The Californication of America

![]() California Cash Crunch

California Cash Crunch

“I would stay in California… if I could be free from extremely high taxes, [extreme] housing costs, increasing crime and out-of-control legislative oppression,” TechReader site administrator John Watson editorialized… In October 2015.

“I would stay in California… if I could be free from extremely high taxes, [extreme] housing costs, increasing crime and out-of-control legislative oppression,” TechReader site administrator John Watson editorialized… In October 2015.

From time to time, we dip our toe into the Golden State’s pool to gauge the temperature. While we hate to nitpick, it would be utterly irresponsible to ignore the world’s fifth-largest economy.

Plus, it’s been three years since we last devoted a full intro to chaos in California. Notwithstanding, the more things change the more they stay the same…

Courtesy: Wikipedia, U-HaulWestward ho!

So, to order our dispatch today, we’ll address (most of) Mr. Watson’s list of grievances…

After a decade, California’s top income tax rate has increased from 13.3% to 14.4% effective Jan. 1, 2024.

After a decade, California’s top income tax rate has increased from 13.3% to 14.4% effective Jan. 1, 2024.

Granted, the 14.4% top rate applies to those earning $1 million or more annually, and it’s still less than the punishing 16.8% rate that lawmakers in Sacramento first proposed.

But the 13.3% rate — long “an irritant to California investors,” Forbes says — still applies to capital gains.

“At the federal level, the capital gain rate is 20% for higher-income taxpayers. Add the 3.8% net investment tax under Obamacare, and you have 23.8%.

“By paying 23.8% plus 13.3%,” Forbes calculates, “Californians are paying more on capital gain than virtually anyone else in the world.”

On the other end of the spectrum, “Californians in the bottom 20% (making less than $23,200 annually) pay 10.5% [in income tax],” Forbes says.

Compare that to, say, income-tax free Texas. Residents of the Lone Star State in the lowest tax bracket (earning less than $20,900 annually) actually pay more in state and local taxes, at a rate of 13%, than low-income Californians, according to the Institute of Taxation and Economic Policy.

“But many people who move out of California with tax concerns among their reasons are likely to be high income, for obvious reasons,” Forbes notes. Which brings us to California’s cavernous revenue shortfall…

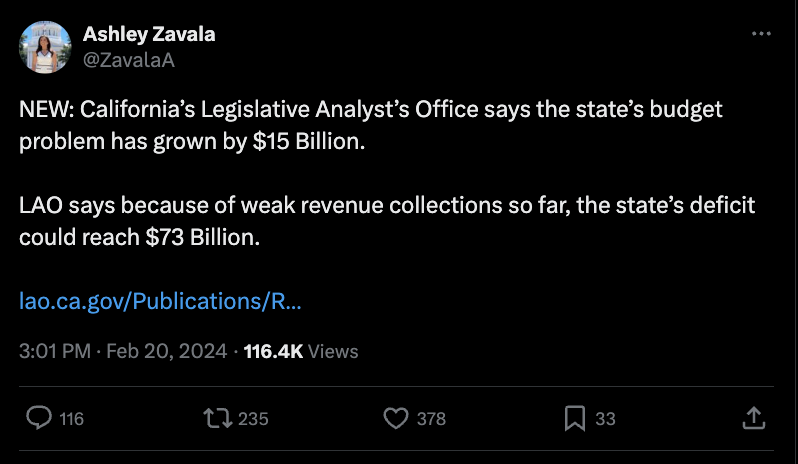

“California’s budget deficit has swelled to a record $68 billion,” Politico reported in December, “a shortfall that could prompt the state’s deepest spending cuts since the Great Recession.” Although the numbers are still fuzzy…

“California’s budget deficit has swelled to a record $68 billion,” Politico reported in December, “a shortfall that could prompt the state’s deepest spending cuts since the Great Recession.” Although the numbers are still fuzzy…

“[2022] Tax filing deadlines across most of California were delayed from April until [November], leaving the analysts in the dark about how much revenue was available,” Politico says.

Before the final receipts had been tallied, however, the state’s Legislative Analyst's Office (LAO) guesstimated “2022–23 revenues are $26 billion under projections and ‘our updated revenue outlook anticipates collections to come in $58 billion below [projections] across 2022–23 to 2024–25,’” CalMatters reports.

Which is more in line with the latest budget deficit number…

California’s $73 billion budget shortfall? Yeah, that’s equivalent to the entire GDP of Belarus…

Thus, CalMatters is less than optimistic about 2024: “California enters the new year with its existential issues still unresolved, and a new one — an immense budget deficit — threatens to make dealing with them even more difficult.

![]() From Housing Shortage to Homelessness

From Housing Shortage to Homelessness

“California has made very little progress, if any, on narrowing its shortage of housing [and] its levels of homelessness and poverty remain among the nation’s highest,” CalMatters adds.

“California has made very little progress, if any, on narrowing its shortage of housing [and] its levels of homelessness and poverty remain among the nation’s highest,” CalMatters adds.

Per Cali’s housing shortage, “California [has been] the most inventory-constrained market for years,” says Selma Hepp, chief economist at CoreLogic.

As we pointed out in 2021: “Public policies [suppressed] construction when the rest of the country underwent a housing boom,” according to Mary L.G. Theroux, chair and CEO of the Independent Institute.

- “It’s virtually impossible to build new construction in California, as, thanks to regulations like the California Environmental Quality Act (CEQA),” Ms. Theroux said at the time, “literally anyone can challenge any development, anonymously, with no legitimate cause”

- Not to mention, the California Energy Commission voted on a law mandating new residential construction be built with solar panels after Jan. 1, 2020 — a requirement which adds about $20,000 to the price tag of every new house, condo or apartment building.

To give you an idea just how tight supply is: “In 2023 the entire state of California issued only 70,000 permits for single-family homes — about the same number as the Houston metro area,” HousingWire reports. [Emphasis ours]

All of which has contributed to a dual affordability and homeownership crisis. Consider, the average home value in the Golden State is now over $750,000, according to Zillow.

“The homeownership rate for California is 50 percentage points lower than the rest of the nation at only 44% in 2021,” HousingWire notes. “That represents a serious downtrend from a 50% homeownership rate in 2000.”

Which logically leads us to California’s homelessness — unhousedness? — emergency..

About one in four homeless Americans call California… home.

About one in four homeless Americans call California… home.

“California accounts for 28% of all people experiencing homelessness in the country,” Axios says. Even worse? Almost 50% of all “unsheltered” Americans — people not living in places fit for human habitation — reside in California.

In a September 2023 interview at the website Yo! Venice, reformer Ms. Theroux says: “By law, California’s homelessness strategy mirrors federal policy of Housing First: that is, the idea that, since the problem is ‘homelessness,’ housing will solve it.”

- Los Angeles, for example, has earmarked $1.3 billion of its 2023–24 operating budget to combat homelessness, mainly via “Project Roomkey”: paying for hotel rooms for those experiencing homelessness.

“Putting people into [very expensive] housing doesn’t solve homelessness,” Theroux says. “There are underlying reasons for their homelessness and until those are addressed appropriately housing simply becomes a revolving door between the street and death.”

And between the “street” and “death” — we fear — there’s likely crime. “California’s propositions 47 and 57 make stealing and public drug use legal,” Theroux adds. Promoting a “culture of tolerance, and acceptance of lawlessness,” she says, and the “[homeless] will come from every state.”

Looking back at Mr. Watson’s list of California complaints when we commenced this episode, I think we’ve highlighted the glaring failures of each. Again, we’re not trying to nitpick… but did you know that one in eight Americans reside in California?

And with presidential shadow candidate Gavin Newsom — having been both mayor of San Francisco and now governor of California — we must put the state under a microscope. Where goes California, there might go the United States, whistling down the poppied path.

![]() Timely Warning (Money Market Funds)

Timely Warning (Money Market Funds)

The following is one of our occasional warnings about money market funds.

The following is one of our occasional warnings about money market funds.

A new report from the Financial Stability Board — an international body set up after the 2008 financial crisis — says money market funds remain “susceptible to runs from sudden and disruptive redemptions.”

That is, everyone wants their money back at once and there’s not enough money to go around — as happened at the peak of the crisis in 2008. Result? Certain funds could “suspend and stop serving redemption requests.”

Apart from the fact that such an event “can lead to contagion effects across the financial system” — as the report puts it oh-so-delicately — there’s the not-small matter of you wanting your money back and not getting it.

The report says the problem lies with those money market funds that hold large amounts of corporate debt. The assets underlying that debt are frequently illiquid, hard to sell in a hurry — for example, empty office space.

We know money market funds look very attractive at a time they often pay a yield over 5% — but you need to pay attention to what’s in your fund.

So we’ll reiterate our long-standing advice: Do a little research at a site like Morningstar and avoid funds with janky corporate debt. Stick with “Treasury only” money market funds. Worse comes to worst, Uncle Sam can always print money to pay you back.

As for the markets today, the big mover is (once again) crypto.

As for the markets today, the big mover is (once again) crypto.

Bitcoin has ripped from $52,000 on Monday to $56,000 yesterday to over $62,000 today. Reminder: The all-time high was about $69,000 in late 2021.

By comparison, Ethereum remains far from its record heights at $3,429 — and if you follow Paradigm’s James Altucher, you know he’s much more bullish on Ethereum.

The major U.S. stock indexes are all in the red — but not by much. The S&P 500 sits at 5,074 — down only five points from yesterday and only 11 points from the all-time closing high last Friday.

Precious metals don’t have anywhere near the thrills of crypto this week — gold stuck at $2,034 and silver at $22.43.

Crude tried to make another run toward $80 earlier in the day, but then the Energy Department’s weekly inventory numbers came out. A barrel of West Texas Intermediate is back to $78.41.

![]() Could Gemini Take Down Google’s CEO?

Could Gemini Take Down Google’s CEO?

OK, so the Gemini AI fiasco has been humiliating for Google — but could it really be the downfall of CEO Sundar Pinchai?

OK, so the Gemini AI fiasco has been humiliating for Google — but could it really be the downfall of CEO Sundar Pinchai?

That’s the bold prediction of Samir Arora — who founded one of India’s leading hedge funds, Helios Capital.

"My guess is he will be fired or resign — as he should,” Arora tweets. “After being in the lead on AI he has completely failed on this and let others take over."

GOOG shares are down another 2% today. They’re down 5.6% since the debacle came to light late last week. And that’s on top of some already-ugly chart action — GOOG is down 11.4% from its all-time high a month ago.

“The trouble for Google is that they are now a big company that has to appeal to everyone,” says Paradigm’s AI authority James Altucher.

“The trouble for Google is that they are now a big company that has to appeal to everyone,” says Paradigm’s AI authority James Altucher.

“They are basically the Disney of tech companies. While startups like OpenAI have the luxury of moving fast and offending people, Google has a hand tied behind its back as it fumbles around the impossible task of avoiding offending anyone.”

[And we know how Disney has likewise fumbled in that regard, right?]

“Without a doubt,” James goes on, “it will take time for Google to reorganize its AI efforts and focus less on politics and more on business. In the interim, I wouldn’t be surprised to see Google’s stock slip further from here.”

But long term, James is less concerned: “Google has some of the very best engineers in the world at their disposal. It was the Google team that actually invented the GPT technology that powers OpenAI ChatGPT (it's unclear if Google receives royalties from OpenAI for their invention).

“Which is to say, Google has what it takes to be a world-class AI company. The question remains whether Google will rise to the occasion.”

For now, James has Google on his watch list. If you’re not yet clued in about the AI plays that he rates as buys, he says only nine days remain before the current AI “wealth window” closes. Once it does, it’ll be harder to claim your share of the $15.7 trillion AI bounty that’s up for grabs. Check out James’ AI playbook here.

![]() Mailbag: Pride of Ownership

Mailbag: Pride of Ownership

“I had no help from my family or the government,” a reader sympathizes with my own personal journey through college.

“I had no help from my family or the government,” a reader sympathizes with my own personal journey through college.

“I went to a state university and worked 25 hours a week at UPS loading and unloading trucks because it was the best-paying job I could get. I was married at a very young age, and my wife worked as a secretary. We paid our rent and all of our expenses, and I managed to graduate in four years with a degree in accounting.”

“My experience is parallel to Emily’s, EXCEPT I did not borrow one thin dime of government or other money for my education,” says another contributor.

“My experience is parallel to Emily’s, EXCEPT I did not borrow one thin dime of government or other money for my education,” says another contributor.

“I financed a double-major BS in physics and mathematics by working nights at Kroger in the usual four years, with NO entertainment during those years. My MS in physics was paid for as a teaching assistant in graduate school. Again, no time or money for entertainment or parties. My JD in law was financed by my teaching physics and math at a small liberal arts college.

“The whole student loan gimmick is nothing but a racket to justify continually raising tuition rates for students who are told to go borrow the tuition as if tomorrow never comes. For those who borrowed it, they owe it, and they have a duty to repay it. Why should we taxpayers who paid our own way pay their way also?”

“For what it's worth, kudos to Emily for taking the rougher road, which tends to make you appreciate your accomplishment more,” writes our final correspondent today.

“For what it's worth, kudos to Emily for taking the rougher road, which tends to make you appreciate your accomplishment more,” writes our final correspondent today.

“And Dave, I couldn't agree more with your assessment of the unnecessary bloat in colleges that is even more of a waste — and not just in terms of dollars. Just another example of how far off track we are as a society.”

Thanks for all the support! It really means a lot… We’ll be back tomorrow with another round of 5 Bullets.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets