We’re Calling BS on AI

- Let’s get real about AI

- Nope, no September rate hike

- The good guys win in Missouri v. Biden (sorta)

- Tiny gold coins empower the poor

- Musk and “conspiracies”

![]() Let’s Get Real About AI

Let’s Get Real About AI

“I am sick of the bull****!” declares Paradigm Press’ venture-capital veteran James Altucher.

“I am sick of the bull****!” declares Paradigm Press’ venture-capital veteran James Altucher.

He speaks of 2023’s buzziest investment trend — artificial intelligence.

Ever since ChatGPT burst on the scene late last year, we at Paradigm have collectively been trying to wrap our heads around AI. How do we explain it to an audience of savvy retail investors like yourself — people who recognize BS from a mile away?

If you’re a Jim Rickards reader — alert to the likelihood that the schemes of politicians and central bankers are doomed to blow up in the financial markets — your suspicion might be especially high. And for good reason.

Here’s the crux of the problem, and maybe you already know it intuitively: AI is real and it will have a transformational effect on many sectors of the economy. That fact will be highly investable — provided you can filter out the incessant noise surrounding AI.

Here’s the crux of the problem, and maybe you already know it intuitively: AI is real and it will have a transformational effect on many sectors of the economy. That fact will be highly investable — provided you can filter out the incessant noise surrounding AI.

James says AI is already transforming industries as diverse as accounting, medical devices and financial services — with manufacturing and tooling to follow in the months and years ahead.

But then there’s the hype: “All day long,” James says, “I get these insanely stupid emails. ‘Come to my $2,000 AI Mastermind!’ They are always from people who have zero tech background, and zero real AI experience.

“‘I’ve been using ChatGPT since it was first released!’ Like 100 million other people. But all I see nowadays are scams that say, ‘Use AI to make millions in a week.’ It’s insane.”

It also reminds him of the dot-com boom in the late 1990s. “Every company would add ‘.com’ to their name and suddenly their stocks would go up 500%.

“When 1-800-Flowers Inc. changed their name to 1800flowers.com, they filed for an IPO that day. Because they were no longer a flower store, they were a ‘.com’ company. High-tech flowers!”

Understand, James’ disgust comes with the authority of having studied the AI field for over 30 years.

Understand, James’ disgust comes with the authority of having studied the AI field for over 30 years.

In 1991, while Hollywood served up its conception of AI in Terminator 2: Judgment Day, James published his first academic paper on AI. He delivered a talk about it at a conference in Kaiserslautern, Germany; he was the youngest person there.

“I have since worked on AI-based fictional characters, chess computers and AI for day trading,” he tells us. “From 2002–2009 I day traded using AI programs I wrote, ran a hedge fund the same way and even wrote a book based on some of my ideas called Trade Like a Hedge Fund.

“On my podcast, I’ve discussed AI with Eric Schmidt, former CEO of Google; Kai-Fu Lee, the godfather of speech recognition and now one of the biggest VCs in China; and many others.

“And I recently recorded a course about what AI is for the short-form podcast company Blinkist, where I went over, step by step, the development of ChatGPT from the beginnings of AI in the ’50s and ’60s all the way up to now.

“So it bothers me that some people are taking advantage of people by pretending to be an expert and using that false expertise to teach others how to make millions in AI,” James goes on.

“So it bothers me that some people are taking advantage of people by pretending to be an expert and using that false expertise to teach others how to make millions in AI,” James goes on.

“And it bothers me that every company out there is now using AI so they can be an ‘AI company’ and get higher valuations as a result.”

James got a vivid illustration of this phenomenon in a recent conversation with Kevin Surace, holder of 94 patents worldwide and CEO of a company called Appvance — which uses AI to test complex computer programs for the presence of bugs. [Disclosure: James has a stake in this privately held company.]

Said Mr. Surace: “Every company is now mandated by their boards to use AI in every single part of their company. So if they are a manufacturing company not only will they use AI to improve their manufacturing but their marketing division has to use AI, their legal division, even their HR division.”

As James sums up: “They barely even know what AI is and all this money is about to get spent.”

Therein lies the opportunity: Who will be the beneficiaries of all this money that corporate America is about to squander on AI without knowing what they’re getting into?

Therein lies the opportunity: Who will be the beneficiaries of all this money that corporate America is about to squander on AI without knowing what they’re getting into?

Or as James puts it, “The companies that actually do AI will benefit an enormous amount.”

And for those companies, James says the profit potential is even more extreme than when PCs were first entering homes and offices four decades ago.

The classic example here is buying Microsoft when it went public in 1986 — which turned a mere $500 investment into $1.6 million.

Generational wealth. And you can get started today with three names James and his team believe have just that kind of Microsoft-level upside. Watch James as he separates the hype and the BS from the real deal at this link.

![]() Nope, No September Rate Hike

Nope, No September Rate Hike

It’s as official as it gets: The Federal Reserve will not raise short-term interest rates at its September meeting next week…

It’s as official as it gets: The Federal Reserve will not raise short-term interest rates at its September meeting next week…

In a long and rambling article posted on The Wall Street Journal’s website over the weekend, reporter Nick Timiraos delivered another one of the Fed’s “authorized leaks” telegraphing Fed intentions. The upshot is no increase on Sept. 20 — and an increase either Nov. 1 or Dec. 13 is “an open question.”

Significantly, the Fed let this story drop before the Labor Department delivers the official inflation numbers on Wednesday. Even a hotter-than-expected reading won’t alter the Fed’s course next week.

To be sure, Paradigm macro maven Jim Rickards went on record last month as saying the Fed would raise in September. But that was an early read — subject to revision until a week before the actual decision. We’ll hear from Jim later this week, but he’s had a perfect record with his final call on every Fed meeting since the Fed began its rate-raising cycle 18 months ago.

With a September rate hike off the table, Mr. Market is staging a mild relief rally to start the week.

With a September rate hike off the table, Mr. Market is staging a mild relief rally to start the week.

The Nasdaq — packed with tech companies that are most sensitive to interest rates because they borrow so much to fund their operations — is up the most on the day, nearly a half percent to 13,824.

The S&P 500 is up more than a third of a percent at 4,473 while the Dow is the laggard, up less than a quarter percent at 34,638.

Precious metals are little moved — gold at $1,922 and silver at $23 on the nose. Crude is also flat at $87.54.

For the record, an auto worker strike come Friday is looking more and more likely.

For the record, an auto worker strike come Friday is looking more and more likely.

United Auto Workers chief Shawn Fain says a proposed contract from General Motors is “insulting.” The UAW’s contracts with GM, Ford and Stellantis all expire at the end of this week and the union could strike at all three.

The scuttlebutt we’re hearing is that the automakers have enough inventory on hand for one or two months of sales — which is about the same amount of time the UAW can issue strike pay to workers before running out of funds.

Also for the record, there will be no decision on a Bitcoin ETF until next month.

Also for the record, there will be no decision on a Bitcoin ETF until next month.

As we mentioned at the end of August, Grayscale Investments won a court victory in its suit against the Securities and Exchange Commission. But as Paradigm crypto analyst Chris Campbell reminded us at the start of September, the court merely ordered the SEC to review Grayscale’s application to issue a Bitcoin ETF: “This process could be dragged out until next year.”

Grayscale is one of a half dozen companies that want to launch a Bitcoin ETF. And sure enough, the SEC has now extended the public comment period on most of those companies’ applications — effectively putting off any decision until mid-October.

In the meantime, Bitcoin is drifting lower to $25,340.

![]() The Good Guys Win in Missouri v. Biden (With a Big *)

The Good Guys Win in Missouri v. Biden (With a Big *)

A federal appeals court has smacked down the White House in its internet censorship campaign.

A federal appeals court has smacked down the White House in its internet censorship campaign.

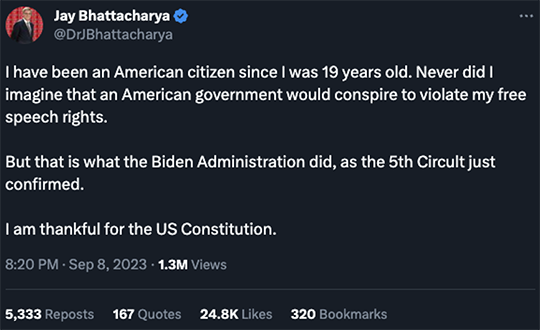

On Friday, the Fifth Circuit Court of Appeals issued a ruling in Missouri v. Biden — the landmark case in which it became obvious that the feds were leaning hard on social media companies to censor posts and suspend entire accounts that ran contrary to government narratives.

As we mentioned last month in our annual censorship issue, the feds were “flagging” posts on nearly every subject under the sun — not just COVID but even monetary policy and the banking system.

Said the three-judge panel: “We find that the White House, acting in concert with the Surgeon General’s office, likely (1) coerced the platforms to make their moderation decisions by way of intimidating messages and threats of adverse consequences, and (2) significantly encouraged the platforms’ decisions by commandeering their decision-making processes, both in violation of the First Amendment.”

The judges smacked down the White House, Surgeon General, CDC and FBI. The plaintiffs are pleased — including epidemiologist Jay Bhattacharya, who challenged conventional wisdom on lockdowns in 2020.

Still, it’s entirely too soon to do a victory lap. The feds might well appeal; the case might end up in the Supreme Court and not be decided until 2025.

Still, it’s entirely too soon to do a victory lap. The feds might well appeal; the case might end up in the Supreme Court and not be decided until 2025.

Also problematic: The appeals court reversed an important part of the district court’s decision. While the White House, Surgeon General, CDC and FBI are under orders to stop pressuring social media platforms, the Cybersecurity and Infrastructure Security Agency was let off the hook.

This development is deeply disappointing to Matt Taibbi, the reporter who broke many of the “Twitter Files” scoops late last year and early this. During the course of his reporting, Taibbi found many instances of collusion between that agency and nonprofit groups like the Election Integrity Partnership launched by Stanford University in 2020 — resulting in social media suspensions and cancellations.

Writes Taibbi: “Not only did judges rule that CISA’s content-flagging, which we saw in volume in the Twitter Files, was conduct that fell on the permitted ‘attempts to convince’ spectrum as opposed to ‘attempts to coerce,’ they removed EIP-type projects from the injunction. This is important because the EIP is likely to be a central vehicle for monitoring of 2024 election speech.”

The story is nowhere near over. We’ll stay on top of it.

![]() Tiny Gold Coins Empower the Poor

Tiny Gold Coins Empower the Poor

Necessity is the mother of invention…

Necessity is the mother of invention…

From the Reuters newswire: “A Gaza dentist has developed ultra-lightweight gold coins to allow people without much money access to one of the most widely used savings methods across the Middle East.”

Gazans have no currency of their own. They use the euro, dollar, Israeli shekel and Jordanian dinar. “As in many parts of the Middle East,” says the story, “mistrust of banks means many people prefer to keep their savings in gold.”

Complicating matters is the fact the Gaza Strip is autonomous in name only; Israel and Egypt control its borders, ports and airspace — which, as you might imagine, makes everyday commerce a fragile thing.

"The idea stemmed from the community's need to own gold amid the difficult living conditions the people live in," says dentist Ahmed Hamdan, developer of the coins.

The coins are as small as a half-gram — worth $30.93 at today’s gold price — and as large as 10 grams. On the front is the Dome of the Rock shrine in Jerusalem. "We have made gold available to people of all categories, gold that even the poor and those with low income can get some."

The head of Gaza’s Economy Ministry, Osama Nofal, is quick to point out the coins are not legal tender. "It mustn't be interpreted as if it were a future currency. It is no more than a way of saving."

But a mighty effective one under the circumstances. "I can't buy heavy grams, but these tiny grams are easier to get,” says Adel Al-Rafati, who’s bought 3.5 grams over the last three months. “I can save because gold is a safer haven than other currencies.”

![]() Musk and “Conspiracies”

Musk and “Conspiracies”

“I don’t know why you Americans have to make a conspiracy out of everything that happens, especially if it is against your beliefs,” writes a reader after Elon Musk was our No. 1 bullet not once but twice in late August.

“I don’t know why you Americans have to make a conspiracy out of everything that happens, especially if it is against your beliefs,” writes a reader after Elon Musk was our No. 1 bullet not once but twice in late August.

“You might consider to do the following:

- Take a step back

- Forget anything in the direction of prejudice

- Analyze objectively.

“Result: You tend to look into the mirror and you might find mistakes you have made all by yourself. If I would get a dollar for everything that didn’t go my way I would be wealthier than Donald Trump.

“Lastly Musk is anything but a free speech absolutist, he is a visionary and very intelligent.

“Being raised in and during apartheid in South Africa left tracks in his fundamental beliefs.

“His EQ is mediocre — have you forgotten how he used the media to manipulate markets?

“Again, he is a genius but he is as faraway from being a free speech absolutist as Trump and I for being honest about beating Noah Lyles over 100 meters.”

Dave responds: See, this is the problem nowadays. We go out of our way to express a subtle and nuanced view on a topic of considerable importance, and someone still sees what he wants to see because he’s primed to be outraged.

Fact is, we never bought into Musk’s protestations that he was a free-speech absolutist. His free-speech bona fides were always in question given SpaceX’s reliance on federal contracts and Tesla’s reliance on tax breaks.

But then we see the feds bringing pressure on him, fulfilling our suspicions, and someone shouts back YOU MUSK FANBOYS THINK EVERYTHING’S A CONSPIRACY. Sheesh!

It’s this simple: You take the government’s money, you dance to the government’s tune. What’s so conspiratorial about that?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets