Impeachment and the Markets

- Impeachment: A gift to the Dems?

- Rickards shocker: Rate hike next week!

- Surging oil, stalling stocks

- Household incomes are backsliding

- Mailbag: Withholding judgment, bogus college courses

![]() Impeachment: A Gift to the Dems?

Impeachment: A Gift to the Dems?

Gee, maybe every president will face an impeachment inquiry throughout the course of the Flaming Twenties.

Gee, maybe every president will face an impeachment inquiry throughout the course of the Flaming Twenties.

We can thank Benjamin Franklin in part for the fact the Constitution has an impeachment clause. During the Constitutional Convention in 1787, Franklin argued that without it the only alternative to removing an executive for grave misconduct was the way European monarchs were removed — by killing them. He had a point, no?

Anyway, as you’re surely aware, House Speaker Kevin McCarthy has given the go-ahead for impeachment proceedings against Joe Biden.

And yes, there will be consequences for the markets, says Paradigm macroeconomics maven Jim Rickards: “Investors should prepare for the uncertainty and volatility that’s waiting right around the corner.”

And yes, there will be consequences for the markets, says Paradigm macroeconomics maven Jim Rickards: “Investors should prepare for the uncertainty and volatility that’s waiting right around the corner.”

More about that momentarily…

“The proceedings will last for a month or more and then the House will vote to impeach Biden, probably in February 2024,” Jim continues. “The impeachment articles will then be delivered to the U.S. Senate.”

At this time, the likelihood of a two-thirds vote in the Senate to remove Biden from office looks remote. “But the possibility could be used as leverage by the Democrats to persuade Biden to resign or not run again for office.”

In that regard, you can already see the stage being set…

That’s not just any Washington Post columnist. That’s David Ignatius, perhaps the corporate media’s most reliable conduit for conveying the Deep State’s agenda to the “opinion shapers” within the rest of America’s power elite. It’s not too soon to say the long knives are out.

Oh, and then there’s this…

Jim expresses confidence that the proceedings will not be a circus: “This impeachment will not be a rushed Mickey Mouse affair like the two impeachments of Donald Trump orchestrated by Nancy Pelosi in 2019 and 2021.

“The Pelosi impeachments of Trump were on flimsy charges. In fact, Trump was impeached for asking Ukrainian President Zelenskyy to investigate Biden crimes in Ukraine that we now know actually happened.

“Instead, the impeachment of Biden will look more like the Nixon impeachment hearings of 1974,” says Jim — “led by Congressman Peter Rodino of New Jersey.

“Instead, the impeachment of Biden will look more like the Nixon impeachment hearings of 1974,” says Jim — “led by Congressman Peter Rodino of New Jersey.

“Rodino’s hearings were sober, dignified and rigorous. Both parties had the opportunity to debate the issues, both pro and con. Ample evidence was provided. In the end, Nixon was not impeached, but resigned once members of his own party explained that impeachment and removal from office were just a matter of time.

“Something similar may happen this time.”

So what happened in the markets amid Watergate and Nixon’s downfall?

So what happened in the markets amid Watergate and Nixon’s downfall?

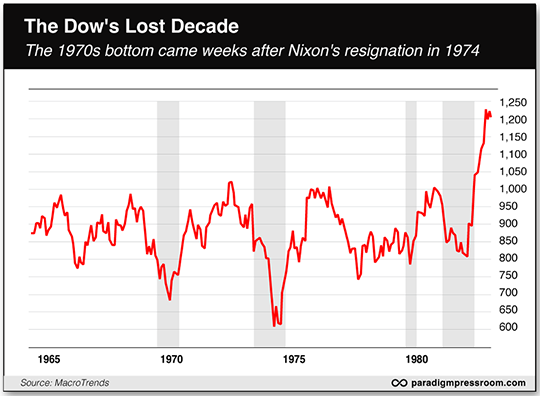

As we mentioned last week, the 1970s were a “lost decade” for stocks. In the midst of that decade, the Dow industrials sank from over 1,000 in late 1972 to nearly 600 a few weeks after Nixon resigned in August 1974.

Granted, a lot of other things were weighing on the economy and the markets at that time — not least the 1973 Arab oil embargo, which quadrupled oil prices in a matter of months.

But the market did recover once Nixon was out of the picture — and once Gerald Ford’s pardon guaranteed there would be no Nixon trial dragging out the drama indefinitely. (Imagine if Nixon had gone to trial and his lawyers presented evidence that most of the Watergate “Plumbers” had a history with the CIA.)

Alas, that’s where the 1974 analogue breaks down — because Biden resigning or declining to run for a second term would not be the end of the story.

Alas, that’s where the 1974 analogue breaks down — because Biden resigning or declining to run for a second term would not be the end of the story.

For one thing, 1974 was not a presidential election year. The public’s attention had moved on from Nixon by the time of the 1976 primaries. In contrast, Biden’s impeachment hearings will take place at roughly the same point in the 2024 election cycle that Trump’s first impeachment took place during the 2020 cycle.

Meanwhile, as maybe you heard somewhere, Trump is seeking another term even as he faces four criminal trials on a pile of charges, most of which carry prison time.

Volatility “around the corner” as Jim says? Yeah, probably. Stay tuned.

[Time-sensitive announcement: Even before impeachment gets underway, Jim says markets are sure to be rocked by something else: “New intel suggests the banking system is at risk of an imminent meltdown,” says Jim.

“This is the kind of situation I haven’t seen since 2008 — when I warned a senior member of Congress the financial system was about to collapse.” That was three weeks before Lehman Bros. went under.

Jim is dropping everything to air an Emergency Banking Briefing for you tomorrow night at 7:00 p.m. EDT — LIVE on Zoom. You can register via Zoom’s website at this link.]

![]() Rickards Shocker: Rate Hike Next Week!

Rickards Shocker: Rate Hike Next Week!

Meanwhile, Jim is sticking to a call that’s looking more audacious by the day: The Federal Reserve will raise interest rates next Wednesday, the 20th.

Meanwhile, Jim is sticking to a call that’s looking more audacious by the day: The Federal Reserve will raise interest rates next Wednesday, the 20th.

That’s despite the futures market assigning a 95% probability the Fed will stand pat — and a Nick Timiraos Wall Street Journal story that dropped last weekend, channeling a Fed message that rates will remain unchanged.

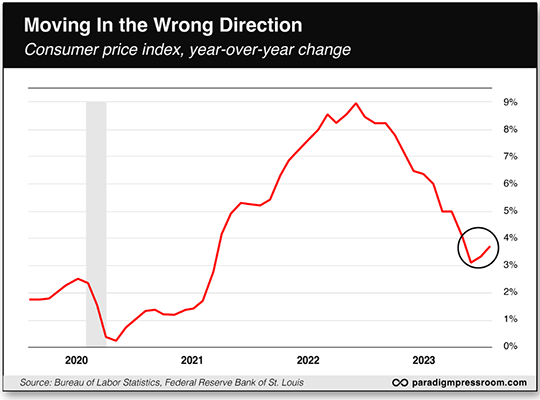

Jim says Fed chair Jerome Powell couldn’t have been clearer during his speech at Jackson Hole, Wyoming, last month: “Although inflation has moved down from its peak,” Powell said, “it remains too high.”

As if to reinforce Jim’s point, the official inflation numbers continue moving in the wrong direction.

As if to reinforce Jim’s point, the official inflation numbers continue moving in the wrong direction.

The Labor Department is out with the August consumer price index — up 0.6% month-over-month, largely on the back of surging energy prices.

Thus the year-over-year inflation rate jumped from 3.2% in July to 3.7% in August. We said the June number of 3.0% would prove to be the bottom… and, sorry to say, we were right.

Also sorry to say, there’s more where that came from: As we mentioned in our Independence Day edition, a raft of academic research demonstrates that once inflation races past the 5–8% level, it typically takes a decade to get back to 2–3%.

![]() Surging Oil, Stalling Stocks

Surging Oil, Stalling Stocks

Speaking of surging energy prices, there’s no relief in sight.

Speaking of surging energy prices, there’s no relief in sight.

Crude shot up to another 10-month high yesterday. The bump came when Bloomberg issued an analysis showing a yawning gap between supply and demand going into the end of the year — 3 million barrels a day, or more than 3% of daily global production.

Checking our screens this morning, West Texas Intermediate has pulled back a few cents from yesterday, now fetching $88.76. If it can bust through $90, there’s a clear shot at $100 before year-end.

So far, it’s a quiet day for the stock market — the Dow ruler-flat, the Nasdaq up about a quarter-percent.

So far, it’s a quiet day for the stock market — the Dow ruler-flat, the Nasdaq up about a quarter-percent.

The S&P 500 is up fractionally to 4,465. On the one hand, that’s up 25% from the bottom last October. On the other hand, the index is no better off than it was two months ago.

Given the choppy-but-generally-down market movement of late, “I believe it will be easier betting on downside action during a potentially volatile fall,” writes Paradigm chart hound Greg Guenthner at The Trading Desk. “If the major averages start to roll over, we could be in for a rocky few weeks.”

➢ Strike update: At this point, it looks as if the United Auto Workers will engage in “targeted strikes” when its contracts with the Detroit automakers expire on Friday. That is, they’ll strike at factories here and there — rather than everyone all at once. UAW chief Shawn Fain will lay out the specifics during a livestream later today.

Precious metals are little moved, gold at $1,910 and silver at $22.82. Bitcoin continues to oscillate around $26,000.

![]() Inflation’s Toll: Household Incomes Backsliding

Inflation’s Toll: Household Incomes Backsliding

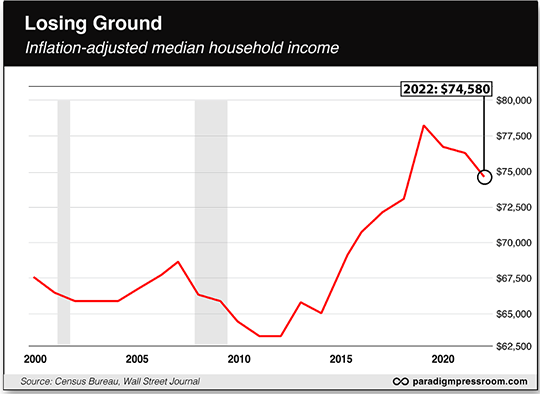

For the record: COVID lockdowns and the resulting inflation have totally done a number on household income the last three years.

For the record: COVID lockdowns and the resulting inflation have totally done a number on household income the last three years.

Yesterday the Census Bureau issued its annual report on median household income: Last year, half of U.S households pulled in over $74,580; the other half pulled in less. Adjusted for inflation, the number is now down 4.7% from its pre-pandemic peak.

Meanwhile, the poverty rate zoomed higher — from 7.8% in 2021 to 12.4% last year.

And yet the liberal commentariat still can’t wrap its mind around why the typical American feels so miserable about the economy (and by extension, doesn’t believe “Bidenomics” is the most awesome thing ever)…

Heh… As we mentioned only last week, Paul Krugman beclowned himself when he said he couldn’t believe that “smart people who follow the news…had no idea that inflation is way down” from its 9.1% peak in summer 2022. Yeah, “inflation” is way down but prices most assuredly are not.

Lest we be accused of partisanship, we remind you Trump bears responsibility for starting this dirty snowball rolling downhill. He gave his assent to lockdowns on March 16, 2020. Then he signed the CARES Act, authorizing $600 weekly checks (tax-free!) for people to sit at home guzzling beer and binging on Netflix. That’s a lot of government spending with nothing productive to show for it. How could it not be inflationary?

![]() Mailbag: Withholding Judgment, Bogus College Courses

Mailbag: Withholding Judgment, Bogus College Courses

On the subject of the Fed’s rate-hike intentions, we heard from a newer reader after Monday’s edition.

On the subject of the Fed’s rate-hike intentions, we heard from a newer reader after Monday’s edition.

We were a bit hasty in declaring there was no chance the Fed would raise rates this month — with the caveat that we had yet to hear from Jim Rickards on the newest developments.

“Your message was reassuring,” the reader wrote. “Since I have joined recently it appears all Jim’s calls are falling on the negative side of my understanding of events and are turning my thoughts more negatively toward your organization's information stream.

“But I will withhold a conclusion for a few more months, to see how events play out, validating or otherwise those predictions.”

Dave responds: Well, as you saw above, Jim is in fact sticking to his outlook of a rate hike one week from today. Yes, he’s putting his rear end on the line.

Here’s the thing: You don’t get far in the newsletter business by parroting conventional wisdom. But at the same time, you do your readers a disservice if you’re a contrarian for the sake of being a contrarian. (It’s the old joke about how “so-and-so predicted eight of the last two market crashes!”)

Jim has stuck his neck out at moments when it counted — standing almost alone in forecasting a Trump victory in 2016, for instance. And since the start of the Fed’s rate-raising cycle 18 months ago, he’s nailed both the direction and magnitude of rates with every Fed meeting every six weeks. Undoubtedly his contacts inside the Fed have helped him in this regard.

If Jim is right on this one, you’ll probably be impressed with his perspicacity. If he’s wrong, well, we hope you’ll evaluate the totality of his analysis when it comes time to renew. In the meantime, we thank you for your trust — and your patience.

We heard from a reader with a different perspective on our item in yesterday’s edition about some of the more boneheaded college courses out there — to wit, “Psychology of Taylor Swift — Advanced Topics of Social Psychology” at Arizona State.

We heard from a reader with a different perspective on our item in yesterday’s edition about some of the more boneheaded college courses out there — to wit, “Psychology of Taylor Swift — Advanced Topics of Social Psychology” at Arizona State.

“I graduated from a mid-level California university in 1985. At the start of my final year my counselor informed me that a pair of classes I took in junior college were no longer transferrable and I would need to take eight extra units my last semester to graduate.

“Enter (1) How to Juggle (courtesy of the athletic department) for two units; (2) The History of Rock ’n’ Roll From Elvis to Elvis (Presley to Costello for the tragically unhip) for three units; and (3) Hitler as an Orator (offered by the communications department) for three units and easily one of the most fascinating classes I ever took at any level.

“These courses existed primarily for seniors such as myself who found themselves short a few units and just didn't want to take any brain-bending classes in their last months of matriculation just to satisfy some faceless bean counters.

“I suspect the classes you listed fall into the same category, although had they offered How to Distill Your Own Whiskey, I might have opted out of my newfound juggling interest in favor of something a bit more useful.”

Dave responds: Huh, my college experience is more or less contemporaneous with yours. I guess I shoulda looked at the course catalog a little more closely to make it easier on myself!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets