OpenAI's $300B Shell Game

![]() Sam Altman’s $300B IOU

Sam Altman’s $300B IOU

The news hit like a lightning bolt last week: OpenAI and Oracle striking a $300 billion deal to build Project Stargate — a globe-spanning network of data centers, the backbone for the next generation of artificial intelligence.

The news hit like a lightning bolt last week: OpenAI and Oracle striking a $300 billion deal to build Project Stargate — a globe-spanning network of data centers, the backbone for the next generation of artificial intelligence.

The market didn’t hesitate. On Oct. 10, Oracle (ORCL) stock exploded, up more than 40%, its market capitalization swelling by a jaw-dropping $250 billion.

To Wall Street, this looked like the dawn of a new era. But as Paradigm’s trading pro Enrique Abeyta cautions: “Whenever you see numbers this big, you have to stop and ask — what’s real cash, and what’s just aspiration?”

And in terms of aspiration, Enrique reminds: “[Sam Altman] co-founded OpenAI in 2015. Since then, Altman has become more than a tech executive.

“He’s a media figure, a cult personality and a symbol of the AI revolution in the eyes of many investors.”

Although Altman’s image is carefully curated, his history is… messy.

Although Altman’s image is carefully curated, his history is… messy.

“Many have forgotten, in 2020, Altman was quietly ousted from Y Combinator” — a startup incubator and fund — “after appointing himself chairman without approval,” Enrique recalls.

The controversies didn’t stop there. “In November 2023, OpenAI’s board voted to remove him for being ‘not consistently candid’ in his communications.

“That’s a rare and direct accusation in the world of executive leadership. Within days, Altman was reinstated after a fierce employee revolt. But the incident left a trail of unanswered questions.”

Recent history is littered with visionaries who flamed out. Think Sam Bankman-Fried. Think Elizabeth Holmes. They, too, were young, celebrated and backed by billions in capital. Their industries were so complex that outsiders had little choice but to take their word for it.

“Of course, this doesn’t mean Altman is guilty of anything. But it does raise the same timeless question investors must always ask…

“Where is the money coming from, and where is it going?” Enrique presses.

“Where is the money coming from, and where is it going?” Enrique presses.

The numbers don’t add up easily. “Just a year ago, OpenAI wasn't profitable. It relied heavily on Microsoft-backed cloud services, and its projected cash burn through 2029 was pegged at over $115 billion.

“Today, the company is still in the red,” he emphasizes. “Yet it’s reportedly behind $10 billion in Broadcom chip orders and committing an absurd $300 billion to Oracle. And that’s just last week!

“However, many of those contracts are nonbinding and won’t even begin until 2027. The commitments, while massive, are not yet cash.

“They are forward-looking aspirations that depend on many assumptions going right: cost, scale, power availability and OpenAI’s own solvency.

“This is precisely why Altman's leadership deserves scrutiny,” says Enrique.

“This is precisely why Altman's leadership deserves scrutiny,” says Enrique.

Of course, it’s possible Altman pulls it off. Tech history is full of skeptics proven wrong. But investors who mistake headlines for cash flows are playing a dangerous game.

Enormous numbers create a gravitational pull that drags in investors who don’t stop to check the fundamentals.

“It’s easy to fall for the shine of big ideas, grand plans and charismatic CEOs,” he adds. “But the only thing that matters in the end is execution.

“That’s why I urge you not to blindly follow false idols when investing your hard-earned money,” Enrique says, “whether it's Altman, Ellison, Musk or anyone else.

“Do the work. Check the earnings. Follow the fundamentals,” he concludes. “And ask the hardest questions, especially when the answers are being drowned out by media noise.”

![]() Powell Tips the Scales

Powell Tips the Scales

As Paradigm’s macro expert Jim Rickards predicted, the Fed cut the target rate for fed funds by 0.25%. “This lowered the Fed’s target rate to 4.25%,” Jim comments, on par with expectations from the “no drama” Fed.

As Paradigm’s macro expert Jim Rickards predicted, the Fed cut the target rate for fed funds by 0.25%. “This lowered the Fed’s target rate to 4.25%,” Jim comments, on par with expectations from the “no drama” Fed.

“The FOMC vote [was] 11–1 in favor. The only dissenter was newly confirmed governor Stephen Miran, just appointed by President Trump. Miran favored a 0.50% rate cut, the largest cut since September 2024.” Embattled Fed Governor Lisa Cook, by the way, voted with the majority.

“Much of Powell’s [post-meeting] press conference focused on the [Fed’s] ‘dual mandate,’” Jim continues, “to maintain price stability and create jobs at the same time.

“This is practically impossible to do on a consistent basis. There is no strong correlation between interest rates and employment.

“Powell didn’t say anything new,” Jim notes. “He simply tipped the scales in the direction of more concern about unemployment than inflation.

“Powell didn’t say anything new,” Jim notes. “He simply tipped the scales in the direction of more concern about unemployment than inflation.

“The Fed is consistently forced to choose which part of the mandate it wants to address,” he says. “The Fed’s action on Wednesday clearly shows it is less concerned about inflation for now and more interested in fighting unemployment by cutting rates.”

Notwithstanding: “Inflation is moving steadily away from the Fed’s 2.0% target. The August 2025 inflation reading was the highest since last January.

“It’s easy to ignore inflation at times because the Fed feels they know how to deal with that, including rate hikes if necessary.

“Rising unemployment is a much more difficult challenge since it feeds on itself and is not readily amenable to rate cuts. So the Fed tipped policy in favor of fighting unemployment.

“The next Fed meeting is Oct. 28–29, 2025. Powell was noncommittal on what the Fed

will do then but a further rate cut is a near certainty,” he says.

“The Fed may cut interest rates again by 0.25% given the deteriorating employment situation, but a

0.50% rate cut as happened in September 2024 cannot be ruled out.

“It’s not that inflation will disappear that quickly. It’s more the case that an economic slowdown and rising

unemployment will cause the Fed to tip back to the employment side of the dual mandate,” Jim summarizes.

Predictably, stocks are off to the races today. Tech, especially, is catching a bid: The Nasdaq index is up 1.20% to 22,530. At the same time, the S&P 500 is up 0.70% to 6,645, and the Big Board’s in third position, up 0.35% to 46,200.

Predictably, stocks are off to the races today. Tech, especially, is catching a bid: The Nasdaq index is up 1.20% to 22,530. At the same time, the S&P 500 is up 0.70% to 6,645, and the Big Board’s in third position, up 0.35% to 46,200.

Taking a look at commodities, oil’s down 0.65% to $63.65 for a barrel of WTI. Likewise, the price of gold is down 1.25% to $3,672.50 per ounce. Silver’s down 0.70% to $41.85.

On the flip side, crypto’s rallying today. Bitcoin’s up 1.50% to $117,500, and Ethereum’s up 2% to $4,600.

As for the major economic number of the day, initial jobless claims fell sharply last week, dropping by 33,000 to 231,000 for the week ending Sept. 13, according to Labor Department data.

That’s the biggest decline in nearly four years and brought claims close to pre-pandemic levels. Economists surveyed by Bloomberg expected 240,000 claims. Continuing claims — the number of people still receiving benefits — declined to 1.92 million from 1.95 million the week prior.

A couple of cautions: Jobless claims often swing around holidays, like Labor Day, and much of the prior week’s surge came from Texas, where officials say thousands of filings were tied to suspected fraud rather than real layoffs — making the latest drop more of a “correction” than a genuine sign of a stronger job market.

![]() America’s Nuclear Wake-Up Call

America’s Nuclear Wake-Up Call

If you want to understand the stakes in America’s energy future, look no further than uranium.

If you want to understand the stakes in America’s energy future, look no further than uranium.

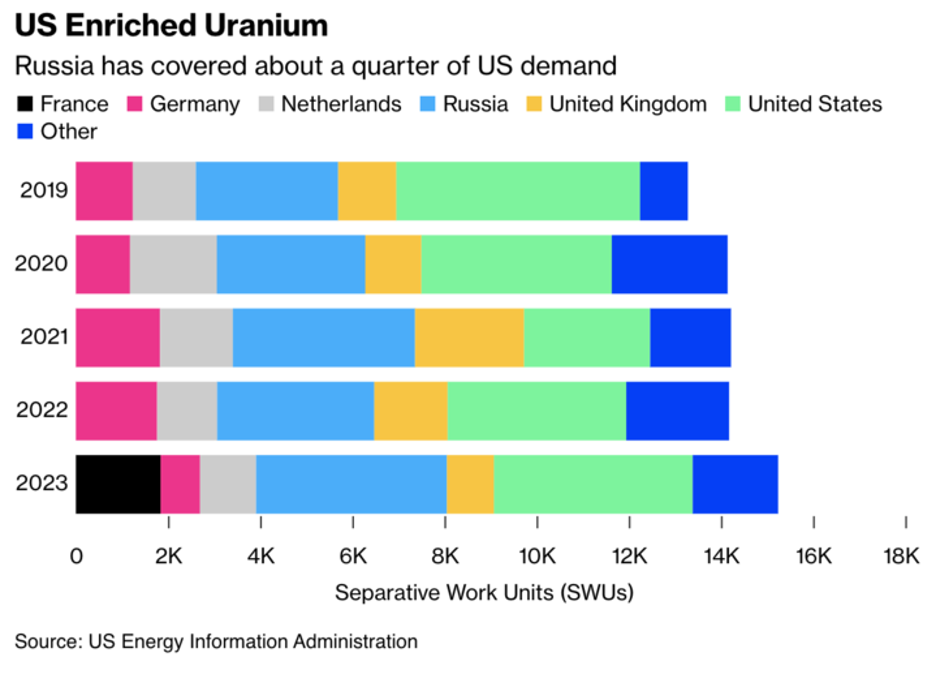

Right now, about 25% of the enriched uranium that powers America’s 94 nuclear reactors comes from Russia. Those reactors, in turn, generate about 20% of all U.S. electricity, according to International Atomic Energy Agency (IAEA) data. That’s a pretty big lever for Moscow to pull.

Source: Bloomberg

U.S. Energy Secretary Chris Wright says: “We’re moving to a place — and we’re not there yet — to no longer use Russian enriched uranium.” He adds the U.S. needs “a lot of domestic uranium and enrichment capacity” to ensure both energy security and growth in nuclear power.

The timing matters. As the U.S. electrifies everything from cars to factories, demand for reliable power is only going up. Nuclear energy — unlike wind or solar — can provide steady, around-the-clock electricity. But the U.S. has just two commercial enrichment facilities, and one of them is foreign-owned. Compare that to China’s 12-year uranium stockpile versus America’s 14-month reserve (IAEA).

Markets got the message. Shares of U.S. uranium producers jumped more than 9% on Wright’s remarks. Investors know the U.S. will need to dig, refine and stockpile much more of its own fuel.

Here’s the bottom line: Depending on Russia for uranium is a liability. Building up a U.S. reserve is not just smart policy — it’s a survival strategy.

![]() What Could Go Wrong?

What Could Go Wrong?

Albania just pulled off a world first: appointing a government minister who isn’t human. Meet Diella — her name means “sunshine” in Albanian — an artificial intelligence now serving as the country’s minister of public procurement.

Albania just pulled off a world first: appointing a government minister who isn’t human. Meet Diella — her name means “sunshine” in Albanian — an artificial intelligence now serving as the country’s minister of public procurement.

Prime Minister Edi Rama unveiled his digital colleague at the Socialist Party assembly in Tirana last week. “Diella is the first member not physically present, but virtually created by artificial intelligence,” Rama told party members.

Rama, fresh off winning a historic fourth term in May 2025, mused this summer about one day having an AI minister, but few expected the idea to materialize so swiftly.

Diella’s mission? To oversee government contracts and shine light on a sector long plagued by corruption.

To wit, as part of its bid to join the European Union, Albania’s system has been flagged repeatedly in EU rule-of-law reports as vulnerable to graft.

Rama insists Diella will help create “a country where [government contracts] are 100% incorruptible and where every public fund… is 100% legible.”

Diella already runs the e-Albania platform, where citizens access most government services. She even comes with an avatar: a woman in traditional Albanian dress.

Courtesy: The National Agency for Information Society, Albania

Of course, anyone who’s spent five minutes with ChatGPT knows AI has a habit of “hallucinating” data. Let’s hope Albania’s new minister keeps her imagination in check. Taxpayers might not appreciate, for instance, a figurative — or literal — bridge to nowhere.

![]() Point, Counterpoint: DST

Point, Counterpoint: DST

“Why is everyone so fired up about changing the clocks twice a year?” a reader wonders. “Now almost every device does so automatically. Air travelers often make more than a one-hour change. I say leave it as it is.”

“Why is everyone so fired up about changing the clocks twice a year?” a reader wonders. “Now almost every device does so automatically. Air travelers often make more than a one-hour change. I say leave it as it is.”

Fair point.

Counterpoint: “Our winter days are much shorter this far north,” says a frequent contributor who lives at 55° north latitude.

“Sunset on Dec. 21 is 4:27 p.m. Sunrise is 9:19 a.m. If year-round DST were adopted, sunrise would be 10:19 a.m. Adjusting everything for year-round DST seems like a really bad idea.” He adds: “Closer to the equator it would matter less. Here, having DST in the summer is ridiculous — on June 21 sunrise is 5:15 a.m. and sunset is 10:40 p.m.

“Personally, the older I get, the more ridiculous it seems.”

Take care, readers! Living as I do in Maryland, I’m counting down to “falling behind” on Nov. 2…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. Since Dave’s masterful censorship episode yesterday, ABC voluntarily yanked Jimmy Kimmel Live! “indefinitely” after FCC Chair Brendan Carr — and Trump appointee — blasted the host’s remarks about Charlie Kirk’s murder as “truly sick” and warned Disney, ABC’s parent company, to act or face federal pressure. Hours later, affiliates pulled the plug.

And it’s no coincidence: Nexstar owns about 10% of ABC stations — and just happens to need FCC approval for a $6.2 billion merger with U.S. broadcast and digital media company Tegna Inc.

When government threats meet corporate self-interest, “voluntary” censorship is anything but…