Irrelevant

![]() Why Does the Mainstream Obsess About This?

Why Does the Mainstream Obsess About This?

It’s astonishing how much internet bandwidth is wasted by the financial media…

It’s astonishing how much internet bandwidth is wasted by the financial media…

Look, I worked in traditional media for 20 years. I totally get why they do this. After all, Apple was until recently the biggest company on the planet. (At this moment, Microsoft takes the crown.) What’s more, Apple is a fixture in most mom-and-pop investment portfolios because of its outsized presence in index funds. And Apple still has a degree of Jobsian mystique even though Steve Jobs has been pushing up daisies since 2011.

But my God — all this oohing and aahing and hemming and hawing ahead of Apple’s earnings release later today?

No one’s going to remember what happened three months from now — when, by the way, the next round of quarterly earnings numbers comes out and the media performs this circle-jerk ritual all over again.

Still, for someone like you, this phenomenon serves up a lucrative opportunity.

See, Apple is going to make an announcement tomorrow at 10:00 a.m. EST — one that stands to disrupt the markets and render Apple’s earnings release this afternoon irrelevant.

Almost no one sees this coming — but Paradigm’s venture capital and hedge fund veteran James Altucher does.

And he wants you to be ready, because he believes this announcement will unleash an opportunity to make 10X your money — but not by buying AAPL shares.

You’ll want to be up to speed before this announcement drops — which is why James is convening an urgent Apple Market Disruption Event tonight at 7:00 p.m. ET.

It won’t cost you a penny to attend — but as the hour approaches, available spots are filling up fast. Don’t wait another minute to secure your spot for tonight — just one click on this link, and you’ll be guaranteed access.

![]() Instead of a “Powell Pivot”… It’s a Powell Flip-Flop

Instead of a “Powell Pivot”… It’s a Powell Flip-Flop

Mr. Market is experiencing a case of “post-Fed letdown.”

Mr. Market is experiencing a case of “post-Fed letdown.”

As expected, the Federal Reserve left the fed funds rate alone yesterday — keeping it at 5.5% until the next Fed meeting in mid-March.

What was not expected was Fed chair Jerome Powell all but ruling out a rate cut in mid-March. “It’s a highly consequential decision to start the process” of lowering rates, he said — “and we want to get that right.”

Translation: As Paradigm’s macro maven Jim Rickards said here just yesterday, the Fed is not winning the battle against inflation.

With a “pivot” to lower interest rates now at least three months away, the stock market sold off hard by day’s end. The S&P 500 notched its first 1%-plus daily drop of the year. The Nasdaq shed more than 2%. Powell painted a “heat map” of the market as red as a Santa suit…

Love how the phone is in landscape mode there, to capture the backdrop in full — details matter!

All that said, there might be a more disquieting factor behind yesterday’s sell-off — the realization that Powell can’t keep his story straight.

All that said, there might be a more disquieting factor behind yesterday’s sell-off — the realization that Powell can’t keep his story straight.

Recall that at the previous Fed meeting in mid-December, Powell abandoned his “hawkish” stance of the previous two years. He even walked back his determination to keep rates elevated until inflation is back within the Fed’s 2% inflation target.

So to see him flip-flop again only a few weeks later? Sorta gives you the idea he doesn’t know what he’s doing, right?

The funny thing is that Powell’s press conference was underway for a half-hour before he let this tidbit drop about no rate cut in March.

But the ignoramus reporters were so fixated on the idea that a March cut was inevitable that no one even thought to give Powell an opening to say otherwise…

Here’s where things get interesting: Powell is still under intense pressure from the White House to cut rates and forestall even the hint of a recession before Election Day.

If the economic numbers take a turn for the worse between now and the March 20 Fed meeting, we might see Powell flip-flop yet again.

Heh — stand by for the January jobs report, due tomorrow morning.

In any event, Mr. Market appears to be overcoming this case of post-Fed letdown, at least for the moment.

In any event, Mr. Market appears to be overcoming this case of post-Fed letdown, at least for the moment.

The S&P 500 is up more than a half-percent at last check to 4,874 — about 50 points below Tuesday’s record close. The Nasdaq’s gain is a little stronger, the Dow’s a little weaker.

For the S&P, “the long-term target remains north of 6,000,” writes our recovering investment banker Sean Ring in today’s Rude Awakening. “That doesn’t mean it’ll get there. But it does mean we’ve likely got a long way to go on the upside.”

Treasuries rallied yesterday and that’s carrying into today — prices up, yields down. The yield on a 10-year note is 3.88%, the lowest in over a month.

Gold fell victim to “Mr. Slammy” after Powell’s press conference yesterday, but as we check our screens it’s recovered almost to the $2,050 level. Alas, silver continues to languish below $23.

Crude likewise took a hit from Powell yesterday, but this morning it’s up to $76.46 as the Biden administration plans a new phase in the forever wars — what’s touted as a “weeks-long” bombing campaign against “Iran-linked” targets in Iraq and Syria and at sea.

That’s even though the Pentagon admits it has no evidence Iran was directly involved in the drone attack that killed three U.S. soldiers. Sheesh…

![]() Censorship… “for the Children”

Censorship… “for the Children”

“Dead kids make bad laws,” says the independent journalist Michael Tracey — which is the backdrop for a four-hour hearing yesterday in which U.S. senators berated social media execs.

“Dead kids make bad laws,” says the independent journalist Michael Tracey — which is the backdrop for a four-hour hearing yesterday in which U.S. senators berated social media execs.

In attendance were Facebook’s Mark Zuckerberg, X’s Linda Yaccarino, Snapchat’s Evan Spiegel and Discord’s Jason Citron.

In theory, the hearing was about whether the companies should face more legal liability when children are harmed by sexual predators, scammers and bullies online. There was tearful testimony from the father of a teenager driven to suicide in a “sextortion” scheme.

Thing is, there are already laws against sexual predation, scams and bullying. Why should online platforms be held liable? By the same token, there are already laws against murder and assault using firearms — and conservatives generally understand it’s stupid to hold gun manufacturers liable.

Alas, they fail to see the same logic when it comes to social media. “You have blood on your hands,” tut-tutted Sen. Lindsey Graham (R-South Carolina) — which is rich coming from one of Washington’s worst warmongers.

Meanwhile, Sen. Tom Cotton (R-Arkansas) couldn’t resist a little red-baiting with the CEO of the Chinese-owned TikTok…

Yikes. As we chronicled at the time, Rep. Dan Crenshaw (R-Texas) beclowned himself in exactly the same way during a House hearing last year.

While the hearing was theoretically about “protecting children,” the real agenda was to continue shredding free speech online.

While the hearing was theoretically about “protecting children,” the real agenda was to continue shredding free speech online.

Republicans and Democrats alike joined in a bipartisan kumbaya to either “reform” or outright repeal Section 230 of the Communications Decency Act of 1996.

Section 230 is what shields online platforms from liability for content posted by users. That might sound obscure — but Section 230 is the legal foundation for much of the internet as we know it.

“Facebook, the commenting section of The New York Times, Wikipedia, review sites, if you repealed Section 230, they just couldn't exist,” said venture capitalist and MIT professor Sinan Aral in 2021 on the Hidden Forces podcast.

“If Facebook, Instagram and X were liable for all the content that appeared in their feeds,” writes Reason’s Robby Soave this week, “they would have to vet it much more carefully. For one thing, this would dramatically increase the need for the platforms to engage in content moderation to protect themselves from libel lawsuits.”

Aren’t conservatives supposed to be concerned about too much content moderation? (They are, and they should be.) “Killing or even limiting Section 230,” says Soave, “plays directly into the hands of the would-be censors.”

![]() Can the Power Grid Support AI?

Can the Power Grid Support AI?

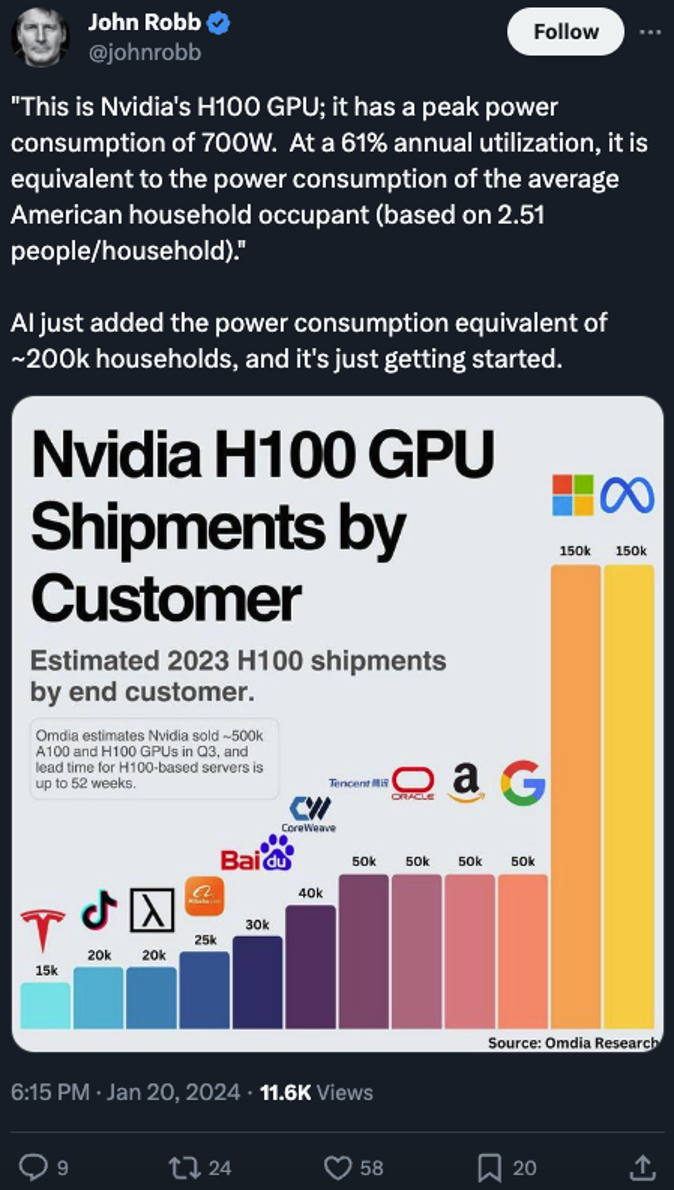

Herewith, some AI-related food for thought from the always-interesting John Robb of the Global Guerrillas page on Substack…

Herewith, some AI-related food for thought from the always-interesting John Robb of the Global Guerrillas page on Substack…

We’ll remind you once more that the capacity of the U.S. power grid is basically unchanged since 2011. Between AI and EVs, the strain is going to be considerable…

![]() Mailbag: Propaganda… and Apple’s “Disruption”

Mailbag: Propaganda… and Apple’s “Disruption”

After yesterday’s missive from a reader who’s grateful that we don’t “spew the same old socialist propaganda crap,” we got this brief note…

After yesterday’s missive from a reader who’s grateful that we don’t “spew the same old socialist propaganda crap,” we got this brief note…

“Let’s see if the newer reader stays the course when you say something that he (or she, but it’s probably a he) doesn’t agree with.”

Dave responds: And I will say something to offend conservative readers sooner or later.

Longtimers know my approach to politics is “a pox on everyone” — and I don’t make an exception for Donald Trump.

But longtimers also know that even if I say something they disagree with, it still gives them something to think about — and reason to keep coming back.

I certainly hope that will be the case with newer readers — even amid the growing tribalism and us-versus-them mentality pervading the zeitgeist…

“To say that Apple hasn’t been a disruptor is revisionist history,” a reader writes after Wednesday’s edition. “They have disrupted the world and the way we view it with three major product categories, the Macintosh, the iPhone and the iPad.

“To say that Apple hasn’t been a disruptor is revisionist history,” a reader writes after Wednesday’s edition. “They have disrupted the world and the way we view it with three major product categories, the Macintosh, the iPhone and the iPad.

“Further, to state that the iPhone was so obvious is only true in hindsight from a vantage point of ignorance. As someone who had a Motorola flip phone, who abhorred texting because you had to press the one key three times when you wanted the letter C and who had to access all internet via a tether to your desktop machine, this suggests that either the author is far too young to opine on the matter, or was one of those foolish DOS/Windows guys that continue to this day to berate the Mac guys who saw the clear advantages that a thoughtful interface brings to the user.

“Just because you can imagine something from the comfort of your chair doesn’t make it an obvious or even necessary next step from an evolutionary perspective. And it only serves to demean the Herculean efforts necessary to turn vision into reality. And it took years of reverse engineering to even produce a somewhat viable copy by those that never invent or innovate anything, other than how to copy the efforts of others.

“Willful blindness or youthful ignorance both perform a disservice to your readership.”

Dave responds: Nice try. As it happens, your editor is old enough to have balanced a checkbook the old-fashioned way. And not only do I remember VCRs, I was capable of programming them so they wouldn’t persistently flash “12:00.”

More to the point, I’ve been exclusively a Mac guy since a friend recommended I get one for my first computer in 1996. That was before Steve Jobs came back to the company. And an iPad has been integral to my day-to-day workflow almost since its introduction in 2010.

As for your flip phone? Yes, texting with it was clunky — so clunky that in a memorable Jay Leno bit from 2005, Morse Code proved to be a speedier means of communication.

But your flip phone wasn’t the precursor to the iPhone. As I said on Wednesday, it was the BlackBerry and the Palm Treo — both of which were a combo phone-music player-internet device. (I remember drooling over a Treo, but I didn’t have the coin to afford one at the time.)

Anyway, thanks for writing in. Ultimately I think we’re speaking past each other over the definition of “disruptor.” In no way was I trying to “denigrate” the “Herculean” efforts of the Jobs-era Apple.

As many others have observed, it was Jobs’ genius to anticipate what the people wanted from a computing device before the people themselves knew what they wanted. Legendary…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Last call: Apple is on the verge of making what could be its most momentous announcement since Steve Jobs’ death more than a decade ago — and (as usual) the mainstream is out to lunch.

It’s set to drop tomorrow at 10:00 a.m. EST — and to make sure you’re positioned to take advantage of a unique 10X profit opportunity, James Altucher is convening an urgent Apple Market Disruption Event tonight at 7:00 p.m. ET.

I can tell you this much in advance: Unlike the release of blockbuster products like the iPod and the iPhone, the most lucrative profit opportunity from this announcement will not come from buying AAPL shares. But to get the rest of the story, you’ll need to join James tonight. Registration is as simple as could be: Click here, and you’re in.