Morning in America (If Only!)

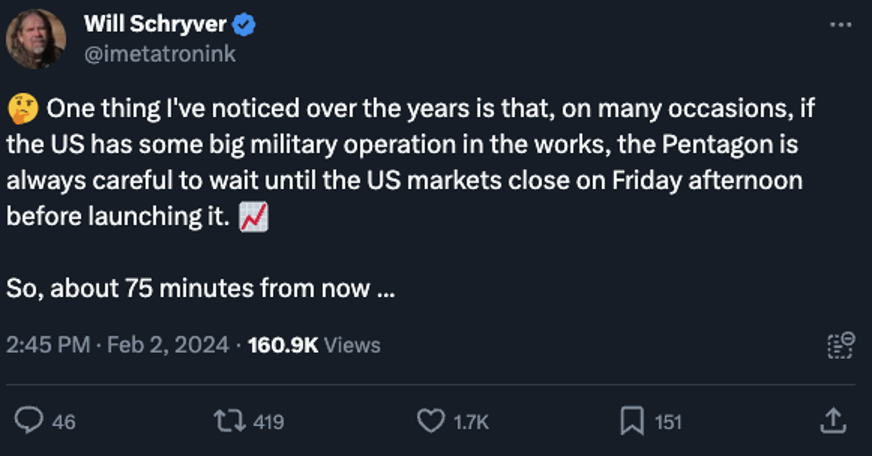

![]() Markets Closed? Bombs Away!

Markets Closed? Bombs Away!

Man, did this guy ever nail it Friday afternoon…

Man, did this guy ever nail it Friday afternoon…

At exactly 4:00 p.m. EST, U.S. forces launched airstrikes against “Iran-linked” targets in Iraq and Syria — payback for the deaths of three U.S. troops in the region who should have never been posted there in the first place.

Along with Yemen, that makes three countries the U.S. military is directly bombing — not to mention the vast arsenal Washington supplies to Israel for its ongoing slaughter in Gaza.

And you thought Washington’s “forever wars” in the Middle East were finally over.

Except as far as the Biden administration is concerned, the United States isn’t actually at war.

Except as far as the Biden administration is concerned, the United States isn’t actually at war.

In fact, to hear National Security Adviser Jake Sullivan tell it on the Sunday morning chat shows, the whole idea of these airstrikes is to avoid war. “We are not looking to take the United States to war.”

Joe Biden said much the same on Friday: “The United States does not seek conflict in the Middle East or anywhere else in the world.”

Who’s kidding whom? “Conflict in the Middle East is what the U.S. empire does,” tweets the Australian writer and media critic Caitlin Johnstone.

“The entire U.S. empire is held together by endless conflict, especially in resource-rich regions where strategic control is necessary to retain planetary hegemony… Saying the U.S. does not seek conflict in the Middle East is like saying the Kardashians do not seek attention.”

But for the moment, anyway, there’s a certain performative nature to the current exercise.

But for the moment, anyway, there’s a certain performative nature to the current exercise.

The airstrikes are not hitting Iranian targets, either inside or outside Iran — only militias in Iraq and Syria that get some measure of support from Tehran.

With any luck, there are back-channel negotiations between American and Iranian leaders keeping the conflict to a dull roar — each side telegraphing to the other what they will and won’t do, each side realizing the other has to keep up appearances for the sake of domestic politics.

The problem is there’s still the potential for miscalculation and escalation — which could end in a truly worst-case scenario for U.S. forces throughout the Middle East.

The best-case scenario is that Joe Biden does what Ronald Reagan did while seeking a second term 40 years ago.

The best-case scenario is that Joe Biden does what Ronald Reagan did while seeking a second term 40 years ago.

Some readers don’t like it when I compare present-day events in the Middle East with the Reagan years, but here’s another instance where Reagan ultimately blundered his way into doing the right thing.

At first, Reagan inserted U.S. Marines into Lebanon’s multisided civil war — a “peacekeeping” mission in which U.S. forces inevitably found themselves taking sides.

American officers on the scene like Marine Col. Timothy Geraghty knew the mission was courting disaster, and it was: On Oct. 23, 1983, a suicide commando squad drove a truck bomb into the U.S. Marine barracks in Beirut — killing 241 Americans.

At first, Reagan vowed revenge — until he realized what revenge would entail.

At first, Reagan vowed revenge — until he realized what revenge would entail.

“There would be no clear goal for the U.S. force, no way to define victory and no exit strategy,” Brown University fellow Stephen Kinzer writes in The Boston Globe.

Gee, sound familiar?

“On Feb. 7, 1984,” Kinzer continues, “Reagan announced that instead of sending the Marines to charge into war, he was ordering them to charge out.” Washington’s mission in Lebanon was over.

“Reagan coolly assessed America’s self-interest rather than reacting with violent anger. An American intervention that could have turned into a long and bloody occupation never happened.”

Despite what looked on the surface like humiliation, Reagan’s campaign advisers could plausibly claim a few months later that it was “Morning in America.” Near-runaway inflation was getting back under control. And the stock market was two years into an epic bull run that lasted all the way to the dot-com bust in 2000.

The likelihood of history rhyming now? Admittedly slim…

![]() The “Magnificent 7” Shrinks to a “Dynamic Duo”?

The “Magnificent 7” Shrinks to a “Dynamic Duo”?

With the market open again, the impact of the Biden administration’s expanded Middle East war-but-don’t-call-it-a-war is muted so far.

With the market open again, the impact of the Biden administration’s expanded Middle East war-but-don’t-call-it-a-war is muted so far.

To be sure, though, it’s a down day: At last check, the Dow is taking it the worst, down nearly 1%. The Nasdaq is down nearly three-quarters of a percent. The S&P 500 is down 0.6% from Friday’s record close, resting at 4,928.

The headlines say Nvidia has powered to still another all-time high this morning — which reminds us that the “Magnificent 7” is looking more like a “Dynamic Duo” now. Research from Piper Sandler finds that through midweek last week, only two AI-adjacent companies — Nvidia and Microsoft — account for 43% of the broad stock market’s year-to-date gains.

Not that that’s an instant sell signal: Piper Sandler’s Craig Johnson says momentum remains on the upside with the S&P 500 still comfortably above its 50-day moving average.

More to the point, Johnson has a knack for eerily accurate year-end calls on the S&P 500 — he was off by only 1.14% for 2023 — and he was interviewed this weekend on the Financial Sense podcast. He sees the S&P ending the year at 5,050 — but he’s not ruling out a tumble to 4,600 along the way.

It’s not just stocks selling off today.

It’s not just stocks selling off today.

Bonds are slumping, too — prices down, yields up. The yield on a 10-year Treasury note is up to 4.17%, equaling its year-to-date high.

No joy with precious metals, either. Gold is down $22 to $2,018 and silver has shed 37 cents to $22.28. Elsewhere in the commodity complex, crude is down 55 cents to $71.73. In crypto, Bitcoin is back below $43,000.

It’s not helping that the dollar has rallied to near-three-month highs relative to other major currencies: The U.S. dollar index has leaped to 104.57, largely on the back of weakness in the euro. (Moments ago, readers of The Situation Report snagged a handsome gain in less than two weeks playing put options on FXE, the big euro-currency ETF.)

![]() AI Profits: Beyond the “Dynamic Duo”

AI Profits: Beyond the “Dynamic Duo”

As noted above, Nvidia and Microsoft are the biggest companies with an AI tailwind — but they’re not the only ones.

As noted above, Nvidia and Microsoft are the biggest companies with an AI tailwind — but they’re not the only ones.

If you were around for Paradigm’s online 7 Predictions Summit in December, you might recall our Ray Blanco saying Advanced Micro Devices has come to market selling chips that are “competitive with any specs Nvidia makes” — and at a much more attractive price.

Last week, AMD reported its quarterly numbers — 10% sales growth year-over-year.

And Ray sees that trajectory continuing. “AMD is positioning itself to capture another clear part of the data center space with its newly released MI300 accelerators — aimed squarely at the artificial intelligence market. The chips are new, so they aren’t reflected in last quarter’s numbers — but they’ll be competing to capture shares from Nvidia this year.”

CEO Lisa Su has upped her sales projections for these accelerators from $2 billion to $3.5 billion — which would represent over 50% of last year’s sales.

“Su might still be too conservative,” Ray avers. “Demand for AI accelerators is hot, and supplies are tight. If AMD can produce enough MI300s, it could easily beat that $3.5 billion estimate.”

In the meantime, Ray’s Technology Profits Confidential readers are happy to be sitting on 18% gains with AMD in a little over three weeks.

![]() Tay-Tay 2024, Continued

Tay-Tay 2024, Continued

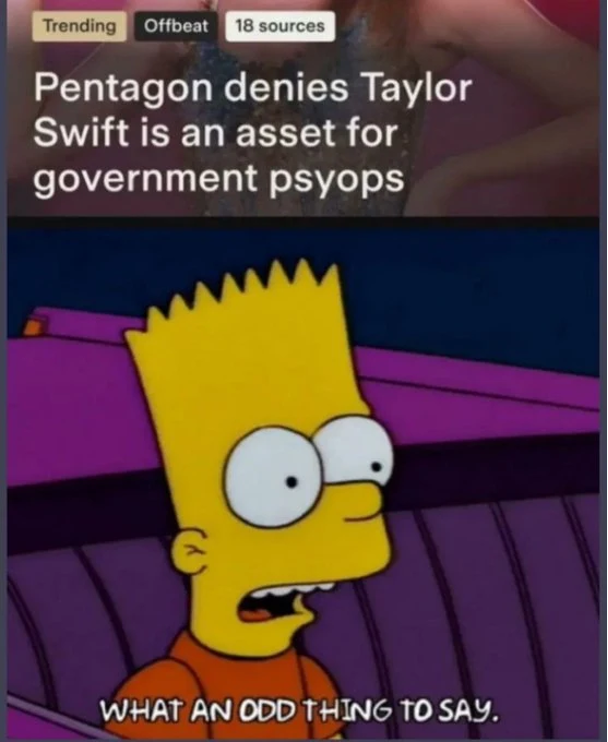

From the Department of “No Rumor Is Confirmed Until It’s Been Officially Denied”...

From the Department of “No Rumor Is Confirmed Until It’s Been Officially Denied”...

Yeah, this really happened. “Pentagon To MAGA World: You Need to Calm Down Over Taylor Swift,” says a Politico headline from last Friday — responding to the notion that Ms. Swift will “activate” hordes of Biden voters this year.

“We know all too well the dangers of conspiracy theories, so to set the record straight — Taylor Swift is not part of a DOD psychological operation. Period,” says Defense Department spokeswoman Sabrina Singh.

Methinks she doth protest too much?

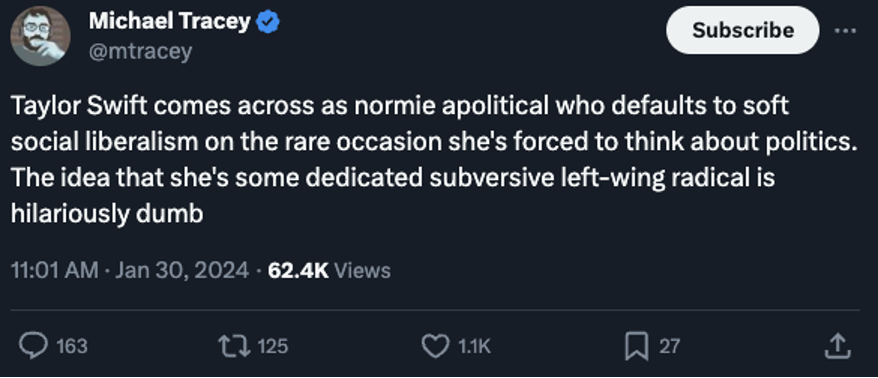

Funny thing is that even though your editor was among the first to notice this kerfuffle becoming “a thing” two months ago, I remain a skeptic and largely on board with my favorite political reporter…

Which doesn’t change the fact that the feds have beclowned themselves by giving oxygen to the notion.

➢ Irritable aside: What’s with all these hapless “Baghdad Bob” PR flacks infesting this administration? There’s Singh at the Pentagon, John Kirby at the National Security Council, Matthew Miller at the State Department and probably more that I can’t remember right now. They’re all as insufferable as they are delusional…

![]() Mailbag: Paying for Advice, Playing Politics, Missing the Summary

Mailbag: Paying for Advice, Playing Politics, Missing the Summary

From a newer reader: “If these stock investments are great, why not just tell the world about them without having to pay to know what they are?

From a newer reader: “If these stock investments are great, why not just tell the world about them without having to pay to know what they are?

“If you truly believe in these stocks you’re recommending, tell the world what they are without asking us to pay for this information and everyone would get involved in the stock and you would accomplish your goals with the stock increases, I don’t understand why are you limiting the number of people getting involved in these stocks by having them pay for it.”

Dave responds: Our livelihood relies almost entirely on the subscription revenue of readers like you.

That’s the business we’re in. With strictly limited exceptions, we don’t take money from advertisers — and we never accept payments from the investor-relations divisions of companies to recommend their stock.

We perform fiercely independent research and analysis, serving up recommendations that (hopefully) satisfied customers pay for. Much more about our business model and how it works in this back issue of 5 Bullets.

From a longtimer on the intrusion of politics into these virtual pages: “Keep doing what you're doing, Dave.

From a longtimer on the intrusion of politics into these virtual pages: “Keep doing what you're doing, Dave.

“If people don't like what you say, they have a choice to continue to read you or not. I don't always agree with what you say. However, I enjoy and respect your thoughts.

“Also, have an observation. There are over 333 million people in this country and the best the two parties can come up with for president are a man who should be in assisted living, not the White House, and a name-calling narcissist who is a terrible leader?”

“Swing away, Dave,” says another when I warned the other day that sooner or later I’m going to offend a swath of conservative readers.

“Swing away, Dave,” says another when I warned the other day that sooner or later I’m going to offend a swath of conservative readers.

“You wouldn’t be much of a journalist if you didn’t say things that some people disagree with. Often that’s what it takes to get them thinking, no? You do it very well.

“The sword of free speech is a weapon to be wielded righteously. It’s not always a feel-good thing (nor should it be IMHO).

“After all these years, I love The 5.”

“One suggestion for format,” writes our final correspondent: I am OK with the conversion from The 5 Min. Forecast to the 5 Bullets... but one thing I miss is having a little summary at the top. I think it would be nice to have a one-liner for each of the 5 Bullets at the top of the daily e-mail.

“One suggestion for format,” writes our final correspondent: I am OK with the conversion from The 5 Min. Forecast to the 5 Bullets... but one thing I miss is having a little summary at the top. I think it would be nice to have a one-liner for each of the 5 Bullets at the top of the daily e-mail.

“Among other things, when I am done reading the 5 Bullets, a quick glance at the top could remind me if there were any points that I needed to re-review or put into my notes, etc.

“Thank you for your work, which I consider high-priority reading.”

Dave responds: You’re not the only one to raise this issue.

We did away with the bullet headlines in November once our market research reaffirmed that over half of the readership now opens these daily missives on a mobile device.

Mobile is a different experience than a laptop or desktop. There just isn’t as much that you can see on the screen at one time. We reached the conclusion that the headlines were cluttering things up — preventing us from “cutting to the chase” and getting right to the meat of the issue.

Also in the interest of a cleaner look, we did away with the ad at the very top of the issue pushing one of our paid publications — a practice we’d had in place for over five years.

On the surface, that might seem as if we’re forsaking revenue — but our collective intuition was that over time, more readers would be more engaged and would actually buy more of our paid pubs in the long term.

So far, it appears that gambit is already paying off. Less is more!

Thanks for writing in — and for once again confirming we have the most attentive and observant readership of any financial e-letter out there!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets