Clowns to the Left, Monkeys to the Right (Boeing)

![]() Clowns to the Left, Monkeys to the Right (Boeing)

Clowns to the Left, Monkeys to the Right (Boeing)

The Boeing 737 Max was “designed by clowns who in turn are supervised by monkeys.”

The Boeing 737 Max was “designed by clowns who in turn are supervised by monkeys.”

So said an instant message traded among Boeing employees in 2018 — not long before two of those jets crashed within the space of five months, killing 346 people.

Wait, where are the supervising monkeys?

As you’re surely aware, the Boeing 737 Max is back in the news after the latest iteration of the jet — the 737 Max 9 — suddenly sported an open-air design during an Alaska Airlines flight on January 5.

We won’t delve into the details, which you can read anywhere. Suffice to say Boeing shares slid another 7.9% yesterday after news that additional safety checks will postpone delivery of older 737 Max models to China. All told, BA shares are down about 20% since the latest incident.

“Simply put, Boeing isn’t the company it used to be,” says Paradigm Press macroeconomics maven Jim Rickards.

“Simply put, Boeing isn’t the company it used to be,” says Paradigm Press macroeconomics maven Jim Rickards.

And there’s a clear starting point to Boeing’s downhill slide — its merger with McDonnell Douglas in 1997.

“That changed Boeing’s culture, and for the worse,” says Jim.

“Boeing was known for its strong emphasis on engineering and quality control. It was part of the company’s ethos.

“McDonnell Douglas, on the other hand, placed special emphasis on cost cutting and financial innovations to improve its bottom line. It’s not that it completely neglected quality control or that it didn’t care about safety. Obviously, airplane manufacturers can’t afford to disregard them.

It’s just that it placed relatively greater emphasis on financial considerations than Boeing.”

Before the merger, Boeing maintained a strict segregation between the civilian and military sides of the company.

Before the merger, Boeing maintained a strict segregation between the civilian and military sides of the company.

“Senior management reportedly enforced an unwritten rule that managers from the defense side should never be transferred to the civilian arm,” wrote Andrew Cockburn in Harper’s in 2019, “lest they infect it with their culture of cost overruns, schedule slippage and risky or unfeasible technical initiatives.”

That division was swept away with the Boeing-McDonnell Douglas merger. By 2003, McDonnell’s former CEO Harry Stonecipher was Boeing’s CEO. “When people say I changed the culture of Boeing, that was the intent,” Stonecipher said — “so that it’s run like a business rather than a great engineering firm.”

Back to Jim Rickards: “Starting in 2010, Boeing spent tens of billions on stock buybacks and other financial machinations to enhance its share price. At the same time, the company took on massive amounts of debt.”

And so two of the post-merger Boeing’s most ambitious projects in civilian aircraft have been star-crossed affairs — the costly and glitch-prone 787 Dreamliner (at least that one hasn’t killed anybody) and the 737 Max.

In the present moment, “legal liability will be enormous,” says Jim Rickards.

In the present moment, “legal liability will be enormous,” says Jim Rickards.

“Business losses will also be huge based on grounding the entire fleet, identifying the defects and repairing them on all of the existing planes as well as making assembly adjustments to any work in progress.

“New safety protocols will have to be developed to make sure the problem does not reoccur, and pilots, crews and ground personnel will have to be retrained to look for future problems. The airlines will suffer losses from the groundings and will seek recourse from Boeing.”

To be sure, Boeing isn’t going anywhere and it won’t face any criminal liability. As we chronicled in 2019 after the initial 737 Max fiasco, Boeing gets the same pass from the feds as the biggest banks — on account of its status as a defense contractor. Not only is it “too big to fail,” it’s too big to jail.

But that doesn’t make Boeing a buy — even after its 20% drop in a week and a half. “This story has much longer to run,” Jim says, “more negative facts will emerge, management changes are likely and the stock has much further to fall.”

➢ You can’t make this stuff up: “Blinken Stranded After Boeing 737 Breaks Down on Davos Trip,” says a Bloomberg alert as we approach deadline. Some sort of oxygen leak that couldn’t be fixed right away, apparently. Thus the secretary of state and his retinue can’t make it home just yet…

![]() Strong Dollar, Stalled Stocks (and Gold)

Strong Dollar, Stalled Stocks (and Gold)

As goes the dollar, so go the markets.

As goes the dollar, so go the markets.

At 103.6, the U.S. dollar index is the highest it’s been in over a month — up sharply from less than 100.5 toward year-end 2023.

All else being equal, dollar strength against other major currencies is a drag on stocks, gold and crypto.

The stock market’s November–December rally coincided with a big drop in the dollar index: Ditto for gold rallying strongly past $2,000.

And so here in early 2021, stocks and gold struggle to set records.

And so here in early 2021, stocks and gold struggle to set records.

At last check, the S&P 500 is down about a half percent to 4,740 — still about 60 points below that early-2022 record close. And gold is only eight bucks away from breaking below $2,000; it breached that barrier briefly in December before rebounding. Bitcoin is in the red at $42,369.

As was the case yesterday, crude is little moved at $72.19 despite ongoing trouble in Middle Eastern sea lanes.

The big economic numbers of the day have a cusp-of-recession vibe…

The big economic numbers of the day have a cusp-of-recession vibe…

- Retail sales jumped 0.6% in December, more than expected. If you factor out volatile automobile sales and falling gasoline prices, you still get a stronger-than-expected 0.6% jump. The bad news here is that most Americans’ pandemic-era savings are long gone; all this spending is being rung up on plastic

- Industrial production ticked up 0.1% in December, as did manufacturing output. The bad news here is capacity utilization: 78.6% of America’s industrial capacity was in use last month, the weakest in over two years and roughly equal to the autumn of 2019 — when we were likely headed into a recession even without COVID.

Meanwhile, the corporate media is stumbling all around trying to make sense of the latest economic data from China…

The Hong Kong and Shanghai stock markets didn’t have any trouble interpreting these numbers: Both of them closed at new 52-week lows today.

And yes, China’s government has resumed reporting unemployment among young people after a six-month suspension. Before the pause, it was 21.3%. Now, miraculously, it’s 14.9%!

Brings to mind the crack by China’s late premier Li Keqiang, about how China’s economic statistics are “man-made.” If only we could have such candor among our own officials…

![]() There’s Truth in Those Old Market Sayings

There’s Truth in Those Old Market Sayings

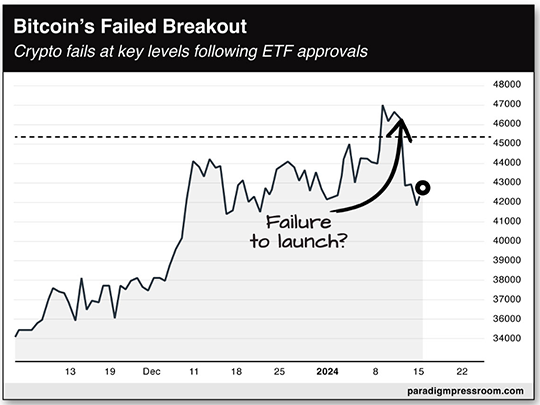

The recent experience of the crypto sector is a perfect illustration of an old market saw: “Buy the rumor, sell the news.”

The recent experience of the crypto sector is a perfect illustration of an old market saw: “Buy the rumor, sell the news.”

As we chronicled in real time last week, the feds approved a slew of Bitcoin ETFs. “The news sparked plenty of excitement throughout crypto exchanges and news providers, as well as the broader investing community,” says Paradigm trading pro Greg “Gunner” Guenthner.

“The mainstream media even dubbed the approval a watershed moment for Bitcoin and the broader crypto industry.

“But for traders attempting to play the news, this watershed moment failed to yield spectacular gains immediately following the announcement. Instead, the new crypto ETFs dropped. As did Bitcoin. Other cryptocurrencies followed suit. The crypto celebrations flipped to confusion.”

What gives? “Investors held overwhelmingly bullish positions into the SEC decision,” Gunner continues. “The market then got its expected result: approval!

What gives? “Investors held overwhelmingly bullish positions into the SEC decision,” Gunner continues. “The market then got its expected result: approval!

“But all the gains were front-loaded into the announcement. The bulls had already bought. When the mind-bending gains didn’t materialize right away, impatient traders sold the news.

“The Bitcoin ETF debacle is a classic case of the market getting way too far ahead of itself. This doesn’t mean the ETF approvals aren’t good for crypto in the long term. But we’ll probably need to see Bitcoin (and crypto-adjacent stocks and ETFs) backfill and consolidate before they resume their rallies that began late last year.

“Last week’s Bitcoin move has all the hallmarks of a failed breakout. It pushed above $49K on the ETF announcement, only to immediately retreat back toward $46K, then into its previous consolidation range below $44K. This is classic sell the news action.”

Consider the Bitcoin ETF episode an object lesson as earnings season gets cranked up.

Consider the Bitcoin ETF episode an object lesson as earnings season gets cranked up.

“I’m betting we’ll see more than a few surprises that catch investors off guard. My theory about why earnings cause so much angst is that the numbers and the market reaction don’t always match. A company can report stellar sales and a growing bottom line and raise forward guidance. Yet shares can still drop once the opening bell rings.

“These post-earnings shenanigans infuriate many market watchers because the stock in question isn’t acting right. ‘It’s not doing what it should be doing,’ they grumble as the stock plummets despite beating analyst estimates.”

Once more — and we can’t emphasize it often enough — the most dangerous word in all of investing is should.

![]() Electric Vehicles + Polar Vortex = Stranded!

Electric Vehicles + Polar Vortex = Stranded!

Welp, it was inevitable…

Welp, it was inevitable…

Amid a Midwestern deep freeze, electric vehicle drivers are contending with “long lines at charging stations and reduced battery life,” reports Chicago’s WGN-TV. Some drivers even needed a tow to get to a charger.

Yep. EV batteries just don’t cope with the cold very well. In extreme cold, they won’t even take a charge. “Public charging stations have turned into car graveyards over the past couple of days,” says Chicago’s WFLD.

Yes, you can “precondition” the battery once it gets below 32 degrees Fahrenheit. But once you get down to, say, 10 below, forget it.

Another sign that green hysteria has peaked out? Not so fast.

Joe Biden’s “climate czar” John Kerry is hobnobbing at the World Economic Forum’s shindig in Davos, Switzerland this week.

“If you wound up with a different president who was opposed to [the] climate crisis,” he said, “I got news for you. No one politician anywhere in the world can undo what is happening now.”

OK, boomer.

The theme for this year’s Davos gathering, by the way, is “Rebuilding Trust.”

Yeah, that ship sailed — using bunker fuel derived from hydrocarbons — long ago.

![]() Mailbag: Backup Power, Golden State Handcuffs

Mailbag: Backup Power, Golden State Handcuffs

“I wouldn't get too snarky about Generacs as doorstops,” writes one of our regulars after we revisited the topic of electricity and natural gas outages last week.

“I wouldn't get too snarky about Generacs as doorstops,” writes one of our regulars after we revisited the topic of electricity and natural gas outages last week.

“I have an all-electric home in a rural area with no gas service. I also get my water from a well that's powered by a 30-amp electrical circuit so my home becomes almost unlivable in a power failure.

“As a result of timely warnings about the dim future for electric system reliability from good folks like you, I had a Generac installed several years ago because they don't operate on just natural gas. Mine runs on propane. They can also be run on gasoline.

“We haven't had many outages, but a couple years ago, we were the only house in the neighborhood with lights on for about four hours one night.”

Dave responds: Good on you. I’m just thinking about the folks whose generators are connected to commercial natgas service. Seems like a major vulnerability even if the gas line is still functioning. I mean, if everyone in the neighborhood gets the same idea to install those units, can the utility support that additional demand?

“My property taxes are such that I cannot afford to leave California,” writes an 80-something reader on the subject of Golden State taxation.

“My property taxes are such that I cannot afford to leave California,” writes an 80-something reader on the subject of Golden State taxation.

“Purchased my home in 1978 for $150K, now worth $1.9 million and rental property as well. Proposition 13 kept my property taxes low, so that selling would be financial suicide. I'll have to leave that to my heirs.

“State income taxes for me are also not a reason to leave as I manage my finances such that my taxable income stays in the lower bracket.”

“I left California in 2013 to work in the Middle East for a couple of years,” writes our final correspondent.

“I left California in 2013 to work in the Middle East for a couple of years,” writes our final correspondent.

“When I was ready to return, my tax preparer told me not to come back to California right away or else California will say I was a California resident working overseas and try to tax my overseas income. I ended up in Pennsylvania, near where I grew up and haven't left yet. Paying a little over 3% state income tax is much better than what it would have been had I gone back to California.

“I still have a house in California that my daughter lives in. Last year I received a letter from the Franchise Tax Board stating that they wanted me to file a return. I let my tax preparer call them and they were able to get me off the FTB radar.

“Hard to see me ever moving back to California. Between the taxes and the other socialist policies California doesn't seem to be a place folks would want to go to. Also encouraging my daughters, who grew up there, to evaluate whether or not it is a place where they want to raise families.

“Enjoy the 5 Bullets every day, even if I read them a day or two later.”

Dave responds: Ha, you and baseball superstar Bryce Harper.

It was five years ago as a free agent that he opted to land with the Philadelphia Phillies over the San Francisco Giants — and as we documented at the time, income taxes appeared to loom large in his decision…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets