“AI Whisperers” Wanted

![]() We’re All “AI Whisperers” Now

We’re All “AI Whisperers” Now

“We are seeking a dedicated and innovative AI Prompt Engineer to join our core Academic team,” says a job posting for an unnamed institution posted at Reddit.

“We are seeking a dedicated and innovative AI Prompt Engineer to join our core Academic team,” says a job posting for an unnamed institution posted at Reddit.

“In this role, you'll be focusing on iterating on generative AI prompts for Advanced Placement (AP), Scholastic Assessment Test (SAT) and K-12 education levels.

“Your work will be pivotal in enhancing the academic effectiveness of our AI tools, which play a significant role in the academic progression of students using our programs.”

The job posting lists just four requirements for the entry-level position — none of which is college degree-related — with an annual starting salary of $100K.

Even as the U.S. job market softens, there’s one in-demand profession: “AI whisperer” (aka AI prompt engineer).

Even as the U.S. job market softens, there’s one in-demand profession: “AI whisperer” (aka AI prompt engineer).

The rapid adoption of AI across industries has been met with a shortage of these professionals. With no standardized training route, prompt engineers most often learn through hands-on experience, online communities and self-study.

And they’re commanding six-figure salaries and sparking fierce competition among employers. (In pricey areas like San Francisco, for instance, salaries can reach $335,000.)

Their skill set combines technical expertise — with creative flair — to optimize large language models (LLMs) by generating well-crafted prompts to improve AI performance, potentially saving companies billions in operational costs.

The rise of AI prompt engineering serves as a reminder of the opportunities that emerge with technological advancements.

And as AI advances — becoming more user-friendly — the role will undoubtedly evolve.

Or, as Redditor “n00bvin” put it, we’re all “AI whisperers“ now…

“If I think about it, the way I use AI to complement my work, I'm getting paid over $100K as a prompt engineer. It's changed the way I work.”

“The good news is that AI isn’t going to destroy the job market as so many people expect,” says James Altucher, Paradigm’s AI expert who wrote a seminal paper on the subject when he was in college at Carnegie Mellon University.

“The good news is that AI isn’t going to destroy the job market as so many people expect,” says James Altucher, Paradigm’s AI expert who wrote a seminal paper on the subject when he was in college at Carnegie Mellon University.

“AI will create a greater supply of services and products in high demand. This will create more conveniences for consumers at cheaper prices,” James notes.

“And selling greater supply at cheaper prices will allow businesses to generate greater profits. Those profits will allow for greater expansion, more products and services and hiring more employees.

“I might be 10% wrong. But I’ll still be 90% right,” he adds wryly. “Creative destruction is a part of life…

“Just ask the buggy whip makers and the lamplighters. When tech came for their jobs — the automobile and the electric light bulb respectively — it happened fast and it was permanent.

“AI WILL shake things up, but it will also create many new opportunities.

“This won’t all happen right away,” James concludes, “but soon we’re going to see a new landscape of jobs. It’s important to get ready for it.

“And it’ll create fortunes for investors who see it coming.”

![]() Coming Soon: Ethereum ETF

Coming Soon: Ethereum ETF

“The Ethereum ETF is expected to launch soon,” says Paradigm’s crypto expert Chris Campbell. “The date isn’t as important as the realization: It’s coming fast.

“The Ethereum ETF is expected to launch soon,” says Paradigm’s crypto expert Chris Campbell. “The date isn’t as important as the realization: It’s coming fast.

“I expect significant growth in Ethereum over a span of 18 months or so — not overnight,” he adds. Meanwhile? “We’re skating to where the puck is headed.

“Looking at the tailwinds during this stage…

- The changing regulatory environment in Washington is favorable to crypto

- Stablecoins, the greatest on-ramp to crypto, are surging in adoption

- Demand for ETH is rising while supply is diminishing.

“Recall, Ethereum’s supply peaked almost two years ago,” says Chris, “and it’s been on a steady downtrend since. All it might take is one big catalyst, like an ETF, to cause a supply shock.

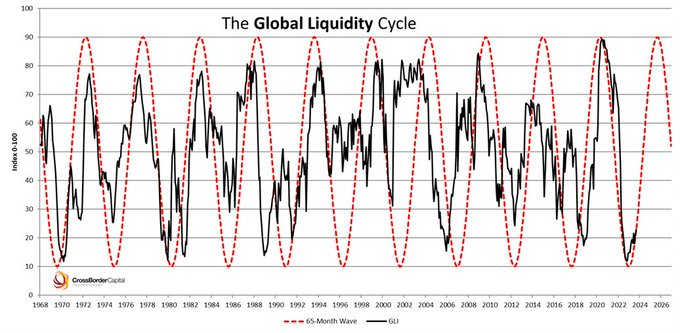

“Finally,” he says, “the global liquidity index bottomed out in 2022. When liquidity is declining, crypto, on the whole, is generally sluggish.

“But like everything else, global liquidity is cyclical. And there are signs global liquidity is turning…

“When liquidity is increasing, crypto is the fastest horse ever.

“Plus, the journey to 1 billion Ethereum users is upon us. Once we hit that milestone, it’s off to the races,” Chris says.

Taking a look at Ethereum today, the second-place crypto is up 1.40% to $3,100. Meanwhile, flagship crypto Bitcoin is in the red — down 0.20% to $57,660 at the time of writing.

Taking a look at Ethereum today, the second-place crypto is up 1.40% to $3,100. Meanwhile, flagship crypto Bitcoin is in the red — down 0.20% to $57,660 at the time of writing.

As for stocks, the S&P 500 broke above 5,600 for the first time today. It’s up about 0.65% to 5,615 this afternoon. As for the other two major U.S. indexes, the techie Nasdaq is up almost 1% to 18,600 while the staid DJIA is up 0.50% to 39,475.

Per the commodities complex, oil is up 0.65% to $81.93 for a barrel of WTI. According to OPEC guidance today, the outlook is strong for crude on the basis of global economic growth. As for precious metals, gold is up 0.45% to $2,378.70 per ounce but silver is down 0.30% — still a nickel under $31.

Meanwhile, copper — more on the red metal in a moment — is up 0.15% to above $4.50 per pound.

![]() So You Bought a Power Plant

So You Bought a Power Plant

Joining Big Tech in buying energy infrastructure, Singapore-based commodities firm Trafigura Group is purchasing a gas-fired power plant near Dallas.

Joining Big Tech in buying energy infrastructure, Singapore-based commodities firm Trafigura Group is purchasing a gas-fired power plant near Dallas.

“Trafigura and its joint venture partner, Frontier Group of Companies, announced the acquisition of the Mountain Creek power plant in Texas from a group of financial investors for an undisclosed sum,” says trade publication Energy Connects.

“The 808MW steam turbine gas-fired power plant [provides] a flexible source of electricity during periods of high demand. [The] 1,500-acre site, equipped with existing grid infrastructure, offers potential for future development opportunities.”

Overhead view of Mountain Creek open-cycle gas turbine

Trafigura spokesman Richard Holtum says: “This strategic asset will support our growing gas and power business in the U.S. and will continue to provide a flexible source of energy to the fast-growing Texas market.”

We underscore that the recent trend of acquiring power plants strongly suggests investors anticipate an incoming energy shortage. By purchasing facilities that might otherwise be decommissioned, these investors could potentially stabilize power supply by keeping these plants online.

This strategy, at the same time, is unlikely to mitigate rising electricity costs, which are expected to increase due to growing grid instability plus the premature closure of gas and coal-fired plants.

It’s worth repeating: The “green transition” won’t be as painless as promised. Read on for more related news…

![]() Strippers Target U.S. Cities

Strippers Target U.S. Cities

Attack of the strippers? The New York Times reports on the rise of post-pandemic copper thefts…

Attack of the strippers? The New York Times reports on the rise of post-pandemic copper thefts…

“The lights are going out across American cities, as a result of a brazen and opportunistic type of crime. Thieves have been stripping copper wire out of thousands of streetlights and selling it to scrap metal recyclers for cash,” the NYT says.

“The wiring typically fetches only a few hundred dollars, but [is] costing cities millions to repair.”

[Our publication’s been following copper thefts for over a decade now — in the U.S. and abroad. In 2013, for example, we mentioned how copper thieves in France stripped extensive railway infrastructure, causing 5,800 hours of train delays. More recently, in May 2024, we reported a high-wire act, targeting a cell tower in Houston.]

“It seemed like a weird little issue when it first came up,” says Minnesota Gov. Tim Walz. “But it is costly and destructive.” Gov. Walz, in fact, recently signed legislation requiring buyers of scrap copper to obtain a state-approved license to verify all copper purchases are legal.

Back to the NYT: “The thefts come amid a feverish demand for copper and other metals. Copper, in particular, is at the heart of the evolving economy — a key component of battery-powered cars, modern electrical grids and the giant new data centers powering artificial intelligence and other technology.”

Karthnik Valluru of Boston Consulting Group emphasizes: “It is the most important metal when it comes to the energy transition.

“The world can’t get enough copper.”

![]() Farewell to the Floppy Disk

Farewell to the Floppy Disk

It's 2024, and Japan has finally decided to kick floppy disks to the curb.

It's 2024, and Japan has finally decided to kick floppy disks to the curb.

You might think Japan would be technologically cutting-edge, but up until last month, citizens were still expected to hand over documents to the government on 3½-inch floppy disks — disks that Sony, for instance, stopped manufacturing in 2011.

(To put that in perspective, one floppy disk holds 1.44MB of data. To match the storage of a 32GB memory stick would require about 22,000 floppies!)

“As part of its belated campaign to digitize its bureaucracy, Japan launched a Digital Agency in September 2021,” the BBC notes.

Three years later, after finally vanquishing the floppy disk, Digital Minister Taro Kono promises to “get rid of the fax machine,” despite “earlier plans to remove these machines from government offices were scrapped because of pushback,” the BBC says.

Japan’s resistance to the digital age, in fact, goes far beyond preferring faxes over emails. “It was not until 2019 that the country's last pager provider closed its service, with the final private subscriber explaining that it was the preferred method of communication for his elderly mother.”

And talk about analog tech: “Many [Japanese] businesses still require official documents to be endorsed using carved personal stamps called hanko” which came into common use circa 1870.

Hanko: Courtesy eBay

It sounds like the Japanese penchant for old-school technology has nothing on the IRS’ archaic computer system — a system so obsolete that the agency has “difficulty finding employees with such knowledge,” according to the GAO.

Good to know…