Hope for Hodgkin’s Lymphoma Survivor

![]() Taking the Sting out of Cancer Diagnosis

Taking the Sting out of Cancer Diagnosis

“When I was 20 years old, I got the kind of news that no young person wants to hear… I had cancer. Hodgkin's lymphoma to be exact,” says Paradigm’s science-and-technology expert Ray Blanco, opening up about how he got his start in biotech investing and much more.

“When I was 20 years old, I got the kind of news that no young person wants to hear… I had cancer. Hodgkin's lymphoma to be exact,” says Paradigm’s science-and-technology expert Ray Blanco, opening up about how he got his start in biotech investing and much more.

“Back in the 1990s when I was diagnosed, surviving Hodgkin's lymphoma wasn't even a 50/50 proposition. The treatments were grueling and the odds of beating this disease were stacked against you.

“The hair loss, the radiation burns, the relentless nausea — it was one of the hardest things I've ever gone through,” he says. “If I'm being honest, there were times I didn't think I'd make it.

“Fortunately, advancements in medical technology over the years turned my fate around. The radiation and chemotherapy regimens that were still cutting-edge at the time ultimately saved my life.

“I'll never forget how fortunate I was to have access to those breakthrough cancer treatments when I did. If I had been diagnosed just 10 years earlier, before those advancements, I may not be here today.

“That life-changing experience sparked my obsession with medical breakthroughs and led me to where I am today — hunting for the next big investment opportunities in health care technology.

“And I've never been more excited than I am right now…

“A brand-new technology is emerging out of Silicon Valley that is poised to revolutionize how we treat cancer and so many other diseases,” Ray says. “I'm talking about artificial intelligence (AI).

“A brand-new technology is emerging out of Silicon Valley that is poised to revolutionize how we treat cancer and so many other diseases,” Ray says. “I'm talking about artificial intelligence (AI).

“Companies are now using advanced forms of AI to discover and develop entirely new drugs at lightning-fast speed,” he says. “This ‘generative AI’ is able to dream up potential new therapeutic compounds, far faster than any human researcher could.

“AI is then used to refine and optimize these computer-generated drug candidates, getting them ready for real-world trials in a fraction of the normal time.

“The implications for treating aggressive diseases like cancer are profound,” says Ray.

“Computer models are able to analyze mountains of data (genetic profiles, scientific studies, patient histories) and find ideal drug targets and candidates that human researchers may have overlooked or given up on.

“Already, dozens of drugs discovered and optimized by AI are in clinical trials for all sorts of cancers, rare diseases, autoimmune disorders and more. And the early results look incredibly promising.

“Never before have we had a tool as powerful as AI to aid us in humanity’s fight against disease,” Ray claims. “It’s a game-changer, an inflection point.

“Never before have we had a tool as powerful as AI to aid us in humanity’s fight against disease,” Ray claims. “It’s a game-changer, an inflection point.

“Using AI, companies will be able to get new lifesaving drugs into clinical trials at warp speed,” he anticipates. “The success rates in those trials will soar as AI optimizes trial conditions and targets only those patients predisposed to benefit.

“And there's one little AI health care company at the forefront of this revolution that you need to know about today...

“This tiny $500 million firm was one of the first to apply advanced AI for drug discovery,” says Ray. “Its breakthrough software platform is able to take in massive datasets and quickly surface ideal drug targets and candidates.

“The AI then takes those candidates through rapid iteration and refinement — checking for safety, optimizing for efficacy and precision targeting.

“Big pharmaceutical giants have already handed this company millions to license access to its AI drug discovery engine. Several early-stage AI-discovered drug candidates are already entering clinical trials for cancers and other diseases.

“With a BIG potential payday (in the billions) from future milestone payments and royalties riding on these AI-optimized drugs, this company is truly a speculator's dream,” Ray concludes.

[Ray Blanco first recommended Nvidia to his readers when the company traded at just $3.

Anyone who acted on his 2011 recommendation — and held until today — made a fortune.

Thirteen years later, Ray recommends a fledgling $6 AI stock — which might be the smallest AI company we’ve ever recommended… with potential to be bigger than Nvidia.

Get all the details right here.]

![]() Buffett Pares Apple

Buffett Pares Apple

Berkshire Hathaway held its annual shareholder meeting on Saturday, and CEO Warren Buffett (sorta) explained why the company sold 13% of its Apple position in Q1.

Berkshire Hathaway held its annual shareholder meeting on Saturday, and CEO Warren Buffett (sorta) explained why the company sold 13% of its Apple position in Q1.

“We have sold shares and I would say that at the end of the year I would think it extremely likely that Apple is the largest common stock holding we have,” said Buffett during the weekend meeting — the first such meeting, by the way, since the passing of Berkshire Hathaway’s longtime Vice Chairman Charlie Munger in November.

“One interesting thing is that Charlie and I looked at common stocks or marketable equities or the things that people love to look at as being businesses, and so when we own a Dairy Queen, or we own whatever it may be, we look at it as a business,” Buffett said, doubling-down on his homespun persona.

“When we own Coca-Cola or American Express or Apple, we look at that as a business.”

So Buffett went on to (sorta) confirm: “We will own — unless something really extraordinary happens — we will own Apple.”

So Buffett went on to (sorta) confirm: “We will own — unless something really extraordinary happens — we will own Apple.”

According to Fox Business: “The sale resulted in Berkshire realizing an $11.2 billion after-tax gain in the quarter from its sale of Apple stock and contributed to the rise in the company's cash holdings to a record of $189 billion.

“[Buffett] also said that given alternatives in the market and uncertainty around the world, holding a larger cash stake is preferable” — which jibes with recent advice from Paradigm’s macro expert Jim Rickards.

If Buffett’s really looking at Apple’s business fundamentals, then perhaps that’s what’s been guiding Berkshire Hathaway’s decision to pare its AAPL position. On Friday, we noted Apple’s subpar earnings report; nevertheless, AAPL shares lifted 6.3% on the day because the company authorized a $110 billion share buyback.

Which dovetails with comments from Jim Rickards’ chief analyst Dan Amoss at Paradigm’s editorial Slack channel…

“I reiterate my view that it is destructive to shareholder value for Apple to borrow near 5% and buyback shares that have a 2% or 3% free cash flow yield,” Dan says.

“I reiterate my view that it is destructive to shareholder value for Apple to borrow near 5% and buyback shares that have a 2% or 3% free cash flow yield,” Dan says.

“That is night and day compared with Apple buybacks around 2016 — when it had more growth potential, it could borrow near zero and its free cash flow yield was near 10%.

“Which stocks fit this description today?” Dan posits. “Refiners like Marathon Petroleum Corp. (MPC) and exploration-and-production stocks like ConocoPhillips (COP).” Plus? “A lot of non-sexy names, like distributors, steel, homebuilding, oil and gas, gas stations, auto dealers, auto parts retailers and railroads.

“These stocks may not be hares,” Dan adds, “but like tortoises, they may win the race over five–10 years — slow and steady.”

Looking at AAPL shares today, they’re down about 1%... But the three major stock indexes are all in the green this afternoon. The tech-heavy Nasdaq is leading the way, up 0.70% to 16,270. Meanwhile, the S&P 500 and Dow are up 0.60% and 0.20% respectively.

As for the commodities complex, oil’s gained about 0.40% to $78.44 for a barrel of WTI. Precious metals are getting some love: Gold is up 1% to $2,333.20 per ounce, but silver’s up 3.5%, firmly above $27.

But the crypto market’s churning in the red at the time of writing. Flagship crypto Bitcoin is down 0.75% to $63,450 while Ethereum’s down 1.70% to $3,000.

![]() Uranium Ban: “Bullish” for Stocks

Uranium Ban: “Bullish” for Stocks

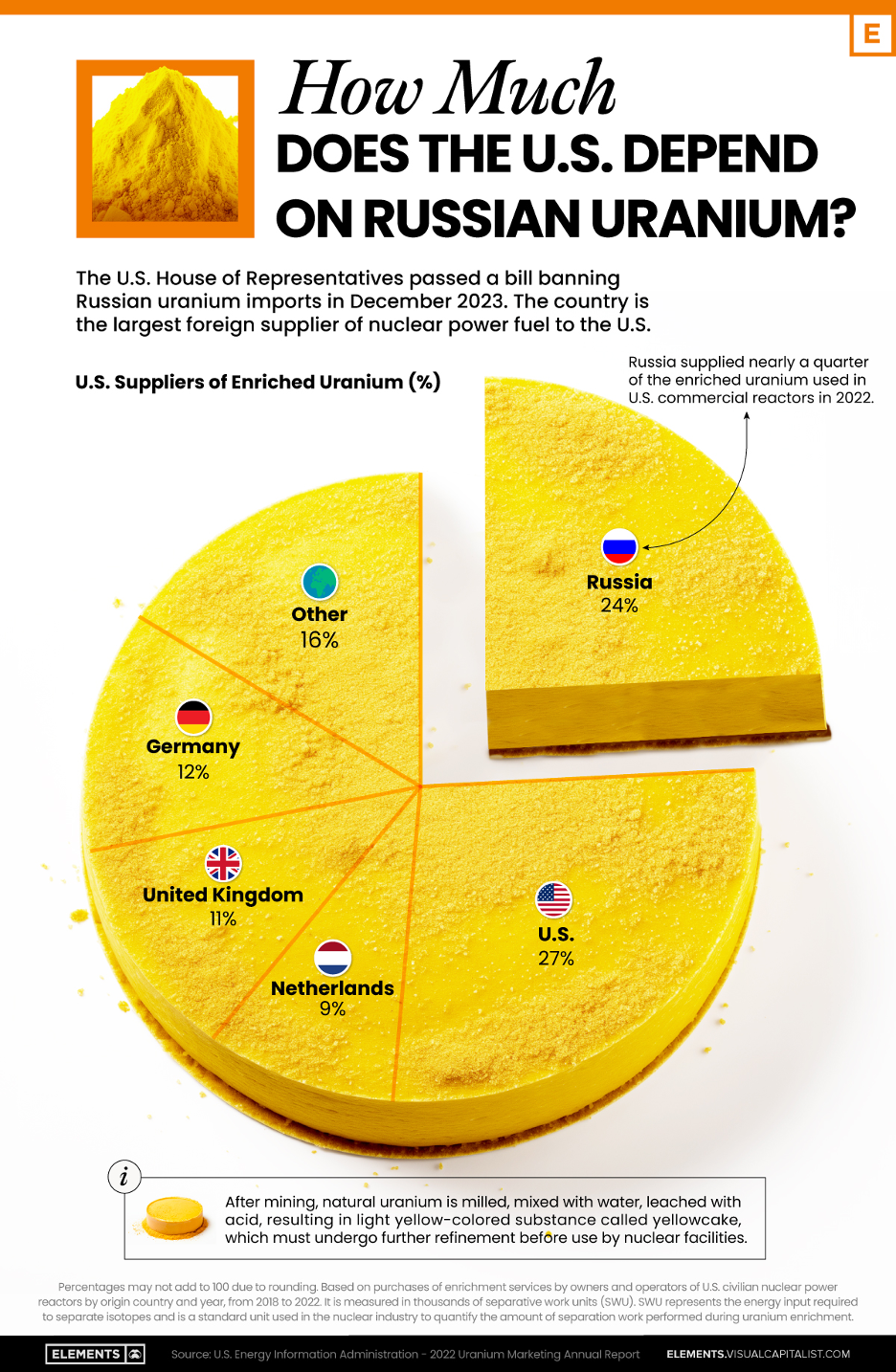

“The U.S. relies on Russia to supply uranium for its nuclear industry. It hasn't happened yet, but the Biden administration wants to ban the import of enriched Russian uranium,” says Paradigm’s geology-and-mining expert Byron King, adding: “That’s bullish for uranium stocks.”

“The U.S. relies on Russia to supply uranium for its nuclear industry. It hasn't happened yet, but the Biden administration wants to ban the import of enriched Russian uranium,” says Paradigm’s geology-and-mining expert Byron King, adding: “That’s bullish for uranium stocks.”

According to an article at OilPrice.com: “Officials from the White House National Security Council, the Department of Energy and other top-level officials have discussed reducing reliance on Russian uranium imports. [The] potential ban could include waivers similar to legislation that quickly passed the House last year.”

Source: Visual Capitalist

“Currently, Russia is the largest foreign supplier of nuclear power fuel to the United States,” Visual Capitalist says. “In 2022, Russia supplied almost a quarter of the enriched uranium used to fuel America’s fleet of more than 90 commercial reactors.”

Citing stats from the Congressional Budget Office, a ban on Russian uranium imports could raise costs, at least, 13% or more. Indeed, Jonathan Hinze of nuclear research firm UxC says uranium prices have most likely “reached a bottom.”

As for stocks, the largest publicly traded uranium company — Cameco Corp. (CCJ) — as well as Uranium Energy Corp. (UEC) and Sprott Uranium Miners ETF (URNM) are all getting a boost from a potential WH ban.

![]() “Biden Bucks” (Zimbabwe-style)

“Biden Bucks” (Zimbabwe-style)

“They gave us no warning. We save and save their useless money and overnight the notes are worthless,” says frustrated Zimbabwean Sylvia Dhliwayo

“They gave us no warning. We save and save their useless money and overnight the notes are worthless,” says frustrated Zimbabwean Sylvia Dhliwayo

To wit: “When Reserve Bank Governor John Mushayavhanu gave Zimbabweans three weeks to exchange their bond notes, they lost what little value they had immediately,” the BBC says.

We reported last month Zimbabwe’s plan to launch its sixth currency in 16 years, replacing “its dollar with the ZiG, short for Zimbabwe Gold,” Bloomberg said. “The new unit is backed by bullion and foreign currency reserves held at the central bank.”

Source: X

“Ms. Dhliwayo would use Zigs if there were any to be had,” BBC notes, “but it mostly exists digitally, and in a place where people can rarely charge their phones because of blackouts, it is cash that counts.”

Most business, in fact, is still transacted in USD. Although, due to a shortage of U.S. coins, grocery stores have resorted to giving change in… lollipops!

So, gee, Zimbabwe has this awesome new gold-backed currency, but no one can use it because it’s mainly digital and electricity is unreliable.

No words…

![]() Caleb Williams’ Tax Arbitrage

Caleb Williams’ Tax Arbitrage

“Regarding Caleb Williams’ Chicago tax burden, couldn't he reside in Hammond, Indiana, and commute just over 20 miles to Chicago for practices and games? As an Indiana resident wouldn't he pay the Indiana rate?”

“Regarding Caleb Williams’ Chicago tax burden, couldn't he reside in Hammond, Indiana, and commute just over 20 miles to Chicago for practices and games? As an Indiana resident wouldn't he pay the Indiana rate?”

A reader responds to a mid-NFL-draft issue where we noted QB Caleb Williams will spend $538,956 in state and local taxes for every $10 million he earns playing for the Chicago Bears.

“The current Indiana state income tax for 2024 is 3.05%, down from 3.15% in 2023. Hammond, Indiana, also has a county income tax of 1.5%

Courtesy: EnviroForensics

Hammond, Indiana: Hmm, not exactly a 22-year-old’s dream destination…

“On top of federal and state and local taxes, NFL players have to pay a ‘jock tax’ in most states and some cities they play in: They pay a portion of each away-game check to the state and sometimes city they play in.

“Depending on what team they play for, and what states/cities their away games are in, NFL players can file as many as 10 tax returns and pay as much as 50% of their salaries and bonuses.

“If they get injured or cut, they often don't get compensation (unless it's written into their contract). And they’re not eligible for unemployment.

“The average NFL career is 3.3 years (running backs under 2.6 years) with an average salary of $860,000. So hopefully they paid attention in school, as it's likely they will need that scholarship education.

“They ALL ought to get financial advisers (and I would certainly hire an accountant).

“Somehow I think that Caleb will be OK. But then again I have seen quite a few Super Bowl rings in hock shops… I could certainly live and invest handsomely on what Caleb will be paying in state and local taxes!”

Emily: You and me both!

To answer your question, surprisingly, moving to Hammond would only be negligibly better than residing in Chicago.

Nonetheless, we hope the Heisman Trophy winner gets the counsel he deserves. Seeing as Caleb Williams’ father Carl is his de facto business manager and agent, well, we’ve all seen how mixing family and business can end disastrously. Here’s hoping it works out for young Williams.

Come on back for another 5 Bullets tomorrow. Until then, take care!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets