“Radical Change”

![]() Apple’s “Radical Change”

Apple’s “Radical Change”

It’s been a good year for the stock market so far. But for the company that dominated the market most of the last decade? Not so much.

It’s been a good year for the stock market so far. But for the company that dominated the market most of the last decade? Not so much.

The S&P 500 is up nearly 11% year-to-date, the Nasdaq Composite nearly 12%. Meanwhile, until yesterday, Apple spent much of 2024 in the red.

“Apple Inc. closed in positive territory for the year on Monday,” says Bloomberg, “in the latest sign of improving sentiment toward the iPhone maker…

“While it continues to lag other megacap technology stocks, Apple had previously been down as much as 14% this year, and the [May] rally has brought Apple back near the $3 trillion market capitalization threshold, which it hasn’t closed above since January.”

It doesn’t hurt that last month AAPL announced the biggest stock buyback program in U.S. history — $110 billion.

It doesn’t hurt that last month AAPL announced the biggest stock buyback program in U.S. history — $110 billion.

But as we’ve pointed out before, that’s also the knock on Apple.

Under Steve Jobs, the company seldom returned cash to shareholders in the form of dividends and buybacks.

Jobs always wanted to plow the company’s cash hoard back into the business, developing ever more and better products. Time and again he said words to the effect of, “If we do buybacks and dividends, that means we’ve run out of ideas.”

That’s why expectations are so high going into Apple’s annual Worldwide Developers Conference starting next Monday. AAPL is behind the curve on AI. What will it do to alter perceptions that it’s “run out of ideas”?

“Apple is about to make a radical change to its product line,” says Paradigm’s AI authority James Altucher.

“Apple is about to make a radical change to its product line,” says Paradigm’s AI authority James Altucher.

As James understands it from his contacts, Apple’s announcement will set off an “AI Supercycle” that could generate $1 trillion in sales.

He projects AAPL’s share price could jump 30% or more in the coming months.

Which is nice — but not exactly life-changing.

See, Apple is simply too big a company nowadays to generate the kind of staggering gains it used to. It’s not 2011 anymore — when James correctly forecast that AAPL’s market cap would soar 10X, from $300 billion to $3 trillion.

Fortunately for you, James has spotted an even more lucrative opportunity tied to Apple’s announcement.

With just one play, he’s eyeing 10X gains over the next year… and 100X over the next decade.

Again, Apple’s announcement is set for next Monday. And to help you get ready, James is organizing an exclusive online briefing set for Thursday at 7:15 p.m. EDT.

Access is free — as long as you do us the courtesy of signing up in advance. And we’ve made sign-up as brain-dead simple as possible — one click on this link, and your spot is guaranteed.

![]() Full Disclosure… or “Market Manipulation”?

Full Disclosure… or “Market Manipulation”?

Since when did “Roaring Kitty” Keith Gill become such a villain?

Since when did “Roaring Kitty” Keith Gill become such a villain?

Citing the usual “people familiar with the matter,” The Wall Street Journal has a front-page scoop today in which E-Trade is “considering” booting Gill from its platform “after growing concerned about potential stock manipulation around his recent purchases of GameStop options.”

Gill set off another big rally in GameStop yesterday when he posted screenshots from his E-Trade account showing a huge position in both GME shares and call options.

How huge? By one calculation, Gill will own 6.3% of GME’s public share float if he holds his options till expiration on June 21.

A pointed question from Paradigm editorial director Chris Harris: “How is Keith Gill’s ‘market manipulation’ different from any hedge fund/short seller/etc. buying something and then going public with their position?”

The answer from Paradigm’s hedge fund veteran Zach Scheidt: “I think the difference is buying something with the intention of the buy orders manipulating the price.

The answer from Paradigm’s hedge fund veteran Zach Scheidt: “I think the difference is buying something with the intention of the buy orders manipulating the price.

“If anyone tries to corner a market and use buy or sell orders to drive a price higher or lower, that's blatant manipulation and securities fraud.

“But if someone takes a position based on an expected or fundamental value - and then shares their opinion - while properly disclosing their position, that seems perfectly legitimate to me.”

That’s what hedge funds do all the time. “If, say, David Einhorn believes a stock is overpriced, takes a short position and then explains why he believes the stock should be worth less (while disclosing his position) I have no problem with that.

“But if Roaring Kitty simply says, ‘Let's drive the price higher and rip the face off those short sellers by driving the stock price higher,’ that seems like clear market manipulation and fraud to me.”

To be clear, Zach is not asserting that’s Gill’s motivation here. “I love seeing the ‘little guy’ make money in the market,” he says. Otherwise, Zach wouldn’t have walked away from his hedge fund job to write newsletters for everyday retail investors.

That said, Gill isn’t exactly a “little guy.” He was once a registered broker for a major insurer and holds several securities-industry licenses. To be continued…

It’s a lousy day in the commodity complex.

It’s a lousy day in the commodity complex.

Yesterday’s modest rally in precious metals didn’t last. Silver’s been crushed more than a buck today — nearly 4% — and back below $30 again. Fortunately, gold’s losses are much more modest — about $25 or 1% — and the Midas metal is still holding the line on $2,300.

Crude is down almost another buck after the OPEC+ decision to pare back on some of its production cuts later in 2025. A barrel of West Texas Intermediate now fetches $73.35 — another four-month low.

But crypto is looking stout, with Bitcoin back above $70,000.

As for the major U.S. stock indexes, they’re all in the red — but nothing dramatic. The S&P 500 is down less than a half percent at 5,261.

The main economic number of the day is an eye-opener — or at the very least another sign the job market is no longer “tight.” Job openings nationwide totaled less than 8.1 million in April — the lowest reading since February 2021.

No one among dozens of Wall Street economists polled by Econoday expected a number this low. The decline in the number of openings is especially noticeable in healthcare and leisure/hospitality.

As always, one month does not constitute a trend. But this number bears watching…

![]() NOW We’re Getting Serious About Nuclear?

NOW We’re Getting Serious About Nuclear?

From the “Day Late, Dollar Short” Department: The Biden administration seeks to “reestablish U.S. leadership” in nuclear power.

From the “Day Late, Dollar Short” Department: The Biden administration seeks to “reestablish U.S. leadership” in nuclear power.

“The White House is throwing its weight behind building large-scale nuclear reactors,” reports Bloomberg, “to help mitigate industry risk associated with the construction of power plants that can cost tens of billions of dollars…

“The White House’s backing for nuclear, which the administration says is needed to meet climate and clean power goals, comes as a dozen reactors have closed since 2013 amid competition from cheaper power from natural gas and renewable energy sources.”

You mean it finally dawned on someone in the West Wing that the power grid’s capacity is no greater now than it was a decade ago? And there’s not nearly enough wind and solar coming online to replace the coal and nuke plants that are shutting down?

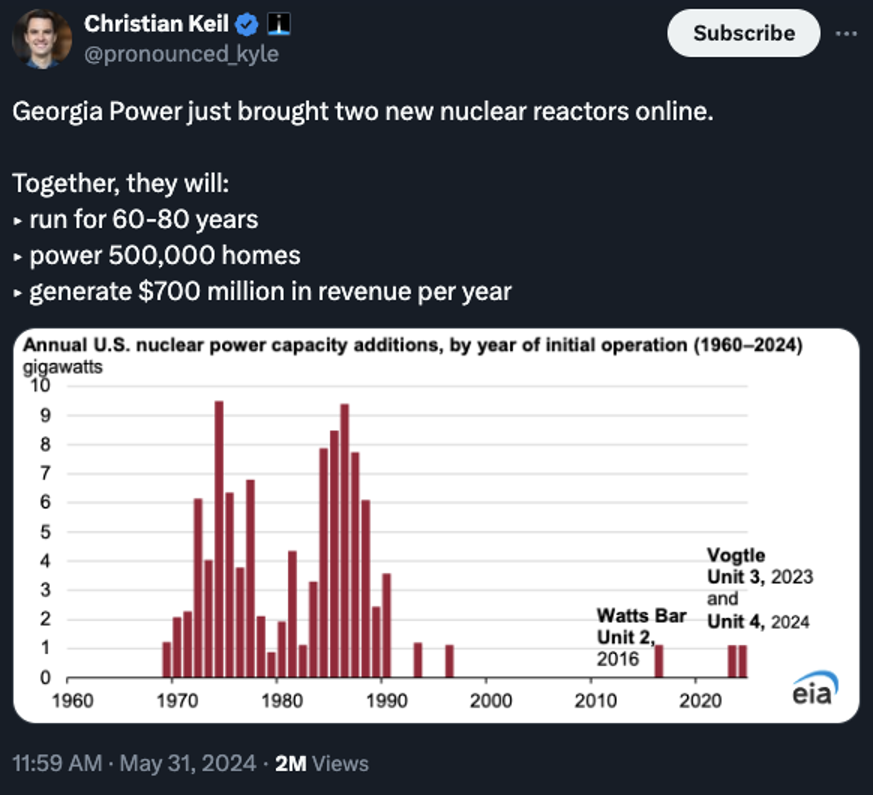

Well, that’s fine as far as it goes, but it’s not going to solve the problem anytime this decade. It takes years to bring new nuclear reactors online.

As the Bloomberg story concedes, “The last commercial-scale reactor built in the U.S., Southern Co.’s Vogtle nuclear project, was more than $16 billion over budget and seven years behind schedule.”

A half-million homes? “No,” counters author John Robb on Xwitter. “They will be bought by AWS, Google or Microsoft to run their AI training.”

He’s not entirely joking…

“Massive AI installations and data centers need reliable, cheap energy,” says Paradigm tech-investing whiz Ray Blanco — “and lots of it, with a strong bias toward sources that don’t contribute to carbon emissions.”

“Massive AI installations and data centers need reliable, cheap energy,” says Paradigm tech-investing whiz Ray Blanco — “and lots of it, with a strong bias toward sources that don’t contribute to carbon emissions.”

It was Ray who first warned us in January about AI’s prodigious demands on the power grid. “There simply isn’t enough energy to go around currently to sustain Big Tech’s AI plans,” he reminds us.

“Estimates for U.S. electricity demand over the next five years have nearly doubled. And utility operators are looking to expand using natural gas and now nuclear.

“This has Big Tech scrambling to find new ways to power its buildout plans. Microsoft, normally a tech company, is putting out job listings for hiring nuclear power specialists. It’s also teamed up with Google and Nucor (a steel company) to explore next-generation clean energy projects, including advanced nuclear.

“Amazon is also in the mix. The company just bought a data center in Pennsylvania situated right next to a nuclear plant, and it will be entirely powered by nuclear energy.

“That’s a boon for companies in the nuclear supply chain. It’s also creating interest in advanced nuclear reactor technology.” Ray has his head down in search of the best opportunities in the space. Stay tuned…

![]() The Red Sea Shutdown Hasn’t Gone Away

The Red Sea Shutdown Hasn’t Gone Away

Talk about beating the holiday rush…

Talk about beating the holiday rush…

“European retailers are rushing to place their Christmas orders early,” reports the BBC, “as soaring shipping costs and trade route disruption threaten holiday deliveries, experts say.”

It hasn’t made headlines lately, but for all intents and purposes the Red Sea and the Suez Canal are still effectively closed to most U.S.- and Israeli-linked shipping. The Houthi faction of Yemen has been remarkably effective with a harassment campaign in support of the Palestinians in Gaza. Result? Many ships have to take the long route around the Horn of Africa.

“Container prices, which peaked in January and briefly declined, have rebounded sharply in recent weeks,” the Beeb continues.

No lie: Yesterday the shipping giant Maersk upped its 2024 guidance for the second time in weeks. Yes, its costs are higher in terms of fuel and overtime for crews… but it’s more than making up for that with what it can charge customers.

Thus, many European retailers are loading up on inventory earlier than usual. "To avoid headlines 'Christmas is cancelled, there's nothing in the shops', people are now actually bringing forward their shipments," says Sue Terpilowski of the Chartered Institute of Logistics and Transport.

But that comes at a cost — and at the moment those costs are having a domino effect on bulky, low-margin items like furniture and appliances. “So unfortunately for consumers,” says Nick Glynn of the Buy It Direct group, “the next few months will see significant rises on these big-ticket items.”

The impact stateside is likely to be more muted: America’s immense imports from Asia don’t have to transit the Red Sea…

![]() Mailbag: Reagan’s Spending, Politician Emissions, “Erroneous” Trades

Mailbag: Reagan’s Spending, Politician Emissions, “Erroneous” Trades

“Thanks for bringing up Reagan’s deficit spending,” a reader writes after I did just that last week (and another reader took me to task, claiming I hail from the “brainless left side of the political spectrum”).

“Thanks for bringing up Reagan’s deficit spending,” a reader writes after I did just that last week (and another reader took me to task, claiming I hail from the “brainless left side of the political spectrum”).

“Back then it was upsetting, so I wrote letters (email didn’t exist) to my congressman, senators, and Reagan, saying that deficit spending was immoral and unethical.

The only reply was from Sen. Thomas Eagleton (D-Missouri), who said that “it allows us to do things that we couldn’t do otherwise”. That was an eye-opener — you could use the same lame excuse to justify robbing banks!

“Politicians haven’t changed since then — any lame excuse justifies them wasting our money and resources on things that nobody would ever pay for voluntarily.

“The 5 is great — I appreciate the work done by you and Emily.”

“The methane capture devices for cows,” a reader writes after yesterday’s edition, “should be mandatory for gasbag politicians whose emissions far exceed those of cows.

“The methane capture devices for cows,” a reader writes after yesterday’s edition, “should be mandatory for gasbag politicians whose emissions far exceed those of cows.

“Properly channeled, these emissions could power the world for decades.”

“I placed an order for GOLD — 20,000 shares at 25 cents a share,” a reader writes after the “technical issue” that afflicted the New York Stock Exchange yesterday.

“I placed an order for GOLD — 20,000 shares at 25 cents a share,” a reader writes after the “technical issue” that afflicted the New York Stock Exchange yesterday.

“Charles Schwab didn't fill it despite the order being executable. I have screenshots of everything. Do you have any idea if I can sue either Schwab or NYSE?”

Dave responds: I take it you’re talking about Barrick Gold (GOLD) yesterday? That was one of the stocks affected by the “software glitch” — although it was Warren Buffett’s Berkshire Hathaway that captured all the headlines.

Once the glitch was resolved, the NYSE made clear that it would cancel all “erroneous” trades — presumably yours included, even if there was no error on your part.

“The exchange’s rules allow traders to claim compensation for ‘clearly erroneous’ trades, and transactions at prices that result from technical glitches have been cancelled in the past,” says the Financial Times. “Last year, NYSE was forced to annul thousands of trades after a manual error led hundreds of stocks to begin trading without accurate limit up-limit down bands.”

Yeah, the word “forced” is doing some heavy lifting there.

So I’m afraid you’re out of luck. But if you can find a lawyer willing to take the case, by all means keep us posted!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets