A Sure Bet, No Matter Who Wins

![]() The Words No One Uttered Last Night

The Words No One Uttered Last Night

As was the case with the first Trump-Clinton debate eight years ago, your editor’s hopes for the Trump-Harris debate were dashed…

As was the case with the first Trump-Clinton debate eight years ago, your editor’s hopes for the Trump-Harris debate were dashed…

Actually, in the interest of my mental health, I didn’t watch. It was past my bedtime. I follow reliable sources who can tell me if anything newsworthy occurred.

Really, were we going to learn anything new?

Kamala Harris believes she can raise the corporate tax rate — and somehow the corporations will eat those costs and not pass them on to everyday consumers? Delusional.

Donald Trump believes he can impose ginormous tariffs — and somehow it’s only “importers” that will eat the costs and everyday consumers won’t feel the impact? Delusional.

As it turned out, the debate lived up to the billing the independent journalist Matt Taibbi anticipated before it got underway — “one of the most abhorrent, ear-splitting, cliche-ridden, factually unmoored, cringe-inducing live TV spectacles ever. Or the worst, at least, since the last debate.”

As it turned out, the debate lived up to the billing the independent journalist Matt Taibbi anticipated before it got underway — “one of the most abhorrent, ear-splitting, cliche-ridden, factually unmoored, cringe-inducing live TV spectacles ever. Or the worst, at least, since the last debate.”

Kamala Harris touts an endorsement by Dick Cheney? Disqualifying.

Donald Trump claims credit for “ending” the Nord Stream 2 pipeline, a phenomenally reckless act actually carried out by Joe Biden? Disqualifying.

In terms of who “won” and “lost,” it appears the corporate media were comparing notes before filing their stories…

But it’s an assessment shared by more objective observers…

The moment Harris started harping about Trump’s threat to “our democracy” — which Trump’s handlers should have known was coming — he could have seized on the Biden administration’s social media censorship, a flagrant violation of your First Amendment rights.

But he lacked the presence of mind. As he would say back in the day, “Sad!”

And so we return to our ongoing election forecast — more war and more dollar debasement no matter who wins. Invest accordingly.

And so we return to our ongoing election forecast — more war and more dollar debasement no matter who wins. Invest accordingly.

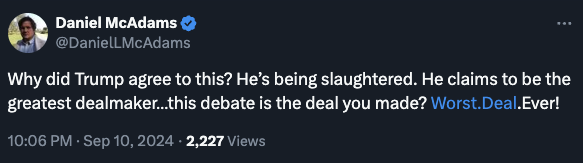

As I mentioned in a mild fit of pique yesterday, annual federal spending has exploded by 56% since 2019 — the last “pre-COVID” year.

The initial burst of spending in Trump’s last year and Biden’s first was theoretically a one-time-only response to the pandemic. The implication was that once the pandemic was over, the spending would be dialed back.

But the numbers from the Office of Management and Budget show otherwise. There’s no going back to a pre-COVID “normal.”

Searching a transcript of the debate, not once did the candidates or the moderators utter the term “federal spending.”

Therefore, we can only assume it’s not a priority for any of them — and the projections on that chart for the next five years are likely accurate, no matter who wins in November.

The explosion of spending and debt these last five years resulted in vicious consumer price inflation — the kind unseen since the 1970s.

The explosion of spending and debt these last five years resulted in vicious consumer price inflation — the kind unseen since the 1970s.

So as you can deduce from that chart, more inflation is on the way. And as we said again just yesterday, the historical record is clear: Once inflation sails past 5%, it typically takes a decade to get back to “normal” 2% inflation.

“It’s either inflate... or die,” wrote Bill Bonner yesterday. Bill is the founder of Paradigm Press’ parent company, one of the true graybeards of the newsletter biz.

“The U.S. economy may be a grotesque zombie with debt growing three times as fast as GDP. But neither political party has the courage to drive a stake through its heart. So inflation it will be.”

How to invest, you ask?

Again, the last time the United States experienced sustained inflation was the 1970s.

Again, the last time the United States experienced sustained inflation was the 1970s.

As the dollar’s purchasing power dropped like a stone, investor money poured into tangible wealth — gold, oil, land, industrial metals, farm goods. It was a commodity supercycle.

The price of gold soared from $35 an ounce in 1971 to over $800 in early 1980 — nearly a 23X gain.

Since 2022, gold has jumped from $1,800 to over $2,500. And while another 23X gain probably isn’t in the cards this time, Paradigm’s Jim Rickards has an outlook for gold of $27,000.

![]() The Disappointment of “Underlying” Inflation

The Disappointment of “Underlying” Inflation

The government has issued the last major economic number before the Federal Reserve embarks on a new cycle of interest rate cuts next week.

The government has issued the last major economic number before the Federal Reserve embarks on a new cycle of interest rate cuts next week.

The official inflation rate is now running 2.5% year-over-year — down from 2.9% the month before and 3.7% a year earlier.

The trajectory has been steadily down for five months now. That’s enough to clear the way for the Fed to start cutting interest rates at its next meeting a week from today, even though inflation is not yet back to the Fed’s 2% target.

Much of that drop you can chalk up to falling gasoline prices — a gallon of regular unleaded down an average 46 cents during the last year.

But hold on: “Underlying U.S. inflation unexpectedly picked up in August on higher prices for housing and travel,” says Bloomberg.

But hold on: “Underlying U.S. inflation unexpectedly picked up in August on higher prices for housing and travel,” says Bloomberg.

This is a reference to the core inflation rate — excluding food and energy. Here, the monthly jump was more than Wall Street expected. Year-over-year core inflation is still running 3.2%, as it was the month before.

Hilarious. During previous bouts of inflation — for instance, the brief one before the 2008 financial crisis — government officials and mainstream economists loved to play up the core rate because it was usually lower than the headline rate. Thus, the blogosphere of that day frequently referred to core inflation as “inflation for people who don’t eat or drive.”

Fast-forward to the present… and the stubborn core rate is problematic for anyone who was counting on a big interest rate cut next week.

Only a few days ago, the futures market was pricing in a 43% probability the Fed would cut the benchmark fed funds rate from 5.5% to 5%. Today, that probability is down to 15%. Look for only a quarter-percentage point cut to 5.25%.

Assuming a connection between the core inflation number and today’s stock market action, the disappointment is palpable.

Assuming a connection between the core inflation number and today’s stock market action, the disappointment is palpable.

At last check, the Nasdaq is down about 1%... the S&P 500 almost 1.4%... and the Dow 1.7%. The S&P sits about 4.4% beneath its all-time high two months ago.

Gold is holding onto the $2,500 level, if barely. But silver is in danger of slipping back below $28. Bitcoin is also losing ground, back below $56,000.

![]() Then Again, on Further Reflection…

Then Again, on Further Reflection…

Or is the stock dump today also a reaction to the debate?

Or is the stock dump today also a reaction to the debate?

Coincidentally or not, the S&P 500’s record close came on July 16 — three days after the attempt on Trump’s life and one day after Trump named J.D. Vance his running mate.

As you might recall, the vibe then was that Trump was a shoo-in. Bloomberg called it “the Trump trade” — describing a “series of wagers — based on anticipation the Republicans’ return to the White House would usher in tax cuts, higher tariffs and looser regulations.”

Bloomberg today? “Traders are further unwinding bets linked to Donald Trump winning the White House.”

Apart from the general stock-market slump, shares of Trump Media (DJT) are down 14% on the day. The dollar is slipping relative to other major currencies. Bitcoin, once spurned but now embraced by Trump, has no traction.

If another Trump-Harris debate is in the offing, a temporary bottom for stocks might be in soon.

If another Trump-Harris debate is in the offing, a temporary bottom for stocks might be in soon.

That’s the assessment of Dan Amoss, Jim Rickards’ senior analyst. “I think a further dump in stocks (in reaction to Trump's perceived debate loss) might get him to actually train for a debate (not in rallies or predictable Sean Hannity interviews), tighten his arguments and have a more receptive audience at the next one.”

Otherwise… “Stocks might keep falling on the odds of a Kamala capital gains tax hike in 2025,” says Dan. That is, financial advisers will tell their clients to take profits in 2024, lest rates be jacked up next year.

Much can change and probably will: There was a 60-day gap between the Trump assassination attempt and the debate last night. There’s a 56-day gap between the debate and Election Day. Having fun yet?

![]() Oil Overreaction

Oil Overreaction

Oil prices are finally experiencing the oversold bounce we anticipated. And one of the smartest hands in commodities says the recent sell-off was a massive overreaction.

Oil prices are finally experiencing the oversold bounce we anticipated. And one of the smartest hands in commodities says the recent sell-off was a massive overreaction.

After yesterday’s 4% drop to 16-month lows, a barrel of West Texas Intermediate is up 1.2% today and back above $66.

That’s despite weekly numbers from the Energy Department showing that inventories are building across the board — in crude, gasoline and distillates (diesel and fuel oil). Expect those inventories to fall with production idled by Hurricane Francine in the Gulf of Mexico.

The two-month drop from $84 to $66 was driven in part by fears of a looming oil glut. But those fears are “completely overplayed,” in the estimation of Jeff Currie.

When it comes to commodities, we have two powerhouse voices at Paradigm — our geologist and resource stock-picker Byron King and our floor-trading veteran Alan Knuckman.

Outside of Paradigm, Currie is one of the commodities voices we pay attention to most: Last year he walked away from a lucrative gig at Goldman Sachs to take an even more lucrative gig at Carlyle Group, the private equity giant.

At a conference in Singapore this week, Currie said participants in the oil market are “dramatically overestimating” an oil glut…

- On the demand side, there’s a perception that demand from China is weak. But that’s only by comparison with record levels of Chinese oil imports a year ago

- On the supply side, U.S. production is stuck at a record 13.3–13.4 million barrels per day — and can’t seem to go any higher.

“The market is dramatically overestimating that flood [in oil supply], and it’s reflected in record short positions … and I’ve never seen anything like that,” Currie said.

Currie didn’t identify a price target or a time frame — at least not in the remarks reported by CNBC — but when it comes to the trend, it’s not hard to read between the lines.

![]() Mailbag: A “Mistake” Made on Purpose

Mailbag: A “Mistake” Made on Purpose

After our item Monday about the goofed-up dimes that are now worth perhaps $500,000, a knowledgeable reader wrote in with some illuminating backstory…

After our item Monday about the goofed-up dimes that are now worth perhaps $500,000, a knowledgeable reader wrote in with some illuminating backstory…

“Hi Dave — The two 1975 dimes in question were thought to have been struck illicitly and then smuggled out of the San Francisco Mint in the crankcase of a forklift sent offsite for repairs. The coins sat in the bottom of the oil pan, covered by motor oil.

“That the coins exist is only due to fraud and theft, not management oversight. A dealer in Illinois, Fred J. Vollmer, sold them to two collectors sometime after 1975. There is no evidence either he or anyone else ever saw the dimes in the sonically sealed hardshell case that housed normal proof sets.

“Other proof coins during the era were released in error by the San Francisco Mint in quantities typically in the 1,000–2,000 range; I can provide documentation from the 2025 Red Book. The fact that only two 1975 no-S proof dimes turned up is highly suspicious in and of itself.

“Did the thief make a killing? Yes. Did Vollmer have legitimate provenance when he brokered the coins? No. Did collectors ordering 1975 proof sets from the mint have a fair shot at receiving a no-S dime in the set of five coins? No.”

Dave responds: Thanks for the clarification. For anyone unfamiliar, the Red Book is a nickname for A Guide Book of United States Coins — a standard reference published annually since 1946.

And lest we allow a random reader to slander someone, the story about the dealer, Mr. Vollmer, checks out in this 2011 Coin World article.

Meanwhile… as long as we’re in emendation mode, I misspoke on Friday when I mentioned “the $95 billion in new aid for Ukraine that Congress passed last spring.”

Meanwhile… as long as we’re in emendation mode, I misspoke on Friday when I mentioned “the $95 billion in new aid for Ukraine that Congress passed last spring.”

The actual figure — which I cited myself last spring! — is “only” $61 billion. The remainder of the $95 billion goes to Israel and Taiwan. Washington has to spread its bets when it comes to stirring up World War III, it seems.

A minor mistake in the scheme of things… but as an old-school journalist for whom accuracy matters, it sticks in my craw. Best get it on the record to ease my conscience…