A Sure Bet for 2024

- Two certainties for 2024

- Premature celebration: Inflation contained?

- American economic warfare: From failure to failure

- Mystery solved (But where’s the golden throne?)

- Mailbag: Biden’s replacement… and a source of inspiration

![]() Two Certainties for 2024

Two Certainties for 2024

“I wish I could end the year on a more optimistic note. But I’m afraid that there are already signs we could be in for a turbulent 2024,” Paradigm’s Zach Scheidt wrote his Lifetime Income Report readers last week.

“I wish I could end the year on a more optimistic note. But I’m afraid that there are already signs we could be in for a turbulent 2024,” Paradigm’s Zach Scheidt wrote his Lifetime Income Report readers last week.

“A powder keg in the Middle East has gone off… Congress can’t seem to reach a lasting budget agreement to avoid a government shutdown… and we’re entering a presidential election year, when volatility stemming from policy unknowns and negative campaigning will flood the market.”

Come to think of it, here’s an update on the second of those three items: We’re still staring down a “partial government shutdown” if Congress and the White House can’t come to terms by this Friday.

Still, for all the uncertainties Zach just noted, he says there are two things you can count on…

Still, for all the uncertainties Zach just noted, he says there are two things you can count on…

“The U.S. government has an enormous military budget, and military spending has been on the rise for several years.”

No amount of budgetary kabuki theater on Capitol Hill will change that. For better or worse — almost certainly worse — there’s overwhelming bipartisan support for throwing billions at both Ukraine and Israel.

“Looking at the current state of U.S. politics and the world more generally,” Zach says, “increased defense spending seems like one of the surest bets you can make.”

Even a “partial government shutdown” won’t stop the money flow: The biggest players in the military industry “work on long-term contracts and typically have billions of dollars in backlogged projects to keep them busy,” Zach points out.

“In previous government shutdowns, these companies tend to underperform the broad market. But they rebound quickly and usually outperform as soon as a deal is reached.”

At the moment, Zach has one name in particular in mind; out of respect for his paying subscribers, we’ll hold it back here. If you want to go the ETF route instead, consider the SPDR S&P Aerospace & Defense ETF (XAR). Unlike other ETFs in this space, XAR has very little weighting assigned to Boeing (and its attendant woes in civilian aircraft).

Of course, if you object to the metastasizing military-industrial complex and America’s forever wars, you might want to pass on this idea. Then again, it’s a way to channel a few of your tax dollars back into your own pocket.

[Editor’s note: As you might be aware, Jim Rickards refers to Zach Scheidt as “the Banker.” That’s a nod to Zach’s hedge-fund days — and the lessons Zach took from that experience that he now puts to work for his readers. People like you can pull down absurd levels of income in as little as 10 days — including returns of up to 166% in only 48 hours.

To help you learn more, Jim has organized an exclusive master class with Zach — which you can begin as soon as you follow this link.]

![]() Premature Celebration: Is Inflation Really “Contained”?

Premature Celebration: Is Inflation Really “Contained”?

With lower-than-expected inflation numbers today, the path is clear for November’s stock market rally to carry through to year-end.

With lower-than-expected inflation numbers today, the path is clear for November’s stock market rally to carry through to year-end.

The Labor Department issued the official inflation numbers this morning. The consumer price index was flat month-over-month — bringing the yearly inflation rate down from 3.7% in September to 3.2% in October.

Thus, the betting on Wall Street is not only that the Federal Reserve is done with its rate-raising cycle, but that the Fed will cut rates as many as four times next year.

Of course, there’s less to the inflation numbers than meets the eye. Let’s see here…

Of course, there’s less to the inflation numbers than meets the eye. Let’s see here…

- The 3.2% reading for October is still higher than the 3.0% reading we got in June

- Much of October’s drop can be chalked up to falling gasoline prices. (Your editor fueled up yesterday for an out-of-town doctor appointment — paying the lowest price per gallon in over two years. Yes, I keep track.) What if gas prices head back up?

- Some of the internals of the report are laughable. Food at home up only 2.1% year-over-year? Yeah, maybe if you cut back on meat and got more of your protein from lentils. (Believe it or not, the statisticians monkey with the numbers exactly this way; they call it “the substitution effect”)

No matter: Wall Street has settled on the narrative that inflation is contained and the Fed will resume mashing the monetary gas pedal in 2024.

No matter: Wall Street has settled on the narrative that inflation is contained and the Fed will resume mashing the monetary gas pedal in 2024.

At last check, the Dow is up 1.5% — back within 150 points of 35,000. The Nasdaq is up 2.3%, back above 14,000. The S&P 500 is splitting the difference, up nearly 2% and only three points away from 4,500.

As Paradigm trading pro Alan Knuckman has been saying for a couple of weeks now, if the S&P could break through 4,400, a run to 4,600 was almost a sure thing — and here we are, smack in the middle of those two numbers.

If the momentum can break through 4,600, look for a test of the January 2022 record highs near 4,800. That’d be one heckuva year-end rally.

Bonds are rallying, too — prices up, yields down. The yield on a 10-year Treasury note is at an eight-week low of 4.46%.

Not to be left out, precious metals are also moving up — gold to $1,966 and silver back over $23. And crude is back within 50 cents of $80 a barrel. The bounce off of the $75 level starting last Wednesday? Impressive.

In contrast with Wall Street, the vibe in small-business America is glum going into year-end.

In contrast with Wall Street, the vibe in small-business America is glum going into year-end.

The National Federation of Independent Business is out this morning with its Small Business Optimism Index — a survey marking its 50th anniversary this month. The headline number rings in at 90.7 — nearly unchanged from the month before. This figure has been mired below its 50-year average throughout 2022 and 2023.

“The October data shows that small businesses are still recovering, and owners are not optimistic about better business conditions,” says NFIB chief economist Bill Dunkelberg. “Small-business owners are not growing their inventories as labor and energy costs are not falling, making it a gloomy outlook for the remainder of the year.”

Inflation and “quality of labor” continue to jockey for the top spot in the portion of the survey where respondents are asked to identify their single most important problem. Finding qualified help was cited by 23%, followed closely by inflation at 22%. Taxes were cited by 13% while everything else was in single digits.

![]() American Economic Warfare: From Failure to Failure

American Economic Warfare: From Failure to Failure

What follows is one of our occasional reminders that the Western scheme to cap the price of Russian oil is an abysmal failure.

What follows is one of our occasional reminders that the Western scheme to cap the price of Russian oil is an abysmal failure.

From the Financial Times: “The U.S.-led price cap on Russia’s oil sales is being almost completely circumvented, according to Western officials and Russian export data, forcing countries to explore ways to reinforce one of their key economic sanctions against Moscow.”

To refresh your memory, the G7 governments capped the price of Russian oil nearly a year ago at $60 a barrel. The way they were going to enforce that cap was to deny Western insurance, financing and shipping to any buyers who paid more.

Solution? Bypass Western insurance. Result? Last month, “only 37 of the 134 vessels that shipped Russian oil held Western insurance.”

“The latest data makes the case that we’re going to have to toughen up,” an anonymous “senior European government official” whined to the FT. How? Russia’s new oil customers in China and India couldn’t care less.

Meanwhile, Washington’s attempts to deprive China of state-of-the-art semiconductors are likewise failing.

Meanwhile, Washington’s attempts to deprive China of state-of-the-art semiconductors are likewise failing.

Ahead of tomorrow’s summit between Joe Biden and Chinese President Xi Jinping in San Francisco, Asia Times columnist David Goldman reports that “policy advisers close to Xi express an unprecedented kind of confidence in China’s strategic position.”

One reason is that “America’s restrictions on high-end chip exports to China failed to prevent Huawei Technologies from offering a new smartphone as well as artificial intelligence processors with performance comparable to or close to what’s achieved by the products of Nvidia and other U.S. designers.

“On Nov. 7, Reuters reported that the Chinese internet giant Baidu had ordered 1,600 of Huawei’s 910B Ascend AI chips, reportedly on par with the Nvidia A100 graphics processing unit, the most popular AI processor.

“Nvidia, meanwhile, has offered a new set of chips for the Chinese market scaled down to conform to new Commerce Department restrictions announced last month. As SemiAnalysis, a consulting firm, reported on Nov. 9, ‘To our surprise Nvidia still found a way to ship high-performance GPUs into China with their upcoming H20, L20 and L2 GPUs. Nvidia already has product samples for these GPUs and they will go into mass production within the next month, yet again showing their supply chain mastery.’”

While we’re at it, a couple of other interesting tidbits from Goldman’s article…

While we’re at it, a couple of other interesting tidbits from Goldman’s article…

- Chinese exports to Islamic countries now exceed Chinese exports to the United States

- Chinese exports to the Global South now exceed Chinese exports to the United States, Europe and Japan.

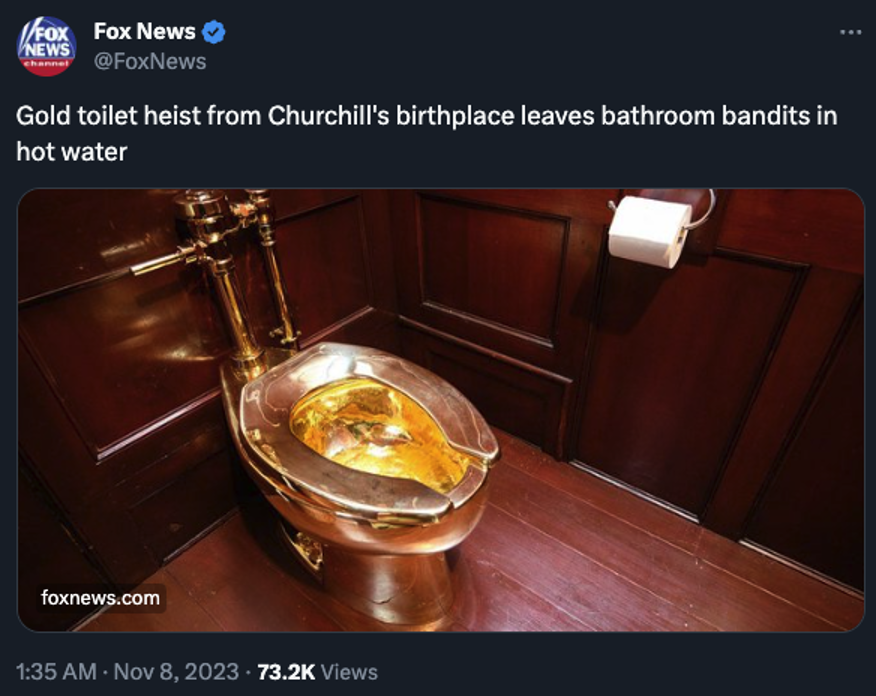

![]() Mystery Solved — But Where’s the Golden Throne?

Mystery Solved — But Where’s the Golden Throne?

After more than four years, the golden toilet caper has been solved.

After more than four years, the golden toilet caper has been solved.

Way back in 2016, we related the debut of an artwork at the Guggenheim in New York — a fully functional toilet made of 18-karat gold, installed in one of the museum’s public restrooms.

The work was the brainchild of the Italian artist and sculptor Maurizio Cattelan, who titled it America. The Guggenheim described the exhibit’s objective as “making available to the public an extravagant luxury product seemingly intended for the 1%.”

In 2019, the luxe loo was installed for display at Blenheim Palace, birthplace of Winston Churchill and now a museum. A few weeks later… thieves managed to rip the toilet from its plumbing and make off with it.

Now comes word from the Crown Prosecution Service that it’s authorized criminal charges against four men, all in their 30s. “They are accused of burglary and conspiracy to transfer criminal property,” says The Associated Press.

As for the fate of the purloined privy… well, “the artwork has never been found,” the AP reports. And with a melt value of nearly $5 million at current prices… “Personally I wonder if it’s in the shape of a toilet to be perfectly honest,” investigator Matthew Barber told the BBC in 2021.

Yep, America has almost certainly met the same fate as the “Big Maple Leaf” — a 220-pound coin from the Royal Canadian Mint that was pinched from the Bode Museum in Berlin during 2017. There too, the perps were identified — but the golden object was never tracked down.

![]() Mailbag: Biden’s Replacement… and a Source of Inspiration

Mailbag: Biden’s Replacement… and a Source of Inspiration

A reader responds to Jim Rickards’ recent forecast that Joe Biden will not be the Democrats’ presidential nominee in 2024…

A reader responds to Jim Rickards’ recent forecast that Joe Biden will not be the Democrats’ presidential nominee in 2024…

“The strategy of pushing Biden through the primaries and then selecting another candidate is likely correct — though shady politics.

“Pick a candidate, without a vote of the people, who you think will beat the Republican candidate, avoid the possibility of voters choosing someone else and avoid a large part of the pre-election political trash.

“I think the selection will be Michelle Obama. The Obamas still reside in D.C. It would just be like a fourth term — followed by a fifth and the media have already produced a puff piece on her.”

Dave responds: Who knows? The inside-baseball political pundits all seem to think the party will coalesce around California Gov. Gavin Newsom — which makes absolutely no sense. Why would you run the guy who made California such a miserable place to live that it’s losing population on his watch for the first time in something like 500 years? (On the plus side, Newsom seems disinclined to pick a fight with China over Taiwan — unlike Biden.)

“Great article!” a reader enthuses after our item yesterday about the fellow whose ingenuity delivered him a wheelchair far better than anything the state of New York would have given him.

“Great article!” a reader enthuses after our item yesterday about the fellow whose ingenuity delivered him a wheelchair far better than anything the state of New York would have given him.

“Having been forced into an end to my flying career earlier than anticipated, I became a fledgling author. With the high cost of publishing and a lack of marketing skills, I became very frustrated. Add to that the frustration of investments in the U.S. stock market and the skin cancer I had to deal with from high-altitude exposure to ultraviolet radiation. These were all a source of depression that has become a daily struggle.

“Reading your article about Thomas Quiter was inspiring and it really helps to look at life with a different perspective.”

Dave responds: Thank you for yet another reminder that the human spirit can overcome almost any level of adversity. We wish you the best facing down your own challenges.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets