Bull Session

Dear 5 Bullets Reader,

We’re breaking from our traditional format today to share some relevant news… because markets move fast. Between breaking headlines and blaring “analysis,” it’s tough to know which signals matter and which are just background noise.

Paradigm Press exists to cut through the static — delivering independent research and expert commentary that helps readers build and protect wealth.

Now, with the launch of the FREE Paradigm Press app, that mission just got a major upgrade.

For the first time, every issue, hot take and research nugget from Paradigm’s team of analysts is right at your fingertips — timely, unfiltered and sorted for readers who can’t afford to miss out. It’s like having a private bull session with some of the sharpest minds in the industry.

One standout feature: the app’s real‑time Daily Feed feature. This stream isn’t just another market ticker or headline dump. Throughout the day, Paradigm’s editors flag critical market moves, new themes and under‑the‑radar risks, distilled into actionable notes so you can react.

This week, that feed surfaced four themes that matter for investors…

Editor Chris Campbell — Crypto Goes Mainstream in Bolivia

Chris drops a post — with a showstopper photo included — about the impact of stablecoins on daily life…

Bolivia lifted its crypto ban last year. In March, its state-owned oil company began accepting crypto for fuel imports. Now, big car brands like Toyota, Yamaha and BYD are accepting Tether (USDT) and even products at duty-free stores in the airport are priced in USDT.

Meanwhile, stablecoins just hit a $300 billion market cap, up $40 billion since the GENIUS Act was passed on July 18. [Treasury Secretary] Scott Bessent expects stablecoins to hit $3.7 trillion by 2030. James Altucher and I expect they will be at least 2X that. (If it continues at this rate, we’re looking at AT LEAST $10 trillion.) Superapps (both DeFi and TradFi) and “Layer 1” protocols (like Ethereum) will be the no-brainer winners.

Dynamic, global shifts — all right at your fingertips.

Market Analyst Greg Guenthner — Decoding the Crypto Signals

Greg’s post zeroes in on the latest crypto dip, and why it might not be the doom signal it looks like…

Bitcoin is posting its worst day so far this month as it sinks below $113K. Meanwhile, Ethereum is down more than 6.5% since Sunday evening. But don’t get too bearish! Crypto mining stocks are flashing red-to-green moves across the board this afternoon. If the miners continue to lead the coins, this is your signal that today’s dip is setting up for a bigger rally.

That’s the kind of contrarian signal you want in your back pocket before the market turns.

Editor Adam Sharp — Avoid the Bond Trap

Adam warns against following old-school allocation advice…

Vanguard Group’s president and CIO recently recommended investors adopt a 60% bond, 40% stock portfolio allocation. If (when) inflation rears its ugly head again, this advice could be disastrous for investors’ purchasing power. Fixed income (bonds) is a risky asset to hold when inflation threatens to return with a vengeance. We’re entering an era of money printing and financial repression. It’s not time to be overweight bonds.

Straight talk that could save your portfolio from death by “safe” assets.

Trading Pro Enrique Abeyta — A Seasonal Setup Worth Watching

Finally, Enrique shares an intriguing chart and some perspective on what history says about markets heading into yearend…

Interesting table from my friend Ryan Detrick and Carson Investment Research showing that if the S&P 500 ($SPX) is UP consecutively in the months of May, June, July, August AND September — that October has been DOWN on average. Not a lot, but down. Rest of the year, though? UP. Think we could tread water here a bit, but come November — watch out!

Just market folklore? When it comes from Enrique, it’s worth paying attention.

Those are four big themes from four Paradigm voices, all hitting this week, all waiting there in the Paradigm Press app feed.

The magic here isn’t just that you get their best ideas. You get them when they happen. No inbox delay. No wading through half your morning news sources just to figure out what actually matters.

This is the stuff our editors read, react to and riff on daily. And now you can see it all the instant they hit “publish.”

So readers never have to wonder: “Did I miss something important?”

If ever there were a time for an information upgrade, it’s in this uncertain market. Major movers are shifting: The Fed is unpredictable, geopolitics are volatile and investors are looking for up-to-the-minute research from credible analysts.

The new Paradigm Press app answers that demand…

- Speed: Get critical ideas fast

- Coverage: All subscriptions, plus exclusive free resources, in one place

- Daily Feed: Out-of-the-box market insights that clear away the clutter.

To cut through today’s noise and uncertainty, a more effective tool is required. Discover for yourself by downloading the FREE Paradigm Press smartphone app for iPhone or Android.

The Paradigm Press app is built for the investor who wants less clutter, more precision — and real-time access to some of the sharpest minds in financial analysis.

The Daily Feed? That’s the icing on the cake: rapid-fire commentary and hot takes on every major shift, from stablecoins to the S&P 500.

The app is right there — when you need it most.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. Nvidia and Oracle are losing steam today, and the major U.S. stock indexes are following their lead. The tech-heavy Nasdaq, S&P 500 and Big Board have each pulled back about 0.15% to 22,530… 6,645… and 46,240 respectively.

Crude, meanwhile, is in the green: up almost 2% to $64.66 for a barrel of West Texas Intermediate. Precious metals? Gold’s down almost 1% to $3,781.30 per ounce, and silver is down 0.55% to $44.35.

As for crypto, Bitcoin’s up 1.85% to $113,730; Ethereum’s up 0.75% to $4,190.

P.P.S. One more bonus item from the Daily Feed, courtesy of Enrique Abeyta…

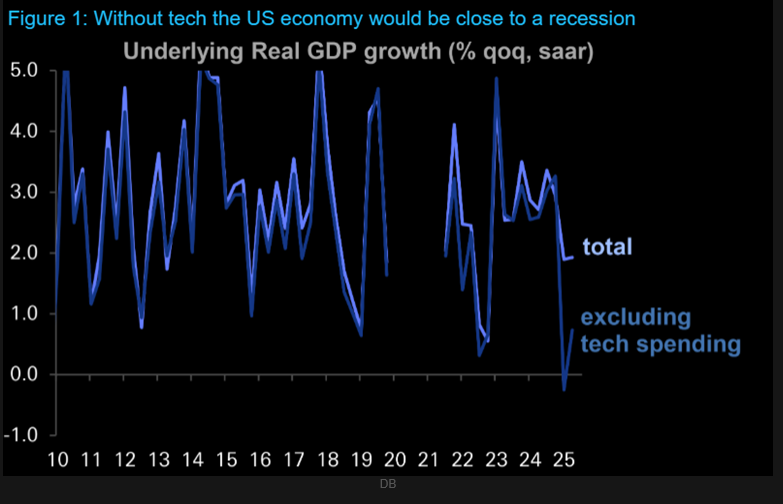

How much does the AI build matter to the U.S. economy? A LOT! Here is a chart showing U.S. economic growth without it.

Eventually it is going to slow down, and when it does — look out below! #recession