Three Little Charts and the Trade of the Decade

![]() Three Little Charts and the Trade of the Decade

Three Little Charts and the Trade of the Decade

Did you take note of this chart at the start of our special video edition yesterday?

Did you take note of this chart at the start of our special video edition yesterday?

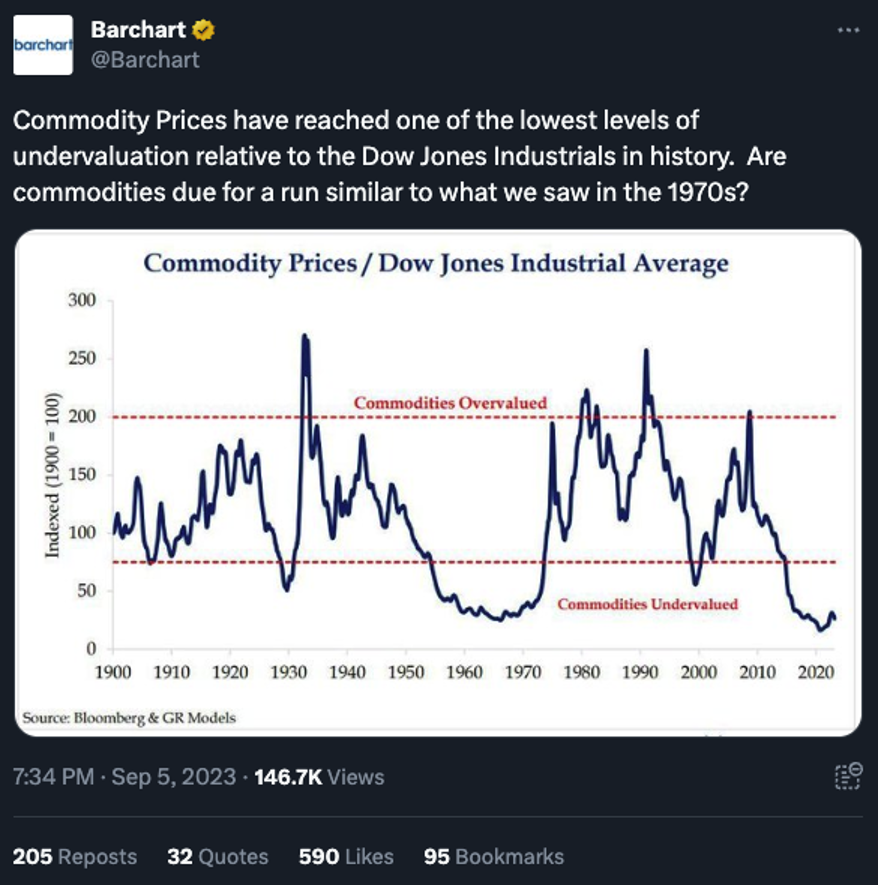

Here it is once again, in tweet form — the chart I shared at the outset of our natural resources panel discussion last fall during the Paradigm Shift Summit…

It’s the ratio of a major commodity index to the Dow Jones Industrials going back to the start of the 20th century.

Low points on the chart suggest that commodities — metals, energy, agriculture — are a buy. Certainly more so than stocks. That was absolutely the case at the outset of the 1970s… and again at the dawn of the 21st century.

As the chart suggests very strongly, we’re in the early innings of a similar era now.

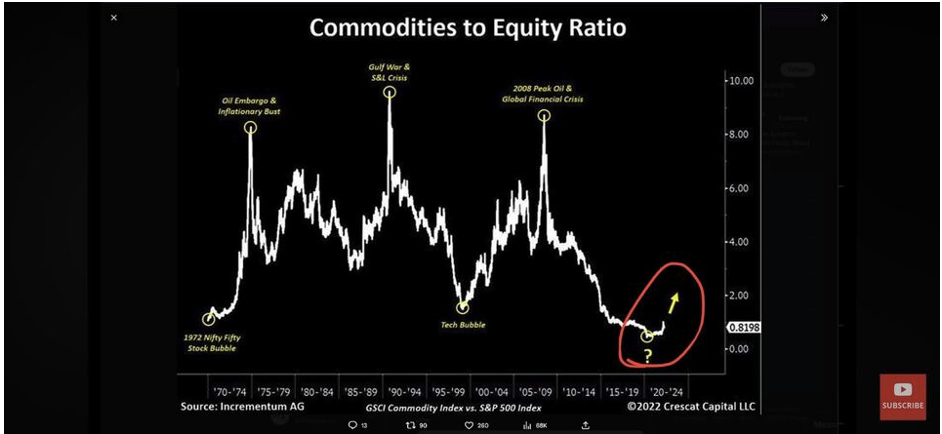

Let’s zoom in on the last 50 or so years…

Let’s zoom in on the last 50 or so years…

Stocks went nowhere from 1966–1982 and again from 2000–2013 — and with much volatility along the way (i.e., the worst of the global financial crisis in 2008).

But while stock-and-bond investors were routinely slaughtered during those eras, investors in natural resources thrived.

Gold stocks soared as gold climbed from $35 in 1971 to over $800 in 1980… and again as gold leaped from $250 in 2000 to over $1,900 in 2011.

Meanwhile, energy stocks outperformed as oil prices quadrupled in the early ’70s… and again in the 2000s as crude climbed from under $35 in 2004 to a record $147 in 2008.

The same went for other natural resources like base metals (copper, nickel, lead and so on) and agricultural plays on grains and livestock.

At any given moment, an individual commodity can experience a brief rally. But it’s only once every few decades when commodities as a whole stage a secular, years-long rally in which the entire natural-resource complex can mint new fortunes.

Here’s one more version of the chart. If the others are too esoteric, this one is as in-your-face as it gets…

Here’s one more version of the chart. If the others are too esoteric, this one is as in-your-face as it gets…

It’s this version of the chart that’s at the heart of a brand-new presentation we’ve put together at Paradigm.

As you can see from all three versions of the chart, commodities became a buy between 2018–2020. And while the S&P GSCI commodities index has doubled since 2020, that’s just the beginning.

Secular bull markets start out slow and steady — in this case, doubling in four years — but that’s just the smart money piling in at the start of the trend. The bigger money is to be made when institutional investors start piling in… and the biggest money, the blow-off top, comes when mom-and-pops finally catch on. That’s how it goes, always, during a commodities supercycle.

This week Paradigm is taking the wraps off a one-of-a-kind strategy to maximize the gains to be had from the commodities supercycle of the 2020s. And it begins with a single gold trade that has 5,000% upside over the next six–nine months.

Imagine one trade that could make 50X your money by springtime next year. That’s the power behind this strategy — as Jim Rickards lays out for you at this link.

![]() Oil Hears the War Drums

Oil Hears the War Drums

Within the commodities supercycle, there are individual catalysts for individual sectors.

Within the commodities supercycle, there are individual catalysts for individual sectors.

In the case of crude oil, it’s trading at eight-week highs — $81.68 for a barrel of West Texas Intermediate — as the war drums beat in Europe and the Middle East.

On the heels of their warnings last week, Israeli officials continue to telegraph their intentions to launch an assault on the Hezbollah militant group in Lebanon. “After the intense phase is finished [in Gaza], we will have the possibility to move part of the forces north,” Prime Minister Benjamin Netanyahu tells Israel’s Channel 14 outlet.

U.S. military officials fear Israel’s missile defenses could be overwhelmed, and Iran might be drawn into the war (to say nothing of any American aircraft carriers cruising the Mediterranean). In the meantime, governments worldwide are urging their citizens to stay away from Lebanon.

More alarmingly… the Kremlin is holding Washington responsible for a Ukrainian airstrike on Crimea that killed four people and wounded over 100.

Moscow claims the attack was carried out with American ATACMS missiles, and that Washington furnished intel to Kyiv ahead of the attack. The Russian foreign ministry says the United States has “effectively become a party” to the war on Ukraine’s side and that “retaliatory measures will certainly follow.”

Because the corporate media are criminally underplaying this story, it’s certain that whenever those retaliatory measures come, officials in Washington will scream about how those measures were a “sneak attack” that was “unprovoked.” And much of the public won’t know any better…

As for the stock market today, it’s not implausible to say that it’s all about Nvidia. Again.

As for the stock market today, it’s not implausible to say that it’s all about Nvidia. Again.

After a wicked sell-off last week, NVDA was due for an oversold bounce. Sure enough, it’s up 5.3% as we write. That’s propelled the Nasdaq up 1.1% at last check to 17,688. The S&P 500 is up a third of a percent to 5,464. Both indexes are within spitting distance of last week’s record closes.

The Dow, of which Nvidia is not a part, is down nearly three-quarters of a percent at 39,134. The Big Board is still well below its heady 40,000 record from over a month ago.

It’s a red day in the precious metals complex — gold down $15 to $2,319 and silver down 2%, back below $29. Bitcoin is recovering from a swoon in recent days, but is still stuck beneath $62,000.

No major economic numbers today. The Federal Reserve’s preferred measure of inflation is due on Friday.

![]() Big Tech + Big Nukes = Power Outages?

Big Tech + Big Nukes = Power Outages?

How powerful is Big Tech? Enough to cut power supply deals with utilities to feed the insatiable demand for AI.

How powerful is Big Tech? Enough to cut power supply deals with utilities to feed the insatiable demand for AI.

Amazon’s 10-year deal with Talen Energy, supplying a data center in Pennsylvania with juice from the Susquehanna nuke plant, is the signature deal to date — but it won’t be the last, according to a research note from S&P Global Ratings.

“There is no denying that [power] demand is increasing for the first time in nearly two decades,” says the report. Thus when it comes to the Amazon-Talen deal, “We think it is reasonable to expect that this will be replicated.”

S&P says the utility operators most likely to sign such agreements are Constellation Energy Group, PSEG Power and Vistra.

Left unaddressed in S&P’s report is where all of this wheeling and dealing leaves homeowners and small businesses.

Left unaddressed in S&P’s report is where all of this wheeling and dealing leaves homeowners and small businesses.

By one estimate, data center power consumption is set to double by 2030. At that time, it will take up 9% of all electricity generation.

Look for other voracious energy users that need always-on power to strike similar deals — like semiconductor manufacturers. Unlike homeowners and small businesses, they can pay higher prices for supply contracts.

Meanwhile, U.S. grid capacity remains stagnant. Coal and nuclear plants are being retired. New solar and wind capacity coming online isn’t nearly enough to replace them. In some parts of the country — including the Upper Midwest where your editor is based — we’re getting used to annual warnings that the grid will have trouble avoiding rolling blackouts in the event of extra-hot summer weather.

When push comes to shove, whose power will get shut off? The question answers itself.

The question still isn’t something you hear in mainstream discussion — mostly because it raises uncomfortable questions about whether the “green transition” will be as painless as promised. For now, that’s still mostly off-limits.

![]() Assange Almost Free, but the Damage Is Done

Assange Almost Free, but the Damage Is Done

An American political prisoner is almost free.

An American political prisoner is almost free.

As you’ve likely heard by now, WikiLeaks founder Julian Assange has struck a plea bargain with U.S. prosecutors. Assuming all goes as expected, he’ll be sentenced to time served during a court date in the U.S. territory of the Northern Mariana Islands — and then head home to Australia to reunite with his wife and two children.

Starting in 2018, and most recently six months ago, I’ve regularly decried Assange’s prosecution as a profound threat to the First Amendment — the constitutional guarantee that safeguards both mainstream and alternative media, including the work we do in the financial publishing trade at Paradigm Press.

While the biggest WikiLeaks bombshells were not financial in nature, the State Department cables published by WikiLeaks in 2010 revealed much about how the markets and the economy really work; it was fodder for our predecessor e-letter back then.

Among other things, we learned that U.S. diplomats take a keen interest whenever Chinese media report that the United States and Europe routinely suppress the gold price to prop up the dollar’s reserve-currency status.

[With Assange’s impending release, the good folks at the Gold Anti-Trust Action Committee just published much more on that angle of the story, if you’re curious.]

While I celebrate Assange’s imminent freedom, I can’t bring myself to express the unqualified relief that colleague Sean Ring did in today’s Rude Awakening.

While I celebrate Assange’s imminent freedom, I can’t bring myself to express the unqualified relief that colleague Sean Ring did in today’s Rude Awakening.

See, the feds never intended to put him on trial in the United States. A trial in the Eastern District of Virginia — where the jury pool consists almost entirely of spooks, military contractors and their spouses — would have been a lurid kangaroo-court spectacle that made the nature of the national security state too obvious to too many of the plebes.

As the tireless journalist and former constitutional lawyer Glenn Greenwald tweeted in 2022, the aim was not to try Assange on Espionage Act charges in the United States. “The goal was to neutralize and break him by keeping him locked up with no trial.”

Assange spent seven years holed up inside Ecuador’s embassy in London… and five more confined to a 6x9’ cell 23 hours a day in the U.K.’s high-security Belmarsh prison.

That’s a powerful deterrent to anyone else who has a mind to expose governments’ dirty laundry the way he did.

Responsibility for this travesty lies with both the Trump and Biden administrations.

Responsibility for this travesty lies with both the Trump and Biden administrations.

Trump was especially craven when he passed on the opportunity to pardon Assange on his way out of office. It would have been an ideal way to stick it to the “deep state” that he allegedly despises.

Alas, by most accounts, Trump’s inner circle feared an Assange pardon would have prompted senators like Marco Rubio and Lindsey Graham to turn on Trump and convict him during his second impeachment in 2021; a conviction would have disqualified him from serving another term as president.

Talk about putting power over principle…

![]() Mailbag: Cashless Society, Collector Coins

Mailbag: Cashless Society, Collector Coins

Unprompted by us, a longtime reader wishes to revisit the subject of the cashless society…

Unprompted by us, a longtime reader wishes to revisit the subject of the cashless society…

“Most retailers including everyone from department stores to fast food would probably like to go cashless if they can,” he writes. Going cashless will help them with shrinkage, or employee theft, as no one can rob register tills that have no money in them.

“But this will obviously create issues with many of their customers who don’t have a credit card or a bank account. As more retail stores move to this concept, the remaining stores will probably convert if it means they will decrease their losses.”

Dave responds: As far as we’re aware, most of retailers’ “shrinkage” issues have less to do with cash disappearing from the register as much as goods disappearing from the shelves.

As for the fate of the “unbanked” — as financial professionals call them — that’s been obvious for a long time, ever since we chronicled the story of a homeless guy in Detroit who took electronic payments with one of those Square card readers way back in 2016.

Square readers and Obamaphones. The “solution” is there; the powers that be need only the right moment to spring it…

Finally, one more comment in our thread about bullion versus collector coins…

Finally, one more comment in our thread about bullion versus collector coins…

“I have been a coin collector for 60 years,” a reader writes. “My experience bears out what Dan Frishberg once said: ‘When you buy them you pay the numismatic value, when you sell, they weigh them’."

Dave: Ha — love it!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets