iPhone Upgrade Pending

![]() The iPhone Becomes the AI-Phone…

The iPhone Becomes the AI-Phone…

Consider yourself on notice: The next iPhone software update might be “the biggest” in the handset’s 17-year history.

Consider yourself on notice: The next iPhone software update might be “the biggest” in the handset’s 17-year history.

“I’m told that the new operating system is seen within the company as one of the biggest iOS updates — if not the biggest — in the company’s history,” writes Bloomberg reporter Mark Gurman. “With that knowledge, Apple’s Developers Conference in June should be pretty exciting.”

Details are thin. Among the possible upgrades is support for “rich communications services” — a messaging protocol that should make it more seamless when you exchange photos and videos via text message with someone who has an Android device.

But most of the upgrades will likely be geared toward — you guessed it — AI.

“A sneak peek into the iOS 17.4 beta has appeared indicating Apple's plans to enhance Siri's AI powers,” says the Livemint website. Depending on who you want to believe, there’s even an embedded capability to link up with ChatGPT — complete with system prompts such as “please summarize” or “please answer this question.”

Elsewhere, “Apple is said to be looking at integrating generative AI into development tools like Xcode to allow developers to write new applications faster,” says the TechCrunch site. “In addition, Apple’s productivity apps, like Pages and Keynotes, should also be getting generative AI updates.”

Presumably the whole thing will be dubbed iOS 18. If the past is any guide, the announcement during the first half of June will be followed by a public beta in July, and formal release in September.

But that’s still months away. In the meantime, Apple has something much bigger on the horizon at 10:00 a.m. EST on Friday — something Paradigm’s James Altucher calls “a 100% guaranteed announcement that I believe will trigger a MAJOR market disruption.”

To keep you ahead of the game — hint: James says buying AAPL shares is not the move to make here — he’s organizing an urgent briefing tomorrow night at 7:00 p.m. EST.

In brief, he says we’re looking at a rare opportunity to perhaps 10X your money over the next decade — one move that could secure your retirement and a legacy for your kids and grandkids. Signup is free and access is guaranteed as soon as you click this link.

![]() Bitcoin’s Next 90 Days

Bitcoin’s Next 90 Days

On the heels of a huge catalyst earlier this month, Bitcoin will enjoy two more tailwinds in the next 90 days.

On the heels of a huge catalyst earlier this month, Bitcoin will enjoy two more tailwinds in the next 90 days.

As our James Altucher correctly forecast, the feds gave the green light to Bitcoin ETFs three weeks ago today.

It’s an event that James’ senior analyst Chris Campbell calls “Bitcoin’s ChatGPT moment.”

“ChatGPT pulled in over 100 million monthly users in just two months of launching,” he reminds us — “making it the fastest-growing app of all time.”

Something very similar happened within days of the Bitcoin ETFs launching: According to figures from CoinDesk, the Bitcoin ETFs already have $30 billion in assets under management.

“It took years for the SPDR Gold Trust (GLD) to hit $30 billion,” says Chris. Even now, a mere $11 billion is stashed in all the silver ETFs combined.

“Imagine the Bitcoin ETFs as a sports car. Soon, the market’s going to attach a turbocharger to that car,” says Chris.

“Imagine the Bitcoin ETFs as a sports car. Soon, the market’s going to attach a turbocharger to that car,” says Chris.

“Options on Bitcoin ETFs are the logical next step and the general consensus is they could begin by the end of February. This means more market makers, more funds and, yes, more volatility and excitement.”

Then come April 20 is the next Bitcoin halving.

“A Bitcoin halving is an event that occurs approximately every four years and is a fundamental part of Bitcoin's economic model,” says Chris. “During a halving, the reward for mining new Bitcoin blocks is cut in half, effectively reducing the rate at which new Bitcoins are created and entering circulation.”

After the last two halvings in 2016 and 2020, Bitcoin rallied to all-time highs roughly 18 months later.

But in the immediate aftermath of the halvings, Chris says the “altcoins” — the much smaller cryptos — go ballistic.

All told, “we’re looking at an exciting three months ahead for crypto,” Chris concludes.

In the meantime, Bitcoin has dipped below $43,000 today — the level at which it began the year 2024.

The first of several big market catalysts this week has come and gone — and stocks are taking a hit.

The first of several big market catalysts this week has come and gone — and stocks are taking a hit.

Microsoft and Google parent Alphabet reported their quarterly numbers yesterday afternoon. MSFT logged its highest profit growth in over two years with the help of excitement over AI — but shares are down 1.3% as we write. As Paradigm trading pro Greg Guenthner said in this space two weeks ago, “The numbers and the market reaction don’t always match.”

As for GOOG, the story is more straightforward: Sales fell short of Wall Street analysts’ expectations; shares are down 6.25%.

Those results are a drag on the broader averages: At last check, the S&P 500 is down over three-quarters of a percent, back below 4,900. The Nasdaq is down harder, 1.5%. The Dow, with less of a tech influence, is slightly in the green.

Gold has pushed its way past $2,050 while silver sits at $23.17. Crude is pulling back after the Energy Department’s weekly inventory numbers — a barrel of West Texas Intermediate fetching $76.09.

The next big market catalyst comes shortly after we hit “send” on today’s edition. The Federal Reserve will issue its latest proclamation on interest rates — in all probability leaving the fed funds rate at 5.5%, where it’s sat for six months now.

Fed chair Jerome Powell will be peppered with questions at his press conference about when the Fed will “pivot” to lower rates, on the theory that inflation is under control.

Except it’s not under control, Paradigm’s Jim Rickards reminds us. “The Fed is losing the battle against inflation,” he wrote his Crisis Trader readers yesterday.

Except it’s not under control, Paradigm’s Jim Rickards reminds us. “The Fed is losing the battle against inflation,” he wrote his Crisis Trader readers yesterday.

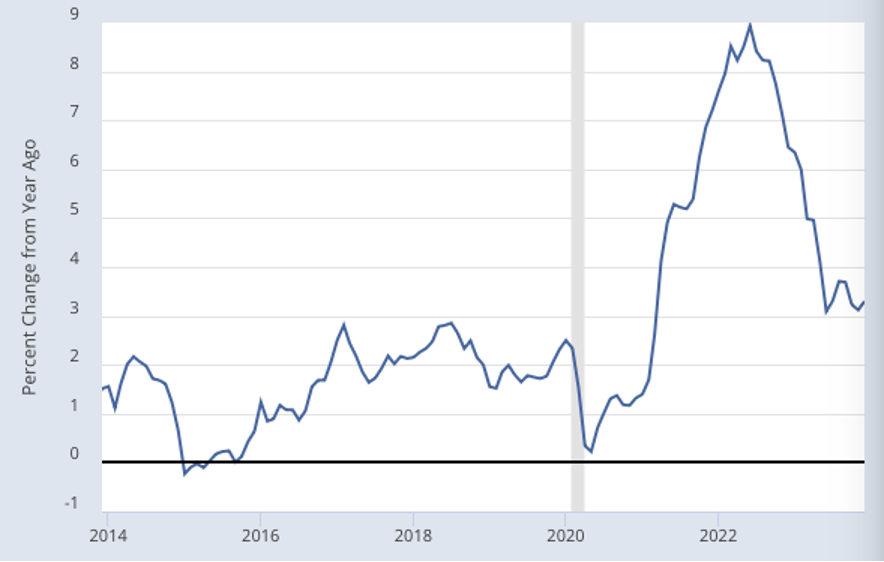

Yes, the official inflation rate is down from its 9% peak in mid-2022, but it’s been stuck between 3.0–3.7% since last summer. That’s still well above the pre-pandemic norm…

Inflation Is Down but Still “Sticky”

Source: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis

Will any reporters even try to confront Powell with this uncomfortable truth?

We’ll follow up with the market fallout from the Fed tomorrow…

![]() Washington’s Economic Warfare Takes Aim at… Texas?

Washington’s Economic Warfare Takes Aim at… Texas?

On the surface, it makes zero logical sense — the Biden administration’s pause on licenses for new export terminals that would ship liquefied natural gas overseas.

On the surface, it makes zero logical sense — the Biden administration’s pause on licenses for new export terminals that would ship liquefied natural gas overseas.

The decision came last week. According to the Reuters wire, the move is “cheered by climate activists” and “could delay decisions on new plants until after the Nov. 5 election.”

As Joe Biden justified it in a statement, “During this period, we will take a hard look at the impacts of LNG exports on energy costs, America’s energy security and our environment.”

American LNG exports have tripled since 2018 — in part because European leaders have been weaning the continent off pipelined gas from Russia ever since Russia’s invasion of Ukraine.

You’d think Team Biden would want to do all it could to keep LNG shipments moving to ensure Europe’s continued dependence on America for gas. Not to mention the fact that while gas is a fossil fuel, it generates far less carbon dioxide than coal or oil.

”If the LNG licensing pause undermines two key policy priorities for the Biden administration, then it is likely the pause is intended to punish Texas and Louisiana,” write the analysts at the Forward Observer private intelligence service.

”If the LNG licensing pause undermines two key policy priorities for the Biden administration, then it is likely the pause is intended to punish Texas and Louisiana,” write the analysts at the Forward Observer private intelligence service.

Consider the fact the biggest proposed LNG projects are in those states. Texas, as you’re likely aware, is in the midst of a standoff with the federal government over border policy. “Texas has mobilized considerable resources at the U.S.-Mexico border,” reports Politico, “such as the Texas National Guard and state troopers, in an approach that has often clashed with the operations of the federal Border Patrol.”

Back to the Forward Observer analysis: By using LNG licenses as an economic weapon, “the Biden administration likely sees a path to assert federal authority over Texas without escalating the situation to a constitutional crisis, and punishing industry in those states seems less likely to cause a crisis than other options Democrats have proposed, such as federalizing the Texas National Guard.”

To be sure, this is all in the realm of speculation. But it’s intriguing. And it makes more sense than any other explanation. To be continued…

![]() Fun With Fake Fingers

Fun With Fake Fingers

There’s more to this story than what’s on the surface…

There’s more to this story than what’s on the surface…

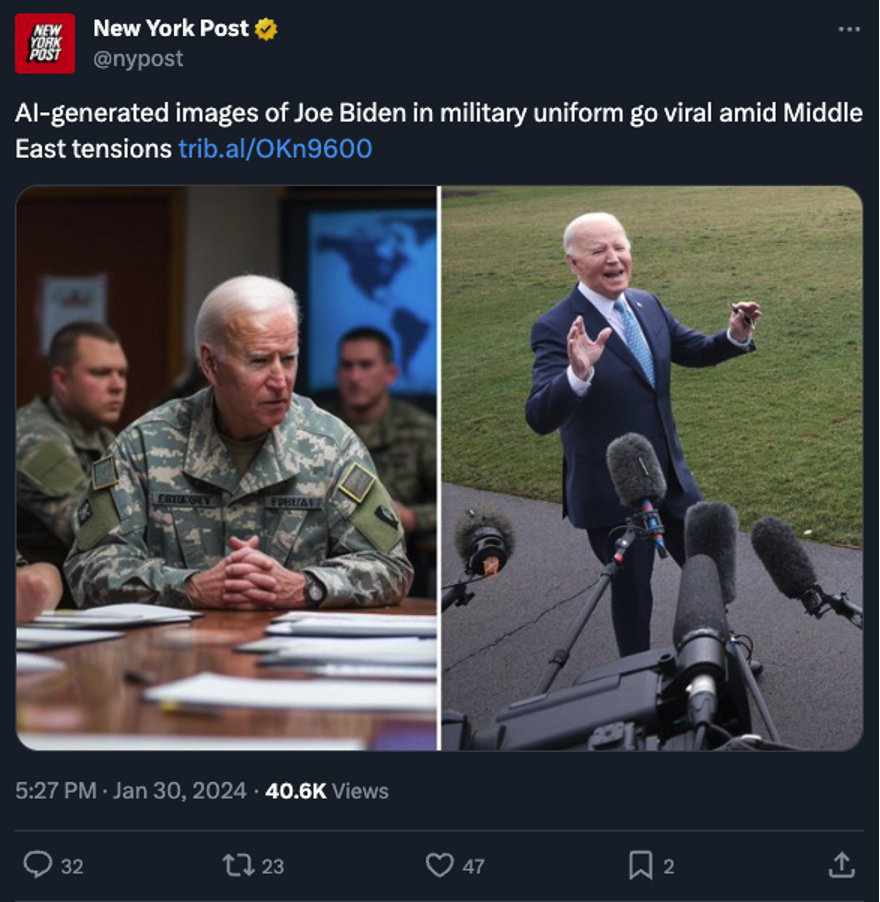

“AI-generated photos showing President Biden decked out in military gear in the Situation Room went viral Tuesday,” reports the New York Post — “amid Middle East tensions in the wake of the deadly drone attack on U.S. soldiers.”

Exactly who created them and propagated them is a mystery — but the fakery is beyond dispute. For instance, this picture…

Yeah, look closely…

He’s right — for whatever reason, it does show up in many AI-generated images.

The practice is so widespread that — well, I ran across this meme a couple of weeks ago and figured it would come in handy sooner or later…

Note well: The preceding is neither investment nor legal advice but for entertainment purposes only. Heh…

![]() A Grateful Reader

A Grateful Reader

We heard from a newer reader after yesterday’s mailbag — in which we were taken to task for “fear-based marketing”...

We heard from a newer reader after yesterday’s mailbag — in which we were taken to task for “fear-based marketing”...

“Every 5 Bullets email I read that contains feedback from leftists disappointed that another business (yours) isn’t spewing the same old socialist propaganda crap makes me even happier that I’m a new member.

“Very rare these days for a business to express contrarian views to the ilk of Rachel Maddow and provide opinions that resonate with the ‘deplorables’. Sure hope that never changes and you sign up 20 people that aren’t tainted by the swamp for every one of those rats that leave complaining about the political perspectives in the newsletters.”

Dave responds: Welcome to the Paradigm family.

And thank you for the opportunity to remind your fellow newbies that investment newsletters were the original “alternative media” — going back to the days when we relied on the U.S. Postal Service for distribution.

Our feisty little industry has a rich tradition that we’ve carried full steam into the internet age. Thanks for coming aboard!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets