TikTok vs. TV

![]() TikTok? That’s SO 2020

TikTok? That’s SO 2020

Stuff you can’t make up: “The Biden campaign will stay on TikTok even after President Biden signed a bill Wednesday that could lead to a potential ban of the app,” according to Axios.

Stuff you can’t make up: “The Biden campaign will stay on TikTok even after President Biden signed a bill Wednesday that could lead to a potential ban of the app,” according to Axios.

Citing an anonymous campaign flack, the site reports, “The Biden campaign is continuing to use the app to engage with voters online, particularly young people, and to ensure their message is being seen amid a high-stakes election.”

So that’s the reason the original proposal for a six-month deadline was pushed out to nine. TikTok can now carry on under Chinese ownership past Election Day. Not until 2025 will parent company ByteDance have to sell TikTok’s U.S. operations or shut them down.

The narrative on Capitol Hill is that ByteDance is controlled by the Chinese government, who use TikTok as a tool to spy on and propagandize young, vulnerable Americans. There’s zero evidence to support that narrative, but lack of evidence has never stopped politicians before.

Then again, as we said from the get-go, the agenda isn’t about just TikTok. The bill gives the president — including a future president Trump, we’ll point out — the authority to ban apps and websites he determines are controlled by a “foreign adversary.”

All that said, TikTok promises to fight the law in court. "The facts, and the Constitution, are on our side,” says TikTok CEO Shou Zi Chew. “Rest assured, we aren't going anywhere."

Here’s the thing: The free market is already solving the “problem” that has the Beltway class wringing its hands. Young people are walking away from TikTok.

Here’s the thing: The free market is already solving the “problem” that has the Beltway class wringing its hands. Young people are walking away from TikTok.

The number of new users has reached a plateau. And most of those new users are folks in their 30s and 40s.

Thus, as the cool kids often mistype it, TikTok is being taken over by “teh olds” — in other words, exactly what happened to Facebook a few years back. And so the Zoomers are seeking out something new.

Something new, as it happens, might be a platform called “Nospace.”

“Like MySpace and the early years of Facebook,” says a New York Post article, “Nospace users will have personal and customizable profile pages where they can share casual updates on what they’re up to.”

Says Nospace’s 27-year-old founder Tiffany Zhong: “What I see right now is all social media is just media — it’s not social anymore. Everyone is ogling at each other’s lives and personalities, but no one is engaging with them,” she tells the Bustle website.

“All these other apps these days, it’s just algorithmic,” Zhong says. “A lot of posts just get pushed down if you don’t get engagement.”

Nospace is set for launch this summer. There’s a waitlist of over 380,000.

No, it’s not publicly traded. Presumably Ms. Zhong has collected ample startup money from the usual Silicon Valley venture capital suspects.

And so we cast our eyes elsewhere today for investing opportunities in media…

![]() TikTok vs. TV

TikTok vs. TV

Consider this: “Who’s going to win the streaming war?” feels like a very 2017 question.

Consider this: “Who’s going to win the streaming war?” feels like a very 2017 question.

So said Paradigm Press publisher Matt Insley on our internal e-chat this week. “The real war,” he asserts, “is between that thing on your wall that funnels pre-selected shows to you versus that thing in your hand that’s producing very ‘sticky’ peer-to-peer content.”

Intriguing point. Especially this year.

Of course, long-term the answer is obvious: TV as older folks know it is going the way of the telegraph.

Even when it comes to live sports — the last realm where “linear TV” still has an advantage — ESPN will offer its full suite of cable channels as a stand-alone streaming service next year, no cable bundle required.

Linear TV is a field your editor happens to follow closely — seeing as I worked in broadcast news for over 20 years, until 2007.

I timed my exit just right. Sometime around 2009, I recall reading an article by Bob Long — a well-known figure in the trade who’d just retired after a stint as news director at KNBC in Los Angeles. He wrote something to the effect of this: “My son is 18 and he’ll never own a TV. His dad’s a news director, his mom is an anchor and he doesn’t give a s*** about what we do for a living.”

Long’s son would be about 33 now. And think of all the people younger than him.

That said… we’ll invoke the Warren Buffett analogy we cited yesterday and tell you there’s one more puff to be had from the cigar butt that is linear TV.

That said… we’ll invoke the Warren Buffett analogy we cited yesterday and tell you there’s one more puff to be had from the cigar butt that is linear TV.

Linear TV still has a lock on older folks — who happen to be the folks who vote in the highest numbers. Between now and Nov. 5, broadcast TV will thrive from an incoming tsunami of campaign advertising cash.

It’s a reliable cycle in the broadcast biz. So reliable that when Oprah Winfrey walked away from her syndicated TV show in 2011, many stations decided against filling her 4:00 p.m. timeslot with another talk show. They launched 4:00 p.m. newscasts instead — knowing the 2012 elections were looming and that newscasts are where campaigns can reach the most politically engaged citizens.

Of course, this is all well-known to Wall Street analysts who cover the half-dozen “pure play” operators of local TV stations.

But here’s what Wall Street hasn’t caught onto yet, and where you could seize the advantage: This year’s tsunami of campaign cash will be geographically concentrated.

But here’s what Wall Street hasn’t caught onto yet, and where you could seize the advantage: This year’s tsunami of campaign cash will be geographically concentrated.

That is, you want to zero in on the companies whose station portfolios give you maximum exposure to the seven “battleground states” where the Electoral College will be decided in 2024 — because that’s where the most money will be spent.

We’re talking about Wisconsin, Michigan, Pennsylvania, North Carolina, Georgia, Arizona and Nevada. Arizona is especially attractive because it also has an open Senate seat that pollsters rate a tossup.

With that in mind, two names stand out…

- TEGNA Inc. (TGNA): Tegna was spun out of the Gannett newspaper chain about a decade ago (hence the goofy sort-of-an-anagram name). It owns the NBC affiliates in Atlanta, Phoenix and Charlotte — along with the Fox affiliate in Tucson and a couple of medium-market stations in Pennsylvania

- Gray Television Inc. (GTN): Gray rolled up several smaller station operators over the last 20 years or so. It owns the CBS affiliates in Atlanta, Phoenix, Tucson and Charlotte; the Fox affiliate in Las Vegas; and a cluster of eight medium- and small-market stations in Wisconsin and Michigan.

Note well: This might be the last presidential cycle in which this investment thesis holds up.

By the time we get to 2028, a substantial portion of the linear TV audience will have, as the saying goes, “aged out.” TV will be defeated once and for all by TikTok — or, likely as not, some other streaming platform.

![]() Markets Today: Congressional Insider Blindsided?

Markets Today: Congressional Insider Blindsided?

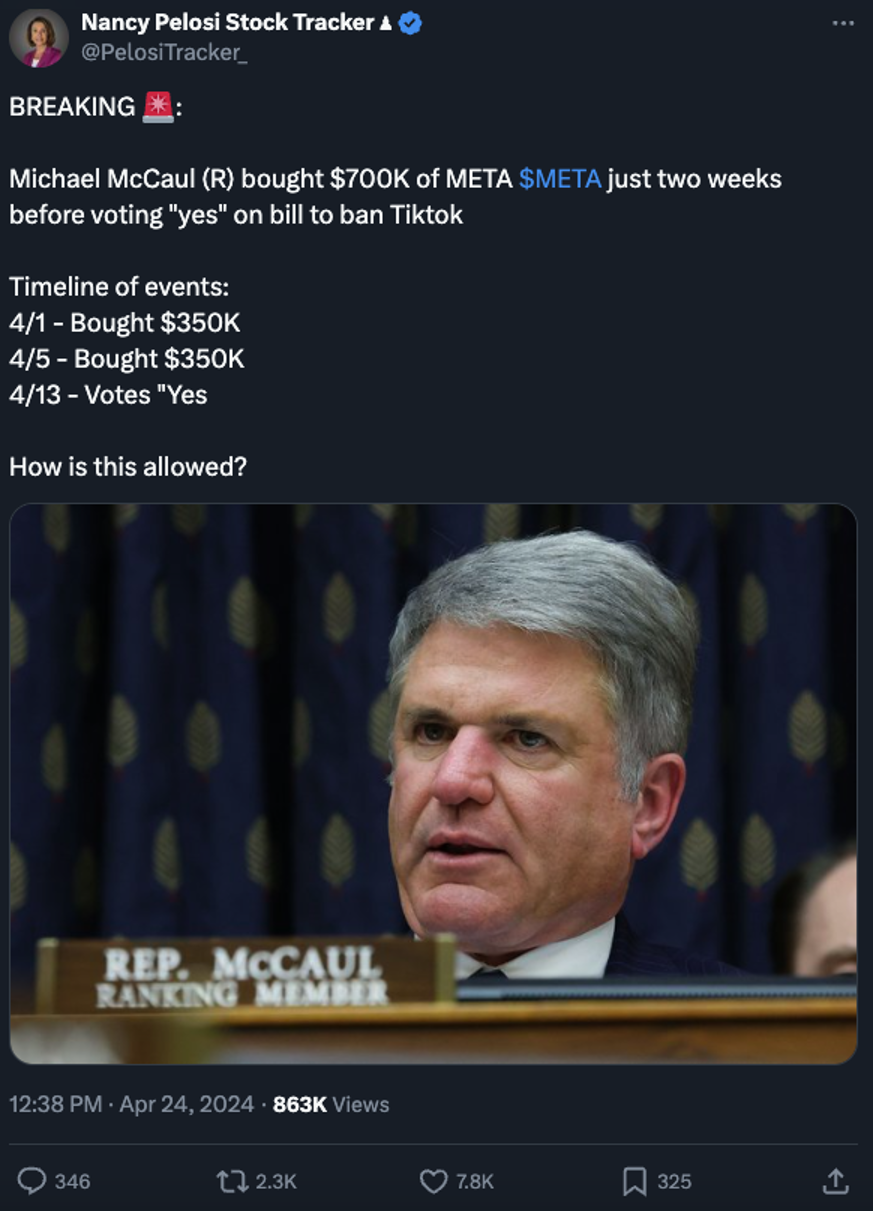

Sometimes those notorious congressional insider trades don’t work out as planned…

Sometimes those notorious congressional insider trades don’t work out as planned…

House Foreign Affairs Committee Chair Michael McCaul (R-Texas) took a position in Facebook/Instagram parent Meta earlier this month — at a time it appeared the TikTok ban was stalled in the Senate.

Those buys don’t look too hot at the moment. After the closing bell yesterday, Meta reported its quarterly numbers. They were great. First-quarter revenue set a record. But the company also projected AI spending for the year that’s higher than previously forecast — spending that will take time to show up on the bottom line.

With that, Meta shares tumbled 10.6% today.

Ouch. Recall that Meta is one of only two stocks — the other being Nvidia — propping up the major averages this year. At one point, they accounted for 43% of the S&P 500’s year-to-date gains.

So yes, Meta is a major drag on the stock market today — but hardly the only one.

So yes, Meta is a major drag on the stock market today — but hardly the only one.

Before the opening bell, the Commerce Department issued its initial estimate of first-quarter GDP. If these figures are to be believed, the economy grew at a meager 1.6% clip annualized. No one among dozens of Wall Street economists expected a number that low; the average guess was 2.6%. Worse, the quarter-over-quarter growth rate has declined for three straight quarters.

Nor does the bad news end there. Included in this report are several estimates of inflation. All of them are up from the final quarter of last year, and not by a little. The report specifically cites massive increases in the costs of health care and insurance.

This is the nightmare scenario Paradigm’s own Jim Rickards has been warning about since last summer — 1970s-style “stagflation” in which the economy stagnates but inflation continues to ravage everyday folks’ finances.

After this report, the betting in the futures market is that the Federal Reserve will cut interest rates only once this year — and not until December.

So much for all that giddy optimism at the start of the year about six rate cuts — or even the muted optimism last month about three.

Thus, no surprise, Wall Street took a spill today.

Thus, no surprise, Wall Street took a spill today.

Not a catastrophic spill, but a spill nonetheless. The day ended better than it began, as it turns out. The S&P 500 never fell below 5,000 and closed at 5,048.

It’s bonds that really got clobbered – prices down, yields up. The yield on a 10-year Treasury note is back above 4.7% for the first time since early November.

Precious metals are up modestly, gold at $2,332 and silver at $27.36. Crude is approaching $84. Bitcoin is approaching $65,000.

![]() Wokery in the Workplace Is SO 2020

Wokery in the Workplace Is SO 2020

For the record: The trend of “wokery” in the technology workplace was snuffed out last week. By Google, no less.

For the record: The trend of “wokery” in the technology workplace was snuffed out last week. By Google, no less.

First, let’s rewind to 2020: Much of corporate America was embracing “social justice” causes, with Silicon Valley leading the way. About the only CEO standing against the herd was Coinbase CEO Brian Armstrong — promising to keep his firm “mission-focused.”

“The reason,” he wrote, “is that while I think these efforts are well intentioned, they have the potential to destroy a lot of value at most companies, both by being a distraction, and by creating internal division.”

Armstrong was roasted in The New York Times and The Washington Post. The mainstream portrayed Coinbase as a cesspool of bigotry.

But Armstrong stood his ground. As we previously chronicled, he offered severance packages of up to six months’ pay for employees who objected to the policy. “Life is too short to work at a company that you aren’t excited about,” he said. Roughly 60 people, or about 5% of the workforce, took the buyout.

Fast-forward to this month. All of a sudden, Google is “mission-first.”

Fast-forward to this month. All of a sudden, Google is “mission-first.”

A group of employees held a sit-in to protest the company’s contracts with the Israeli government. Twenty-eight of them were fired.

"Physically impeding other employees' work and preventing them from accessing our facilities is a clear violation of our policies, and completely unacceptable behavior," said a company spokesman in a statement.

“This is a huge escalation and a change in how Google has responded to worker criticisms,” said one of the fired 28.

Look, I actually sympathize with the cause these people profess to support. But if your employer is doing something you find morally objectionable, isn’t it better to, you know, go find another employer? Google is well within its rights to give these people the heave-ho.

And just wait till they discover that because they were fired “for cause,” they might be ineligible to collect unemployment…

![]() Great Moments in Bureaucracy, Italian Edition

Great Moments in Bureaucracy, Italian Edition

From the Department of Problems We Didn’t Know Existed…

From the Department of Problems We Didn’t Know Existed…

“For many, a late-night gelato is a part of Italian culture,” reports Sky News, “but this is in danger under a new law being introduced in the city.

“A legislative starting paper has been filed by the city's local government, and if passed it could see late-night ice creams banned as soon as next month.”

And not just ice cream: All take-out food and drink would be proibito after 12:30 a.m. on weeknights and 1:30 on weekends.

For city fathers, this is the sledgehammer solution to the problem of noise stirred up by late-night revelers. "The goal is to seek a balance between socializing and entertainment, and the peace and tranquility of residents,” says Deputy Mayor Marco Granelli.

Colleague Sean Ring of Rude Awakening fame, who’s called northern Italy home the last two years, is not altogether surprised. “Honestly, Milan is my least favorite place here,” he tells me. “This is especially ludicrous.”

Speaking of Italy’s second-largest city: Milan, along with Cortina d’Ampezzo, is hosting the 2026 Winter Olympics. Will NBC label it “Milano” the way the network called Turin “Torino” in 2006? Gag…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. I know I promised something today about the Biden administration’s attempts to electrify freight transport. But the word count is spiraling out of control — and Emily already has a full plate for tomorrow’s edition. We’ll get to it next week…