Birthright Payout Proof

![]() Canadian Company Delivers on the American Birthright

Canadian Company Delivers on the American Birthright

Gold has topped $3,700 as a new week begins — up nicely from $3,350 in mid-July, an 11% jump in a little over two months.

Gold has topped $3,700 as a new week begins — up nicely from $3,350 in mid-July, an 11% jump in a little over two months.

For readers of Jim Rickards’ The Situation Report, that jump has translated to a 381% gain in the same time frame.

Every once in a while, we like to examine the anatomy of a winning trade here at Paradigm Press.

In this case, the recommendation dates to July 18 — when, again, gold was at $3,350 and Jim wrote the following: “We are entirely comfortable saying that gold will reach $4,000 per ounce (or higher) before the end of 2025 and will continue a historic rally in the years beyond.

“The inputs are relatively few (supply/demand, technical factors, safe-haven demand, geopolitics, interest rates and inflation) and the distribution of outcomes is heavily weighted toward higher prices.”

So far, so good.

And it gets better. Because this story isn’t just about gold. It’s also about the “American Birthright.”

And it gets better. Because this story isn’t just about gold. It’s also about the “American Birthright.”

As a reminder, the “birthright” is Jim’s shorthand description for the vast mineral wealth on federal lands, valued at up to $150 trillion. The Trump administration is keen to tap into it.

All this year Jim has been showing his readers how to piggyback this policy for big gains in his flagship newsletter Strategic Intelligence.

Starting in June, he was already anticipating the birthright plan accelerating into a Phase II — with potentially bigger gains to be captured.

Granted, the risk profile on these plays was somewhat greater — and as such he limited these recommendations to his premium advisory The Situation Report.

But the research on this July 18 trade was airtight. Jim and his senior analyst Dan Amoss made sure of that as they recommended call options on Barrick Mining (B) — one of the world’s major gold producers.

While Barrick is a Canadian company, it still lies at the heart of the “birthright” thesis.

While Barrick is a Canadian company, it still lies at the heart of the “birthright” thesis.

Dan Amoss explained it this way in that July 18 recommendation: “In March, Trump signed an executive order to streamline mining permits. That’s a tailwind for companies like Barrick, which owns some of the richest untapped gold reserves in the country, especially in Nevada.”

Barrick’s joint venture called Nevada Gold Mines produced 342,000 ounces of gold during the first quarter of this year — “nearly half of Barrick’s global total,” said Dan.

“And Nevada is just the beginning,” he went on. “The Fourmile project, also in Nevada, is shaping up to be one of the world’s next Tier One gold mines. Barrick has begun drilling and pre-feasibility work. Trump’s permitting reforms could accelerate its development.”

Then Dan ran the numbers thoroughly, as he always does…

Barrick is on track to produce 4.4 million ounces of gold in 2025. At $4,000 gold, that’s $17.6 billion in revenue.

Assume that Barrick’s all-in sustaining costs (AISC) remain near the high Q1 level of $1,775 per ounce.

If so, Barrick could generate $9.8 billion in free cash flow (FCF) in the first full year that gold prices average $4,000.

With 1.7 billion shares outstanding, that works out to $5.66 per share in free cash flow. On a $20 stock, that’s a dirt-cheap 4X FCF.

The trade? Barrick call options expiring in March of next year. As of last Friday, they were up 381%. Jim and Dan said it was time to take profits — even as they’re looking for still more outstanding gold-stock trading opportunities in the weeks to come.

And not just gold. But also copper and other base metals… along with oil and other energy sources.

In fact, the next round of profit opportunities is shaping up to be even more lucrative than the Barrick trade — as Paradigm Press publisher Matt Insley shows you when you follow this link.

Staying with gold as we move on to Bullet No. 2…

![]() Rickards and Dalio Agree: 10% Gold

Rickards and Dalio Agree: 10% Gold

The founder of the world’s biggest hedge fund is in sync with Jim Rickards — recommending a 10% gold allocation to your portfolio.

The founder of the world’s biggest hedge fund is in sync with Jim Rickards — recommending a 10% gold allocation to your portfolio.

“We are going to see non-fiat currencies become [a] more important store of wealth and money,” says Bridgewater founder Ray Dalio.

He describes the mad spending of the U.S. government as “unsustainable” — setting up America for a crisis.

Speaking at the FutureChina Global Forum 2025 on Friday, Dalio estimated Uncle Sam will have to sell another $12 trillion in debt — $9 trillion in current debt that needs to be rolled over, plus another $2 trillion to cover budget deficits and $1 trillion in interest on the debt.

The problem is that “the market in the world does not have that same sort of demand and that creates a supply-demand imbalance.”

He didn’t give a precise timeline… but based on his numbers and the current debt-and-spending trajectory, we’re looking at no more than two or three years before the situation goes critical.

Thus, his recommendation for a 10% gold allocation — even with gold prices at all-time highs. This is exactly what our own Jim Rickards has been recommending for over a decade.

Specifically, Jim says 10% of your investable assets. In other words, don’t count your home equity.

And ideally that should be physical gold in your possession or in safe storage at a reputable depository. Not a bank — the moment you’ll need gold in a crisis is probably the moment there’s also a bank holiday.

Silver is no slouch as the new week begins, either — up another 51 cents after closing a hair over $43 on Friday, the first weekly close at that level since 2011.

Silver is no slouch as the new week begins, either — up another 51 cents after closing a hair over $43 on Friday, the first weekly close at that level since 2011.

As for stocks, not much movement after the major indexes all set records on Friday: The Nasdaq is up another quarter percent this morning while the S&P 500 is up barely and the Dow is flat.

The big economic number of the day is the Chicago Fed National Activity Index, crunching 85 economic indicators total into a composite figure. Over the decades, it’s been a reliable indicator of when the economy is tipping into recession — but today’s reading isn’t there even if the job market is slowing down.

No joy in crypto-land — Bitcoin just over $113,000 and Ethereum in danger of cracking below $4,200.

Crude sits on the low end of its trading range going back to early August at $52.40.

![]() Social Security: Kicking the Can

Social Security: Kicking the Can

So much for any meaningful Social Security overhaul — at least right now.

So much for any meaningful Social Security overhaul — at least right now.

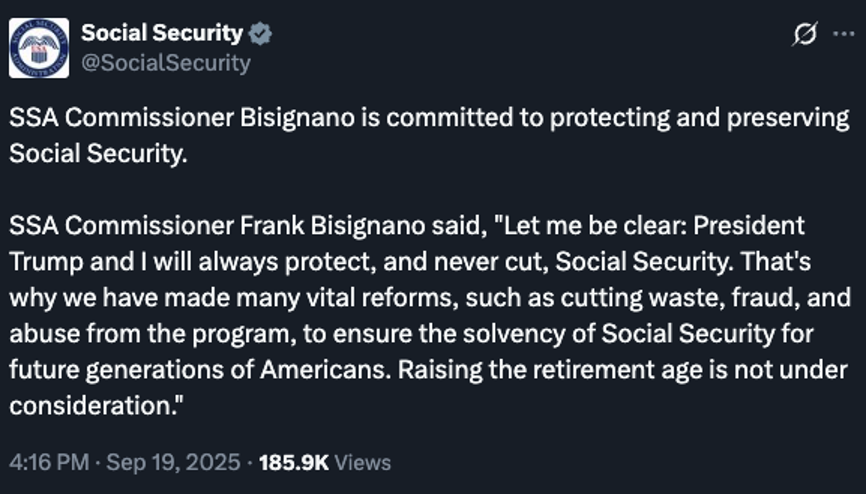

On Friday, Social Security Commissioner Frank Bisignano inadvertently put his foot in it during an interview with Fox Business anchor Maria Bartiromo.

Asked if he’s open to raising full retirement age from the current 67, he replied, “I think everything’s being considered and will be considered.”

Someone at the White House ripped him a new one — because later the Social Security Administration issued the following statement in his name…

As we mentioned in June, the Social Security trustees estimate that the portion of Social Security’s trust fund devoted to retirement benefits will likely run out in 2033. Beyond that, the system would be funded only by incoming FICA taxes — and benefits would have to be cut by up to 23%.

At the risk of repeating ourselves, there’s nothing about Social Security that’s so broken that it can’t be fixed with some combination of higher taxes and a higher retirement age. (It’s Medicare that’s the real disaster when it comes to “entitlements.”)

Congressional Democrats regularly propose higher taxes. Congressional Republicans at times have proposed raising the retirement age. But clearly that’s something the Trump White House doesn’t want to touch.

No surprise really; major reforms never happen when one party controls the White House and both houses of Congress. Doing so guarantees only one party takes the political heat.

Real reforms take place under “divided government” — a major overhaul in 1983, lesser reforms in 2000 and 2015.

But the atmosphere in Washington has been too toxic in recent years; there was no progress under divided government in either 2019–2020 or 2023–2024.

➢ By the way: It would have been nice if Bisignano had identified the amount of savings the DOGE boys have achieved by rooting out “waste, fraud and abuse.” Why didn’t he seize on the opportunity? Are the savings really there?

![]() Comic Relief: Breakfast Club Edition

Comic Relief: Breakfast Club Edition

Another reminder of how politicians and central bankers have debased the currency and your standard of living in 40 years…

Another reminder of how politicians and central bankers have debased the currency and your standard of living in 40 years…

![]() Mailbag: Censorship 2025 Style

Mailbag: Censorship 2025 Style

There was a vigorous response, as expected, to our 2025 censorship edition published last week.

There was a vigorous response, as expected, to our 2025 censorship edition published last week.

Some of it was praise: “Excellent comment on all speech with the point made from Charlie Kirk. Exchange of ideas, good, bad or indifferent, is absolutely as essential as the right to protect oneself from bodily harm.”

And there were brickbats. I suspect this individual who wrote in speaks for a lot of others who didn’t…

“Your left-leaning political views came shining through your Bullet points. You have the nerve to say Trump is worse than Biden on free speech.

“Your lazy cherry-pick of Trump’s oversteps of the Justice Department’s attacks on the First Amendment are laughable compared with what has gone on the last four years.

“Everyone on both sides of the political fence uses free speech as a political weapon. I don’t know what the answer is but the enemies of our way of life are using free speech to destroy us. We have to smarten up and understand that there are outside forces that are undermining our experiment and we must destroy them or lose it all.

“How to do that and stay within and honor our Constitution is a hard task. We have not picked very good leaders and will have to pay the price I guess. I just feel that Trump is our best chance with the leaders we have right now. There may be some missteps but I feel he is at least pro-American and honestly cares about our country and all our futures.

“I guess what I am trying to say is to cut some slack at this time considering the situation the country is in and that he works hard and he is honestly trying to do good for America.

“Sorry, but I didn’t like your read. It felt slightly condescending, shortsighted and maybe pompous. We are in a tough spot right now. We need a strong leader and unbiased evenhanded press to navigate the choppy waters ahead. That’s all I got.”

Dave responds: Newer reader? I invite you to check out last year’s censorship edition — or my takedown of the Supreme Court’s rotten decision in the landmark censorship case Murthy v. Missouri. At the conclusion I think you’ll agree I am a “liberal” only in the “classical” sense of the word.

I appreciate your acknowledgment that the Constitution still matters.

There’s been way too much social-media chatter in recent days to the effect that it’s gloves-off time — especially as it pertains to the Jimmy Kimmel situation.

No. Trump’s Federal Communications Commission has no more authority to decide truth and falsehood than Biden’s “Disinformation Governance Board.” (I’ll probably have more to say about Kimmel later in the week.)

There’s no country worth preserving for future generations if we throw our founding values overboard in the face of a crisis, either real or perceived.

A “strong leader” you want? Sorry, no one is coming to save you.

I know that sounds harsh — but really, that’s the ethos behind our company and our whole reason for being. Paradigm’s parent firm has been empowering people to take their financial future into their own hands starting with the inflationary Jimmy Carter years… continuing through the savings-and-loan crisis and the early-1990s recession… the dot-com bust and the 2008 crisis… up to the present day.

It’s a powerful mission. It does, however, require editors to take unpopular stances now and then…

“I've seen people doing TikTok dances to celebrate Charlie Kirk's death getting fired hailed as a shoe-on-the-other-foot moment,” writes one of our regulars — “but it's also a pretty clear signal that cancel culture has bipartisan support and is going to be here to stay.

“I've seen people doing TikTok dances to celebrate Charlie Kirk's death getting fired hailed as a shoe-on-the-other-foot moment,” writes one of our regulars — “but it's also a pretty clear signal that cancel culture has bipartisan support and is going to be here to stay.

“Since you mention the seizing of Americans' passports as a possible response to the government not liking what they say, whether it be about Israel or anything else, I figure it's a good time to bring up that the government has already set a precedent for doing exactly that.

“The Biden administration confiscated the passport of American journalist Scott Ritter to prevent him from covering an economic summit in Russia since he is an outspoken critic of the Ukraine war and constantly tries to promote Russian-American relations.

“How long till it's not just journalists in the crosshairs, but regular internet denizens sending private messages or posting on forums? Palantir sure seems to be on the up and coming at just the right time and the government has no shortage of ways to make people's lives miserable.”

Dave: You’ve captured the essence of why I wrote last Wednesday’s edition. I know you’re on the younger side relative to the typical newsletter customer — so your words give me extra hope!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets