How California Avoids Collapse

![]() A Golden State Reality Check

A Golden State Reality Check

California is backing away from its hard line on oil drilling. Facing warnings that gas prices could spike as much as 75% alongside a wave of refinery closures, state lawmakers pushed through a package of energy bills and sent them to Gov. Gavin Newsom.

California is backing away from its hard line on oil drilling. Facing warnings that gas prices could spike as much as 75% alongside a wave of refinery closures, state lawmakers pushed through a package of energy bills and sent them to Gov. Gavin Newsom.

The centerpiece is SB 237, which would clear the way for drilling in Kern County, home to 80% of California’s oil. For more than a decade, legal battles froze new well permits.

That gridlock drove refineries out of state and left California increasingly reliant on foreign imports. By certifying a long-delayed environmental report, SB 237 would allow up to 2,000 new drilling permits a year.

[Why include this tweet from golfer — and sometimes reluctant California resident — Phil Mickelson? Because he’s been a consistent critic of California’s misguided tax and policy decisions — a frustration that’s been building for years.]

One of the bill’s sponsors, Republican Sen. Shannon Grove, who represents Kern County, welcomes the move: “Californians cannot afford $10-a-gallon gas. “It’s time to unleash Kern County producers to meet our state’s energy needs with affordable, locally produced oil for Californians by Californians.”

Even opponents on the left admit the passage of SB 237 is a necessary course correction, and the vote shows rare bipartisan agreement: Without more domestic production, California risks both economic turmoil and collapsing public support for its climate agenda.

“After months of hard work with the legislature, we have agreed to historic reforms that will save money on your electric bills, stabilize gas supply and slash toxic air pollution — all while fast-tracking California’s transition to a clean, green job-creating economy,” Newsom says in a statement.

The package now sits on Newsom’s desk, awaiting his signature by the Oct. 13 deadline.

While Sacramento is loosening its grip on oil exploration, Trump’s allies are redrawing the entire energy map…

![]() Birthright in a Barrel

Birthright in a Barrel

Harold Hamm — the Oklahoma wildcatter who built Continental Resources into a shale powerhouse — high-fived Donald Trump on election night.

Harold Hamm — the Oklahoma wildcatter who built Continental Resources into a shale powerhouse — high-fived Donald Trump on election night.

Hamm, Energy Transfer’s Kelcy Warren and Liberty Energy’s Chris Wright — now Trump’s Energy Secretary — poured tens of millions into Trump’s campaign. Their goal: ensure that America’s energy industry remains central to the nation’s future.

That wager is paying off.

Since January, the Trump administration has opened vast tracts of federal land and waters to drilling, approved long-delayed natural-gas export terminals and moved to scrap emissions rules dating back to the Obama era.

Trump’s “One Big Beautiful Bill” ended subsidies of up to $7,500 for electric vehicles and expanded tax breaks for oil and gas companies.

ConocoPhillips, EOG Resources, Occidental Petroleum and Devon Energy told investors those tax changes alone will save them more than $1.2 billion in 2025 — and billions more in the years ahead.

For Kelcy Warren, the policy shift is personal. His company spent more than a decade trying to complete its Lake Charles LNG terminal. Biden’s administration paused the project.

Trump lifted the moratorium and granted a key permit extension within months. Warren and his company together contributed more than $25 million to Trump-aligned groups.

Access to the president has never been greater: Trump regularly phones executives after seeing them on television. Chevron CEO Mike Wirth got a call. Exxon Mobil’s Darren Woods and EQT’s Toby Rice sat at Trump’s table at a Pittsburgh summit.

A dozen executives — from Hamm to former Hess CEO John Hess — have spoken to Trump directly since the election. During Biden’s term, the American Petroleum Institute couldn’t even get a meeting. Now it meets regularly with Trump’s cabinet.

The energy industry is also shaping policy at the agency level.

The energy industry is also shaping policy at the agency level.

In July, the EPA proposed rescinding the 2009 endangerment finding — the ruling that greenhouse gases pose a public health risk. Oil-and-gas lobbying groups, including one co-founded by Hamm, praised the move as a reset of the regulatory landscape.

But the new era has not come without turbulence.

Crude oil, about $76 a barrel when Trump returned, now trades closer to $62. For some smaller producers, that’s below break-even. Plus, tariffs on steel and aluminum, doubled earlier this year, have driven up drilling costs by nearly 25%, according to Diamondback Energy.

ConocoPhillips said it would cut up to 25% of its workforce following its Marathon Oil acquisition. Chevron announced cuts of up to 20%. Nationwide, oil-and-gas extraction jobs are down more than 3% since January, to the lowest in two years.

Even so, many in the industry view today’s pressure as the price of reshaping the rules. Taylor Sell, CEO of Texas-based Element Petroleum, put it plainly: “We all voted for this.”

America’s energy industry isn’t just playing defense anymore — it’s shaping Washington’s playbook. Federal lands are opening, projects are moving forward and industry voices are once again steering national policy.

For the companies that backed Trump, this isn’t only about quarterly profits. It’s about energy dominance, access to global markets and keeping America’s resources in American hands.

The question is no longer whether the wager paid off. It’s how far this new era of energy power will reach — and who outside the inner circle will recognize what’s really unfolding.

![]() The Dot-Com Echo

The Dot-Com Echo

Every week, Paradigm editor Davis Wilson says his inbox fills up with the same urgent plea:Davis, what stock should I buy today?

Every week, Paradigm editor Davis Wilson says his inbox fills up with the same urgent plea:Davis, what stock should I buy today?

“There’s always a sense of urgency behind it, as if waiting even one more day means missing out forever,” Davis notes. “My guess? Too much financial media.”

The constant drumbeat of CNBC, YouTube hot takes and Twitter hype, he warns, “can make anyone feel like they’re falling behind. That fear of missing out (FOMO) is powerful. But it’s also dangerous.”

Instead of chasing the latest craze, Davis stresses: “Investing isn’t about chasing what’s hot today. It’s about positioning yourself where the odds of success are highest.”

But right now, he says, “the odds of success are the lowest since the dot-com boom…

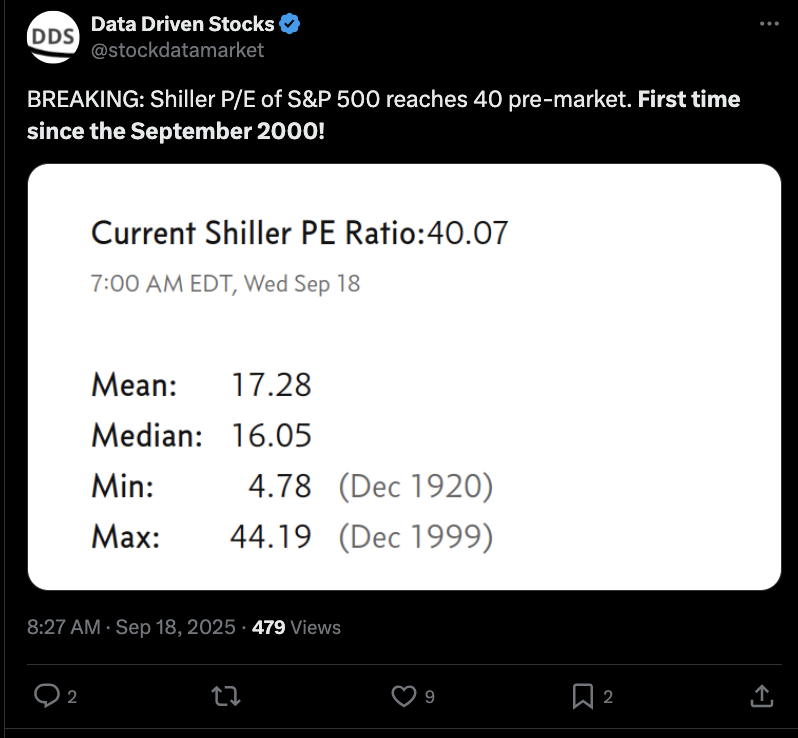

“One of the best ways to measure whether the market is expensive is the Shiller P/E ratio,” Davis explains.

“One of the best ways to measure whether the market is expensive is the Shiller P/E ratio,” Davis explains.

The Shiller P/E ratio looks at the average earnings of the S&P 500 over the past 10 years and compares it to today’s stock prices. It reveals whether the market is cheap or expensive compared to history.

“The historical average is about 17,” Davis adds. “Today, it sits around 40. The only time it’s been higher was during the dot-com bubble in 1999–2000. And we all know how that ended…

“This doesn’t mean the market will crash tomorrow. Overvalued markets can defy gravity for a long time. But the higher the starting valuation, the lower the future returns.”

So what’s an investor to do? “I still recommend stocks I like long term,” Davis says, pointing to Nvidia (NVDA), Uber (UBER) and Fannie Mae (FNMA). “These are companies I believe can compound wealth over years, not just the next few days.”

Davis’ parting advice? “Great investors don’t rush. The best money in investing isn’t made by buying when everyone else is rushing in… It’s made by buying when everyone else is running away.”

Looking at our screen today, the three major U.S. stock indexes are in the green.

Looking at our screen today, the three major U.S. stock indexes are in the green.

Like yesterday, it’s the tech-heavy Nasdaq that’s leading the way — today, up 0.20% to 22,520. The S&P 500 and Dow are both up about 0.05% to 6,635 and 46,170 respectively.

Commodities, meanwhile, are moving in different directions. Crude, for instance, is down 0.70% to $63.10 for a barrel of West Texas Intermediate. But precious metals are rallying: Gold’s up 0.60% to $3,700.30 per ounce, and silver’s up 1.85%, just a few cents under $43.

When it comes to crypto, we’re seeing red. Bitcoin’s lost 1.55% to $115,600 while Ethereum’s pulled back 2.75% to $4,465.

![]() Jensen Just Validated Intel

Jensen Just Validated Intel

“Sometimes the most hated stocks become the most essential,” said Paradigm’s science-and-tech expert Ray Blanco in August. To wit, Intel (INTC)...

“Sometimes the most hated stocks become the most essential,” said Paradigm’s science-and-tech expert Ray Blanco in August. To wit, Intel (INTC)...

That transformation accelerated yesterday when Nvidia CEO Jensen Huang announced a $5 billion equity investment in Intel at $23.28 per share, along with a partnership to co-develop AI infrastructure and PC chips. And Intel stock immediately surged past $32 in premarket trading.

“They will build custom x86 CPUs for Nvidia's AI platforms and create new system-on-chips integrating Nvidia RTX GPU chiplets for PCs,” Ray says. “In other words, the world's dominant AI company just chose Intel as its partner for future computing platforms!”

For Intel’s long-struggling foundry business, this is game-changing. “Nvidia gets domestic manufacturing capabilities,” Ray explains. “Intel gets the foundry customer it desperately needs.

“When Jensen writes a $5 billion check, every other tech giant notices,” Ray elaborates. “Broadcom needs domestic alternatives. Qualcomm and Apple need foundry diversification and U.S. sourcing. Amazon and Microsoft need their own in-house designed AI processors — and the American semi company to fabricate them.”

Ray’s takeaway: “One major player just validated Intel’s Foundry. Jensen Huang,” he adds, “doesn’t bet $5 billion on short-term plays. Intel just got a [boost] from the one CEO whose opinion matters most in AI.

“With Jensen on board, Intel’s best days are ahead,” Ray forecasts. “Intel’s real run is just getting started to what one day I expect will reach $1 trillion in market cap.”

![]() Meltdown: 3,000 Years of History

Meltdown: 3,000 Years of History

A 3,000-year-old ancient Egyptian treasure has vanished forever — not spirited away to some shadowy private collection, but destroyed for scrap.

A 3,000-year-old ancient Egyptian treasure has vanished forever — not spirited away to some shadowy private collection, but destroyed for scrap.

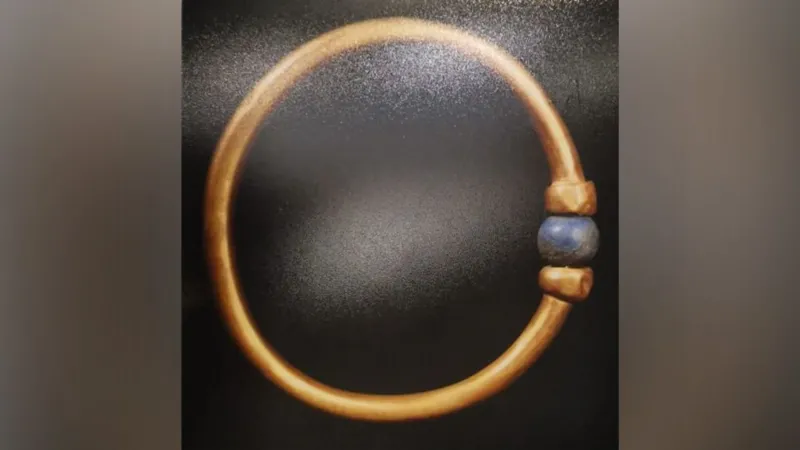

While preparing objects for an upcoming exhibit in Rome, the Egyptian Ministry of Tourism and Antiquities clocked the bracelet’s disappearance from a museum safe. Officials circulated images of the gold band, adorned with lapis lazuli, to airports, seaports and border crossings in case it was smuggled abroad.

Source: Egyptian Ministry of Tourism and Antiquities

According to Egypt’s Interior Ministry, a restoration specialist at the Egyptian Museum in Cairo stole the gold bracelet dating back to the reign of King Amenemope, a pharaoh who ruled around 1,000 BC.

Authorities say the specialist turned to a silversmith she knew who passed the bracelet along to a gold dealer for about $3,735. The dealer then sold the artifact to a foundry worker for $4,025. The worker melted it with other pieces of jewelry — erasing three millennia of history in a matter of minutes.

Police arrested all four individuals, who have since confessed, and they’ve recovered the money involved. Still, the priceless artifact itself is gone.

Sadly, we note, this type of theft and destruction is not the first of its kind — and probably won’t be the last.

Sorry to leave you on a bit of a downer to close this Friday edition… But try to enjoy the weekend. And take care!