“New Blood” Revitalizes Stocks

- The market needs a blood transfusion… Stat!

- Just what the doctor ordered: In praise of market rotation

- Shareholders abandon their ESG ideals

- How to bypass a guilt trip in Japan

- “Ferry problems”: From Mersey to Jersey.

![]() The Stock Market Needs a Blood Transfusion

The Stock Market Needs a Blood Transfusion

“What's unhealthy about a rally that drives tech stocks like Nvidia sky-high?” asks Paradigm’s income-investing ace Zach Scheidt.

“What's unhealthy about a rally that drives tech stocks like Nvidia sky-high?” asks Paradigm’s income-investing ace Zach Scheidt.

“The problem [is] most of the market's recent strength has been driven by a handful of very large individual stocks. Meanwhile, the majority of companies in the S&P 500 have been left behind.

“Unfortunately, this issue has been invisible to most investors,” Zach notes. “That's because the S&P 500 is a ‘market cap-weighted’ index. In other words, the big companies carry much more weight when it comes to calculating the S&P 500's performance.”

For instance: “Because of the way the S&P 500 is calculated, Apple represents 7.5% of the entire index, even though it's only one of 500 stocks.

“And the top five names in the S&P 500 represent nearly a quarter of the entire index!” Zach continues.

“And the top five names in the S&P 500 represent nearly a quarter of the entire index!” Zach continues.

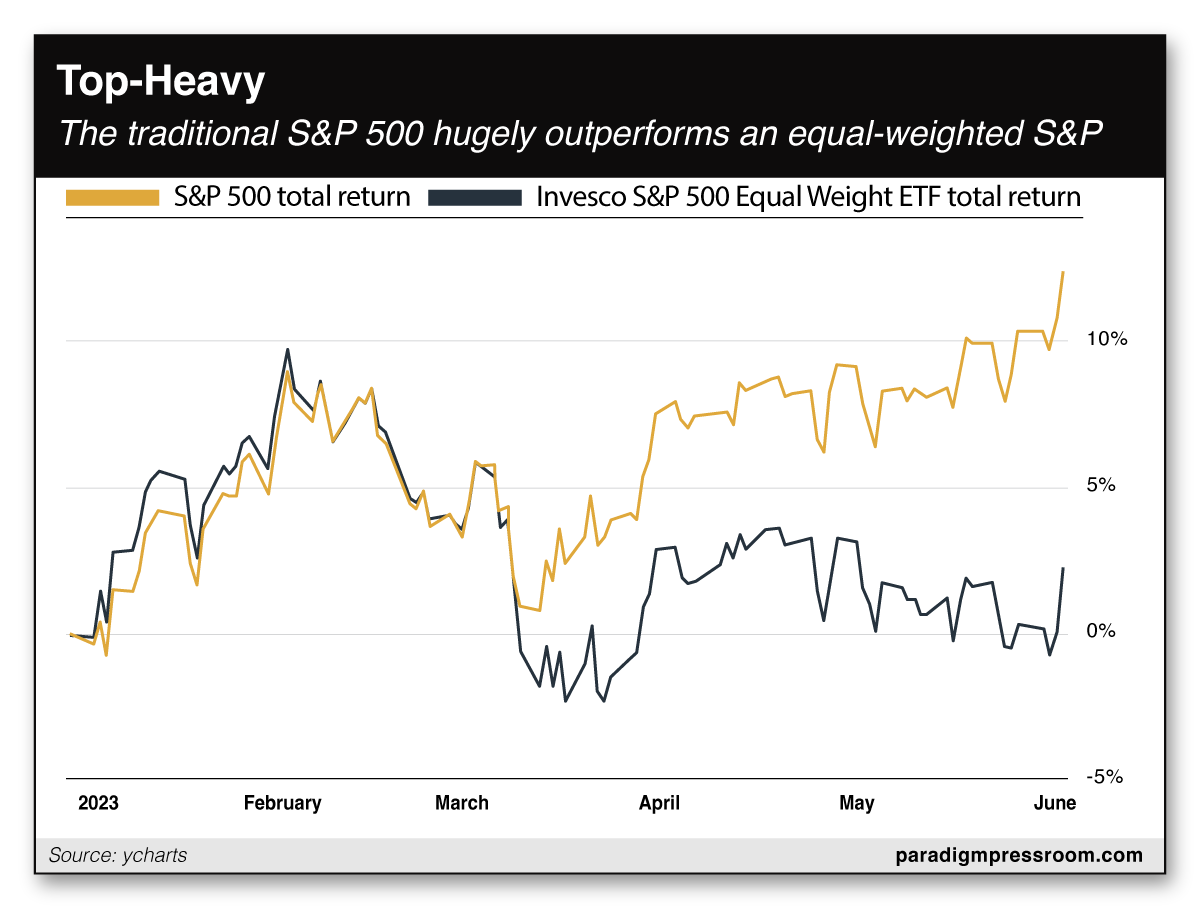

To further illustrate this concept, the following chart shows the performance of the Invesco S&P 500 Equal Weight ETF (RSP) compared with the traditional market cap-weighted index:

In other words, “the blue line shows the performance of the index if all stocks had the same amount of influence,” says Zach.

“There's a big difference between the 12.3% gain from the S&P 500 index and the 2.2% gain from the average stock in the market.

“If you're diversified into many different areas of the market (as you should be),” he says, “chances are you haven't been keeping up with the market.”

Perhaps adding to investors’ sense of being left behind…

“We've got a brand-new bull market…. Or at the very least, we're approaching a key threshold,” says Zach.

“We've got a brand-new bull market…. Or at the very least, we're approaching a key threshold,” says Zach.

“But the stock market's rebound over the last few months has been quite unhealthy.” (See above.) “Some of the professionals that I compare notes with have called this rally anemic.”

The market’s prognosis, however, might be changing.

“The recent surge from Nvidia could be a blowoff top for speculative stocks, marking the end of the bull market for these stocks and the beginning of a new bull market for other fundamentally sound stocks.

“While large-cap stocks led the market's rally since early spring, the first few days of June have given us a welcome shift,” he observes.

“While large-cap stocks led the market's rally since early spring, the first few days of June have given us a welcome shift,” he observes.

“Stocks in many different areas of the market have started to catch up. I'm talking about…

- Industrial stocks

- Energy companies

- Utilities

- Consumer staples

- Travel plays

- Health care stocks.

“Basically, this market rally is broadening out, meaning more stocks are participating. And that's great news for diversified investors like you and me.

“As we head into summer, I've been holding some cash in reserve while we wait for more clear direction from the markets,” says Zach.

“As we head into summer, I've been holding some cash in reserve while we wait for more clear direction from the markets,” says Zach.

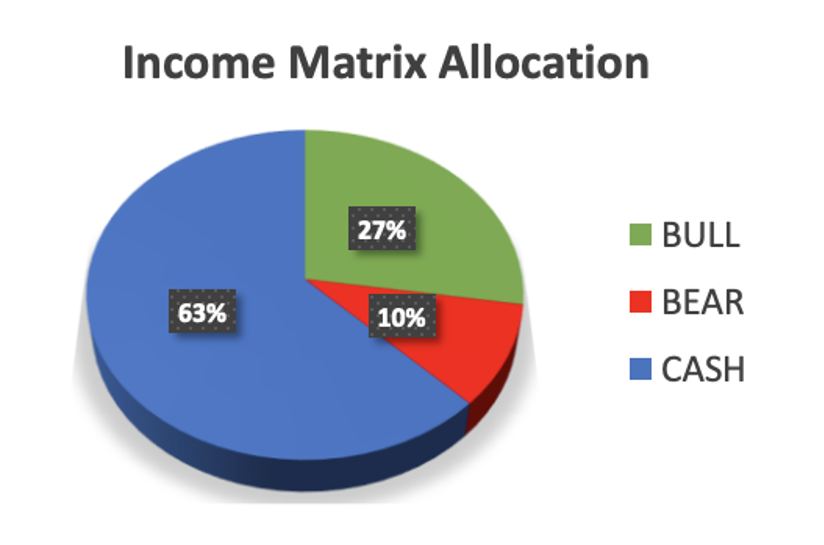

“I put $100K of my own capital into a trading account” — which is a key feature of Zach’s new trading service, Income Alliance. “And I'm letting Income Alliance members follow along as I put this money to work.

“The pie chart below shows how much cash I've put to work already and how much dry powder I have ready to go…

“As you can see, I've already put some of my cash to work…

“Now that the market is becoming more healthy — and more stocks are participating — there are plenty of great plays to tap into,” he says.

“Now that the market is becoming more healthy — and more stocks are participating — there are plenty of great plays to tap into,” he says.

“This week, I would start by adding some energy plays to your portfolio. Perhaps some oil refiners or oil-and-natural gas producers.

“From there, I've got my eye on some medical device companies as more patients have elective procedures done,” Zach says. “On top of these opportunities, I've put some of my money to work on some big travel rebound plays.”

By Zach’s estimation: “This month, the market is giving us a signal to start putting more capital to work. I hope you'll join me as we invest in some of the catch-up plays this market is giving us.”

[Editor’s note: For almost 20 years, our company operated under one unbreakable rule. And in hindsight, this policy somewhat “censored” our editors, barring them from sharing some of their favorite investments with you.

But after decades of operating under this rule, we’ve decided to up the ante… We want to prove that our editors put up or shut up. Which starts with Zach Scheidt, who’s so confident, he’s personally investing $100K into his recommendations at his new trading service, Income Alliance.

Our vice president of publishing, Doug Hill, explains why this is one of the biggest moments in our company’s 20-year history — and how you can follow Zach’s recommendations at Income Alliance, too.]

![]() “Rotation, Rotation, Rotation!”

“Rotation, Rotation, Rotation!”

“We'd been waiting for something like this to happen for the past couple weeks… and the Nasdaq has delivered, finally pulling back following its furious rally to new 52-week highs,” says Paradigm’s market analyst Greg Guenthner.

“We'd been waiting for something like this to happen for the past couple weeks… and the Nasdaq has delivered, finally pulling back following its furious rally to new 52-week highs,” says Paradigm’s market analyst Greg Guenthner.

Dovetailing nicely with what Zach had to say, Greg continues: “Big Tech has clearly been overbought, and it's blowing off some steam. MSFT, NVDA and GOOG lost more than 3%. AMZN dropped 4%. META down 2.75%. AAPL held its ground, slipping a little less than 1%.

“Meanwhile, small stocks are racing to catch up,” he says. “IWM posted its second day of big gains, KRE is recovering. Microcaps (IWC) are even joining the party. Industrials, materials and utilities all posted strong performances yesterday.

“Rotation, rotation, rotation!” Greg emphasizes. “This is what any bull market needs to survive. We'll need to watch to see if it continues — and where Big Tech eventually catches a bid.”

So at the time of writing, the major U.S. stock indexes are in the green, with the Nasdaq in the lead (+0.80%) at 13,210. Meanwhile, the Dow and S&P 500 are neck and neck — each up about 0.50% — to 33,825 and 4,290 respectively.

Turning to the commodities complex, crude is down 1.7% to $71.27 for a barrel of WTI, but precious metals are getting some love. Gold is up 1% to $1,978.10 per ounce and silver’s barreling ahead, up 3.5%, over $24.

As for the crypto market, Bitcoin is barely in the green at $26,500, but Ethereum has lost 0.25% to $1,845. For more on why crypto’s struggling today, read our update on the Coinbase lawsuit…

“Finally,” says Coinbase chief legal officer Paul Grewal, “I now at least know what it is that we are accused of.”

“Finally,” says Coinbase chief legal officer Paul Grewal, “I now at least know what it is that we are accused of.”

As we reported Tuesday, the SEC filed a lawsuit against the popular crypto exchange platform Coinbase, claiming the company failed to register as a securities exchange.

“Grewal argues that Coinbase had been operating in the dark, with the SEC refusing to reveal which products and services were under scrutiny,” says Paradigm’s crypto expert Chris Campbell.

“[Grewal] says that the SEC’s constant call for crypto companies to ‘come in and register’ has been disingenuous at best.”

And SEC chair Gary Gensler is at the center of this crypto bait-and-switch — which is truly an about-face for the former MIT professor who, in 2018, described cryptocurrency as “cash, or a commodity, but not a security.”

“How the times have changed,” Chris says.

“Since ascending to the throne of the SEC,” says Chris, “Gensler quickly insisted that most cryptocurrencies are securities” — the implication being crypto exchanges would need to register accordingly. And companies including Coinbase, Robinhood and Ripple have been trying to comply.

“Since ascending to the throne of the SEC,” says Chris, “Gensler quickly insisted that most cryptocurrencies are securities” — the implication being crypto exchanges would need to register accordingly. And companies including Coinbase, Robinhood and Ripple have been trying to comply.

“As things currently stand today,” says Mr. Grewal, representing Coinbase, “no operating exchange or other intermediary can register with the SEC. There’s no way for issuers to practically register under the current regime.”

Robinhood chief legal officer Dan Gallagher concurs: “We went through a 16-month process with the SEC staff trying to register a special-purpose broker-dealer. And then we were pretty summarily told in March that that process was over and we would not see any fruits of that effort.”

Chris notes: “Ripple (XRP) CEO Brad Garlinghouse has been saying the same thing since at least 2020, when the SEC filed a similar lawsuit against Ripple… Perhaps giving a glimpse of what’s to come for Coinbase, Ripple has since spent at least $200 million defending itself against the SEC.”

Not that Coinbase has to look too far into the future to see the effects of the SEC lawsuit; Coinbase shares dropped 14% on news of the lawsuit. (Shares have recovered today.)

“While Gensler asserts that he has been ‘awfully clear about a bunch of this stuff,’” Chris concludes, “the specific ‘stuff’ which he is referring to remains unclear.”

![]() Shareholders Tell ESG: “Take a Hike”

Shareholders Tell ESG: “Take a Hike”

“Investors’ support for environmental and social activism sank overall at this year’s annual meetings of U.S. companies,” says a Financial Times article.

“Investors’ support for environmental and social activism sank overall at this year’s annual meetings of U.S. companies,” says a Financial Times article.

Specifically, non-profit data collector Sustainable Investments Institute looked at how investors have been voting on shareholder proposals, finding that, altogether, only 23% voted for climate-change proposals at the end of May — down from 36.6% last year.

“The waning enthusiasm was evident across an array of businesses including Amazon, Exxon Mobil and United Parcel Service,” says FT.

“Only 11% of Exxon shareholders last week backed a petition to set emissions reduction targets consistent with the Paris climate agreement, down from 28% last year.” And although half of participating Amazon shareholders voted for more transparency about plastic packaging in 2022, that number sank to fewer than one-third this year.

“Shareholder proposals, usually non-binding in the U.S., have increasingly become an activism tool,” the article says. “A U.S. policy change in 2021 has allowed more petitions to go to a vote.

“Shareholder proposals, usually non-binding in the U.S., have increasingly become an activism tool,” the article says. “A U.S. policy change in 2021 has allowed more petitions to go to a vote.

“As a result, proposals have evolved from anodyne disclosure requests to specific demands for action from companies.”

But despite the fact the number of shareholder proposals is expected to reach a record high this year, per research firm Esgauge, support for ESG action has dwindled.

“Only five U.S. shareholder resolutions on environmental and social issues have won majority support of company shareholders this year, down from more than 35 in 2022 and 2021,” FT says.

“We have seen… a rise in overly prescriptive proposals appearing on company ballots,” says Benjamin Colton of State Street Global Advisors. “Our observation is that these dynamics have led to an overall decline in investor support for environment and social shareholder proposals.”

![]() A New Spin on “Quiet Quitting” in Japan

A New Spin on “Quiet Quitting” in Japan

“When you try to quit, they give you a guilt trip,” says Toshiyuki Niino of Kamakura, Japan.

“When you try to quit, they give you a guilt trip,” says Toshiyuki Niino of Kamakura, Japan.

After unhappily working at a job for several years, Mr. Niino was trying to muster the courage to quit… Unsuccessfully.

“Niino’s experience gave him and his childhood friend Yuichiro Okazaki an idea: What if you could avoid the ordeal of quitting your job by getting someone else to do it for you?” says an article at Al Jazeera.

“So began Exit, a [2017] startup that handles the awkward business of handing in your notice on behalf of Japanese employees who are too ashamed or embarrassed to do it themselves.”

For a fee amounting to $144, Exit informs an employer of the employee’s decision to quit, eliminating any messy confrontation. (We guess a two-week notice isn’t a “thing” in Japan?)

For a fee amounting to $144, Exit informs an employer of the employee’s decision to quit, eliminating any messy confrontation. (We guess a two-week notice isn’t a “thing” in Japan?)

Exit has even sparked a cottage industry, with about two dozen Japanese companies entering the “resignation outsourcing” biz.

“Niino said most of his clients are men in their 20s and that his business receives about 10,000 inquiries each year,” the article continues.

“The two major reasons I see [for hiring Exit] are [employees] are scared of their boss so they cannot say that they want to quit, and also the guilty feeling they have for wanting to quit,” Niino says.

It’s here that I could say a lot of things, but something about “testicular fortitude” definitely comes to mind. On the other hand, in a country which literally coined a word for “death from overwork” — karoshi — and lifelong employment has been the norm, job-hopping isn’t what it is in the States.

![]() Ferry Cross the… Puget Sound

Ferry Cross the… Puget Sound

“Unfortunately, you don’t need to go all the way to Scotland to find islands with ferry problems,” says a longtime reader, highlighting an issue Dave brought to our attention Tuesday.

“They exist right here in the Puget Sound area where I live. For example, ferry service in San Juan County islands, none of which has a bridge connection to the mainland, has been a problem for some time now.

“Just recently, a ferry run was canceled, leaving vehicles and passengers stranded. People had to spend the night sleeping in their cars.”

On Memorial Day, she tells us: “Inter-island ferry service among the San Juan County islands was suspended temporarily: The problems with the Puget Sound ferry system primarily involve elderly vessels as well as staffing shortages.

“In my opinion, it’s the usual inattention to infrastructure maintenance and upgrade that is rampant in the U.S. Railroads, power grids, highway systems, etc. are all deteriorating while money is thrown out the window chasing elusive military gains overseas as well as meaningless shiny boondoggles designed to appeal to voters in the short run.

“As usual, love The 5, whatever the format.”

Emily responds: Being as this is my first foray with the 5 Bullets format, I appreciate the vote of confidence. Although I feel about as rusty as a derelict ferry. But I’ll get there!

As always, thank you for reading… and we’ll be back with another episode tomorrow.

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets