Set Your Watch for This Sell-Off

![]() Altcoins: “Huge Moves Are Coming”

Altcoins: “Huge Moves Are Coming”

“My prediction: Bitcoin will hit $150,000 by September 2024. And it’s the prediction I’m LEAST excited about when it comes to crypto,” says Paradigm’s crypto expert Chris Campbell.

“My prediction: Bitcoin will hit $150,000 by September 2024. And it’s the prediction I’m LEAST excited about when it comes to crypto,” says Paradigm’s crypto expert Chris Campbell.

“Don’t get me wrong, Bitcoin (BTC) is King Kong. It is — and always has been — the dominant force in crypto.

“But as the market matures, altcoins” — cryptos (including Ethereum) that are not Bitcoin — “keep gaining more and more traction, pulling investors seeking higher returns and access to new opportunities.

“In 2016, Bitcoin’s market cap made up 90% of the total cryptocurrency market. Today? That number’s around 50%.

“We don’t expect this trend of altcoin dominance to end in 2024…

“With the fourth Bitcoin halving set to occur on or around April 20, 2024, many wonder how this event will impact the altcoin market,” says Chris.

“With the fourth Bitcoin halving set to occur on or around April 20, 2024, many wonder how this event will impact the altcoin market,” says Chris.

First, about Bitcoin’s “halving”....

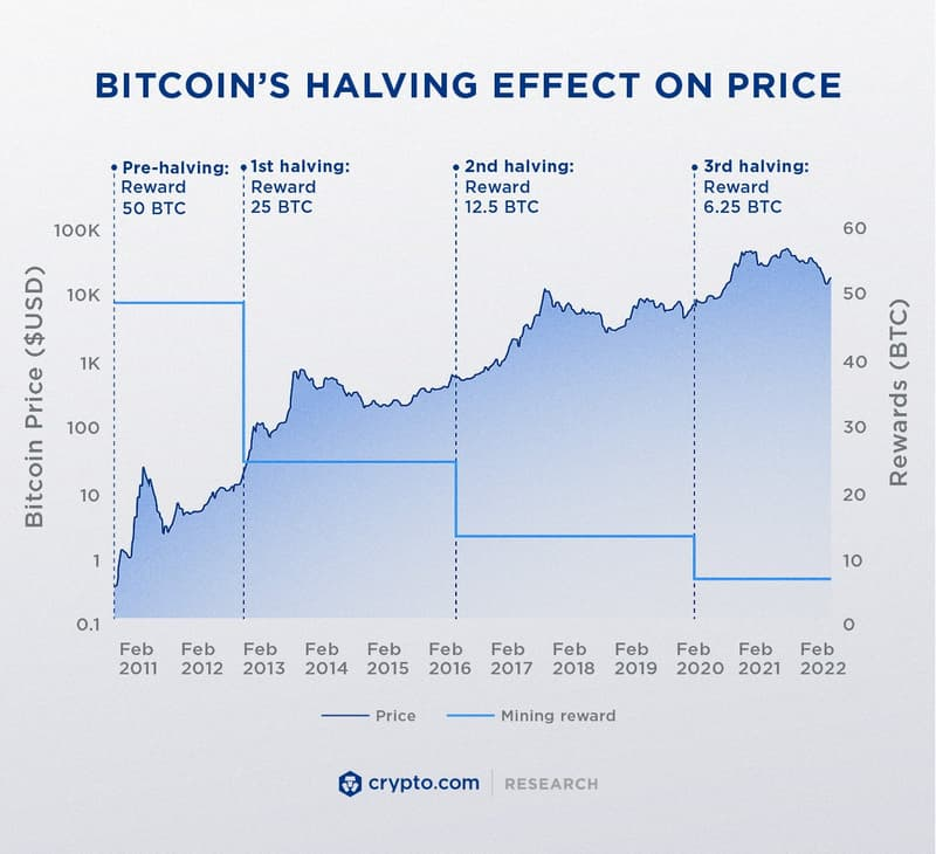

“For every 210,000 blocks [on Bitcoin’s blockchain], the number of newly issued Bitcoins is cut in half,” says Crypto.com.

“This translates to roughly every four years, depending on how quickly blocks are mined, which averages about [one] every 10 minutes.”

At the same time, the incentive for Bitcoin miners is cut in half. Whereas the incentive for mining one block was initially 50 BTC through November 2012, that incentive has incrementally reduced by half to where it will land later this month at 3.125 BTC.

Chris adds: “To get a clearer picture of where we are, let’s look at previous halvings…

“In 2012, the altcoin market didn’t exist, so there’s not much to say,” he says

“In 2016, the altcoin market — still in its infancy — experienced a relatively cool period following the halving, with prices remaining stagnant for around seven–eight months.

“The 2020 halving showed a similar picture. The altcoin market didn’t make big moves for months.

“As we approach the 2024 halving, the current altcoin cycle seems to be moving way ahead of both 2016 and 2020,” Chris observes.

“Increased mainstream attention and institutional investment in crypto have accelerated the market cap of altcoins to $1.15 trillion as of April 1, 2024.

“With a few impactful catalysts barreling down the pike in 2024, the trend is our friend.

“BUT it could also mean altcoins are getting out ahead of their skis.

“Based on the historical data from the 2016 and 2020 Bitcoin halving events, we shouldn’t count out a pre-halving correction in Bitcoin and altcoins,” Chris notes.

“Based on the historical data from the 2016 and 2020 Bitcoin halving events, we shouldn’t count out a pre-halving correction in Bitcoin and altcoins,” Chris notes.

“In 2016, a ~30% BTC correction took place 10 days before the halving, while in 2020, a ~15% correction occurred 15 days prior to the event.

“Both corrections were accompanied by increased volatility and trading volumes, as well as a hefty decline in the altcoin market.

“With the 2024 Bitcoin halving scheduled for April 20, the estimated correction date is Friday, April 5–Friday, April 12.

“Of course, this time could be different.

“We’re already seeing signs altcoins are beginning to diverge from Bitcoin…

“As for the rest of 2024, expect fireworks,” says Chris.

“As for the rest of 2024, expect fireworks,” says Chris.

“As the altcoin market matures, it will be CRUCIAL for investors to focus on cryptos with strong fundamentals, real-world utility and the ability to adapt to the evolving market conditions.

“We may see a consolidation phase where successful projects join forces or are acquired by established players,” he adds.

“We’re already seeing signs of this happening: Projects that can navigate the regulatory landscape and deliver value to users are more likely to succeed in the long run.”

Chris’ key takeaway: “As investors seek out higher-risk, higher-reward opportunities, altcoins are poised to benefit BIG from the increased attention and inflows. Especially as we inch toward more catalysts coming in 2024.

“In short, huge moves are coming,” he concludes.

[Note: In early March, Paradigm’s iconoclast crypto investor James Altucher and his team predicted a massive catalyst would strike the crypto market. That prediction came to fruition when Bitcoin hit a record-high $73,750 on March 14.

If you missed out on gains, the good news is that it’s not too late. Although crypto is a fast-moving market, there are still opportunities still up for grabs.

To put you in the best position, get all the details. Straight from James.]

![]() Anticipating a Homebuilder Reversal

Anticipating a Homebuilder Reversal

“Three years ago, I highlighted homebuilders as a way to take advantage of a few converging trends in the housing market,” says Paradigm’s income-investing ace Zach Scheidt.

“Three years ago, I highlighted homebuilders as a way to take advantage of a few converging trends in the housing market,” says Paradigm’s income-investing ace Zach Scheidt.

“Even with higher mortgage rates, there were just too many families interested in buying a home and not enough housing inventory,” he says.

“Ironically, higher interest rates actually compounded this problem, because existing homeowners who locked in low mortgage rates were unwilling to sell.

“Why move when you’re paying a very low interest rate on your current home?

“Higher home prices have naturally benefited homebuilders,” says Zach. “Over the past two years, the iShares U.S. Home Construction ETF (ITB) is up 163%.

“Now that homebuilders have soared, investors are starting to become more bullish on this area — but at the worst possible time!

“As the Fed prepares to cut its target interest rate later this year, mortgage rates are also likely to drop quite a bit, possibly dragging homebuilder stocks much lower,” he says.

“As the Fed prepares to cut its target interest rate later this year, mortgage rates are also likely to drop quite a bit, possibly dragging homebuilder stocks much lower,” he says.

“Many homeowners have been waiting for mortgage rates to drop below 5–6% to give them a better shot at moving without a dramatically higher monthly payment,” he says.

“All of these existing homes will hit the market while homebuilders continue constructing new housing across the country.

“The age-old laws of supply and demand are in play here,” says Zach. “It appears that the supply side will pick up and outpace demand, reversing the trend of the past couple of years.”

With that shift looming in the housing market, yesterday Zach advised members of his subscription service, Lifetime Income Report, to sell shares of Lennar Corp. (LEN).

“I’m happy with how this income play has performed,” Zach notes. “We’re up nearly 100% since buying in February 2021.

“Now is a great time to sell while the stock is still trading near all-time highs,” he says. “I think our capital could be put to better use elsewhere.”

Of course, congratulations to Lifetime Income Report subscribers on near 100% ROI! Zach will have other income opportunities for today’s market. We’ll let you know when Zach’s service opens to new subscribers. Stay tuned…

Taking inventory of the market, the three major U.S. stock indexes are in the red today.

Taking inventory of the market, the three major U.S. stock indexes are in the red today.

Ailing most, the tech-laden Nasdaq is down 1.25% to 16,190; at the same time, the Big Board and S&P 500 are both down about 1% to 39,145 and 5,195 respectively.

Despite a strengthening dollar, gold “refuses to yield to the dollar and continues to extend its historic breakout into the early days of the second quarter,” Paradigm’s market analyst Greg “Gunner” Guenthner notes.

“Gold isn’t supposed to rally in these conditions,” Gunner emphasizes. “Therefore, we can only assume there are more than a few strong buyers defying market relationships and buying as this historic breakout unfolds.” Indeed, gold is up about 0.20% to $2,255 per ounce — and up about 8% YTD.

Gunner says: “The action we’re seeing this week is once again working in favor of my 2024 prediction that the gold breakout will accelerate and run to $2,600.”

Silver, you wonder? The white metal is catching a bid, up 2.30% to $25.65. As for oil, crude’s up 1.20% to $84.72 for a barrel of West Texas Intermediate.

It’s a tough day for crypto: Bitcoin’s dropped about 5.5%, just under $66,000. As for Ethereum, the altcoin is down 5.75% to $3,265. The pre-halving correction might be happening early? Who knows. What we do know: The crypto market’s here to stay. Buy the discount…

![]() Ninety is the New 40?

Ninety is the New 40?

“What if advanced AI systems could analyze your medical data with superhuman accuracy, spotting diseases years before symptoms emerge?” posits Paradigm’s science-and-tech expert Ray Blanco.

“What if advanced AI systems could analyze your medical data with superhuman accuracy, spotting diseases years before symptoms emerge?” posits Paradigm’s science-and-tech expert Ray Blanco.

“What if AI could instantly create a treatment plan optimized for your unique biology, constantly learning from the latest research to provide you with personalized care?

“This isn’t some distant fantasy…

“It's happening behind the scenes right now as cutting-edge companies harness the power of AI to radically extend the human lifespan,” Ray says.

“With AI's ability to model drug candidates, analyze our genes and develop anti-aging therapies, the prospect of a 90-year-old having the biology of a 40-year-old is no longer science fiction.

“And early investors in the right AI health care players stand to profit tremendously from the trillions of dollars expected to pour into this market in the years ahead.

“The age of AI-powered longevity medicine is coming,” he says, “bringing a wave of profits along with it.”

Ray is putting the finishing touches on a presentation now that explains how you can take advantage of this trend. Expect to hear more details from us soon.

![]() Follow-up File: Eclipse-pocalypse

Follow-up File: Eclipse-pocalypse

“NEW YORK STATE HAS PUT A LIMIT ON GASOLINE,” screams a clickbait headline from radio station Country 106.5 WYRK.

“NEW YORK STATE HAS PUT A LIMIT ON GASOLINE,” screams a clickbait headline from radio station Country 106.5 WYRK.

In light of (heh) the solar eclipse this coming Monday, we mentioned last month how states in the “path of totality” have been freaking out. (And maybe, to an extent, the freak-out’s justified?)

Here’s another alarming headline out of San Antonio, Texas…

But before you flip your lid about gas rationing in New York, you should know the headline is misleading.

But before you flip your lid about gas rationing in New York, you should know the headline is misleading.

Because there are already rules on the books, circa 1996, about stockpiling gasoline…

“Transportation of fuel shall be accomplished by portable fuel cans with a maximum capacity of five gallons each, or cargo fuel tanks. All containers shall be properly labeled. Gasoline shall only be transported in approved five-gallon portable gas cans, with a limit of four (4) cans per vehicle.” [Emphasis ours]

There’s still a lot of wiggle room there, but the National Fire Protection Association proposes a limit of 25 gallons of stockpiled gas per household. In New York City, however, you can’t store more than 2.5 gallons of gasoline.

Instead of gas rationing, New State Police issued “Eclipse Guidelines” which warn about “an increase in 911 calls, gridlocked traffic and the potential for stranded motorists, reduced cellular service and empty gas stations,” NCPR highlights.

“It also suggests fueling up before visitors arrive at their destinations, and to have extra food and water stowed in your vehicle.”

Carry on… Nothing to see here.

![]() Mailbag: “Dear James” Letters

Mailbag: “Dear James” Letters

“James, I loved your 5 Bullets article!” says our first contributor today about Friday’s guest essay. “Thanks for writing and sharing it!”

“James, I loved your 5 Bullets article!” says our first contributor today about Friday’s guest essay. “Thanks for writing and sharing it!”

More praise for Paradigm’s iconoclast crypto investor? “I'm new to crypto investing, anxious to make money in this wild sector with so many options and unknowns. But I’m constantly aware of crypto millionaires being minted by this new opportunity.

“Reading James’ history helped me understand more about crypto’s evolution. It puts me into a more comfortable place, trusting the guidance provided.

“Well done.”

“Just wanted to send a SHOUTOUT to James for his persistence and courage,” says another contributor.

“Just wanted to send a SHOUTOUT to James for his persistence and courage,” says another contributor.

“It may well be that he is an eccentric genius — eccentric, certainly, but I like that. Which is why I would champion him every time over some smarmy wonk pictured against his brand-new Lambo.

“Keep writing, keep informing; you're great at it.

“I don't personally have heroes (unless they rescue people from life-threatening situations), but I still consider myself a huge admirer.

“Thanks for the work!”

“I am one of the many (and brand-new) readers who value learning from you, James. Thank you for making complex things intellectually accessible.

“I am one of the many (and brand-new) readers who value learning from you, James. Thank you for making complex things intellectually accessible.

“I'm very sorry for the way you’ve been treated. I guess it is lonely out front...

“All the best to you (and me!).”

If you’re brand-new to the Paradigm Press fold, welcome! If you want to access James’ favorite altcoin this year, he freely names the coin and ticker right here.

Take care! We’ll be back tomorrow with a brand-new episode of the 5 Bullets…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets