Calm Before NVDA Storm

![]() Nvidia’s Decision Day

Nvidia’s Decision Day

Will Nvidia’s CEO Jensen Huang have another “Steve Jobs moment”?

Will Nvidia’s CEO Jensen Huang have another “Steve Jobs moment”?

That’s how Paradigm’s iconoclast investor James Altucher described Huang wowing a San Jose, California crowd earlier this year with Nvidia’s AI chip codenamed “Blackwell.”

Much as Apple co-founder Steve Jobs did back in the day with iPhones and more…

“He even looked like Steve Jobs!” observed our VP of Publishing Doug Hill.

Once again today, financial media is plastered with Nvidia news. It’s inescapable: Nvidia reports earnings on Wednesday…

Once again today, financial media is plastered with Nvidia news. It’s inescapable: Nvidia reports earnings on Wednesday…

This after the giant chipmaker’s shares have skyrocketed 87% so far this year; in fact, NVDA closed at a record high yesterday.

“Traders are pricing in a big move for Nvidia’s shares after the chipmaker reports earnings on Wednesday, though expectations for volatility are more muted than in the past, U.S. options markets show,” Reuters reports.

“Nvidia's options are primed for an 8.7% swing in either direction by Friday, according to data from options analytics firm Trade Alert.” That’s a decent — but not mind-blowing — swing, right?

But get this: “That would translate to a market cap swing of $200 billion,” says Reuters, “larger than the market capitalization for about 90% of S&P 500 companies.”

“There is a lot riding on the AI trade,” says Steve Sosnick of Interactive Brokers.

“There is a lot riding on the AI trade,” says Steve Sosnick of Interactive Brokers.

“Wall Street is betting on a blowout quarterly report from Nvidia,” Reuters adds. “A downturn in Nvidia could test investors’ resolve regarding the broader AI trade.”

On the other hand, in a BofA note Monday, strategists say: “It’s not just about NVDA anymore… AI benefits are broadening out.”

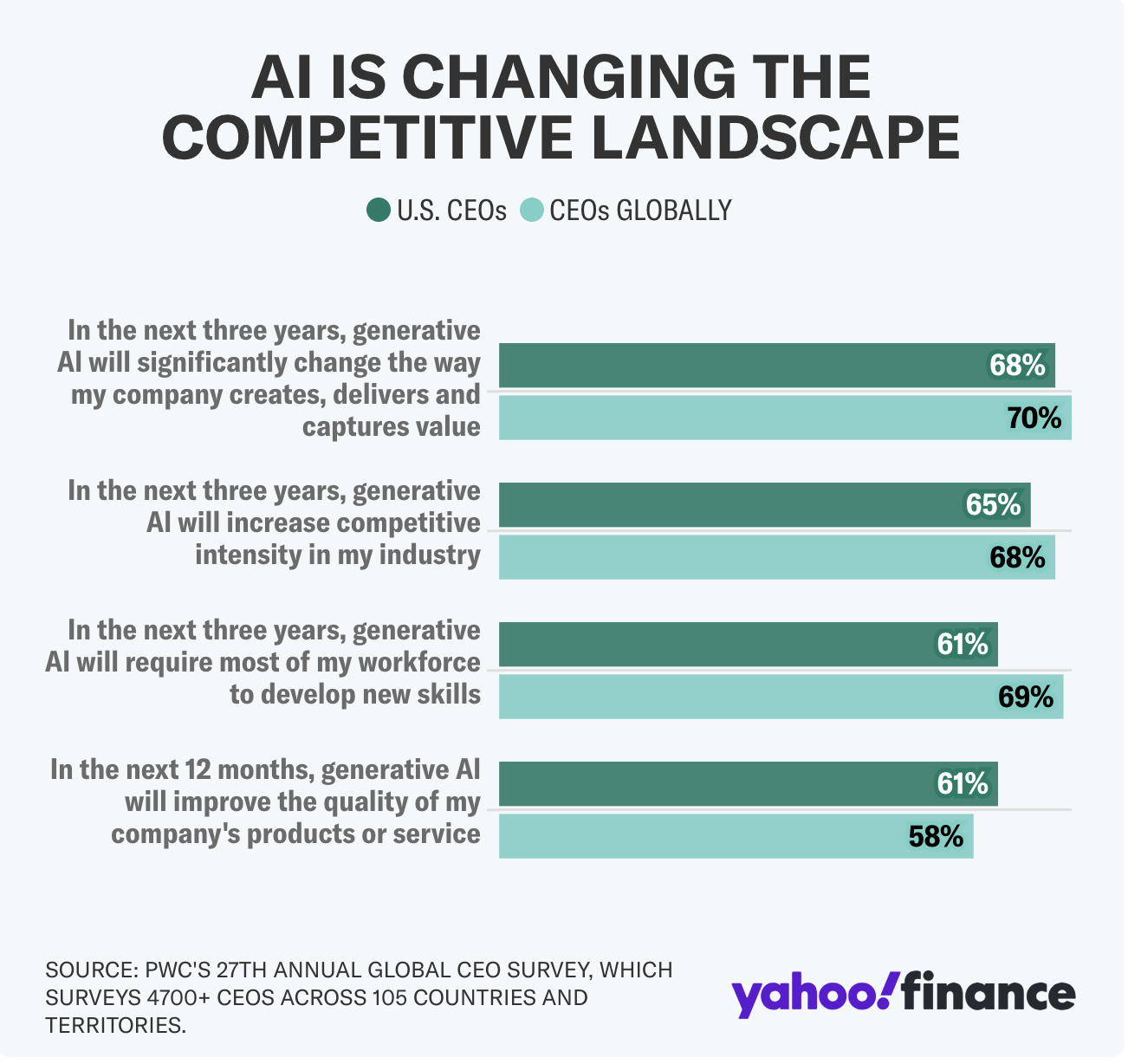

And a recent survey of more than 4,700 CEOs in 105 countries verifies that point…

To wit: “BofA’s strategists expect [Nvidia] to drive 9% of the S&P 500 earnings growth over the next 12 months, compared to 37% over the last 12 months,” says Reuters.

Regardless, Steve Sosnick says to proceed with caution: “Yes, the rally has broadened out… but I'm not sure how sturdy it would be if Nvidia sold off hard.”

Word. We’ll find out Wednesday…

As for Paradigm’s AI expert James Altucher, he says Nvidia’s next announcement will be “one of the most defining moments in tech history… Like when Steve Jobs presented the world’s first iPhone on Jan. 9, 2007.

“That’s why I don’t want you to wait until Wall Street catches on,” he says, “dumping trillions of dollars into a few small AI stocks.”

If you view James’ briefing, he makes a compelling case for why Main Street investors should make AI innovation a top priority.

And for why he’s eyeing a fledgling AI firm that could be at the center of a $15.7 trillion windfall in 2024…

![]() A TLT-erwhirl Market

A TLT-erwhirl Market

“If interest rates are remaining higher for longer, why has the bond-related ETF TLT been performing so badly this past month?” a reader asks Paradigm’s income-investing ace Zach Scheidt at the Lifetime Income Report.

“If interest rates are remaining higher for longer, why has the bond-related ETF TLT been performing so badly this past month?” a reader asks Paradigm’s income-investing ace Zach Scheidt at the Lifetime Income Report.

“First, let’s talk about what Treasury bonds are and how they work,” says Zach.

“A Treasury bond is an agreement that the U.S. Treasury will pay back all the money you invested when your bond matures.

“You may also receive interest payments (or coupons) along the way, depending on which type of bond you buy.

“Since the amount that the bond pays remains the same, the only thing that can change about that bond is its current price.

“The current price of a Treasury bond has an inverse relationship to interest rates.

“In other words, bond prices tend to fall when interest rates are high. And bond prices tend to rise when interest rates fall,” Zach says.

“In other words, bond prices tend to fall when interest rates are high. And bond prices tend to rise when interest rates fall,” Zach says.

“The same principles apply to other bond-related investments like iShares 20+ Year Treasury Bond ETF (TLT).” For example…

- “The ETF plummeted when the Federal Reserve started raising interest rates in 2022

- The ETF began to recover late last year as investors speculated about rate cuts in early 2024.

“But now that it’s clear the Fed will likely keep rates higher for longer,” Zach says, “the ETF is under pressure once again.

“While the index will make short-term moves,” Zach points out, “a long-term tailwind for bonds likely won’t come until the rate-cut cycle begins.”

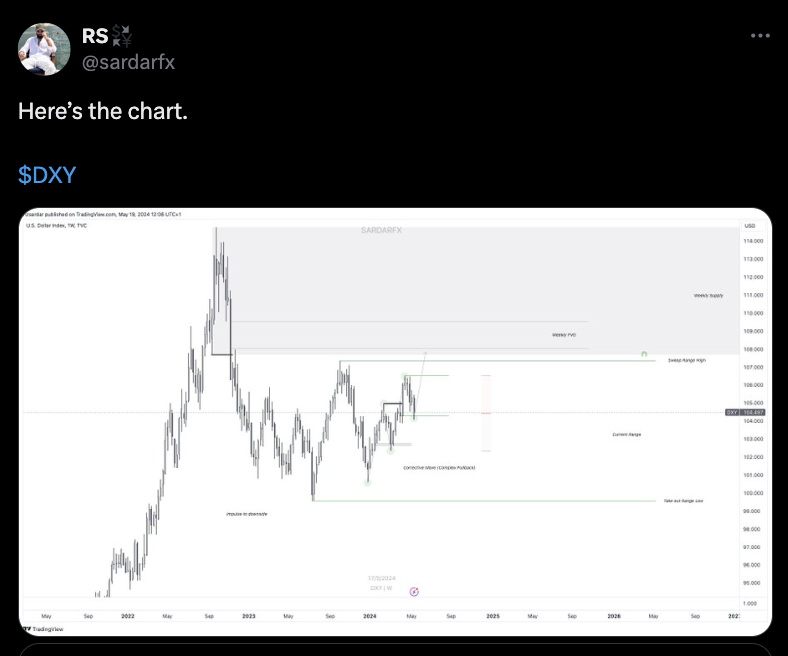

“The dollar index has failed to find any traction so far in May — much to the delight of stock market bulls,” says Paradigm’s chart hound Greg “Gunner” Guenthner.

“The dollar index has failed to find any traction so far in May — much to the delight of stock market bulls,” says Paradigm’s chart hound Greg “Gunner” Guenthner.

In general? Weak dollar = strong stocks…

“Yes, stocks managed to fight against the dollar rally for most of 2024, but the extra ‘slippage’ into this month couldn’t have hurt.

“The major averages are all fresh off new highs — and the U.S. indexes aren’t the only names on the list,” Gunner says. “In fact, 14 of the world’s 20 largest stock markets have recently logged all-time highs, including Europe, Canada, Brazil, India, Japan and Australia.”

“The major averages are all fresh off new highs — and the U.S. indexes aren’t the only names on the list,” Gunner says. “In fact, 14 of the world’s 20 largest stock markets have recently logged all-time highs, including Europe, Canada, Brazil, India, Japan and Australia.”

Glancing at stocks today, the three major U.S. indexes are barely hanging onto green. The Dow, S&P 500 and Nasdaq are up to 39,815, 5,305 and 16,800 respectively. (Similarly, NVDA shares are pretty much flat at $949.77 per share.)

Commodities are cooling with crude down 1.60% to $78.50 for a barrel of WTI. Precious metals, you wonder? Gold’s pulled back 0.50%, but it’s still above the $2,400 mark, at $2,425 per ounce. Silver, too, is taking a breather, down 1.50%, but just pennies under $32.

- Meanwhile, Gov. Kay Ivey signed state Senate Bill 297yesterday, making Alabama the 13th state to eliminate all income taxes on capital gains from the sale of gold and silver. “By eliminating taxes on transactions involving these precious metals, we affirm our commitment to upholding the principles of sound money and protecting the savings of our constituents,” says one of the bill’s sponsors, state Sen. Tim Melson.

Checking on crypto, Bitcoin has gained 0.55%, just above $70,000. Simultaneously, Ethereum has rocketed 12% to $3,800. More on ETH to come…

![]() Ethereum’s Decision Day

Ethereum’s Decision Day

“On Thursday, the SEC will either affirm or deny the Ethereum spot ETF,” notes Paradigm colleague and editor Chris Campbell.

“On Thursday, the SEC will either affirm or deny the Ethereum spot ETF,” notes Paradigm colleague and editor Chris Campbell.

Depending on the source, the odds of a May 23 approval range from Polymarket’s 11% to Bloomberg’s collective ETF analysts’ 75%.

All to say, those firmly in the DeFi space are exceedingly more bearish than traditional finance.

“Much of the bearish sentiment comes from the fear that the SEC is going to classify Ethereum as a security,” Chris continues.

In a 2018 video, however, SEC chair Gary Gensler proposed that Ethereum was not a security; instead, he told a group of hedge fund managers that ETH was a commodity.

Case closed? Not quite. Gensler’s claim was made before Ethereum switched from proof-of-work mining to a proof-of-stake model in 2022.

“While [Gensler] has been reluctant to clarify Ethereum's status in front of Congress, the upcoming ETF decision will force the issue,” says Chris.

“While [Gensler] has been reluctant to clarify Ethereum's status in front of Congress, the upcoming ETF decision will force the issue,” says Chris.

“There’s a real chance the SEC is moving toward classifying Ethereum staking as a security, while keeping Ethereum as a commodity.” Not confusing at all…

“Though speculative, consider this: Ark and 21Shares, two prominent financial firms, have spot ETH ETF decisions due on May 23,” Chris adds.

“Interestingly, they both recently amended their filings to remove the staking of underlying ETH.

“Normally, staking ETH in an ETF would provide free revenue, so no issuer would proactively remove this unless a regulator had signaled a path forward.

“This indicates that they are preparing for an approval that aligns with regulatory expectations.”

In addition, the world’s largest crypto asset manager Grayscale, “a firm known for its tenacity in the face of regulatory hurdles, recently withdrew its ETH futures ETF application,” Chris says.

Which is unlike Grayscale — the firm fought tooth-and-nail for spot Bitcoin ETF approval, for instance. “Their decision to withdraw could suggest they see a spot ETH ETF approval as imminent.

“So what’s going to happen on Thursday?

“The approval of spot ETH ETFs could be a game-changer for Ethereum and the broader crypto industry,” Chris notes.

“The approval of spot ETH ETFs could be a game-changer for Ethereum and the broader crypto industry,” Chris notes.

“It would provide regulatory clarity and open up access to new capital inflows, similar to the impact of spot Bitcoin ETFs.

“An unexpected approval this week would undoubtedly reverse the current low sentiment surrounding Ethereum and potentially lead to a WILD run upward.

“If the ETF is denied, not much will happen,” Chris claims. “We might see a small dip in ETH, but most people will shrug.

“But… is it worth the speculative risk?

“The downside seems pretty limited,” Chris concludes. “So the risk isn’t huge for Ethereum. I’m also NOT saying go bet the farm on Ethereum.

“To be clear, James Altucher and I both believe the Ethereum spot ETF is inevitable” — it’s simply a matter of timing.

“But if we see a surprise approval Thursday? We’re going to see fireworks.”

![]() South Korea Embraces Gold

South Korea Embraces Gold

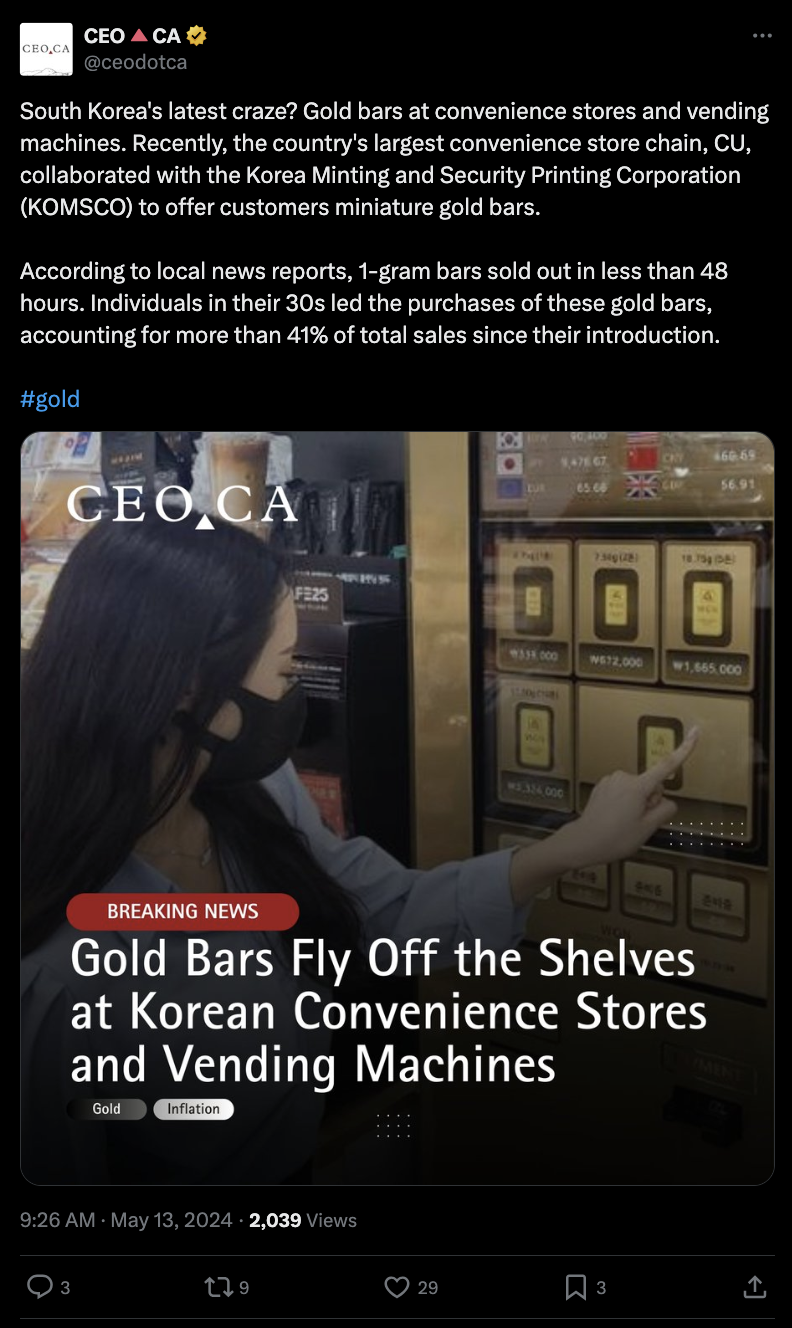

Last week, we told you about a cookie-delivery company offering a deluxe (literal) gold package. Today? “South Korea’s convenience stores have a new popular item on the menu — gold bars,” says CNBC.

Last week, we told you about a cookie-delivery company offering a deluxe (literal) gold package. Today? “South Korea’s convenience stores have a new popular item on the menu — gold bars,” says CNBC.

Incidentally, Gen Z was the least likely to buy gold at CU, accounting for just about 7% of CU’s gold sales. (Probably just broke, heh.)

The shift to young precious metals investors is real. It’s something Paradigm’s mining expert Byron King observed in-person in 2022 at the world’s largest mining conference in Toronto: “This is not your dad's PDAC,” he said at the time, “let alone Granddad's.”

![]() Mailbag: “Touch Grass” and Very British Things

Mailbag: “Touch Grass” and Very British Things

“Emily, you wrote on Friday: ‘Touch grass this weekend, as the kids say.’

“Emily, you wrote on Friday: ‘Touch grass this weekend, as the kids say.’

“Having already achieved the biblical three score and ten, I had to look that phrase up. I mistakenly thought it might be akin to the older phrase: touch wood.

“On the other hand, all things considered, perhaps we should all go outside and touch wood for good luck.”

Emily: Having two college-age kids keeps me in the linguistic loop… And did you know that “touch wood” is an anglicism?

Which leads to our next correspondent today…

“I enjoy reading your 5 Bullets,” he writes. I sense the inevitable but…

“I enjoy reading your 5 Bullets,” he writes. I sense the inevitable but…

“In Saturday’s issue you write: ‘Like most everything related to government bureaucracy, the ULEZ-scrap scheme isn't going according to plan.’

“Just to point out that the London ULEZ-scrap scheme is a local government initiative, not a national government initiative. These schemes are up to the local city councils, elected by the people of that city, to implement if they wish. The national government has delegated numerous powers to various cities in England, including those involving vehicle emissions.

“This is perhaps best illustrated by the fact that in the recent local election for London mayor (which elected Sadiq Khan for a third term), his main opponent had on her ticket the immediate abolition of the entire ULEZ scheme were she to win the mayoral election.

“I apologize for what might seem to be a trivial point, but as a London voter, any such unintentional ambiguities need to be clarified.

“Nevertheless, it’s very nice to see a U.S. company focus on England’s largest city.”

Emily: We always enjoy hearing from our overseas Paradigm readers. No need to apologize; thanks for the clarification! (Also, what do you think of ULEZ fines? Have you been affected?)

We’ll be back at it again tomorrow… Take care!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets