The S&P 500 is down a mere seven points to 4,448.

Crude is up nearly 2% to $71.13 after OPEC announced it’s sticking to its planned production cuts at least through next month. Gold is down a bit to $1,922 but silver is back above $23.

➢ One economic number of note came out during the abbreviated trading session Monday. The ISM Manufacturing Index registered an eighth consecutive monthly reading below 50 — suggesting the U.S. factory sector is shrinking. At 46.0, the number is the lowest since lockdown in May 2020. On Twitter, Bianco Research chief Jim Bianco points out the last time the number was this low and there was no ensuing recession was 1996.

➢ For the record: The Shanghai Cooperation Organization opted not to drop any monetary bombshells at its annual meeting this week. The SCO is a nine-nation group formed by China and Russia in 2001 to serve as a counterweight to U.S. global primacy. This year’s meeting turned out to be all talk, with China’s Xi Jinping rallying fellow leaders to resist Western economic sanctions. Any big moves to undermine the U.S. dollar will now wait till the summit of BRICS leaders set for Aug. 22.

Speaking of resistance to Western sanctions…

![]() Chip Wars

Chip Wars

Chinese leaders just demonstrated they too can wage economic warfare.

Chinese leaders just demonstrated they too can wage economic warfare.

Starting Aug. 1, Beijing will restrict exports of gallium and germanium — two minerals essential for high-performance semiconductors, solar cells and missile systems.

“Most gallium comes out as a byproduct of smelting and refining bauxite into aluminum,” points out Paradigm’s mining-and-energy authority Byron King. “You do not get gallium by recycling your beer cans.” According to the U.S. Geological Survey, 86% of global production capacity is located in China.

“Most germanium comes out as a byproduct of smelting and refining zinc,” Byron continues. “Most zinc smelters are in Japan, Korea and... China.”

The announcement came Monday, only days after The Wall Street Journal reported the Biden administration is looking to step up its limits on exports of artificial intelligence chips to China.

And just to make sure China has no workaround, the Biden administration is about to tell Amazon and Microsoft that they’ll need federal permission whenever they want to let Chinese companies access their cloud-computing services that use advanced AI chips. (That was in this morning’s Journal.)

All of this comes as Treasury Secretary Janet Yellen arrives for talks in Beijing tomorrow.

All of this comes as Treasury Secretary Janet Yellen arrives for talks in Beijing tomorrow.

The analysts at the private intelligence service Forward Observer have an unintentionally droll description of what’s in store: “Yellen is expected to tell Chinese officials that the U.S. will continue its opposition to China’s human rights record and its military buildup but wants to work with China on important issues like climate change and international debt relief.”

Sounds like a real win-win she’s taking over there!

![]() Mailbag: Student Loans and Inflation Protection

Mailbag: Student Loans and Inflation Protection

“This topic really irks me!” a reader writes about repayment of student loans. Amazingly, this note came in before the Supreme Court issued its ruling on Friday!

“This topic really irks me!” a reader writes about repayment of student loans. Amazingly, this note came in before the Supreme Court issued its ruling on Friday!

“My husband and I finished paying off our Parent PLUS loans a couple years ago — just before retirement. Our four kids have finally paid off their ends — by getting jobs and not missing a month.

“Many young people seem to believe they should GET to go to college and not have to do anything but enjoy it, rather than understand the opportunity for learning and growing and, yes, WORKING during that time as well. All our kids worked during school and summers.

“Also, isn’t it a legal contract signed by the borrower, agreeing on a payback? I paid mine back and my kids did too. I resent others thinking they shouldn’t have to. We had to give up many things over time to pay back our debts as we agreed. If these students made a bad choice of a nowhere major or too costly a school, why should taxpayers cover for them? The students got what they wanted, and now it’s time to face life, economize and pay the piper.

“The federal government also needs to rethink loans to students for these Ivy League and highly endowed enterprises masquerading as schools. They are part of this problem as well.”

Dave responds: Long ago, a part-time job was enough to pay for a degree. The fact it’s not is at the heart of the problem. See above.

“It was only through a series of changes made by Congress over decades, the most serious being Obama's federalization of essentially all student loans, that led to this problem in the first place,” writes Karl Denninger at his Market Ticker blog.

“A degree that costs $100,000 yet doesn't get you a job that pays more than being a retail employee at [a convenience store] has negative real value. Nobody could sell such a thing except through government-endorsed and backstopped scam; in any other circumstance the demand for such a worthless degree would be zero.”

“Dave, thanks for that ‘memory flogger’ by John Pugsley, whom I am old enough to remember,” a reader writes after our Independence Day inflation playbook.

“Dave, thanks for that ‘memory flogger’ by John Pugsley, whom I am old enough to remember,” a reader writes after our Independence Day inflation playbook.

“Had I known I would get this old, I may have saved more of his suggestions. I followed his advice on some things but now, I don't even buy green bananas.

“I would add one more item to that list, which did not exist when Mr. Pugsley wrote his opus. It is needed by all of us, takes up virtually no space and holds its value — the U.S. first-class Forever Stamp.”

Dave responds: Indeed. I had Pugsley in the back of my mind in late 2018 when the Postal Service announced a rate increase and I said you could buy Forever Stamps for 50 cents each and get a guaranteed 10% return in only 65 days.

New ones cost 63 cents now, and 66 cents effective this coming weekend. The ones my wife and I acquired five years ago — both regular and holiday — will have appreciated 32% in five years, better than the official inflation rate. And we’ve got enough to last us at least 10 more years — maybe longer!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets