OpenAI Wants a Bailout

![]() OpenAI Wants a Bailout

OpenAI Wants a Bailout

It’s come to this: The company behind ChatGPT is so poorly managed it wants a taxpayer backstop. You know, like the too-big-to-fail banks.

It’s come to this: The company behind ChatGPT is so poorly managed it wants a taxpayer backstop. You know, like the too-big-to-fail banks.

From the AFP newswire…

ChatGPT creator OpenAI, the world’s largest private company, is asking the U.S. government to provide loan guarantees for its massive infrastructure expansion that will eventually cost more than $1 trillion.

Speaking at a Wall Street Journal business conference, OpenAI CFO Sarah Friar explained that government backing could help attract the enormous investment needed for AI computing and infrastructure, given the uncertain lifespan of AI data centers.

“This is where we’re looking for an ecosystem of banks, private equity, maybe even governmental,” Friar said.

Federal loan guarantees would “really drop the cost of financing,” she explained, enabling OpenAI and its investors to borrow more money at lower rates to meet the company’s ambitious targets.

Unlike AFP, much of the financial media “buried the lead,” as the saying goes.

Unlike AFP, much of the financial media “buried the lead,” as the saying goes.

The Wall Street Journal, sponsor of the conference where Friar spoke, thought it was more newsworthy when she said taking OpenAI public is “not in the cards right now.”

Bloomberg’s angle was that Friar thinks the talk of an AI bubble is overblown and the market should demonstrate more “exuberance” about the sector.

But on social media… everyone knows the score.

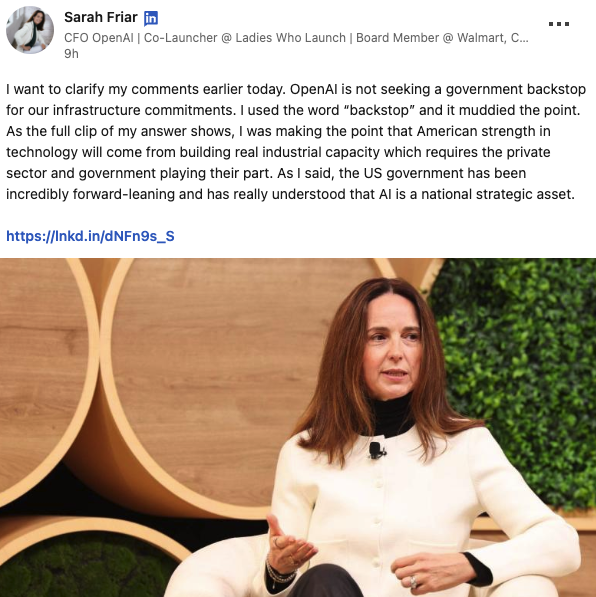

The backlash was such that Friar tried to walk back her remarks in a LinkedIn post.

Yeah, too late.

Then again, maybe Friar was floating a trial balloon?

Then again, maybe Friar was floating a trial balloon?

Maybe the endgame is that the federal government takes a stake in OpenAI, the way it has this year with Intel, U.S. Steel, MP Materials and so on.

It’d be a win-win for OpenAI and the feds…

- OpenAI gets a sorely needed cash infusion. As mentioned here in September, how is OpenAI going to spend $300 billion on a deal with Oracle over the next five years when its revenue this year will total $13 billion? And that’s just one of OpenAI’s announced deals!

- The government gets to call the shots on the platform with 75% market share of generative AI chatbots.

But it’d be a lose-lose for taxpayers and ChatGPT users…

- If OpenAI’s reputed $1 trillion valuation is vastly overblown, Uncle Sam is likely to overpay for the acquisition

- ChatGPT could easily become a tool for censorship and surveillance — either by the current administration or a future one.

We’ll see what shakes out in the weeks and months ahead. Presumably someone in the White House took notice of this torches-and-pitchforks moment as it unfolded over the last 24 hours.

![]() FAA Grounds Airline Stocks

FAA Grounds Airline Stocks

Airline stocks are taking a hit now that the “partial government shutdown” is about to curb the number of planes in the sky.

Airline stocks are taking a hit now that the “partial government shutdown” is about to curb the number of planes in the sky.

As we mentioned on Tuesday, Transportation Secretary Sean Duffy was threatening “mass cancellations” of flights if air traffic controllers continued to call in sick while they’re not getting paid.

Yesterday, the Federal Aviation Administration made it official. Flight capacity at the nation’s 40 biggest airports will be cut by 10% over the next few days. The details aren’t yet public but according to the Reuters newswire the most likely scenario is a 4% cut tomorrow, gradually ramping up to 10% by next week.

At last check, American Airlines is down 2.9% on the day and United Airlines 2%. Delta and Southwest are holding up somewhat better, both down about 1.5%.

➢ Shutdown update: We might have to recalibrate our call that the shutdown would be over by the end of this week. According to the Axios site, Capitol Hill Democrats are strategizing today — and Connecticut’s Chris Murphy is among nine Dem senators urging their colleagues to continue holding out.

Actually, Delta and Southwest are doing no worse than your typical Nasdaq stock today.

Actually, Delta and Southwest are doing no worse than your typical Nasdaq stock today.

Yesterday’s mild rally had no staying power. As we write the Nasdaq is down 1.4% from yesterday’s close and the S&P 500 is down nearly 0.9% to 6,738. For perspective, 6,738 was a record high only a month ago — but it’s down 2.2% from just last week.

“I'm still expecting a melt-up -- but I don't want to be early on betting on a turnaround!” Greg Guenthner writes his Trading Desk readers. “We'll let the charts guide us.”

Precious metals are digesting their gains from earlier this week — gold at $3,976 and silver at $47.82. Crude is sinking further below $60, a barrel of West Texas Intermediate now $59.25.

Crypto can’t catch a break. Bitcoin is hanging out at $101,545 while Ethereum has sunk below $3,300.

![]() Tariff Refunds

Tariff Refunds

It’s the day after the Supreme Court hearing that might end up with the justices nixing the Trump tariff regime — at least in its present form.

It’s the day after the Supreme Court hearing that might end up with the justices nixing the Trump tariff regime — at least in its present form.

As mentioned here yesterday, both conservatives and liberals piled on Solicitor General John Sauer as he made his case for the Trump administration.

“You want to say that tariffs are not taxes, but that’s exactly what they are,” said liberal justice Sonia Sotomayor. As we learned in school, new taxes must originate in the House of Representatives.

Conservative Neil Gorsuch posed an eye-opening hypothetical under a Democratic administration — citing the language of the law the Trump White House is leaning on.

“Could the president impose a 50% tariff on gas-powered cars and auto parts to deal with the ‘unusual and extraordinary threat’ from abroad of climate change?”

In so many words, Sauer sheepishly said yes.

As mentioned here two months ago, there’s now a distinct possibility the federal government would have to issue refunds for tariffs already collected.

As mentioned here two months ago, there’s now a distinct possibility the federal government would have to issue refunds for tariffs already collected.

And that’s not chump change: Uncle Sam’s tariff revenue in fiscal year 2025 — including eight full months of the Trump administration — totaled $195 billion. That’s a substantial rise from fiscal 2024’s total of $77 billion.

But the story is a bit more complex than that — as our Jim Rickards wrote his Strategic Intelligence readers recently.

“If the U.S. Supreme Court rules that Trump did not have the legal authority he claimed to impose tariffs, then the court might impose remedies, including a refund of tariffs collected.

“However, it is also possible the Supreme Court could hold that Trump lacked legal authority but then returns the case to a lower court for the determination of remedies, which could include refunds…

“If the court decides Trump acted illegally, it is likely that Trump will quickly turn to another statute for authority and keep the tariffs collected on the basis of such other statute. That could result in further litigation over the alternative authority.

“In all cases, Trump’s team will hold onto the tariffs until all legal theories are exhausted. Trump is likely to win in the long run on one theory or another.

“Therefore, it seems likely the tariffs will never be refunded.”

![]() Follow-Up: Pennies… and the Cash Economy

Follow-Up: Pennies… and the Cash Economy

Intriguing: The owner of 25 Burger King franchises in Michigan, Indiana and Ohio figures that 60% of his customers pay in cash.

Intriguing: The owner of 25 Burger King franchises in Michigan, Indiana and Ohio figures that 60% of his customers pay in cash.

This tidbit turns up in today’s Wall Street Journal — which is picking up our theme from earlier this week about the developing penny shortage.

By order of the Trump administration, penny production at the U.S. Mint ended last May. A shortage that wasn’t expected to develop until next year is here now. A Baltimore-area Burger King operator is asking employees to pick up rolls of pennies anytime they go to the bank — seeing as the franchisee’s amored-car operator is no longer delivering them.

But the bit about 60% of BK customers paying cash — at least for one small string of Midwestern franchises — is an eye-opener.

So we dug into some Federal Reserve figures: Cash was used for about 26% of all payments in the pre-pandemic year of 2019. By 2023–24, that figure had fallen to 16%.

Cash remains popular among the 55-and-over set… among low-income households… and for small-value purchases (under $25). A 2024 Fed report suggests the decline in cash use might have reached a “floor” for the time being.

Cash still has the advantage of privacy in a way digital payments do not. Earlier this year we mused over how the Trump administration might have reason to do away with cash. We’ll have an update on the theme either tomorrow or next week…

![]() Mailbag: Mamdani, Gold, Planned Obsolesence

Mailbag: Mamdani, Gold, Planned Obsolesence

“Thank you for calling the moment honestly around Mamdani’s election,” an appreciative reader writes. “You cut through all the emotional noise and put your finger on the real issue: ‘the decades-long dispossession of the middle and working classes by connected elites.’

“Thank you for calling the moment honestly around Mamdani’s election,” an appreciative reader writes. “You cut through all the emotional noise and put your finger on the real issue: ‘the decades-long dispossession of the middle and working classes by connected elites.’

“That’s the heart of what’s driving so much frustration in this country. The ‘taking game’ has been running for a long time — wealth and power extracted upward with the full participation of the political class — while everyday Americans are told to fight each other over scraps. You’re one of the few willing to name the dynamic directly rather than get lost in the partisan theatrics designed to distract from the truth.

“I appreciate your clear-eyed analysis. It helps people see the game that is actually being played.”

“Interesting graph of central bank gold purchases and interesting commentary,” writes a Strategic Intelligence subscriber after yesterday’s edition.

“Interesting graph of central bank gold purchases and interesting commentary,” writes a Strategic Intelligence subscriber after yesterday’s edition.

“One additional thing to point out though. While the tonnage of gold purchased by the banks has gone down (maybe by 20% if the year ends at 850 metric tons?), by another measure (U.S. dollars spent by central banks on gold), I wonder if gold purchases actually increased.

“With the higher U.S. dollar prices of gold in 2025, it would take more money for the central banks to buy the same amount of gold. If the amount of money that a central bank has for buying gold stays the same, then, at a higher price, they must buy less.

“Love the 5!”

Dave responds: Undoubtedly true. That’s why the tonnage totals might well have topped out for now. But in no way does it suggest the central bank gold-buying spree is over!

“I believe refrigerators were made to fail after about six years due to energy requirement changes here in the U.S.,” a reader observes. “The motors and compressors struggle.”

“I believe refrigerators were made to fail after about six years due to energy requirement changes here in the U.S.,” a reader observes. “The motors and compressors struggle.”

(See, this all started the other day with an item about Samsung “smart” fridges serving up ads on their touchscreens. But since then it’s touched a nerve about the durability of major appliances.)

“Further, these appliances are nearly all made overseas. LG is Korean and HUGE washer, dryer and refrigerator maker. All inferior to previously made U.S. brands. Bah humbug.”

Dave: Yeah, and don’t get me started on the built-in icemakers, whose lifespans seem inevitably shorter than those of the main unit. Here in our household, the icemaker in our circa-2012 Maytag model hasn’t worked for years — but we can’t justify the cost of either repair or replacement.

We could, however, justify the cost of a modest countertop icemaker. Hopefully, it’s not one more item for the scrap heap in a few more years, right?