Market Dodges a Bullet

![]() One Bullet Dodged, but More Are Incoming

One Bullet Dodged, but More Are Incoming

Already the U.S. stock market has dodged a bullet this week.

Already the U.S. stock market has dodged a bullet this week.

“Nvidia shares began trading Monday on a new 10-for-1 split basis,” says Yahoo Finance — “revising the stock from its Friday closing price of $1,208.88 to $120.88. The stock was little changed at the open, falling about 0.4%.”

No, nothing about this event should have triggered a stock-market hiccup. But in an era when social media posts can juice the share price of junky brick-and-mortar retailers… and when “software glitches” can tank the share price of Berkshire Hathaway 99%... who knows, right?

The next bullet — at least the bullets we can identify in advance — comes Wednesday.

The next bullet — at least the bullets we can identify in advance — comes Wednesday.

The Federal Reserve will issue its latest proclamation on interest rates. Almost no one expects the Fed to cut rates — except for Paradigm’s recovering investment banker Sean Ring.

He’s still not ruling it out. On our internal e-chat this morning, he reminds us the Labor Department issues the official inflation numbers on Wednesday — just hours before the Fed announcement.

“I reckon if the consumer price index comes in super soft — and who knows how they’re going to engineer that number — there’s a really good chance Jay Powell will cut.”

A shock rate cut could send stocks soaring on the theory that more EZ money is headed Wall Street’s way. Then again, depending on what Powell would say, the market could tank on the theory that the economy isn’t as “robust” as the official narrative insists.

Another bullet comes Thursday — when, after the closing bell, Tesla shareholders vote on a $56 billion compensation package for Elon Musk.

Another bullet comes Thursday — when, after the closing bell, Tesla shareholders vote on a $56 billion compensation package for Elon Musk.

Passage is not guaranteed — not when outfits like BlackRock and Vanguard own meaningful percentages of nearly every publicly traded company via index funds.

If it fails, Jim Rickards’ senior analyst Dan Amoss envisions the following: “I could see Elon throwing a tantrum, announcing his resignation, dumping all his Tesla stock and destabilizing the entire market.”

Dan concedes this catalyst is as “low probability” as it is “high impact.” But it never hurts to entertain all plausible possibilities.

And there’s one more bullet coming this way — one that’s not getting nearly as much mainstream attention as these other three…

And there’s one more bullet coming this way — one that’s not getting nearly as much mainstream attention as these other three…

Jim Rickards is calling it “Biden’s Big Steal.” And before you jump to conclusions… it has nothing to do with the election or green-energy schemes or your retirement account.

On Thursday, Joe Biden is set to meet other heads of state from around the world. At the conclusion of that meeting, Jim says “America will never be the same.

“Are you prepared for the dollar to lose its role as the world’s reserve currency?” he asks. “The cost of imports will become more expensive. Inflation will skyrocket due to the printing of money.”

Come to think of it, a dollar collapse would have a devastating impact on your retirement account.

Jim and his team have formulated a three-step protection plan for what’s coming on Thursday. Follow this link to get started.

![]() Those Full-Time Job Blues

Those Full-Time Job Blues

There’s even less to the May job numbers than meets the eye.

There’s even less to the May job numbers than meets the eye.

As we mentioned when the figures were released on Friday, the headline number of 272,000 new jobs was belied by — among other things — a separate survey with a different methodology suggesting a loss of 408,000 jobs.

But even the official number of plus-272K is skewed by the fact that 85% of those “new jobs” were a statistical inference.

See, the headline number is derived from a survey of businesses. But new businesses are coming into existence all the time; the wonks at the Bureau of Labor Statistics don’t necessarily know how many or where they are. Likewise, if a business doesn’t respond to the survey, it’s possible that’s because the business has gone out of existence.

So the analysts resort to a statistical invention known as the “birth-death model.”

Alas, the model has an unfortunate habit of underestimating the number of new jobs whenever the economy is coming out of recession… and overestimating the number of new jobs whenever the economy is going into recession.

Oh, and if you want evidence the economy is approaching a recession… the report reveals the number of full-time jobs in the United States has fallen slightly over the past year — from 134.4 million to 133.3 million.

One more ill omen: The number of temporary workers has been in steady retreat for over two years. That too is a trend that typically precedes a recession.

Meanwhile, having dodged the Nvidia-split bullet, the stock market is off to a quiet start for the week — the S&P 500 up eight points and back in record territory (barely!) at 5,356.

Meanwhile, having dodged the Nvidia-split bullet, the stock market is off to a quiet start for the week — the S&P 500 up eight points and back in record territory (barely!) at 5,356.

Under the surface, however, there is much movement. After the closing bell Friday, the keepers of major stock market indexes like the S&P 500 announced one of their periodic rebalancings — in which a handful of names are added to the indexes and others deleted.

Thus, for instance, the cybersecurity firm CrowdStrike Holdings (CRWD) is up 9% on the day because it will be added to the S&P 500 later this month. Meanwhile, one-time biotech darling Illumina (ILMN) is down over 4% because it’s being removed.

After Friday’s brutal beat-down, gold has reclaimed the $2,300 level — barely. Silver is up nearly 2% to $29.66.

Crude is rallying hard, and for no obvious reason — up nearly two bucks at last check to $77.39, the highest since the first of the month.

Bitcoin is back within reach of $70,000.

![]() SpaceX: Step-by-Step Success

SpaceX: Step-by-Step Success

For SpaceX, the fourth time is a charm.

For SpaceX, the fourth time is a charm.

Last Thursday, the company launched its Starship rocket. “The huge ship, the biggest ever launched, is part of Elon Musk’s vision for making us an interplanetary species,” says Paradigm’s tech-investing specialist Ray Blanco.

“No launch of the Super Heavy first stage and Starship second stage has been a complete success. But the company’s iterative design-and-build and redesign-and-build process has meant that each launch gets a little further toward perfection.

“The first launch in April last year ripped the launchpad apart, damaging the rocket, and had to be aborted early on.”

But each launch since then has progressively worked the bugs out. On Thursday, one of Super Heavy’s Raptor rocket engines failed — but as Ray points out, “The design philosophy behind the Super Heavy/Starship vehicle is to have many engines in order to sustain a failure.

“The engine-out condition didn’t prevent space access; Super Heavy simply needed to boost a bit longer on its remaining 32 Raptors to compensate.

“Unlike the third launch, Starship maintained attitude control as it followed its suborbital trajectory toward an Indian Ocean splashdown, while Super Heavy successfully made a soft controlled splashdown in the Gulf of Mexico.

“It was more exciting with Starship, traveling at a much higher speed of over 16,800 miles per hour,” Ray goes on.

“It was more exciting with Starship, traveling at a much higher speed of over 16,800 miles per hour,” Ray goes on.

“The vehicle successfully assumed the correct attitude and began to re-enter the atmosphere, encountering high temperatures and developing a halo of plasma that put its reusable heat shield to the test.

“The heat shield worked well for the most part, until an area around the joint for one of its articulating fins allowed white-hot plasma to enter, partially destroying the fin.

“What’s amazing is that Starship was able to retain much of the fin and even articulate it, meaning it was mostly able to retain attitude control as it descended in a fiery blaze and decelerated. Starship also appears to have been able to perform a final engine burn and slow down enough for a soft landing in the Indian Ocean.”

That’s good enough under the circumstances — especially compared with Boeing. In addition to all of Boeing’s aircraft woes, its Starliner space vehicle failed to dock on the first try last week with the International Space Station.

“This historic company can’t seem to get anything right these days — not even a space capsule, a technology that we mastered back in the 1960s. But SpaceX shows that some things in America still work.”

As you’re perhaps aware, SpaceX is still a privately held company. But Ray’s Technology Profits Confidential readers are privy to a “hidden backdoor” way of playing SpaceX — and it’s still below his buy-up-to price.

![]() The 75-Mile One-Way Commute

The 75-Mile One-Way Commute

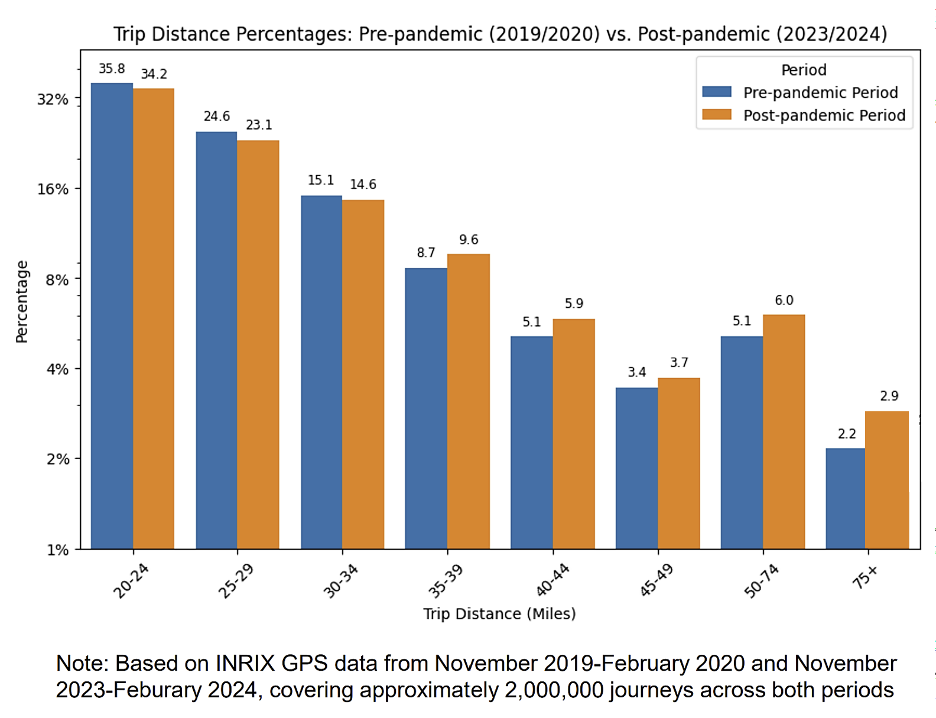

For all the chatter about work-from-home, the post-pandemic era has also given rise to “super-commuters” traveling at least 75 miles one way.

For all the chatter about work-from-home, the post-pandemic era has also given rise to “super-commuters” traveling at least 75 miles one way.

Researchers at Stanford recently analyzed GPS data from the 10 biggest U.S. cities. They compared two time periods — November 2019–February 2020 and November 2023–February 2024.

The upshot? Between hybrid work and the quest for more affordable housing, the share of commuters who travel 75 miles or more one way has jumped 32%. And the share who travel 50–74 miles is up 18%.

To be sure, Stanford’s chart is misleading; for whatever reason the researchers used a logarithmic scale. Even now, the share of super-commuters is less than a tenth of those with a one-way commute of 20–24 miles.

Still, even if it’s only once or twice a week, super-commuters don’t have it easy: Typically they start their trip at 6:00 a.m., and they don’t arrive until 8:19 a.m. And then they do it again the other way.

For whatever it’s worth, the metro area with the biggest increase of super-commuters is Washington, D.C. — where it’s doubled. And New York isn’t far behind, up 89%. The only metro where the share of super-commuters declined was Chicago.

![]() Black-Market Legos

Black-Market Legos

Who knew? Legos are one of a handful of legal items that have a thriving black market.

Who knew? Legos are one of a handful of legal items that have a thriving black market.

“Two people were arrested in California as part of a suspected Lego theft ring after police found more than 2,800 stolen sets,” says the BBC.

Police say the toys were stacked to the ceiling inside the Long Beach home of one Richard Siegel — where, even as cops were raiding the place last Wednesday, wannabe buyers were arriving at the house "lured by advertisements placed by Siegel on internet sales sites," according to an LAPD statement.

These Lego sets are hot. No, really… [LAPD photos]

Siegel, who’s 71, is under arrest. So is a 39-year-old woman named Blanca Gudino who cops say did the dirty work of lifting the Legos from local retailers including Target.

“Expensive Lego sets have become a popular target for thieves,” the BBC elaborates — “especially as the sets have expanded from a child's toy to a popular hobby for adults.”

Well, yes — when a Star Wars set like the Millennium Falcon fetches nearly $850 online. That’s relatively high value for the amount of space it takes up sitting in a box.

Total value of the stolen goods? Roughly $100,000. But that pales in comparison with a case from only two months ago — in which the California Highway Patrol picked up four suspects who officers say were sitting on a Lego haul worth $300,000.

The mind boggles — enough that we’ll wrap it up here. Catch you tomorrow…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Congratulations to readers of The Situation Report With Jim Rickards — who took 134% gains this morning playing a decline in Mexican stocks after the recent election there. Not bad for less than two months.

Jim says even bigger gains are to be had from a situation taking shape this week — in which Joe Biden is scheming with foreign leaders to steal hundreds of billions of dollars.

We’ll talk more about the scheme tomorrow — but what you need to know right now is that what Jim calls “Biden’s Big Steal” is opening a window in which you can make stunning gains (legally, we hasten to add!) of 10X, 50X or even 100X. Click here and Jim will show you what’s at stake.