Obama Says “Buy”

![]() Barack Obama’s Buy Signal

Barack Obama’s Buy Signal

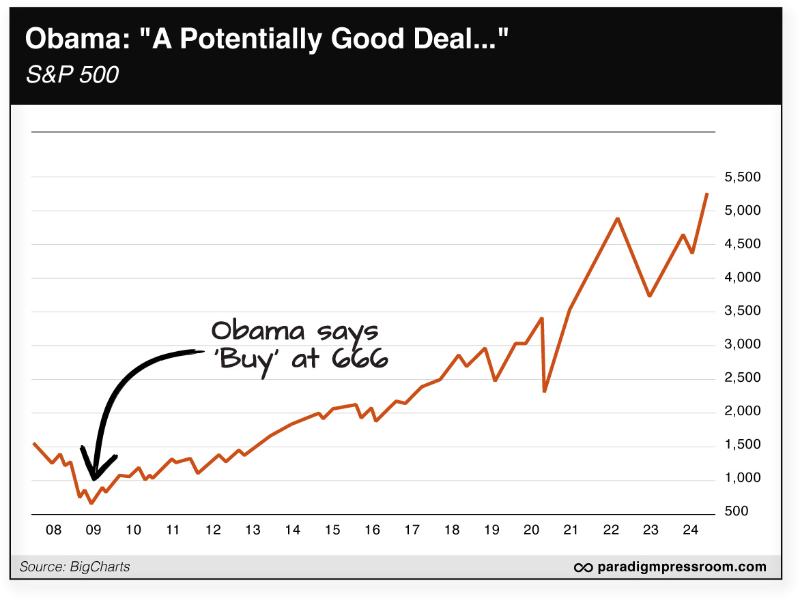

It was 15 years ago yesterday when President Barack Obama issued “the mother of all buy signals.”

It was 15 years ago yesterday when President Barack Obama issued “the mother of all buy signals.”

It was March 3, 2009. The global financial crisis had crushed the stock market by 58% in the space of 17 months.

Obama had been in office barely six weeks — and on that date, he ventured into the realm of stock-market punditry.

“What you're now seeing,” he said at a press conference, “is profit and earning ratios are starting to get to the point where buying stocks is a potentially good deal if you've got a long-term perspective on it.”

OK, so his handlers couldn't drill the lingo into him quite right. We presume he meant "price-earnings ratios."

No matter. The rest was history. Six days later, the S&P 500 bottomed at a rather infamous level of 666.

By the time Obama left office in early 2017, the index had more than tripled. And after the S&P notched another record on Friday at 5,137, the 15-year gain is 671%.

Gee, it’s almost as if Obama knew something others didn’t…

Two critical events took place in the two weeks following the president's buy signal…

Two critical events took place in the two weeks following the president's buy signal…

- The Federal Reserve nearly tripled the size of its first “quantitative easing” program in which it bought Treasuries and mortgage-backed securities. QE began during the 2008 panic with $600 billion in purchases. Suddenly in March 2009, the total ballooned to $1.65 trillion

- The Financial Accounting Standards Board (FASB) proposed easing corporate accounting rules. It was a gift to the too-big-to-fail banks: No longer would they have to assign current market prices to the assets on their balance sheets ("mark to market"). They could instead assign hypothetical future prices that were, of course, higher.

In theory, FASB is a private nonprofit entity. In reality, it is highly subject to political influence. On March 9 — the very day the S&P bottomed — word slipped out from Washington that Reps. Barney Frank and Paul Kanjorski planned to schedule a subcommittee hearing clearly aimed at strong-arming FASB into changing the rules.

Which it did three weeks later.

These two events gave the market the “juice” it needed to rally throughout 2009–2010 — the start of a secular bull market that’s still intact 15 years later.

We’re going to spend some time this week exploring the seamy intersection of politics and finance.

We’re going to spend some time this week exploring the seamy intersection of politics and finance.

We’ve been getting an earful lately — especially from newer readers — whenever politics intrudes into these daily musings.

But politics and finance are often inseparable. And the interplay frequently confounds everyone’s political biases, no matter what they are.

Many conservatives wanted nothing to do with stocks in early 2009. They were certain Obama’s policies would throw a wrench into the machinery of American business. At best, these individuals felt the stock market would be range-bound for years to come.

But as you can see above, that’s not how it worked out. Again, the market was up over 200% by the time Obama left office.

When he uttered those words on March 3, 2009, he knew the fix was in. Really, what’s the likelihood he was in the dark about the Fed’s intentions? Or about Congressional Democrats’ plans to pressure FASB to change the banks’ accounting rules?

Look, you can get angry about a “rigged system” if you want. But please don’t let your emotions get in the way of growing your portfolio. If you know how to follow the political breadcrumbs, you can do much to secure your financial future.

Look, you can get angry about a “rigged system” if you want. But please don’t let your emotions get in the way of growing your portfolio. If you know how to follow the political breadcrumbs, you can do much to secure your financial future.

Which brings us to Joe Biden’s State of the Union speech this coming Thursday night.

Paradigm’s own Jim Rickards has been in touch with one of his most trusted D.C.-connected insiders.

This individual tells Jim that Joe Biden will utter two words on Thursday night that will propel three stocks dramatically higher. A small stake could turn into a windfall.

“Most people won’t know what to do,” says Jim — “and they could actually lose money.”

That’s why the night before the State of the Union, Jim is taking part in a 24 Hour Countdown Event — so you can position yourself ahead of time.

Jim will introduce this former congressional insider — who will clue you in to what’s at stake, and how to act. It all gets underway Wednesday at 7:00 p.m. EST. Registration couldn’t be simpler:

One click at this link and you’re guaranteed a spot…

And rest assured… We’ll get to some Republican shenanigans as the week goes on. As I said to a newer reader a few days ago, we’re equal-opportunity offenders here.

![]() Run for the Records (Gold and Bitcoin)

Run for the Records (Gold and Bitcoin)

Gold and Bitcoin are competing for bragging rights among non-dollar assets as a new week begins. Both are within sight of their all-time highs.

Gold and Bitcoin are competing for bragging rights among non-dollar assets as a new week begins. Both are within sight of their all-time highs.

Bitcoin sits at $66,650 — a hyperbolic rise from $53,000 at this time a week ago and an impressive rise from $62,000 on Friday. The late-2021 record of $69,000 isn’t that far away now.

Gold is likewise adding to last week’s gains — up $26 at last check to $2,108. Gold popped over the $2,100 level three months ago, but the move couldn’t stick. If it can stick this time, Alan Knuckman — our eyes and ears at the Chicago options exchanges — says $2,300 is the next logical target.

Meanwhile, silver is looking stout — up 59 cents to $23.68.

After a run past $80 on Friday, crude is back to $79.18.

While the stock market takes a breather today, Alan says it’s poised for a further run into record territory — for three reasons…

While the stock market takes a breather today, Alan says it’s poised for a further run into record territory — for three reasons…

- Small caps are poised to play catch-up with bigger names. The small-cap Russell 2000 index remains over 10% below its previous record, but it’s “set up for a big breakout to the upside,” he tells readers of The Profit Wire. Once that happens, “that could be the next catalyst in stocks”

- Earnings season is winding down in positive fashion — “13 consecutive quarters of revenue growth,” he says. “That's the most in history since they've been keeping this stat since 2008”

- Volatility as measured by the VIX is in retreat — down 20% in two weeks. “It was sitting at the 16 level, that 16 top. Now we're at about 13, but we're still 10% from the 2024 low.” All else being equal, lower volatility means rising stock averages.

In the meantime, all the major U.S. averages are slightly in the red — no more than a third of a percent. At 5,132, the S&P 500 is down a mere five points from Friday’s record close.

![]() The Dollar Gets a Reprieve

The Dollar Gets a Reprieve

The White House’s disastrous plan to seize the dollar-based assets of Russia’s central bank has been pushed back by a few months.

The White House’s disastrous plan to seize the dollar-based assets of Russia’s central bank has been pushed back by a few months.

Originally the Biden administration hoped to have a plan in place for late February — the second anniversary of Russia invading Ukraine as well as the annual international security conference held in Munich, Germany.

Now according to Bloomberg, Biden “wants the Group of Seven nations to make progress on plans to tap frozen Russian sovereign assets to help support Ukraine by the time the leaders meet in June.”

Washington froze about $300 billion in assets — much of it U.S. Treasury debt — held by the Central Bank of Russia shortly after the invasion. As we’ve said from the get-go, it was a watershed event — in which leaders of every government around the world not closely allied with the United States began wondering if they might be next.

Freezing those assets rash enough… but seizing them and giving them to Ukraine is next-level crazy that would only accelerate a global rush of “de-dollarization.”

As colleague Sean Ring wrote last week for TheDaily Reckoning, nothing less is at stake than the dollar’s status as the world’s reserve currency: “A loss of reserve status likely leads to a significant decline in global demand for the U.S. dollar, causing its value to depreciate. This depreciation would reduce the dollar’s purchasing power, making imports more expensive and leading to inflation within the United States…

“Inflation, higher borrowing costs and potential economic disruptions would evaporate the middle and lower classes. The cost of living could increase, while wages wouldn’t keep pace, making it harder for individuals and families to afford necessities.”

![]() Gold and the Election (and the Eclipse?)

Gold and the Election (and the Eclipse?)

Sheesh, how much doom can be crammed into one story?

Sheesh, how much doom can be crammed into one story?

From the U.S. edition of The Sun: “Millionaires and elites are hoarding gold as part of their doomsday preparations as they look to barter with it, an expert has revealed.”

The “expert” happens to be a gold dealer — Jonathan Rose of Genesis Gold Group. (Good on him for generating his own publicity, although we’ll point out we have our own affiliated gold dealer that offers very attractive premiums.)

“Rose highlighted how doomsday prepping has become popular among millionaires such as Mark Zuckerberg and Sam Altman, along with pro athletes and other elites. The gold group's CEO said he has inside knowledge of these people spending their fortunes on gold for prepping purposes.”

The reasons he cites are legion — everything from the recent AT&T wireless outage to dollar devaluation and the BRICS nations potentially scheming on a gold-backed alternative to the dollar as a reserve currency. “And obviously, coming up to an election, a very tumultuous year, we don’t know what's going to happen.

“But many people are speculating there is going to be an attack on the power grids and no power causes chaos, chaos causes panics, panic causes sell-offs in the market.”

Hmmm… Come to think of it, there’s an event well before Election Day where it seems there’s the potential for trouble — be it spontaneous or engineered.

Hmmm… Come to think of it, there’s an event well before Election Day where it seems there’s the potential for trouble — be it spontaneous or engineered.

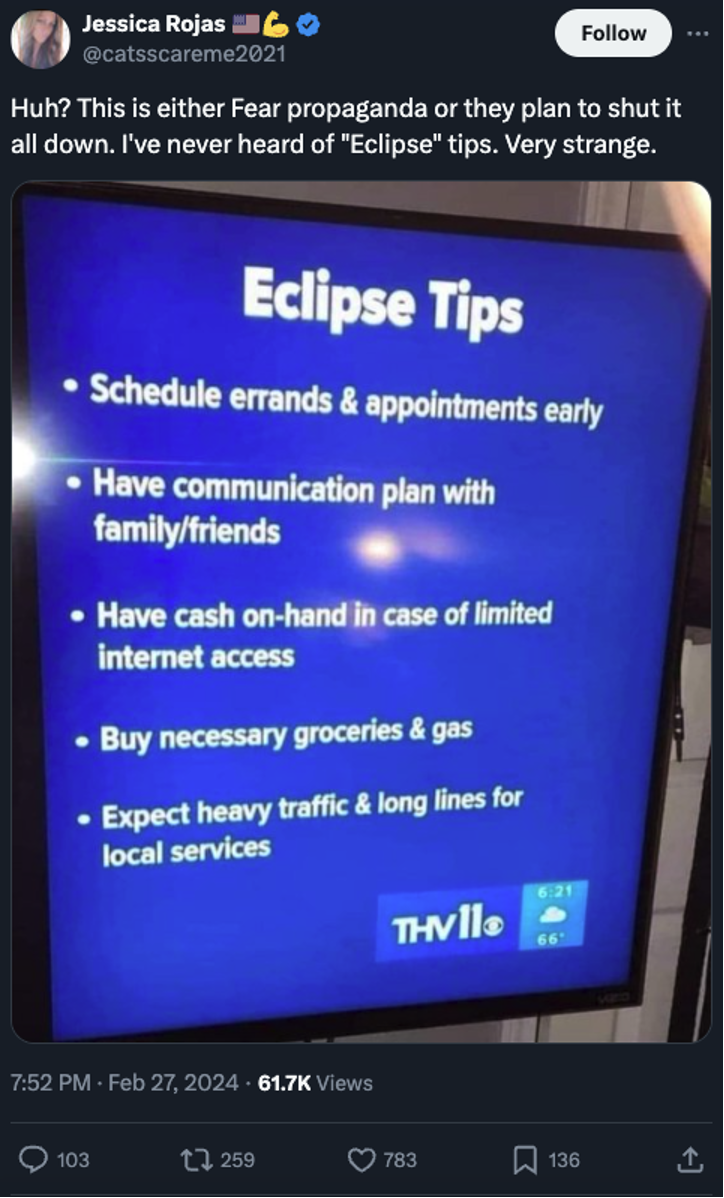

As you might be aware, a solar eclipse will cross North America on Monday April 8. The path of “totality” — i.e., darkness in the daytime — will cover several U.S. cities including Dallas, Indianapolis, Cleveland and Buffalo.

Oh, and Little Rock, Arkansas — where the local CBS affiliate recently splashed some peculiar “eclipse tips” on the screen…

Seriously, was there any “predictive programming” of this nature ahead of the eclipse that crossed North America in August 2017?

Make of it what you will. Here, we’ll reiterate the guidance we’ve passed along for over two years now: Be ready at all times for disruptions that could take down the internet and/or the power grid. No electricity means no credit/debit cards and no power to the gas pumps. Keep a wad of cash, your tank at least half-full and your battery-powered devices charged.

![]() Mailbag: Student Debt Forgiveness, Leavin’ California

Mailbag: Student Debt Forgiveness, Leavin’ California

On the subject of student-loan forgiveness, a reader writes…

On the subject of student-loan forgiveness, a reader writes…

“Perhaps because I went to school in a constitutional republic that insisted on everyone obeying the law, how does this administration get away with what appears to be criminal?

“Thank you for a great job providing informative and straight-shooting observations. I work long hours so I'm always behind trying to read everything, but try anytime I have a few minutes.”

Dave responds: Jim Rickards, who’s a lawyer among many other qualifications on his extensive CV, weighed in on this very question last week with readers of Strategic Intelligence…

The Supreme Court has ruled that Biden cannot forgive student loans without congressional approval. Biden has ignored that ruling and is forgiving student loans in tranches based on technicalities such as misrepresentations of the schools about job prospects or putative public service by the borrowers, etc. These tricks go against the spirit of the Supreme Court’s ruling.

It would be interesting to see if an aggrieved taxpayer could sue the administration. Alas, I suspect he or she would be denied a day in court on the grounds of “standing.”

Evidently our recent musings about California have revived our mailbag thread about interstate migration…

Evidently our recent musings about California have revived our mailbag thread about interstate migration…

“My wife and I moved from California to Idaho in 2020,” a reader writes. “Fortunately we bought the land in 2018 and started construction in 2019 before the huge price jumps in building material costs.

“I was ready years prior due to the runaway growth and the decline in quality of life, which always follows. California politics also played a big part. It just became unbearable (to me). There was an added benefit to the move due to the lower cost of living.

“Over the past four years the benefit of lower cost of living has nearly vanished and the mass migration of California, Oregon and Washington expats combined with crushing inflation has delivered growth pains to our new state.

“With that said, I would still do it again due to the common sense and hands-off approach to our government policies, the refreshingly slowed pace of life and the naturally friendly community-minded people. We still have family in California so are visiting regularly, which reminds us every time we go how great a decision it was to make the move.”

Dave responds: So you beat the rush, more or less.

Sometime during the first COVID summer of 2020, I remember reading a message board about migration from California to Idaho.

The natives didn’t much mind the Californians who’d moved in during the previous decade. If anything, the newcomers’ presence helped goose an otherwise moribund economy.

But the ex-Californians really resented the new pandemic-era arrivals from the Golden State — bidding up housing prices, crowding the restaurants and so on.

Having relocated in 2016 to a spot in the Upper Midwest that many people consider a tourist destination, my wife and I can definitely relate…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets