Delta Force vs. “Disinformation”

- The U.S. military is adopting AI to fight “disinformation”

- September is lousy for stocks, except…

- Jim Rickards on AI

- The have and have-nots at Burning Man

- “No cash, no dice.”

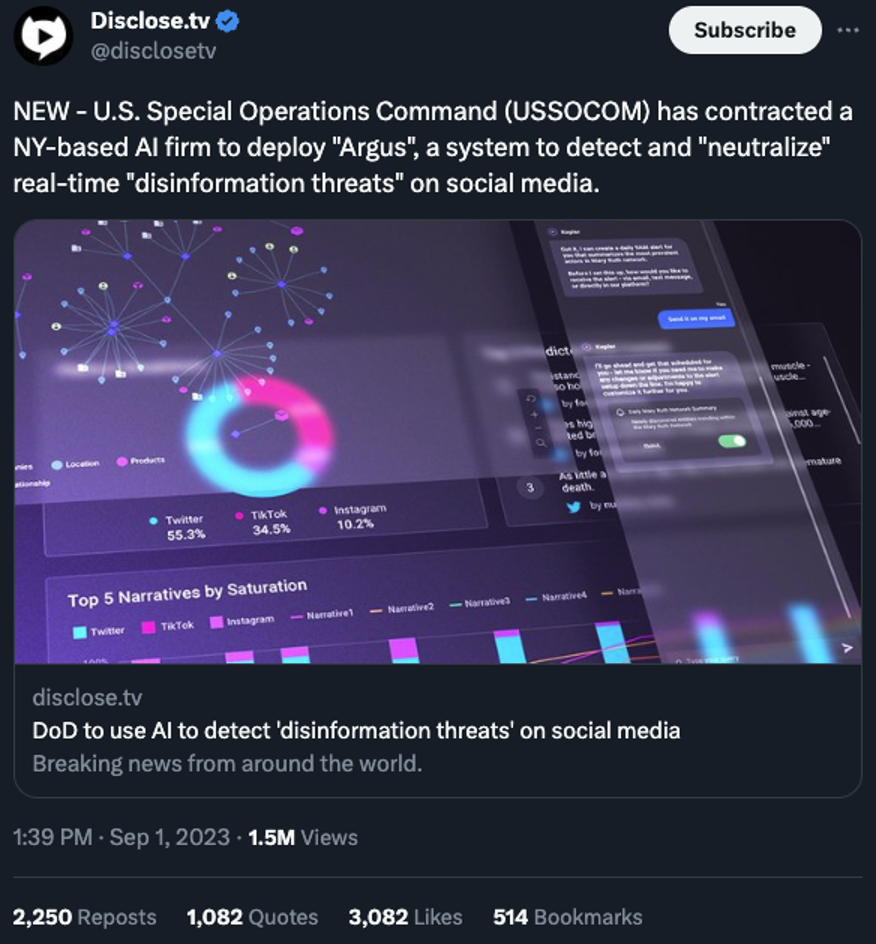

![]() The U.S. Military Is Adopting AI to Fight “Disinformation”

The U.S. Military Is Adopting AI to Fight “Disinformation”

Yeah, so this is totally normal for a liberal Western democracy and not at all a sign of a creeping authoritarian dystopia…

Yeah, so this is totally normal for a liberal Western democracy and not at all a sign of a creeping authoritarian dystopia…

From the site The Defense Post: “The U.S. Special Operations Command (USSOCOM) has contracted New York-based Accrete AI to deploy software that detects ‘real time’ disinformation threats on social media.”

USSOCOM, as in, the special-ops wing of the U.S. military. Using AI to sniff out what it considers “disinformation.”

More from the article: “The company’s Argus anomaly-detection AI software analyzes social media data, accurately capturing ‘emerging narratives’ and generating intelligence reports for military forces to speedily neutralize disinformation threats.”

So from that description you might get the idea that this is something the military would use only overseas — you know, just the next step in a long line of propaganda efforts targeting the populations in adversary nation-states.

But no, not really: “The company also revealed that it will launch an enterprise version of Argus Social for disinformation detection later this year.

But no, not really: “The company also revealed that it will launch an enterprise version of Argus Social for disinformation detection later this year.

“The AI software will provide protection for ‘urgent customer pain points’ against AI-generated synthetic media, such as viral disinformation and deep fakes.”

So from that description you might get the idea that companies would use the software to counter “disinformation” pertaining to their own products and operations. And that’s how Accrete AI CEO Prashant Bhuyan is peddling it: “Companies are already experiencing significant economic damage caused by the spread of AI-generated viral disinformation and deep fakes manufactured by competitors, disgruntled employees and other types of adversaries.”

But let’s get real.

Knowing everything we know about “the censorship industrial complex”... knowing how the government is strong-arming social media to enforce mainstream orthodoxy (we detailed this in our annual censorship issue republished yesterday)... it’s impossible to shake the thought that the U.S. military will soon have jurisdiction over the information you are and aren’t allowed to access. And that the military will find a way to keep its fingerprints off the whole thing, outsourcing its efforts to the “trust and safety” units of the social media giants.

Reminder: Control over information leads inevitably to control over money.

Which brings us to the plight of The Grayzone.

Which brings us to the plight of The Grayzone.

The Grayzone is a news site led by the veteran independent journalists Max Blumenthal and Aaron Mate.

It’s often described as a “left-leaning” site, but that’s a bit simplistic: Blumenthal & co. oppose COVID lockdowns, restrictions and mandates. From the beginning, they understood the devastating impact of such measures on the working class, the poor and the Global South. Most of their coverage, however, shines a bright light on the seamy side of U.S. foreign policy.

Last month, The Grayzone launched a fundraising campaign to support the work of three reporters. The campaign raised $90,000 from about 1,100 contributors on GoFundMe — until GoFundMe froze The Grayzone’s account due to unspecified “external concerns.”

“They only told me due to some external concerns, and I assume that someone would have to be fairly powerful to get GoFundMe to overlook the profit motive that usually governs companies like this to cancel a fundraiser that is extremely successful,” Blumenthal tells Al Jazeera.

A GoFundMe flack would say only that its terms of service do not allow users to “promote inaccurate or misleading information.”

Blumenthal has no problem reading between the lines: The Grayzone has been in the forefront of alternative news sites pushing back against the Establishment narrative that Ukraine is a plucky little democracy and Big Bad Putin’s invasion was totally unprovoked by the U.S. government and if you say otherwise you’re probably on the Kremlin’s payroll.

Blumenthal has no problem reading between the lines: The Grayzone has been in the forefront of alternative news sites pushing back against the Establishment narrative that Ukraine is a plucky little democracy and Big Bad Putin’s invasion was totally unprovoked by the U.S. government and if you say otherwise you’re probably on the Kremlin’s payroll.

At least GoFundMe refunded the readers’ donations. Since then, Blumenthal says The Grayzone has raised $110,000 on an alternative crowdfunding platform called Spotfund.

“GoFundMe is now officially the poster child for politicization of economic services,” writes the independent journalist Matt Taibbi — who exposed many of the government’s strong-arm tactics against social media in his Twitter Files reporting a few months ago.

“GoFundMe is now officially the poster child for politicization of economic services,” writes the independent journalist Matt Taibbi — who exposed many of the government’s strong-arm tactics against social media in his Twitter Files reporting a few months ago.

“They prevented a parents group from renting a billboard to publicize Abigail Shrier’s book Irreversible Damage, froze nearly $8 million in donations to the ‘Freedom Convoy’ Canadian Trucker movement, even wiped out two fundraisers for [the news site] MintPress.

“This Grayzone incident is perhaps most loathsome, lacking even a patina of necessity or justification, while serving as a depressingly obvious preview of things to come…

“The ‘anti-disinformation’ complex,” Taibbi continues, “is close to perfecting the application of financial pressure, finishing a job begun 13 years ago, when PayPal froze donations to Wikileaks after the leak site received a letter from the U.S. State Department. This system is nimble enough now to financially disable actors as different from one another as an American porn star and the London-based Free Speech Union.”

If you’re familiar with Jim Rickards’ “Biden Bucks” thesis, you know the endgame for all of this is a CBDC, or a central bank digital currency. “In a world of CBDCs,” Jim has said, “the government will know every purchase you make, every transaction you conduct and even your physical whereabouts at the point of purchase.”

And in that world, cash is no longer a choice.

As it turns out, we got an enormous response to our Friday edition — in which we asked if you’d continue patronizing a business that goes cashless. Stick around for the mailbag later…

![]() September Is Lousy for Stocks, Except…

September Is Lousy for Stocks, Except…

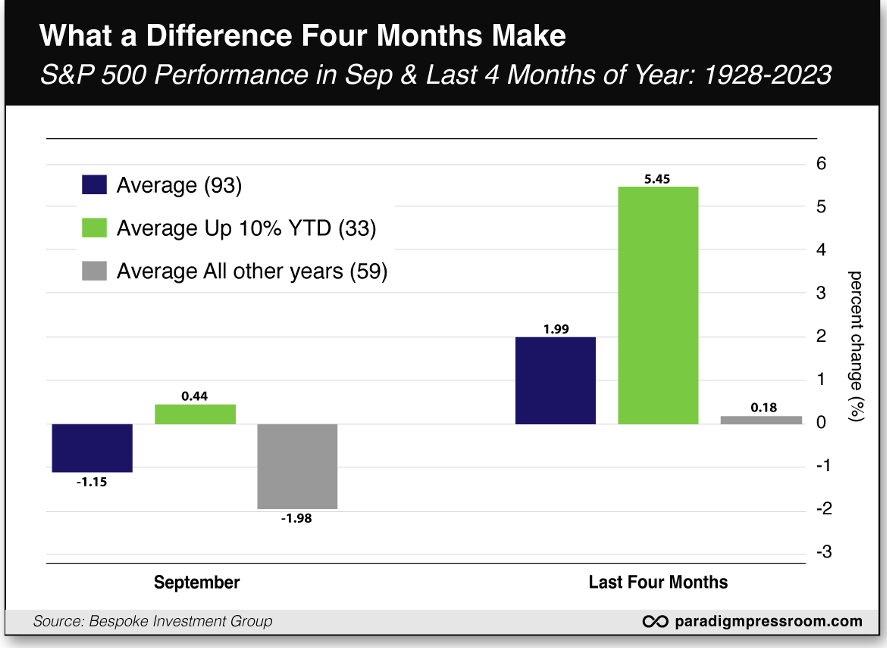

On average, September is the worst month of the year for the stock market — but Paradigm retirement authority Zach Schiedt says the average doesn’t tell the whole story.

On average, September is the worst month of the year for the stock market — but Paradigm retirement authority Zach Schiedt says the average doesn’t tell the whole story.

Research from Bespoke Investment Group finds September the worst month for stock market returns — a negative 1.15%. Similar research from other firms finds September is the only month with an average negative return.

But Zach sees a noteworthy exception to the rule. Consider this: The S&P 500’s total return, including dividends, jumped 19% during the first eight months of 2023.

As he sums up Bespoke’s findings, “the average market return for September is positive 0.44% when the market is up more than 10% heading into the beginning of the month.”

It’s simple: Positive momentum has a way of feeding on itself. And that goes not just for September but for the rest of the year. “In the last four months of the year, the average market return has been 1.99%,” says Zach. “That's a pretty low number compared with the first eight months of an average year.

“But if you only look at the years when the S&P 500 is up more than 10% heading into the last four years of the month, that gain nearly triples to 5.45%.”

Yes, Zach is still concerned about the high-priced speculative tech stocks going into autumn. Retail, too. “So it's important to use discretion when picking which stocks to invest in, and which areas to avoid.”

Zach is most bullish on energy right now, followed by gold miners. “And I still think travel stocks could have a ways to run.”

Did we say energy stocks? That’s the sector that’s once again on the move this morning.

Did we say energy stocks? That’s the sector that’s once again on the move this morning.

A short time ago, Saudi Arabia’s government announced the kingdom would continue its 1-million-barrels-per-day production cut through year-end. This is the cut that began in July, which translates to just over 1% of global crude production.

On top of Saudi Arabia joining the BRICS constellation of nations, it’s safe to say that after many decades the kingdom is no longer doing Washington’s bidding. Oh hell, we’ll trot out this meme from last year again…

With that, crude is up another $1.59 to $87 — a level last seen in November of 2022. And energy is far and away the best performing stock-market sector — up about 1% on the day.

But the major U.S. averages are all in the red — if only by a quarter-percent or so. The S&P 500 is down 13 points at 4,503. Bond yields continue their September ascent, the 10-year Treasury note at 4.25%.

Precious metals are losing ground, gold at $1,926 and silver at $23.66. Bitcoin has sunk just below $25,700.

![]() Rickards on AI

Rickards on AI

So what does Paradigm’s macro maven Jim Rickards think about AI?

So what does Paradigm’s macro maven Jim Rickards think about AI?

“Could you briefly explain,” inquires a reader of Rickards’ Strategic Intelligence, “what effect artificial intelligence will have on the stock market and our economy in general? I hear it may put many out of work and disrupt our entire way of life and livelihood.”

Jim’s reply: “Artificial intelligence (AI) may eliminate some jobs, but new technology tends to create new jobs even as it eliminates others.

“In 1789, 97% of Americans were farmers and their output was needed to feed 100%. Today, only 3% of Americans are farmers but they feed 100% and produce surplus for export. Yet over 120 million Americans have non-farm jobs doing things that were unheard-of in 1797.

“AI will likely follow a similar path although the burden will fall on Americans to learn new skills to keep ahead of the coming changes. AI should lead to productivity improvements, which tend to be deflationary. That can lead to higher real wages.”

Meanwhile, “the stock market will be affected by AI in good and bad ways,” Jim says.

Meanwhile, “the stock market will be affected by AI in good and bad ways,” Jim says.

Jim alluded to some of this in June, but it’s worth reiterating: “Many investors may use ChatGPT-type apps to pick stocks and forecast the market. That can be useful if combined with other analytic methods. But AI can also be used to manipulate markets by creating false and misleading training materials that the robots take at face value to draw wrong conclusions.

“Those feeding the market the false information can profit from predictable market moves. It’s really just good old-fashioned market manipulation and front-running with new AI tools and channels. The danger is that this can escalate into robot-versus-robot misinformation wars that cause volatility in markets unrelated to fundamental or technical factors.

“Investors facing this prospect might want to increase allocations to cash and hard assets that will be relatively unaffected by the robot wars.”

Like, well, energy names.

![]() The Haves and Have-Nots at Burning Man

The Haves and Have-Nots at Burning Man

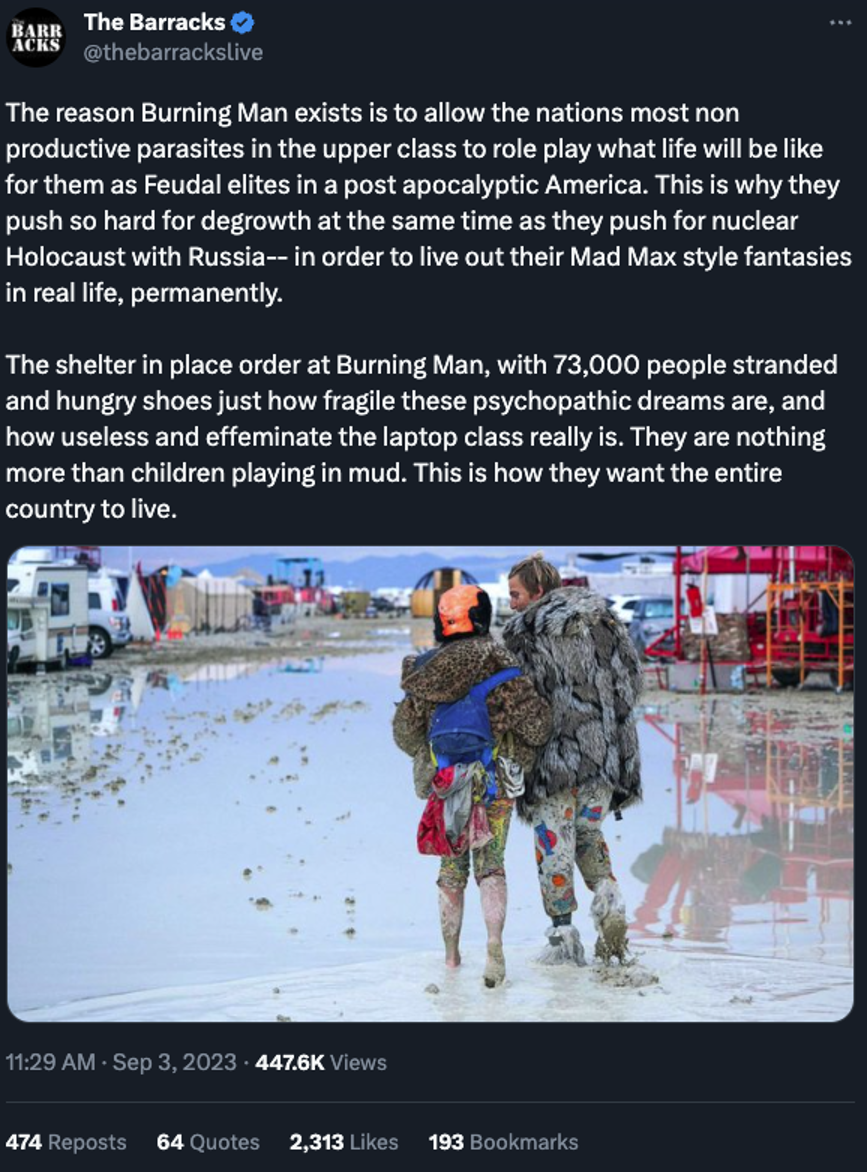

Chances are you heard about how the Burning Man festival in the Nevada desert turned into a miserable muddy mess — tens of thousands trapped, with limited water and sanitation.

Chances are you heard about how the Burning Man festival in the Nevada desert turned into a miserable muddy mess — tens of thousands trapped, with limited water and sanitation.

Over the weekend we encountered a couple of intriguing hot takes — including one from the aforementioned Max Blumenthal of The Grayzone…

![]() “No Cash, No Dice”

“No Cash, No Dice”

“If a business goes cashless, they won’t get my business,” says a reader’s pithy note.

“If a business goes cashless, they won’t get my business,” says a reader’s pithy note.

After our Bullet No. 1 on Friday about fast-food places that have gone cashless, and our inquiry about whether you’d still patronize a business that goes cashless…

… wow, did we ever get a response! Pasted into a document, it works out to 20 pages.

“Many times I do pay using a credit/debit card,” says another reader. “Sometimes I use cash. I like having the option. When the option’s gone… so am I!”

“I will stop going to the business if they won't accept cash,” says a third — “for example if Taco Bell goes that route I will find another place to order tacos.”

“Absolutely,” says a fourth. “No cash, no dice.”

“Dave, if any business I deal with announces a no-cash policy, I will definitely abandon that business,” adds a fifth. “Unless and until the government eliminates cash. Then I'm trapped in the cow's corral.”

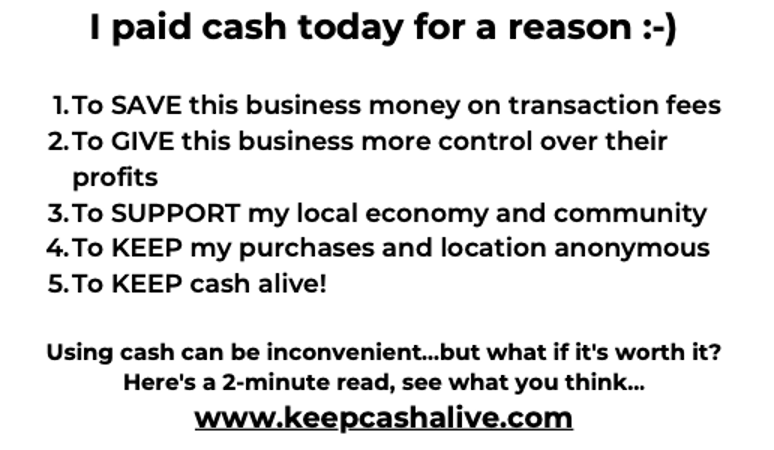

“I use cash as much as possible and pass out a business-size card that explains why:

“I use cash as much as possible and pass out a business-size card that explains why:

Writes another reader: “Unless there is absolutely no alternative, like in the LaGuardia Airport concourses, I will not patronize any establishment that doesn’t accept cash, and I am likely to go in and tell them.

“I am already pissed that our money is no longer gold, silver and copper. I was surprised and disappointed that the U.S. Consulate in Tahiti would not accept cash, USD or CPF. Fortunately, I had a credit card, but I had to help out a poor woman who didn’t.

“As always, thanks for your efforts to deliver pertinent facts and intelligent and interesting opinions from more than just one point of view.”

“I'm the customer. I'm to be catered to, not instructed in how I'll be allowed to buy,” writes a reader from Idaho. “And once you get on my sh*t list, good luck getting off.

“I'm the customer. I'm to be catered to, not instructed in how I'll be allowed to buy,” writes a reader from Idaho. “And once you get on my sh*t list, good luck getting off.

“I'm still boycotting a couple of local businesses over their COVID policies. Some franchise outlets put restrictions in place that were more stringent than the recommendations of our area health district, so I quit them. I found out I could get along fine without them then, so why go back now?

“I get a bigger kick out of voting with my dollars than voting in political elections because opportunities come around more often, especially in our ‘woke’ society.”

We have a handful of people in the minority, but even they have caveats…

We have a handful of people in the minority, but even they have caveats…

“If I like the product or service, and want to acquire it, paying with a credit card has already become routine and ubiquitous. Already, I pay much more often with a credit card than with cash.

“Will I like CBDC? Absolutely not! That is a far cry from a credit card.”

Another: “I'm not sure I would completely avoid businesses that go cashless but I probably would make them a second or further-down choice.

“It would depend on the business and what I needed from it. I see a lot of people getting upset with businesses going cashless but then will make a lot of internet purchases with a credit card — kind of hypocritical in a sense.

“My big concern is when we are ALL forced to go cashless.”

And on that score, we give one of our longest of longtimers the final word today…

And on that score, we give one of our longest of longtimers the final word today…

“It’s disheartening to acknowledge the collective ‘We the people’ have been intentionally divided to the point that any stand in unity for our common good is now greatly fractured and diluted as to be ineffectual.

“This is exacerbated by the fact that a growing portion of the population believes that the government cares about them and will take care of them so they vote for ever larger enslavement by licking the boots that kick them.

“But yes, I will continue what I consider to be a losing and very lonely battle against a growing dystopian and tyrannical government control over every aspect of our lives by continuing to use cash at every opportunity.

“Still love the FIVE.”

Dave responds: That really is what’s at stake, isn’t it?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets