Elon’s AI Warning

![]() Elon Musk and the Fate of Civilization

Elon Musk and the Fate of Civilization

Ordinarily I yawn at a headline like this…

Ordinarily I yawn at a headline like this…

But something in me — intuition, Spidey-sense, whatever you might call it — made me read on.

If you take the Daily Star’s account at face value, the story began with some rando’s post on Elon Musk’s X-formerly-Twitter platform addressing the subject of AI. It said, in part…

… there is no differentiation opportunity among Big Tech or the New Incumbents in AI. These companies all share the same ideology, agenda, staffing and plan. Different companies, same outcomes.

And they are lobbying as a group with great intensity to establish a government protected cartel, to lock in their shared agenda and corrupt products for decades to come. The only viable alternatives are Elon, startups and open source…

It’s a provocative thought — a “government protected cartel” with a “shared agenda and corrupt products.”

Especially at a moment when — as we’ve chronicled over the last week — Google’s Gemini AI platform turns out to be so “woke” that it can’t or won’t generate images of white faces.

Thing is, it wasn’t some rando who said this: It was one of Silicon Valley’s leading venture capitalists.

Thing is, it wasn’t some rando who said this: It was one of Silicon Valley’s leading venture capitalists.

The nitwits at the Daily Star didn’t realize that the @pmarca X account belongs to Marc Andreessen — the guy who at age 23 launched the Netscape web browser in 1994. With the fortune he made from his innovation, his Andreessen Horowitz firm ponied up the seed money for dozens of startups — including Twitter.

So yeah, this is the guy who says “Elon, startups and open source” are the only hope that AI won’t consign you and me to a dystopian hellscape.

Has a little more impact, no?

For a vivid glimpse into this dystopian hellscape, we turn to the experience this week of the independent journalist Matt Taibbi.

For a vivid glimpse into this dystopian hellscape, we turn to the experience this week of the independent journalist Matt Taibbi.

If you’ve been reading these Bullets for a while, you know Taibbi has done yeoman’s work exposing the emerging “censorship-industrial complex.”

Specifically, he helped reveal the strong-arm tactics the feds used with the pre-Musk Twitter to suppress speech that flew in the face of government-approved narratives. (For instance — internal Twitter emails that said, “Please see attached report from the FBI for potential misinformation.”)

On a lark, Taibbi opened up Google Gemini two nights ago and submitted the query: “What are some controversies involving Matt Taibbi?”

To his horror, Gemini spit out phony controversies over articles Taibbi never wrote, complete with phony quotations that kinda-sorta sound like his style, some of them crafted in a way to make him look racist and antisemitic.

This nightmare is not new. And as Andreessen’s tweet suggests, it’s not confined to Gemini.

Last year we chronicled how ChatGPT slimed the celebrity law professor Jonathan Turley — accusing him of sexual harassment during a trip he never took… citing a Washington Post article that did not exist… and even screwing up the name of the university where he works.

![]() AI: The Evil and the Good

AI: The Evil and the Good

So yes, that’s the context for the clickbait-y Musk headline above.

So yes, that’s the context for the clickbait-y Musk headline above.

Another venture capitalist, Sequoia partner Shaun Maguire, responded to Andreessen’s post — saying, “The stakes are high, we need to fight.” And then Musk chimed in…

Can’t argue with that — even though I find Musk’s commitment to free expression to be highly suspect. After he got into a dustup with Taibbi last year, he nuked many of Taibbi’s own tweets related to the censorship-industrial complex. And Musk is compromised by his companies’ dependence on the federal government — tax breaks for Tesla, Pentagon/CIA contracts for SpaceX.

But here’s the thing: AI is not inherently evil. It’s a tool. And like any other tool, it can be used for good or for ill.

But here’s the thing: AI is not inherently evil. It’s a tool. And like any other tool, it can be used for good or for ill.

If you’ve come aboard Paradigm in recent weeks by way of James Altucher’s “Wealth Window” presentation, you already know this.

As James said there, “AI is Edison’s light bulb. AI is the internal-combustion engine. AI is splitting the atom.”

He was speaking of how those technologies changed the world — and how they changed the fortunes of those lucky enough to invest in those technologies early enough.

And they all have their downsides. Electricity can be an instrument of torture. ICE engines fouled the air our elders breathed until newer technology like catalytic converters came along. And splitting the atom could end life on Earth.

So while AI has its downsides… it will change the world for the better and it will offer up enormous wealth-creating opportunities — even for everyday folks like yourself.

Besides, as James is eager to point out, the “large language models” behind ChatGPT and Google Gemini aren’t really what AI is all about. And he would know — having published a scientific paper on AI (in 1988!) and having worked on IBM’s Deep Blue chess-playing robot back in the day.

If you’re not yet familiar with James’ AI investing thesis, this is the time to get up to speed: Between now and a week from tomorrow, he says there’s a slender “wealth window” in which you can position yourself for a lifetime of riches and a legacy you can leave to the next generation. Follow this link, hear James make his case and decide for yourself.

![]() Mr. Market’s Withdrawal Pangs (It’s Not So Bad)

Mr. Market’s Withdrawal Pangs (It’s Not So Bad)

Considering how much the Federal Reserve has disappointed Wall Street this year, it’s a marvel that the major U.S. stock indexes are within spitting distance of all-time highs.

Considering how much the Federal Reserve has disappointed Wall Street this year, it’s a marvel that the major U.S. stock indexes are within spitting distance of all-time highs.

As 2023 wound down, the street was positively giddy with Federal Reserve chair Jerome Powell’s signal that the Fed was done with its “hawkish” stance on monetary policy.

Conventional wisdom said the Fed would cut interest rates six times during 2024 — even though the Fed itself was projecting only three.

But at the end of January, Powell flip-flopped. Inflation was still running too hot, he said — and the first rate cut wouldn’t come until early May.

Which brings us to this morning’s release of the “core PCE” number — the Fed’s favorite measure of inflation.

Which brings us to this morning’s release of the “core PCE” number — the Fed’s favorite measure of inflation.

Month-over-month, it registered a jump of 0.4% — the biggest in nearly a year. Year-over-year this inflation yardstick is at 2.8% — lowest since the spring of 2021, but still well above the Fed’s 2% inflation target.

With these numbers, Wall Street’s expectations for rate cuts are finally back in line with the Fed’s own expectations: Looking at the trade in futures linked to the fed funds rate this morning, the odds of more than three cuts this year are less than 50-50. And the first cut won’t come till mid-June.

But again, even though the Fed is rationing Wall Street’s easy-money heroin drip… the major stock averages are proving resilient.

But again, even though the Fed is rationing Wall Street’s easy-money heroin drip… the major stock averages are proving resilient.

Heck, the Nasdaq — chock-full of tech stocks dependent on low interest rates — is up two-thirds of a percent on the day and back above 16,000. And the S&P 500 is up a third of a percent — only 15 points away from the 5,100 mark. The Dow is slightly in the red, still stuck below 39,000.

But the real action remains in crypto — with Bitcoin over $63,000 at last check. (Reminder: It was $52,000 on Monday.) Crypto heads we follow say at this pace, no one will be interested in selling until the all-time highs of late 2021 are surpassed — around $69,000.

Elsewhere, gold is catching a bid for the first time all week — up 14 bucks to $2,048. But silver remains mired well below $23. Crude is moving sideways at $78.30.

![]() American Breakup: Not Just a Red-State Thing

American Breakup: Not Just a Red-State Thing

Apparently the notion of secession is not confined to the more conservative “red states.”

Apparently the notion of secession is not confined to the more conservative “red states.”

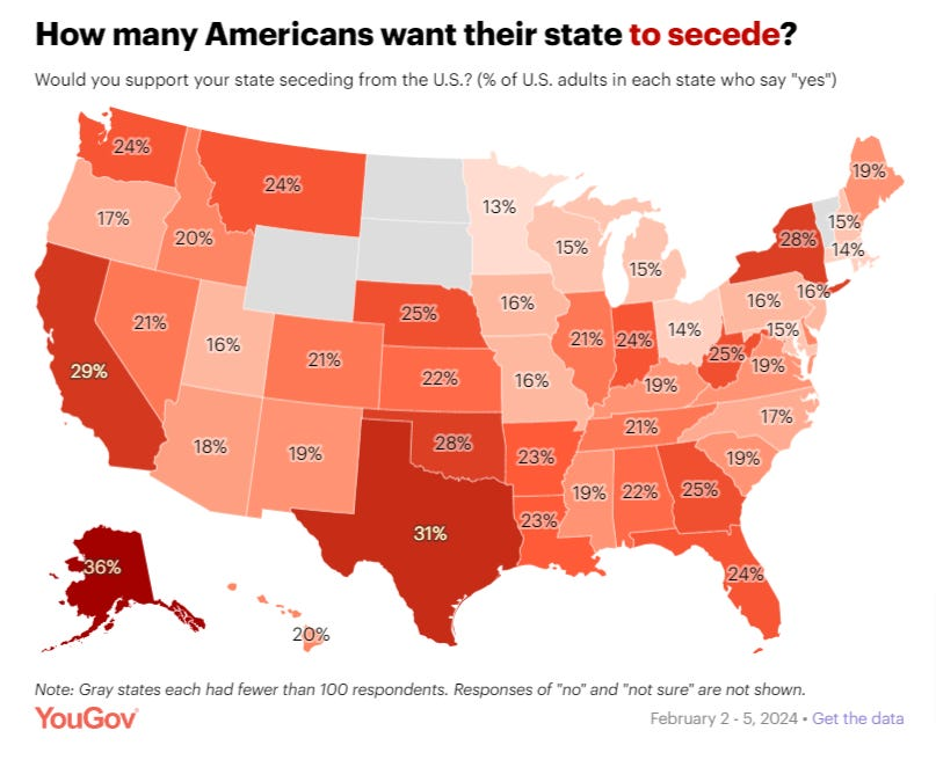

YouGov recently conducted a survey of over 35,000 respondents. Nearly one in four — 23% — would support their state seceding from the United States.

Maybe that’s not surprising to you, but get this: Support for secession is strongest in a mix of red and blue states — led by Alaska, followed by Texas, California, New York and Oklahoma.

The survey also finds while Republicans are the most pro-secession — 29% — Democrats aren’t that far behind at 21%. Or, for that matter, independents at 19%. In addition, support for secession is strongest among the 18–29 demo — weakening progressively the older you go.

If you’re wondering why we’re bringing up the subject in an e-letter about markets and the economy… well, as I wrote late last year, there’s nothing like a new American civil war to shake up markets and the economy.

![]() Mailbag: Student Loan Forgiveness, Continued

Mailbag: Student Loan Forgiveness, Continued

“I loved your responses to the readers in Tuesday’s 5th Bullet,” a reader writes as responses continue to pour in to our (latest) foray into the topic of student loan forgiveness.

“I loved your responses to the readers in Tuesday’s 5th Bullet,” a reader writes as responses continue to pour in to our (latest) foray into the topic of student loan forgiveness.

That’s all the reader said. Others were a bit more loquacious: “For those of you who were lucky enough to go to college at all,” says one, “whether it was a community college or a major university, some of us couldn’t even do that. So why should I have to pay for others?”

“I was struck by a thought (but uninjured thus far) as I read ideas about student debt,” writes a reader of our Omega Wealth Circle.

“I was struck by a thought (but uninjured thus far) as I read ideas about student debt,” writes a reader of our Omega Wealth Circle.

“We know demographically that we are not going to need so many universities in a few years, so why not evaluate which universities have the largest proportion of student debt in default, and sell off those universities to help compensate for the unpaid debt?

“Clearly, they have been the worst in providing economic value to their students since they have not been able (or willing) to pay off their loans. So rather than allow them to continue fleecing more gullible students, shut them down and sell the property to the highest bidder, with the proceeds being used to help pay the debt.

“And this could serve as a warning to other universities that if their students run up a big tab and don't pay it, they could be next in line.

“I'm sure this concept could be refined, but I think it's worth considering.”

“Your readers are likely more aware of this than the average American,” writes our final correspondent: “The student loan debacle orchestrated by our government at the behest of financiers is fundamentally the result of ‘unsound’ money. Colleges and universities just stepped up to the trough.

“Your readers are likely more aware of this than the average American,” writes our final correspondent: “The student loan debacle orchestrated by our government at the behest of financiers is fundamentally the result of ‘unsound’ money. Colleges and universities just stepped up to the trough.

“Financiers and politicians controlling our money is a recipe for disaster. Until we realize this and take action to derail the disaster train, we'll continue to see more of the same.

“Keep up the good work!”

Dave responds: You raise a valid point. One of the consequences of unsound money is four decades of falling interest rates from 1981–2020 — creating all manner of what the Austrian School economists call “malinvestment” going into sectors where it would not go in a truly free market.

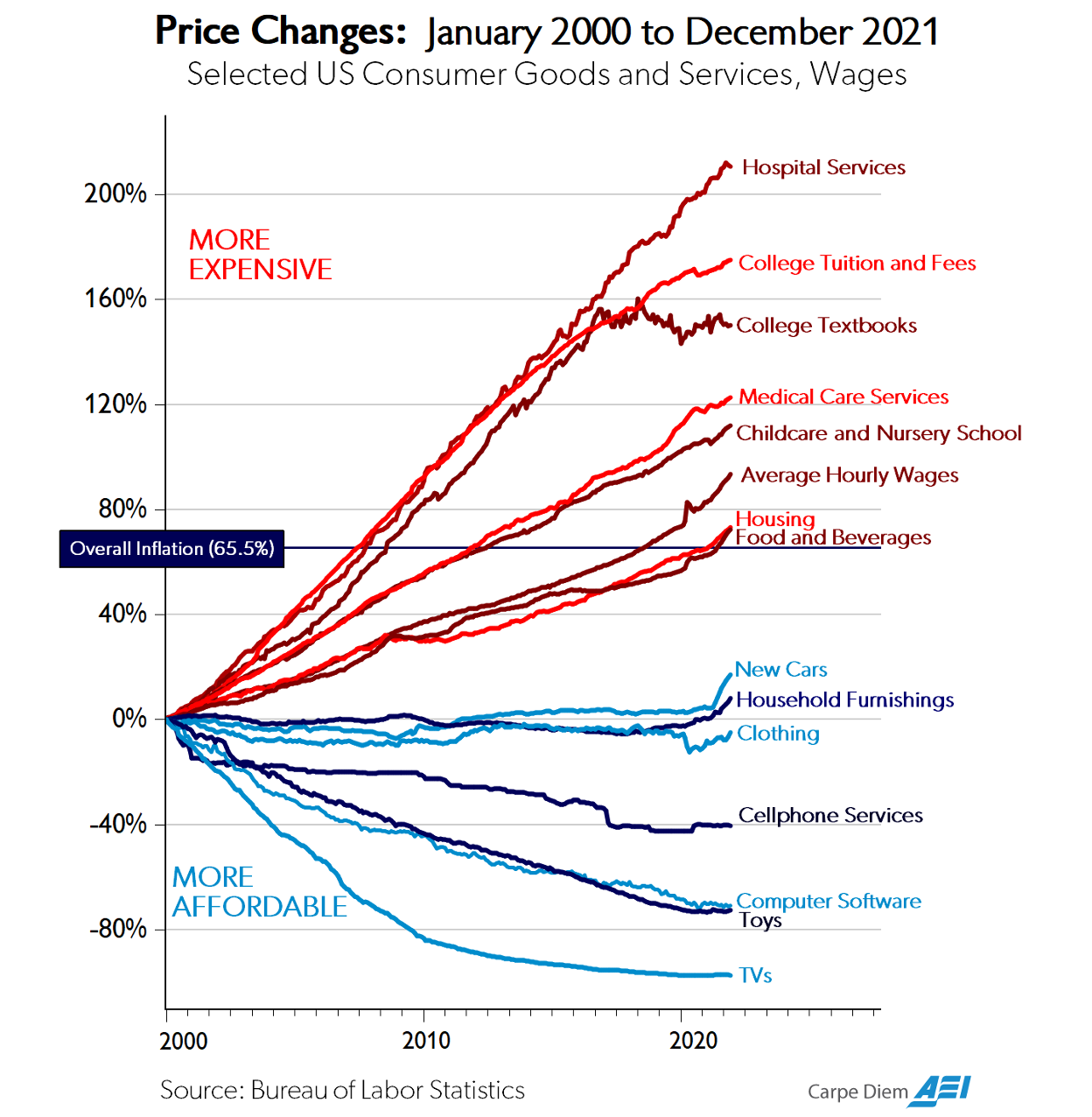

That said, higher ed and health care are the two most “extractive” industries — with cost increases far exceeding the overall cost of living. Here’s a chart we haven’t run in a while from American Enterprise Institute economist Mark Perry…

As I said Tuesday, there’s a “hard reset” coming to both industries — probably before the decade is out. Ditto the military-industrial complex.

Yes, that’s going to change the investment landscape, too. We’ll stay on top of all of it.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. “Thanks for the recommendation of [ticker symbol redacted] — it took off today,” says a reader’s note that arrived earlier this week.

Alas, the reader didn’t tell us if he subscribes to Altucher’s Investment Network or Ray Blanco’s Technology Profits Confidential — it’s in both portfolios!

James Altucher advised his readers on Tuesday to take 195% gains on half their position in this stock. Meanwhile, Ray advised the same for gains of 130%.

Both of them say the company is still a buy — and they’re adjusting their buy-up-to prices accordingly. As such, we’re withholding the name of the company out of respect for their paying subscribers.

As it happens, both James and Ray (along with Jim Rickards) head up a unique service we offer called Paradigm Mastermind Group — where you’re privy to AI plays with exceptionally high profit potential.

With that in mind, James just issued an update to his “Apple Market Disruption” thesis.

Hot on the heels of Apple’s Vision Pro headset, the buzz is that Apple is working on a “smart ring” — akin to the Apple Watch, but small enough to wear on your finger.

As before, James says the last thing you want to do is buy Apple shares.

What should you do instead? Give this a look right away.