Nvidia! OpenAI! $100B!

![]() Nvidia! OpenAI! $100B!

Nvidia! OpenAI! $100B!

In the annals of AI headlines, yesterday brought us the ultimate — a bus full of nuns holding babies.

In the annals of AI headlines, yesterday brought us the ultimate — a bus full of nuns holding babies.

That’s a reference to a novelty song that caught on briefly in the early 1980s — lambasting the media’s penchant for the lurid and sensational.

The lyrics — totally fictional — were about a bus that crashed through a guardrail, tumbled over a cliff and crashed onto some rocks below. That was terrible enough — but yes, even worse, it was a bus full of nuns holding babies.

The punch line toward the end: “The nuns were blind and the kids were refugees!”

Along those lines, yesterday delivered the ultimate AI mash-up for the financial media. It had it all. Nvidia! OpenAI! And a nine-figure sum of money!

Along those lines, yesterday delivered the ultimate AI mash-up for the financial media. It had it all. Nvidia! OpenAI! And a nine-figure sum of money!

“Nvidia and OpenAI, two U.S. giants powering the country’s race for AI superintelligence, outlined an expansive partnership on Monday,” says The Wall Street Journal — “including plans for an enormous data-center build-out and $100 billion investment by the chipmaker into the startup.”

The arrangement “will allow OpenAI to build and deploy at least 10 gigawatts of Nvidia systems” — enough electricity to power 8 million homes, we’re told.

The announcement comes on the heels of OpenAI committing $300 billion over the next five years to a deal with Oracle. (Reality check: OpenAI’s expected revenue this year is $13 billion.)

It’s at this moment we invoke the words of Paradigm’s hedge fund veteran Enrique Abeyta, shared here on Thursday: “Whenever you see numbers this big, you have to stop and ask — what’s real cash, and what’s just aspiration?”

It’s at this moment we invoke the words of Paradigm’s hedge fund veteran Enrique Abeyta, shared here on Thursday: “Whenever you see numbers this big, you have to stop and ask — what’s real cash, and what’s just aspiration?”

Answer, buried in the ninth paragraph of the Journal’s article: “Nvidia will make its investment in OpenAI progressively as each gigawatt is deployed to support data center and power capacity, the companies said. That could allow it to hedge its risk should OpenAI not be able to continue growing at its current rate.”

Mr. Market’s reaction? “Details, shmeetails.” The news pushed NVDA’s share price up 4% yesterday to a record, the company’s market cap approaching $4.5 trillion.

From the start of this year, Enrique has been warning us about the potential for a massive overbuild of AI infrastructure — not unlike the overbuild of fiber-optic lines for the internet in the late 1990s. Or to use a much older example, the overbuild of railroads in the 19th century.

Yes, all that excess capacity was put into use eventually. But in the interim, there was a vicious shakeout.

If you’re old enough, you remember the internet example well — perhaps too well. The dot-com bust took down the price of Amazon, for instance, by 90%... before it rebounded and became a world-beating colossus.

It’s likely to end in tears this time, too — just not right away, as this meme demonstrates. (Hat tip to Adam Sharp at our sister e-letter The Daily Reckoning…)

“We've seen this movie before, right? The hype cycle kicks in, valuations go through the roof and then... pop!”

“We've seen this movie before, right? The hype cycle kicks in, valuations go through the roof and then... pop!”

So said Paradigm’s AI and crypto authority James Altucher in this space on Sept. 6 of last year.

But he also said, in so many words, “Not so fast.”

“If we were to draw a parallel to the internet boom, we'd be somewhere around 1994 or 1996. Remember, Amazon was just a twinkle in Jeff Bezos' eye back then. Google didn't exist. Facebook was still a decade away. The real game-changers were yet to come.”

Fast-forward a year, and we’d be somewhere around 1995–1997. Not the insane frenzy of 1999 and all the pain that followed as the dot-com bubble burst. (Check back with us in 2028!)

That said… James recently made a major change to his AI thesis — based on an event he expects could go down as early as tomorrow.

Even now, only a slim segment of the Paradigm readership base is up to speed on these fast-moving developments. Follow this link for James’ up-to-the-minute debriefing.

![]() Elevated Markets Can Stay Elevated

Elevated Markets Can Stay Elevated

“Selfishly, I’d love for the market to pull back this week and slip a bit into October,” Paradigm trading pro Greg Guenthner tells his Trading Desk readers.

“Selfishly, I’d love for the market to pull back this week and slip a bit into October,” Paradigm trading pro Greg Guenthner tells his Trading Desk readers.

The S&P 500 began the month of September at 6,415. As we write this morning, it’s only a smidge under yesterday’s record close of 6,692. That’s a 4.3% gain in three weeks — during what historically has been the market’s worst month.

For ideal trading opportunities, “We desperately need a reset,” says Greg. Even a little one would be great. The strongest stocks would reset to more reasonable levels where we could potentially enter for fresh trades. Some of the excess enthusiasm would drain from the market. And stocks would set up nicely for a beautiful end-of-year ripper.

“Of course, the market doesn’t care about my wants and needs. If only it were so simple! Instead, we have to trade what’s in front of our faces. For now, that means concentrating on the rotation trade and many of the long setups that continue to pile up on our screens.”

➢ Congratulations to Altucher’s True Alpha readers who collected 438% gains today on the first half of a trade recommended only three weeks ago. And hang on tight for the second half!

Meanwhile, gold is touching another record and silver is touching another 14-year high.

Meanwhile, gold is touching another record and silver is touching another 14-year high.

At last check, the bid on the Midas metal is up to $3,771… and silver is over $44.

And that’s after yesterday, when silver “had a day for the ages,” says our recovering investment banker Sean Ring in The Rude Awakening.

“According to my charts, gold’s new target is $4,586, representing a 21.8% increase from its current level. Silver’s target is $53, representing an increase of over 20% from its current price.

“Of course, they’re just targets. That means we may not even hit them. Or we’ll hit them. Even better, we may hit and then far exceed them. We simply don’t know how far this train will run.”

Meanwhile, crypto is stuck in the mud — Bitcoin under $113,000 and Ethereum under $4,200.

For no obvious reason, crude is up 2% on the day to $63.54.

![]() The Unpopular Tax Cut, Continued

The Unpopular Tax Cut, Continued

Is someone in the Trump administration reading these daily missives?

Is someone in the Trump administration reading these daily missives?

In late July, we took note of polling data suggesting only 42% of Americans support the “Big Beautiful Bill” passed over the summer. And 54% of independents oppose it.

As mentioned at the time, there was no effort to sell the American people on the necessity of the bill’s most important provision — making the 2017 Trump tax cuts permanent.

No one was out there screaming to folks that if Congress didn’t act, Obama-era tax rates would come back. No one warned folks in the 22% tax bracket that they’d be going back to 25%, for example.

Now comes word of an effort to rebrand the bill retroactively.

Now comes word of an effort to rebrand the bill retroactively.

“So the bill,” said the president last month. “I’m not going to use the term ‘great, big, beautiful.’ That was good for getting it approved, but it’s not good for explaining to people what it’s all about. It’s a massive tax cut for the middle class.”

After a series of meetings in recent weeks, the GOP has settled on the name “Working Families Tax Cut.”

It’s not just the branding either. Apparently the administration has (finally) learned its lessons from the 2017 Trump tax cuts — which I once labeled “the most hated tax cut in history” for the administration’s ham-fisted attempts to sell that tax cut to the public.

When it comes to the 2025 legislation, “many of the tax cuts included in the law — including Mr. Trump’s campaign promises to reduce taxes on tips and overtime, as well as an increase to the standard deduction and child tax credit — are retroactive to the start of the year,” says The New York Times.

“Because the Internal Revenue Service has not yet changed how taxes are withheld from workers’ paychecks to reflect the new law, Americans will largely claim the cuts after they file taxes early next year.”

In other words, bigger refunds.

But there’s still a problem here. How many taxpayers run the numbers to anticipate the size of a refund — or how much they owe — in advance? (I do — and my estimates are usually within 3% of the actual number — but I obsess over this stuff…)

So will they even realize their refund is bigger than it would be otherwise?

Probably not. And even if they do, “people may not necessarily connect a higher tax refund to a law passed in Congress six months earlier,” says the Times story. The paper quotes a poli-sci professor who says if they do get a bigger-than-expected refund, they usually credit their tax preparer!

![]() Thought for the Day

Thought for the Day

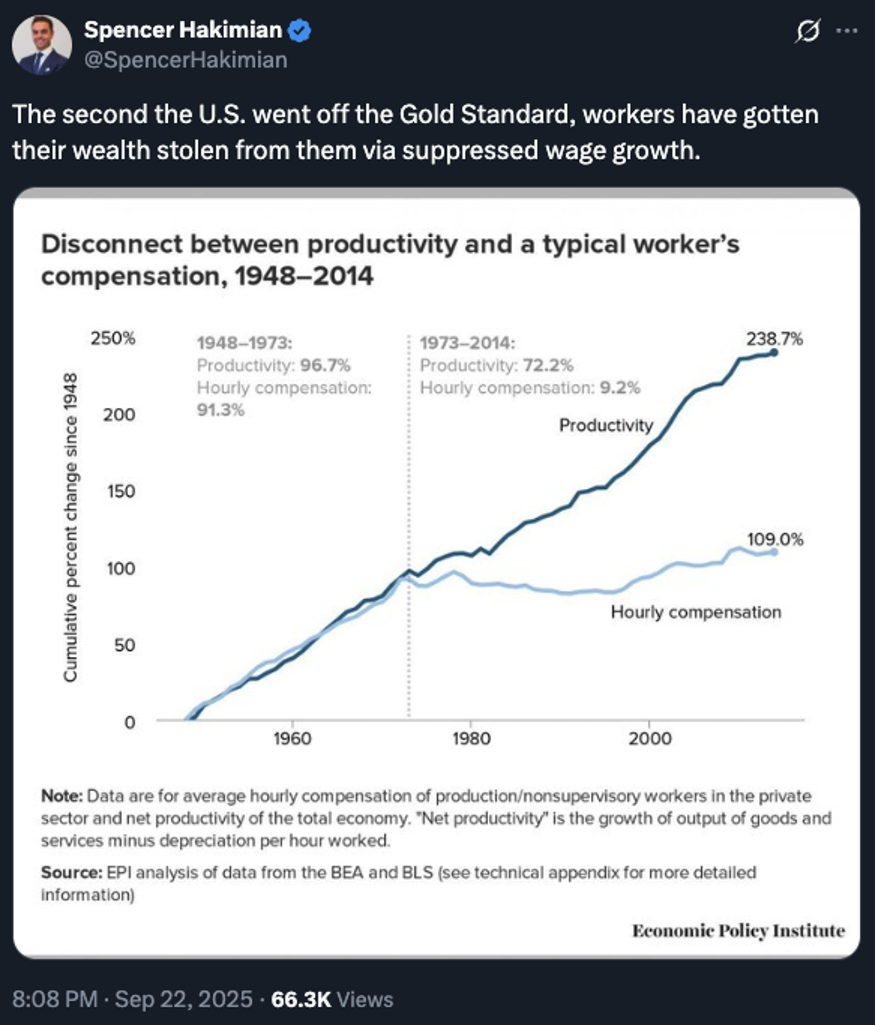

In lieu of a meme today — we already had one above — here’s some food for thought…

In lieu of a meme today — we already had one above — here’s some food for thought…

![]() Mailbag: “Receipts”

Mailbag: “Receipts”

“Dave, I am very behind on my reading. I have been traveling for work for seven days straight. After Charlie Kirk was assassinated I was incensed. My blood no longer boils,” a reader writes.

“Dave, I am very behind on my reading. I have been traveling for work for seven days straight. After Charlie Kirk was assassinated I was incensed. My blood no longer boils,” a reader writes.

[Presumably he read the 2025 censorship edition last week? Maybe not…]

“I have to think that some sort of change needs to happen on the amendment level and I am writing you because you are maybe the most rational person I have come across.

“I have not fully fleshed out my idea, but I feel the press has a higher responsibility to be truthful and needs to have more accountability for libel and slander. Calling someone Hitler as an example should be off-limits. Conservatives just brush it off and find it ridiculous, but unfortunately people with TDS actually think Trump, Charlie Kirk and JD Vance are as bad as Hitler. We are talking about a man who was behind the deaths of over 11 million people.

“In order to call someone racist the press should have to attach some receipts or proof. If I were to say all green people are inferior to silver people, then you could then call me a racist as long as you attached the proof.

“If this assassin were to say a big cause of his hate for Kirk was from listening to the ladies on The View, for instance, there should be some repercussions for their part in this basic brainwashing. If the FBI found hours and hours of listening to a certain podcaster who regularly mislabeled people on the right, then that podcaster should be held accountable for his speech.

“Opinions are opinions and I get that but facts are also facts. If I have never murdered anyone and then someone calls me a murderer, there is something very wrong with that.

“Sorry for such a long letter. I would love to hear your thoughts.”

Dave responds: First I appreciate the vote of confidence.

And I also appreciate your implicit recognition that the language of the First Amendment is clear — and any changes must come about through an additional constitutional amendment and not, say, a proclamation on a podcast by the chair of the FCC.

(More on the Jimmy Kimmel situation coming Thursday…)

But didn’t conservatives spend the last four years fearing the Biden administration acting as the arbiter of truth and falsehood? Pressuring Big Tech to deplatform and demonetize people they judged to be engaged in “misinformation”?

And didn’t conservatives once argue that decisions about truth and falsehood should not be left to the government but rather to the marketplace of ideas? That everyday people could be trusted to make up their own minds?

What changed?

For today, I’ll conclude with the words of a former congressmember, one of the few who ever commanded my respect…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets