Forecast Fulfilled (USAR)

![]() Forecast Fulfilled (USAR)

Forecast Fulfilled (USAR)

Uncle Sam’s stock-buying spree is moving into an aggressive new phase…

Uncle Sam’s stock-buying spree is moving into an aggressive new phase…

“The Trump administration is planning to inject $1.6 billion into an American rare earths company, its biggest investment in the sector,” reported the Financial Times on Saturday — “in Washington’s latest foray into private industry to shore up supplies of key minerals.”

Citing the usual “people familiar with the matter,” the FT says the Commerce Department will take a 10% stake in USA Rare Earth (USAR). A formal announcement is expected today.

To be sure, management was dropping hints about this arrangement as long ago as October. We chronicled it right here.

To be sure, management was dropping hints about this arrangement as long ago as October. We chronicled it right here.

On Thursday Oct. 2, CEO Barbara Humpton told CNBC her company is “in close communication” with the White House.

CFO Robert Steele was more specific — saying the government might be “a capital source through the combination of loans, grants and other potential opportunities.”

Key point: The Pentagon had already taken a 15% stake in another rare-earth player, MP Materials last summer (much to the benefit of many Paradigm Press readers.)

All of this is music to the ears of Paradigm readers who took action back in August.

All of this is music to the ears of Paradigm readers who took action back in August.

On Thursday Aug. 7, we convened our first “All-In Summit.”

Our macro maven Jim Rickards… our AI-and-crypto authority James Altucher… our trading pro Enrique Abeyta… all of them were in agreement USAR was a screaming buy.

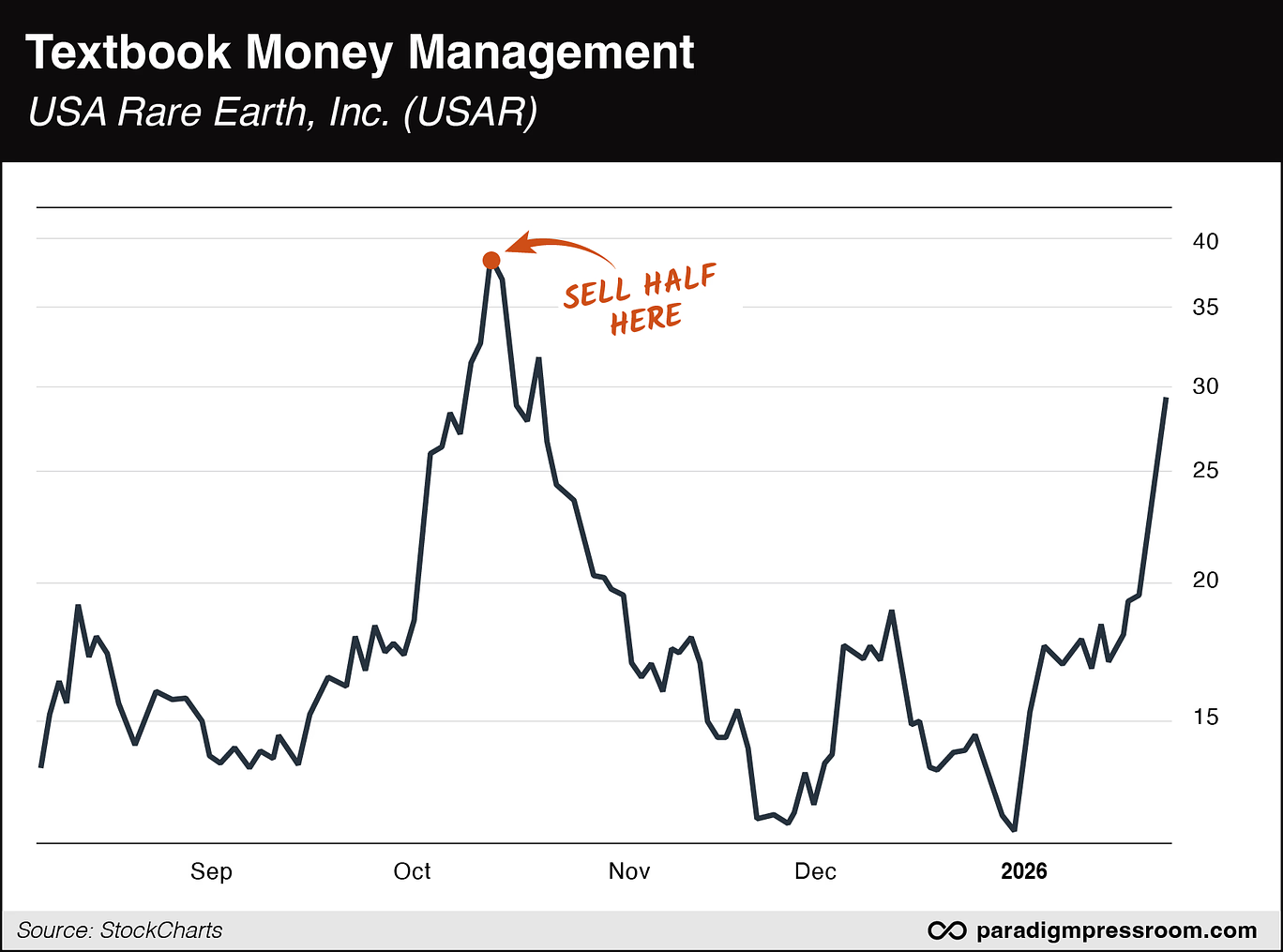

After management began dropping hints about a deal with the feds in early October, shares began to soar. On Oct. 13, readers were urged to sell half their position for a 191% gain. The timing couldn’t have been better; that sell recommendation marked a near-term top.

The rest of the position? Let it ride, readers were told. This is textbook money management — and it’s paying off handsomely. Of course, shares are taking off again this morning — up 19% in early trade.

Whether or not you laid on this trade… you might naturally wonder when Paradigm’s leading lights might come to a consensus on another recommendation with similar potential.

All I can do today is to counsel patience.

The last thing we want to do is force our editors to reach agreement where agreement doesn’t really exist just so we can sell more subscriptions. Agreement has to be reached authentically.

That said, I’ve been privy to some very interesting backchannel discussions in recent days. Something’s in the works that might not be exactly like the USAR recommendation… but that I think readers will like.

That’s all I can say right now without violating any confidences. But watch this space as we move from January into February…

![]() Gold $5K

Gold $5K

“Do you see any bearish catalysts in the near future that would signal an end to the current gold bull market?” a reader wrote Jim Rickards last week.

“Do you see any bearish catalysts in the near future that would signal an end to the current gold bull market?” a reader wrote Jim Rickards last week.

If anything, the question is even more timely this morning. Gold punched decisively through $5,000 when electronic trading opened for the week last night. And just like that, $5,100 is in sight; at last check the bid is up $111 to $5,094. Silver is screaming even higher — up $8.76 as we write to $111.84.

Jim’s answer to Strategic Intelligence readers: “No.

“The drivers of higher gold prices include net buying by central banks, flat mining output, buying as an alternative to U.S. Treasuries since the U.S. is now stealing Treasury securities from lawful holders such as Russia, the fact that Russia has survived economic sanctions because over 25% of its reserves were held in the form of physical gold and the use of gold by BRICS members as an alternative to the dollar.”

That’s a mouthful — but it gives you the rough idea that the rally is nowhere near over.

“The retail frenzy stage has not yet started but that’s coming,” says Jim, who still anticipates gold will reach $10,000 before it’s all over. Maybe even before year-end 2026.

In the meantime, congratulations are in order for Strategic Intelligence subscribers who bagged a 460% gain on Hecla Mining after a hold time of only seven months. “Hard-to-believe gains!” a happy reader wrote to the 5 Bullets inbox.

In the near term, gold’s strength over the last year is largely a function of dollar weakness.

In the near term, gold’s strength over the last year is largely a function of dollar weakness.

The U.S. dollar index — which measures the greenback against a basket of a half-dozen developed-market currencies — is down 10% since early 2025. In the world of currencies, that’s an earthquake.

And the trend is continuing today amid rumors that Washington will coordinate some sort of action with the Japanese government to support the yen.

It’s the Trump administration’s policy to weaken the dollar this way. “When a government is incentivized to cheapen its currency to monetize its debt, it's madness for investors to fight that policy,” Sean Ring writes in today’s Rude Awakening.

“Going with the flow is the easiest money you’ll ever make.”

Which means metals and miners. “Gold and silver will continue to rise, maybe with a bump or two along the way,” he says. “And while the miners have performed, they’re still priced as if gold is trading at $3,500 and silver is at $40.”

![]() Inflation Flashbacks: Is It the ’70s Again?

Inflation Flashbacks: Is It the ’70s Again?

If history rhymes, the big spike of inflation in 2022 is only a preview of coming attractions.

If history rhymes, the big spike of inflation in 2022 is only a preview of coming attractions.

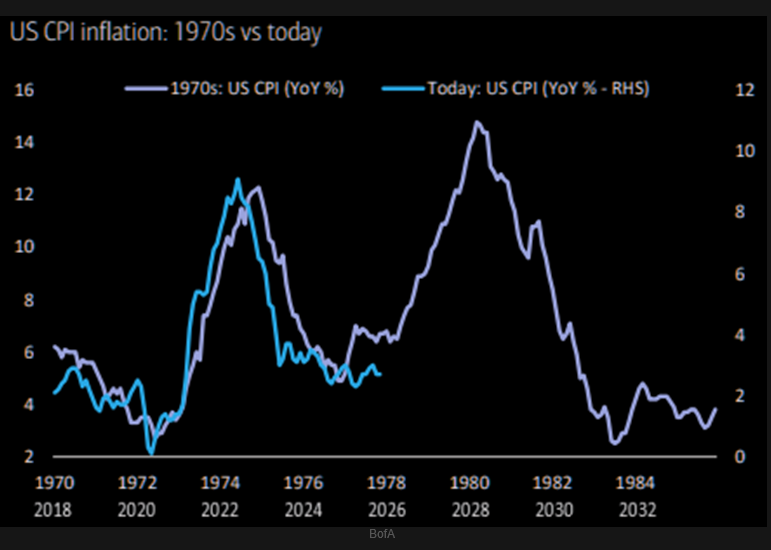

From our trading pro Enrique Abeyta: “Fascinating chart from Bank of America comparing the year-over-year increase in inflation from the 1970s to the most recent period starting in 2018…”

We caution that “analog” charts like these are compelling — but not predictive by definition.

“No reason inflation will necessarily follow through and track like it has… but kind of scary,” Enrique allows.

This much is certain: Inflation is proving to be “sticky” going by the Federal Reserve’s preferred gauge, a measure called core PCE. Last week the Commerce Department reported that year-over-year core PCE edged up from 2.7% in October to 2.8% in November.

As we can’t remind you often enough… once the inflation rate sails past 5% as it did in 2022, it takes a decade on average to get back to “normal” 2% levels.

[Editor’s note: Enrique shared this chart on the Daily Feed section of the Paradigm Press mobile app — a place where our editors deliver hot takes on the economy and the markets you won’t find anywhere else. It’s also an easy way to track your buy and sell alerts without sifting through your email. Download here.]

As earnings season moves into high gear, the major U.S. stock market indexes are starting the week in the green.

As earnings season moves into high gear, the major U.S. stock market indexes are starting the week in the green.

Several of the “Magnificent 7” companies report their numbers this week as well as a slew of financial, industrial and energy names.

But that’s not till Wednesday. For the moment, the S&P 500 is up a half percent on the day to 6,951. The Nasdaq’s gain is stronger, the Dow’s weaker.

Elsewhere, crypto continues to hurt, Bitcoin at $87,307 and Ethereum just under $3,000. “Until crypto can string together some winning sessions, it’s looking like lower for longer will be the story,” writes Greg Guenthner at The Trading Desk.

Crude has pulled back slightly to $60.61. Traders bid up oil late last week because they didn’t want to be “short” going into a weekend when there was the possibility of a new U.S. attack on Iran. But that didn’t come to pass, so now oil is selling off.

In contrast, electricity prices are surging in areas affected by the big winter storm.

In contrast, electricity prices are surging in areas affected by the big winter storm.

“Real-time wholesale electricity prices topped $1,800 per MWh early Sunday in Dominion Energy’s Virginia territory,” reports CNBC — “up from $200 per MWh on Saturday morning. Virginia houses the largest cluster of data centers in the world.”

The regional grid operator PJM expects record wintertime demand tomorrow as the storm is followed by a cold snap. With that in mind, PJM “is pushing power plants to secure natural gas supplies through the week,” reports Bloomberg.

Specifically PJM “is taking a rare step of committing to buy power from generators through 10 a.m. on Jan. 31, as opposed to its typical method of making day-ahead purchases.”

As such, PJM anticipates it will be able to avert rolling blackouts.

![]() The “New and Improved” TikTok

The “New and Improved” TikTok

TikTok is now under U.S. control — and users are noticing. They’re not happy.

TikTok is now under U.S. control — and users are noticing. They’re not happy.

The long-anticipated sale was consummated last Thursday, China-based ByteDance retaining 19.9% ownership.

The new arrangement complies with a 2024 law that ordered TikTok to shut down unless ByteDance sold. The other 80.1% will be owned by a group of investors including Oracle and the Emirati investment firm MGX.

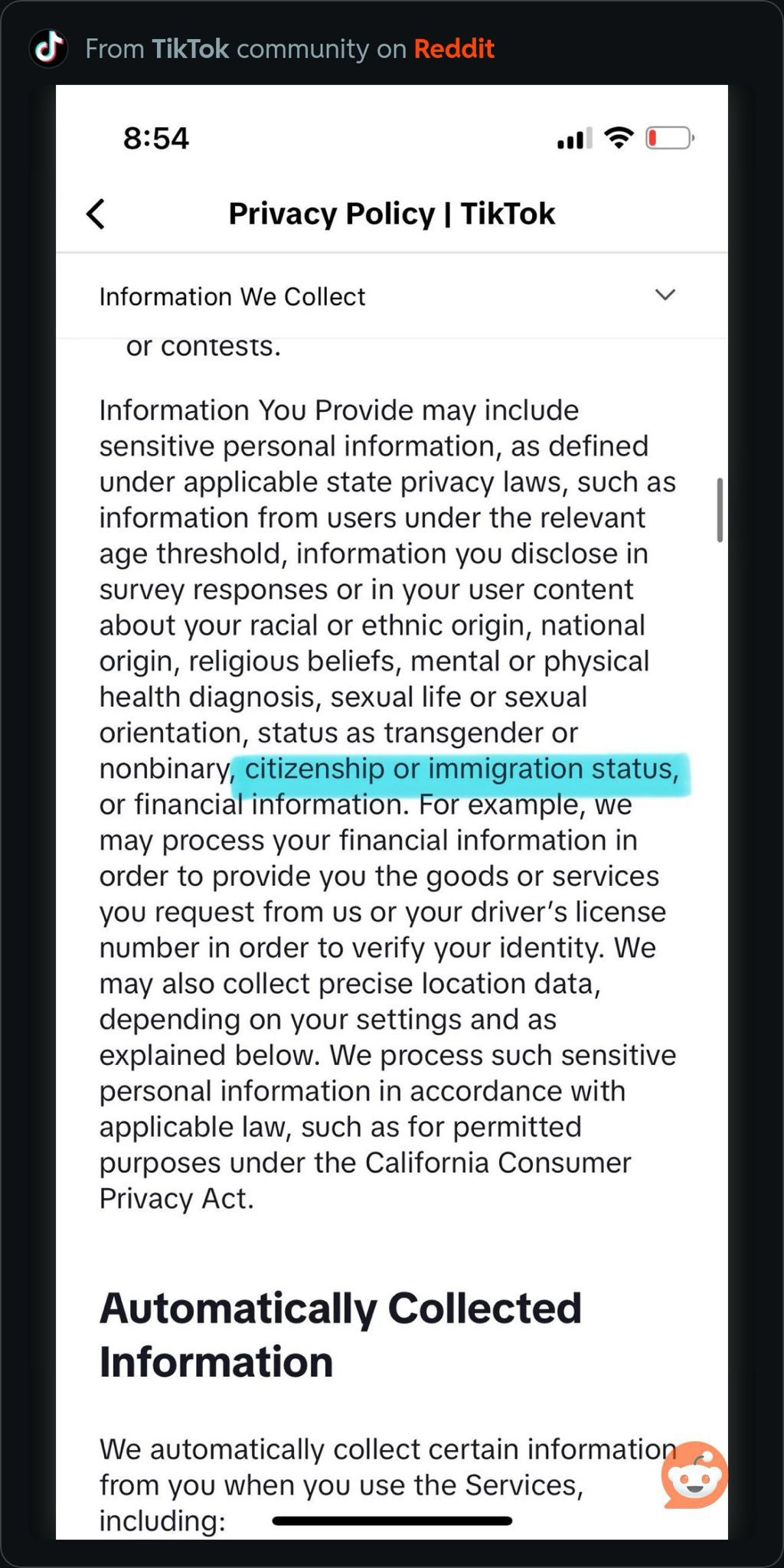

No sooner did the deal close than TikTok “made changes to its privacy policy that include expanding the type of location data the company can collect from its 200 million American users,” reports the BBC.

“The new joint venture said in its updated privacy terms that it may now ‘collect precise location data, depending on your settings’ - a change from the previous policy which allowed for the collection of ‘approximate’ location data.”

And there’s more, as shown in this screenshot making the rounds on other social media platforms…

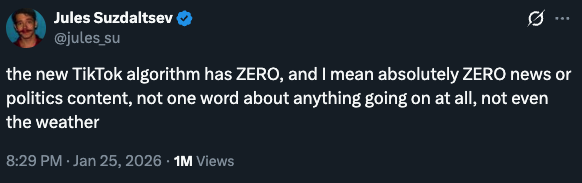

Beyond the terms of service, the user experience is also changing in a big way.

Beyond the terms of service, the user experience is also changing in a big way.

To be clear, he’s talking about the “For You” tab. News is still available if that’s what you want — but you have to search for a specific topic.

Love it. The whole rationale in Congress for lowering the boom on TikTok was that the Chinese government was spying on and propagandizing TikTok’s U.S. users. (There was never any evidence to support that claim.)

But now that Oracle’s Larry Ellison is large and in charge, it’s just peachy keen to hoover up location data and anything users disclose about, say, their mental health — while at the same time suppressing vigorous dialogue about the issues of the day.

Reminder: Ellison can’t wait for the arrival of a surveillance state where “citizens will be on their best behavior because we’re constantly recording everything that’s going on.”

- Still unclear is whether this change to the algorithm is slamming small businesses that rely on TikTok to sell their wares. (If you’re a small-business owner with any insight, please write: feedback@paradigmpressroom.com)

![]() Mailbag: Gratitude

Mailbag: Gratitude

From the mailbag comes this item submitted by a reader who joined Paradigm last August at the time of our All-In Summit. Presumably he’s faring handsomely from the editors’ USAR recommendation…

From the mailbag comes this item submitted by a reader who joined Paradigm last August at the time of our All-In Summit. Presumably he’s faring handsomely from the editors’ USAR recommendation…

“Hi Dave and Emily — I just retired last year and with that I took over my wife's and my portfolio to try and make sure that we have enough to get by. In doing so, we stumbled on Paradigm through a circuitous route. I don't normally reach out like this, but with the storm coming, I feel uncommonly grateful this morning.

“Grateful that we have a home, a full tank of oil, some really good friends we could lean on if things got tough, some amazingly beautiful human beings as adult children and even enough food.

“With that being said, I wanted to let you both know that in these CRAZY times, I appreciate your thoughtful, well-written articles. I know you get pushback from some people (refer to: CRAZY times), but I wanted to let you know that I'm a fan. Keep up the good work.”

Dave responds: Emily and I are blown away by your kindness. Thank you. (And stay warm wherever you are.)

Like any business, we have certain metrics that we follow and numerical goals we aim to meet. But a note like yours reminds us that as long as we empower satisfied customers like you… the numbers will take care of themselves.