Trump Takes a Stand (CBDCs)

![]() CBDCs: Trump Takes a Stand

CBDCs: Trump Takes a Stand

To the extent that this is a positive development, we at Paradigm Press will take the credit…

To the extent that this is a positive development, we at Paradigm Press will take the credit…

Campaigning last night in New Hampshire, Donald Trump took a stand against the implementation of CBDCs.

“As your president, I will never allow the creation of a central bank digital currency,” he said. “Such a currency would give a federal government — our federal government — absolute control over your money. They could take your money and you wouldn’t even know it’s gone.”

If you’re familiar with Jim Rickards’ “Biden Bucks” thesis, introduced in the summer of 2022, you know what a menace CBDCs could be.

If you’re familiar with Jim Rickards’ “Biden Bucks” thesis, introduced in the summer of 2022, you know what a menace CBDCs could be.

“In a world of CBDCs,” Jim warned, “the government will know every purchase you make, every transaction you conduct and even your physical whereabouts at the point of purchase.”

From there, it’s a very small step toward “account freezes… and even putting you under FBI investigation if you vote for the wrong candidate or give donations to the wrong political party.”

Within months, corporate media were publishing lame “fact checks” trying to debunk Jim’s thesis.

But there’s no stopping a powerful idea: By last spring, Sen. Ted Cruz (R-Texas) introduced a bill barring the Federal Reserve from pursuing a CBDC and Florida Gov. Ron DeSantis successfully pushed a bill through the legislature banning CBDCs in the Sunshine State.

DeSantis and Vivek Ramaswamy both talked up the threat of CBDCs during their presidential campaigns. Under the circumstances, it’s smart politics for Trump to take up the cause as well.

Whether Trump’s promise can be believed is another matter altogether.

Whether Trump’s promise can be believed is another matter altogether.

Trump is, after all, the guy who let his minions order lockdowns in March of 2020 — whether he realized it or not. If he dropped the ball at such a crucial moment, how much can he be trusted on this score?

Too, the deep state has infinite ways in which it can thwart a president’s agenda. It’s done so successfully for more than 75 years and was most successful of all with Trump.

Still, we’ll give Trump credit for raising awareness about CBDCs — and we’ll give Jim Rickards credit for bringing the issue to the forefront in the first place.

![]() Wait, Who’s Fighting Whom?

Wait, Who’s Fighting Whom?

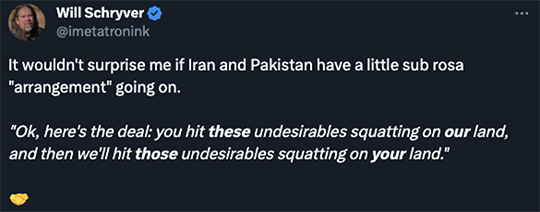

As closely as we follow geopolitics around here, a war between Iran and Pakistan was not on our 2024 bingo card.

As closely as we follow geopolitics around here, a war between Iran and Pakistan was not on our 2024 bingo card.

Iran launched airstrikes in Pakistan this week targeting Jaish al-Adl, a militant group with a history of carrying out terrorist attacks in Iran.

“This violation of Pakistan’s sovereignty is completely unacceptable and can have serious consequences,” protested Pakistan’s foreign ministry.

Then Pakistan launched airstrikes inside Iran, targeting what it called “terrorist hideouts.” Tehran promptly denounced the attack.

“The two nations were careful to say that they had only targeted their own nationals in the strikes,” per The Wall Street Journal, “an indication that neither country wants the situation to spiral, experts said.”

Sounds about right…

Oil prices have popped a little, as you might expect as a knee-jerk reaction — up a little over 1%. But at $73.37, crude is still firmly within a $70–75 range that’s held all month.

The U.S. stock market’s up-and-down action of late is up today.

The U.S. stock market’s up-and-down action of late is up today.

At last check, the S&P 500 is up 21 points to 4,760. The index continues to struggle to take out its record close of Jan. 3, 2022.

On the heels of the big November-December rally, “sentiment is swinging wildly and folks have no idea what to do,” Greg Guenthner writes at The Trading Desk.

“One week, they’re ecstatic. Next, they’re ready to sell their stocks and crawl into their hillside bunker to wait out the great crash of 2024. Believe it or not, #stockmarketcrash was even trending on Twitter yesterday afternoon. Crazy!”

Meanwhile, “you might recall that a big AAPL downgrade set off the early-January pullback. Well, AAPL actually caught an upgrade this morning and we’re starting to see the opposite effect. Tech is pushing higher today, helping the Nasdaq gain about 0.9% as I type. We’re seeing some strong action down the cap scale as well. We’ll see if it lasts!”

Elsewhere, Treasury yields are climbing, with the 10-year note near 4.13% — the highest in over a month.

Precious metals continue to languish, gold at $2,014 and silver at $22.59. Ditto for crypto, with Bitcoin at $42,487.

There’s a slew of minor economic numbers today. The one that stands out is first-time unemployment claims: At 187,000 for the week gone by, this figure is the lowest since September 2022. On the surface that suggests the labor market is still “tight” — despite a boatload of evidence to the contrary.

![]() When AI Gets “Uncomfortable”

When AI Gets “Uncomfortable”

The next iteration of ChatGPT is “going to make a lot of people uncomfortable,” says OpenAI CEO Sam Altman.

The next iteration of ChatGPT is “going to make a lot of people uncomfortable,” says OpenAI CEO Sam Altman.

Perhaps it won’t surprise you to learn Altman is rubbing shoulders with the power elite this week at the World Economic Forum’s annual shindig in Davos, Switzerland.

On the sidelines of Davos, Altman tells the Axios website that OpenAI’s next big model “will be able to do a lot, lot more” than what’s available now — including “quite a lot of individual customization.”

Going forward, different people will get different answers from ChatGPT depending on what their values are or even what country they live in.

What would that look like? “If the country said, you know, all gay people should be killed on sight, then no... that is well out of bounds," Altman says. "But there are probably other things that I don't personally agree with, but a different culture might... We have to be somewhat uncomfortable as a tool builder with some of the uses of our tools."

Hmmm…

![]() AI Needs LOTS of Electricity. Where Will It Come From?

AI Needs LOTS of Electricity. Where Will It Come From?

Left unaddressed at Davos is this question: Where the hell will all the electricity come from to power ever-more robust forms of artificial intelligence?

Left unaddressed at Davos is this question: Where the hell will all the electricity come from to power ever-more robust forms of artificial intelligence?

“The rapid growth in internet traffic and cloud computing has led to skyrocketing energy demands for data centers around the world,” says Paradigm’s technology authority Ray Blanco.

“As more and more data is created, processed and stored, the power needed to operate massive banks of servers and infrastructure keeps increasing. In fact, according to the International Energy Agency, data center electricity requirements are projected to rise from 1% of total electricity demand to 8% by the end of the decade.

“While video traffic used to dominate bandwidth, AI has now overtaken it as the primary data speed driver. This results in a massive challenge for data center operators, struggling to support relentless growth in traffic and power consumption.”

No lie: A typical data center’s computing power needs to double every three months just to keep pace with the demands of AI.

“The solution to this problem comes from Mother Nature herself,” Ray says.

“The solution to this problem comes from Mother Nature herself,” Ray says.

“There’s technology that’s already been developed using groundbreaking organic (carbon-based) electro-optic polymer materials that can bring blazing-fast internet speeds and, very importantly, solve the speed crunch in data centers.

“Novel polymers allow for high-speed light modulation in photonic devices — devices that use light, rather than electricity, to move data.

“These tiny chips can then be used in next-generation transceivers, the key components that transmit data through fiber-optic networks.

“Pulses of light are sent through glass fibers carrying vast amounts of data at the speed of light. Transceivers contain lasers that convert electronic data from servers into optical signals.

On the receiving end, photodetectors in the transceivers convert the light back into electronic signals.

“Organic polymer materials can modulate the laser light at incredibly fast speeds of up to 800 gigabits per second or more. This allows much more data to be transmitted through networks.”

The difference is so vast, it’s like today’s broadband compared with 1990s dial-up modems.

“The combination of high speed, low power, small size, stability and flexible materials makes polymer electro-optics very compelling solutions for next-generation circuits and data communication,” Ray concludes.

[Reminder: Ray recently joined forces with colleagues James Altucher and Jim Rickards for a private mastermind event — during which they named three tiny AI stocks set to soar during AI’s second wave. The names and ticker symbols are yours FREE. You can start watching right away at this link.]

![]() Mailbag: High Praise, the Power Grid, Boeing

Mailbag: High Praise, the Power Grid, Boeing

The mailbag begins with high praise for Byron King’s guest essay on Monday — “Welcome to Earth, the Mining Planet.”

The mailbag begins with high praise for Byron King’s guest essay on Monday — “Welcome to Earth, the Mining Planet.”

“Your 5 Bullets article for Jan. 15, 2024, was beautifully and clearly written, totally outstanding! Looking forward now to your article on the investability of planetary mining.”

On the subject of threats to the power grid, we just heard from a Canadian reader…

On the subject of threats to the power grid, we just heard from a Canadian reader…

“In Alberta, during the recent cold snap, power grid alerts were issued four times in four days.

“The most serious must have been Saturday night around dinnertime as they sent it out on the emergency alert system (every cellphone in Alberta) asking everyone to turn off all nonessential electricity use.

“At that point we were very close to rolling blackouts. It was about -40 C (-40 F) at our house with -50 C (-58 F) wind chill.

“For us having some extreme cold in winter is normal. This was just a short cold spell at less than a week.

“My family and I were warm and comfortable with our wood stove going. We already use minimal electricity due to cost. ( My five-year locked-in rate expired on Jan. 15 and my power bill doubled. Nothing to do but dig out the lanterns and hope for the best.”

Dave responds: “Jan. 12, 2024, is the day decarbonization died in Alberta,” writes Michelle Stirling at the Canadian conservative site Western Standard.

Electric vehicles couldn’t hold a charge — much as we noted yesterday in the case of Chicagoland.

And the wind turbines all shut down for the sake of self-preservation. “In extremely cold weather,” Stirling goes on, “infrastructure like wind turbines with exposed blades and internal mechanics way up high face the risk of embrittlement and… shattering.

“Even though there was some wind, the risk was too great to continue operations, meaning that almost all of Alberta’s 4,481 MW of wind power became useless. About that same time, the sun went down. Meaning that all of Alberta’s 1,650 MW of solar power vanished for the night…

“Imagine the deadly outcome if we were to go along with the climate plans to entirely phase out fossil fuels and rely on renewables.”

After we mentioned a couple of different defense-sector ETFs yesterday, a reader weighed in…

After we mentioned a couple of different defense-sector ETFs yesterday, a reader weighed in…

“Just looked up XAR. Boeing was the fourth-largest holding,” he writes. Which doesn’t jibe with my claim that Boeing isn’t even in the top 10.

Weird. I was working off Morningstar, but then I looked at Yahoo Finance and yes, Boeing shows up at No. 4.

So then went straight to the source — State Street’s own website. Looks as if Morningstar’s list is more accurate and/or current. Boeing is the No. 18 holding.

And in any event, no single company in XAR makes up more than 4.5% of the total. That’s good diversification.

Thanks for keeping us on our toes, though!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets