The Year of AI

![]() AI: It’s Not Just Hype

AI: It’s Not Just Hype

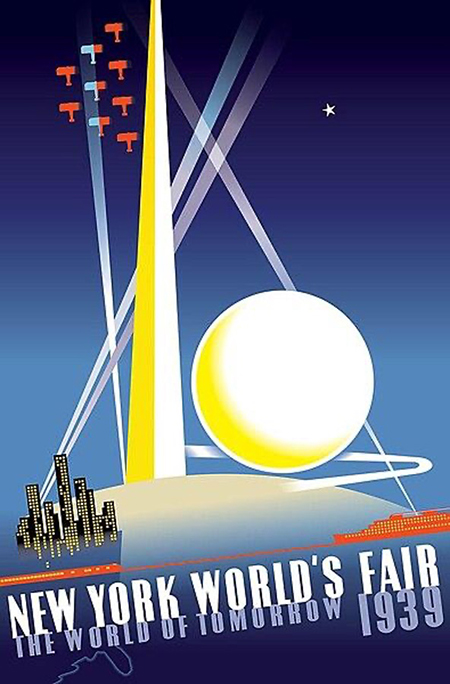

It was a grim time in history. War overseas, dissension and economic struggles at home. And yet, there was a palpable air of optimism about technology and the future.

It was a grim time in history. War overseas, dissension and economic struggles at home. And yet, there was a palpable air of optimism about technology and the future.

Between April 1939 and October 1940, more than 44 million people flocked to the New York World’s Fair — “a celebration of technology on a vast scale and of humanity’s power to reshape the environment,” as Neil Howe wrote last year in his book The Fourth Turning Is Here.

The Depression had dragged on for a decade. Hitler was on the march in Europe. But the possibilities for humanity’s progress and betterment seemed boundless.

It was at this venue, for instance, that RCA president David Sarnoff chose to introduce television to the public. “In order to convince skeptical visitors that the television sets were not a trick,” says Wikipedia, “one set was made with a transparent case so that the internal components could be seen. As part of the exhibit at the RCA pavilion, visitors could see themselves on television.”

The parallels to the present moment are unmistakable — conflict abroad, anger and hardship at home. And yet, interest in artificial intelligence is off the charts.

The parallels to the present moment are unmistakable — conflict abroad, anger and hardship at home. And yet, interest in artificial intelligence is off the charts.

Maybe you’re a skeptic about AI. Truth be told, so am I. The ability of “large language models” to mimic human expression is intriguing, even useful at times — but is it really world-changing?

Here’s the thing, though: AI is about so much more than ChatGPT and its ilk — as colleague Chris Campbell schooled me shortly before the holidays.

Chris and I have been colleagues for over a decade now. Among other hats he wears, he’s right-hand man to Paradigm’s investing iconoclast James Altucher. And in a recent edition of our sister e-letter Altucher Confidential, Chris laid out a host of ways in which AI is already changing the world…

- “Google used AI to optimize energy usage in its data centers, reducing cooling energy consumption by up to 40%. Forty percent!

- “Companies like John Deere and Blue River Technology use AI for precision farming, allowing farmers to apply the exact amount of water and fertilizers needed, thereby increasing yield and reducing waste. How much of an increase in yields could this garner, you ask?: 20–30%, a massive improvement over traditional farming techniques, which saw only gradual improvements over decades

- “Research reveals AI-based algorithms in the auto manufacturing sector can lead to more than an estimated 20% increase in equipment availability, up to 25% lower inspection costs and up to 10% lower total annual maintenance costs. This improvement is largely due to AI's ability to predict equipment failures and optimize maintenance planning

- “In quality inspection processes, AI-based machines can detect defects up to 90% more accurately than humans. This not only improves the product quality but also operational efficiency

- “What about supply chains? AI is estimated to be able to reduce forecasting errors by 30–50% and overall inventories by 20–50%. This results in cost savings by eliminating the transport, warehousing and administration of unneeded goods.”

And the list doesn’t end there.

And the list doesn’t end there.

“In areas like IT and finance,” Chris goes on, “AI can automate tasks leading to an automation rate of approximately 30%. In specific cases like IT service-desk automation, a degree of automation of around 90% is possible. (!)

“AI is widely used in telemedicine platforms for remote diagnosis and monitoring. For example, platforms like Babylon Health use AI for initial medical consultations.

“Of course, companies like Tesla and Waymo have developed autonomous vehicles that are already on the roads, optimizing routes and fuel efficiency.

“IBM's AI-powered system helps predict cloud movement to optimize solar energy harvesting.

“Streaming services like Netflix and YouTube use AI to adjust video quality in real-time based on the user's internet bandwidth, optimizing data usage.

“Now, think of the investment opportunities… and the unprecedented level of wealth this will create,” Chris implores.

“Now, think of the investment opportunities… and the unprecedented level of wealth this will create,” Chris implores.

“In all major economic transformations, there was a tiny window of opportunity…

“The Industrial Revolution (18th–19th centuries) created a wealth window through the establishment of factories, mechanization and mass production.

“The California Gold Rush (1848–855) led to a massive influx of prospectors and entrepreneurs, creating enormous wealth for some.

“The rapid expansion of the railroad network in the 19th century opened new opportunities for trade and commerce, significantly boosting economic growth.”

Likewise with all of the more recent technology breakthroughs — the internet, mobile, e-commerce. “ALL of them had a wealth window through which a lucky few got fantastically rich.”

Except that “luck” had very little to do with it.

That’s the whole point of a recent presentation by our own James Altucher. Thousands of people like yourself have learned from James’ entry-level newsletter — Altucher’s Investment Network — that for all the hype that AI got in 2023, the most lucrative opportunities are still ahead.

What he calls AI 2.0 is opening a new wealth window between now and next Tuesday, Jan. 9.

Curious? Then give this a look right away.

![]() Get Your Precious Metals at… Walmart?

Get Your Precious Metals at… Walmart?

On the heels of Costco’s foray into one-ounce gold bars and U.S. Silver Eagles…

On the heels of Costco’s foray into one-ounce gold bars and U.S. Silver Eagles…

Apparently, Wally World has been selling precious metals for a while. But over the holidays, it got fresh attention on social media.

Near as we can tell, fulfillment is by APMEX — one of the major gold and silver retailers — and Walmart takes a small markup over what you’d pay if you bought direct from APMEX. Since most folks are more familiar with Walmart than APMEX, the upside for both companies is a no-brainer.

Whether it’s the publicity about Costco and Walmart, or something else, demand for U.S. Silver Eagles so far in 2024 is intense.

Whether it’s the publicity about Costco and Walmart, or something else, demand for U.S. Silver Eagles so far in 2024 is intense.

At the close of business yesterday, the U.S. Mint reported January sales of 3,179,000 Silver Eagles to its network of wholesalers.

Only two days into the month, that’s already approaching the total for all of January 2023 — 3,949,000. Granted, the Mint was still dealing with supply-chain issues last year — one-ounce blanks were hard to come by — but the comparison is nonetheless impressive.

Checking our screens today, precious metals are finally giving in to the U.S. dollar’s newfound strength so far in 2024.

Checking our screens today, precious metals are finally giving in to the U.S. dollar’s newfound strength so far in 2024.

The U.S. dollar index is up to 102.52 this morning — a dramatic move from below 100.5 less than a week ago.

Gold and silver managed to hold their own — until today. Spot gold is down $23 at last check to $2,035 and silver is down 79 cents to $22.86.

Perhaps in sympathy, crypto is also pulling back — Bitcoin back below $43,000.

The strengthening dollar isn’t doing any favors for stocks, either.

The strengthening dollar isn’t doing any favors for stocks, either.

By the close yesterday, the Nasdaq logged its worst day since October, a drop of 1.6%. And it’s down nearly 1% as we write, to 14,627.

The S&P 500 is down nearly two-thirds of a percent to 4,712. That’s about 1.75% below the early-2022 record of 4,796. Taking out that record is still within the realm of possibility — but the S&P might need to do some more “backing and filling” after 2023’s furious late-year rally.

After notching a record high yesterday, the Dow is down about a half percent to 37,509.

Bonds are selling off in sympathy with stocks, pushing yields higher: At one point the yield on a 10-year note was back above 4%.

The big economic number of the day is the ISM Manufacturing Index — up to 47.4 for December, but it’s the 14th-straight month of sub-50 numbers, suggesting a shrinking U.S. factory sector.

Still to come this afternoon are the “minutes” from the Federal Reserve’s December meeting. It will be mildly interesting to see whether this document is crafted in a way to massage Mr. Market’s expectations for interest-rate cuts this year. We’ll follow up tomorrow…

![]() Middle East: The Hits Keep Coming

Middle East: The Hits Keep Coming

Crude is up more than 3% to $72.69 after what sure looks like a provocation aimed at amping up the conflict in the Middle East.

Crude is up more than 3% to $72.69 after what sure looks like a provocation aimed at amping up the conflict in the Middle East.

Bombs went off in Iran at the tomb of Gen. Qasem Soleimani, the revered chief of Iran’s Revolutionary Guard Corps. A crowd was gathered there to mark the fourth anniversary of his assassination by a U.S. drone. The death toll is 103 and likely climbing.

State TV is calling it a “terrorist attack.” So far, no one has claimed responsibility and it’s too soon to suss out what the fallout might be.

But “Wednesday's incident comes amid heightened tensions in the region,” the BBC reminds us, “after the deputy leader of the Iran-backed Palestinian group, Hamas, was killed in an apparent Israeli drone strike in Lebanon.”

To say nothing of the attacks on Israel-linked shipping in the Red Sea by Yemen’s Houthi faction. So far, no one in Washington is formally tamping down the rumors about airstrikes against the Houthis by an already stretched-to-the-max U.S. military…

The OPEC nations issued a statement this morning promising to stick together in their “efforts to maintain oil market stability going forward” — a cleverly worded statement that conveys zero information about either future production or price movement.

![]() Uranium: It’s Not Too Late

Uranium: It’s Not Too Late

Uranium is trading at its highest since 2007… and it has a lot more room to run, says Paradigm’s income-investing pro Zach Scheidt.

Uranium is trading at its highest since 2007… and it has a lot more room to run, says Paradigm’s income-investing pro Zach Scheidt.

A pound of uranium fetches $91 this morning. Amid constrained electricity supply — and growing demand from EVs, data centers, etc. — nuclear power will be one of the answers, maybe the answer, going forward.

The backstory: “Commodities are notorious for having boom and bust cycles,” says Zach. “When demand is high, rising prices create an incentive for new production. Typically, the additional supply then pushes prices lower, causing the weak producers to go out of business. This reduces the supply and sets up another bullish cycle.

“Uranium can follow a similar pattern. But its cycle tends to be much longer than for other commodities.

“That's because it takes a long time to permit and build new nuclear reactors. So it takes a while for demand to rise. Meanwhile, uranium supplies have been subsidized by decommissioned weapons, many of which came from Russia.”

But that was then and this is now: “Thanks to strong electricity demand, new reactors are finally being built,” says Zach. “And old reactors are getting upgraded to meet international standards so they can begin producing electricity again.

But that was then and this is now: “Thanks to strong electricity demand, new reactors are finally being built,” says Zach. “And old reactors are getting upgraded to meet international standards so they can begin producing electricity again.

“Meanwhile, much of the uranium from weapons has been used up. With rising geopolitical tensions, programs for decommissioning nuclear weapons are facing new challenges.

“In other words, we're seeing strong demand for uranium while supplies are very limited. And it will take awhile for uranium production to pick up to where supply matches demand.”

Zach has two names to consider. First is Cameco Corp. (CCJ), the big Canadian uranium miner. [Disclosure: Zach holds a position in the Income Alliance portfolio.] Also, the Sprott Uranium Miners ETF (URNM), which allows you to spread the risk among a basket of companies in the sector.

![]() Bank Run in Canada?

Bank Run in Canada?

“Stealing Russia’s reserves,” reads the subject line of a reader’s email after yesterday’s edition.

“Stealing Russia’s reserves,” reads the subject line of a reader’s email after yesterday’s edition.

“Expect Canada to be all in on stealing Russia's reserve funds. Our deputy prime minister Chrystia Freeland has a strong Ukrainian/ Nazi heritage. She is also a sitting World Economic Forum board member. They have been talking about this for a while. She can’t wait.

“They started a huge bank run when they weaponized the banking system against peaceful protesters. Multiple governments breaking the rule of law could start a domino effect in the world banking system.”

Dave responds: OK, as long as you brought it up, I have an inquiry for you and other Canadian readers…

Was there a bank run in Canada in response to the “debanking” of the Canadian truckers during February 2022?

I know from our voluminous archives that the websites and phone systems at Canada’s Big Five banks went down a couple of days after the Trudeau government invoked the Emergencies Act of 1988 — which everyone knew was a prelude to freezing the protesters’ accounts. And I know there were social-media rumors of a bank run at the time.

But was there ever an “official” explanation?

More to the point, is it credible to assume that the government backed down after this episode? Yes, it froze the accounts of the protest leaders — but the original threat was to freeze the accounts of anybody who sent money to support the protesters, too. And as far as I’m aware, that never happened.

Is this actually a case of the people successfully withdrawing their consent to be governed? Canadian readers, please weigh in: feedback@paradigmpressroom.com

“Dave, Emily, Happy 2024! Thank you for being warriors for the things that matter — and the liberty that makes them possible,” writes one of our regulars.

“Dave, Emily, Happy 2024! Thank you for being warriors for the things that matter — and the liberty that makes them possible,” writes one of our regulars.

“The sword of free speech, used righteously, is a weapon. You do it well. It can’t be easy.

Keep swinging away!”

Dave responds: Thank you. Kind words do keep us going!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets