Stress-Free Crypto

![]() Zen and the Art of Owning Crypto

Zen and the Art of Owning Crypto

No one said the road to $140,000 Bitcoin would be straight and narrow.

No one said the road to $140,000 Bitcoin would be straight and narrow.

That figure, as you might already know, is our own crypto evangelist James Altucher’s year-end forecast.

For perspective, Bitcoin’s all-time high came in mid-March — just over $73,000. The every-four-years Bitcoin “halving” came two weeks ago. This morning Bitcoin trades under $62,000.

If previous halvings are any guide, Bitcoin will rally strongly over the next 15–18 months, and so will the rest of the crypto space. But there will be many thrills-n-chills along the way.

“Unless you want to rely 100% on LUCK, you need to have a long-term approach,” says James’ senior crypto analyst Chris Campbell.

And the right long-term approach means you can sleep soundly despite the volatility. “If your crypto portfolio is keeping you up at night, then you probably have too much money in crypto,” says Chris.

“The ideal is when you can forget about it and do other things. Start a garden. Write a book. Learn Russian. Play the piano. Diversify your interests.”

To help you achieve that level of Zen, Chris joins us today to dispel some of the crypto fearmongering you might have encountered in recent days.

To help you achieve that level of Zen, Chris joins us today to dispel some of the crypto fearmongering you might have encountered in recent days.

Much of that fearmongering surrounds the Securities and Exchange Commission.

“The SEC's actions against various crypto entities, such as the lawsuits against Ripple, Grayscale and Coinbase, aren’t ideal by any means,” Chris allows.

“However, it's important to note that the SEC has been losing many of these battles in court. Ripple and Grayscale have already won against the SEC, and based on legal analysis, Coinbase is likely to come out on top as well.”

The biggest amount of hand-wringing right now surrounds the applications by several firms to launch an Ethereum ETF, similar to the Bitcoin ETFs that launched in January.

Spoiler alert: The SEC will probably nix these applications when it comes time to decide in three more weeks. That’s even though the giant asset manager BlackRock has submitted one of those applications and what BlackRock wants, BlackRock almost always gets. Probably not this time, though.

Perspective: “It's important to remember that Ethereum has already reached highs of $4,800 in 2021 without an ETF,” says Chris. [It’s a little over $3,000 now.] “The ETF is a bonus but not essential for Ethereum’s rise.”

Perspective: “It's important to remember that Ethereum has already reached highs of $4,800 in 2021 without an ETF,” says Chris. [It’s a little over $3,000 now.] “The ETF is a bonus but not essential for Ethereum’s rise.”

Indeed. Ethereum has a capability Bitcoin does not: It’s “the leading platform for decentralized applications across finance, gaming and social media,” says Chris. “In other words, its technology focus provides utility and fundamental demand beyond just speculative value storage.”

That too will give a lift to the entire crypto space. But again, that’s not an overnight thing. The whole point of getting into crypto is not instant riches — it’s generational wealth.

As James Altucher is keen to point out, “Long-term patience will pay off big. My investors who held on when Bitcoin dropped from $10,000 to $5,000 are now sitting on $55,000 in gains.”

To be sure, the gains to be had from Bitcoin now won’t be as lucrative. That’s why James is so keen on a sub-niche of tiny cryptos with truly staggering profit potential.

After the last halving in 2020, coins like these generated gains of 15,416% in the space of just 18 months.

![]() Bad News Is Good News Again

Bad News Is Good News Again

As was the case for much of the period between the 2008 financial crisis and the 2020 COVID lockdowns, bad news is good news for Mr. Market today.

As was the case for much of the period between the 2008 financial crisis and the 2020 COVID lockdowns, bad news is good news for Mr. Market today.

The monthly job numbers are out. The wonks at the Bureau of Labor Statistics conjured only 175,000 new jobs for April. No one among dozens of Wall Street economists polled by Econoday expected a number that weak.

The mainstream is putting the best spin on the number it can: The official unemployment rate ticked up to 3.9%. “That marks the 27th consecutive month that the unemployment rate was below 4%,” says The Washington Post. “This was previously recorded during a low-unemployment period between 1967–1970 and the longest period on record between 1951–53.”

Yes, that’s deceptive. Really, it’s an apples-to-oranges comparison. What the statisticians count as “unemployed” today is not what they counted as “unemployed” in the ’50s and ’60s. Nowadays if you’re a part-timer looking for full-time work, you’re not considered “unemployed.” And if you’re out of work and given up looking, well, that doesn’t count as “unemployed” either.

Economist John Williams of the ShadowStats research firm uses the same methodology the statisticians used up until the 1980s. By his reckoning, the real-world unemployment rate is close to 25%.

As far as Mr. Market is concerned, the weak job number suggests that maybe the Federal Reserve will cut interest rates before Election Day after all.

As far as Mr. Market is concerned, the weak job number suggests that maybe the Federal Reserve will cut interest rates before Election Day after all.

Never mind that one month does not constitute a trend and the Fed will want to see two or three months of weakness before even thinking about changing its tune.

Just the hint of a prospect of a suggestion that lower rates are on the way is enough to propel the major U.S. stock indexes higher today. The Nasdaq is in line to close over 16,000 for the first time in three weeks. The S&P 500 is up nearly 1% and back above 5,100.

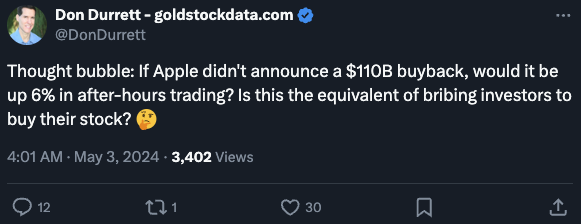

Helping the rally is the reaction to Apple’s quarterly numbers. They were subpar — with iPhone sales down 10% and overall sales down nearly everywhere except Europe. But at last check, AAPL is up 6.3% on the day because the company authorized a $110 billion share buyback.

But as always, it’s not the facts that matter as much as the reaction to the facts. “Apple’s price action and psychology look exactly like Tesla,” says Alan Knuckman — Paradigm’s eyes and ears at the Chicago options exchanges. Recall that Tesla’s numbers also stank — but a few choice words from Elon Musk about more-affordable models propelled TSLA shares 15% higher.

Elsewhere, bonds are also rallying, pushing yields down; the yield on a 10-year Treasury is back to 4.53%, the lowest in three weeks.

Alas, precious metals have been excluded from this easy-money party. Gold is on track for a weekly close below $2,300. Silver sits at $26.33. Crude is adding to its losses this week — now below $79, the lowest since mid-March.

![]() Fact-checking the IRS

Fact-checking the IRS

The IRS is being purposely deceptive about how it plans to ramp up audits…

The IRS is being purposely deceptive about how it plans to ramp up audits…

Yesterday, IRS chief Danny Werfel laid out specifics about how the agency plans to spend the $80 billion in new funding it got from the misnamed Inflation Reduction Act of 2022.

CBS News bought into his spin: “The agency will focus on wealthy individuals and large corporations.” Audit rates will nearly triple for corporations with assets of more than $250 million. And they’ll rise 50% for individuals with income over $10 million.

But to hear Werfel tell it, you’re at no greater risk of audit now than you were before if you earn under $400,000. "There is no new wave of audits coming from middle- and low-income [individuals], coming from mom and pops. That's not in our plans.”

That depends on how you define “wave.”

As we’ve been pointing out since the law took effect in 2022, the total number of audits is set to grow… and Treasury Secretary Janet Yellen promises only that the share of under-$400k earners would not grow. That means the absolute number of under-$400k earners subject to audit will grow.

Small-business owners and the self-employed are particularly subject to shakedown. They’re not W2 employees and thus they can be nailed more easily for inflating deductions and (especially) underreporting income.

As Jim Rickards warned in 2022, the stepped-up enforcement “will not primarily audit the rich and large corporations that are already heavily audited and who have the lawyers and accountants needed to fend off IRS attacks,” says Jim Rickards.

“Instead, these agents will be deployed against small businesses, professionals such as lawyers, doctors and consultants, entrepreneurs who do business as LLCs, farmers and others who may be successful but not super-rich.”

You heard it here first…

![]() The War on Cash, Greece Edition

The War on Cash, Greece Edition

Speaking of independent business owners targeted by the taxman…

Speaking of independent business owners targeted by the taxman…

Effective two days ago, “taxis and outdoor market stalls, like other sectors previously dominated by cash, will also have to accept card payments from customers,” says a Financial Times dispatch from Greece.

“Greece, long regarded as one of the most tolerant countries for tax evaders in the EU, is notorious for the number of undeclared business transactions and the size of its cash economy and had come under intense pressure from Germany and other eurozone partners to tighten its controls.”

When the Greek government was on the verge of default in 2015, the authorities imposed strict limits on cash withdrawals. “Card usage at the time was as little as 5% of all transactions,” says the FT, “but soon became the main way to bypass the cash limits — a development that also boosted tax revenues because card payments leave an electronic record.”

As far as getting cabbies on board, the country’s finance minister makes it plain: “We need everything to be interconnected.”

Greek cabbies assimilated by the Borg. Sad.

![]() Mailbag: Nvidia and Funky Place Names

Mailbag: Nvidia and Funky Place Names

Some praise followed up by an inquiry to begin today’s mailbag…

Some praise followed up by an inquiry to begin today’s mailbag…

“I finished reading your publication, and found it quite entertaining,” a reader writes after Tuesday’s edition. “Humorous.”

What caught her eye was the presence of Nvidia CEO Jensen Huang on Homeland Security’s new “Artificial Intelligence Safety and Security Board.”

Which reminded her that she’s currently in the red on her NVDA holdings: “Do I hold them or fold them?”

The answer is that NVDA is a buy up to $1,000 per share in Altucher’s Investment Network. (With such a large, liquid and well-known stock, I don’t think I’m doing James’ paid readership a disservice by mentioning that here.)

James issued that recommendation about eight months ago when NVDA was about $470; it’s up almost 88% since.

Obviously not everyone who’s become a James subscriber since then — and there are a lot of them — bought at the same price.

But most of the Paradigm editors include a buy-up-to price with their stock recommendations. They’re a useful guide to ensure that you don’t overpay relative to the stock’s value. NVDA has yet to achieve that $1,000 share price — so just hold on tight.

Let’s wind down the week on a light note with more reader musings about pronunciations and place names.

Let’s wind down the week on a light note with more reader musings about pronunciations and place names.

After I pointed out the existence of places in Illinois pronounced MY-lan, VY-enna and CARE-o… someone pointed out: “You missed ‘Versailles’ KY, which is pronounced ‘ver-SAILS,’ and ‘Cadiz.’ which is pronounced ‘KAY-diz.’

“Once when entering the U.S. at the Texas border,” says another reader, “I was asked for my nationality. Recalling that border agents would know nuances of Americana, I responded: ‘Hoosier!’ which he acknowledged. How else would you pronounce that?

“The origin is a bit obscure. Many years ago after one Notre Dame-USC football game in South Bend, an inebriated fighting Irishman spotted a California ear on the field and asked: “Whoosh ear?”

“The matter of officially approved names,” writes our final correspondent, “reminded me of a 1980s-era joke…

“The matter of officially approved names,” writes our final correspondent, “reminded me of a 1980s-era joke…

An old woman was asked, ‘Where were you born?’

‘St. Petersburg.’

‘Where did you grow up?’

‘Petrograd.’

‘Where do you live now?’

‘Leningrad.’

‘Where would you like to live?’

‘St. Petersburg.’

“The fictitious woman in the joke may have lived long enough to have her wish come true.”

Dave responds: Which reminds me… Way back in the day, the Op-Ed page of the Florida newspaper then called The St. Petersburg Times was regarded as so left-leaning that some folks referred to it as “Pravda West”!