57 Days

![]() 57 Days

57 Days

Yesterday’s media freakout appears to be already over.

Yesterday’s media freakout appears to be already over.

When we left you 24 hours ago, shares of Palantir Technologies were selling off despite boffo sales and earnings. CNBC and the rest of the conventional-wisdom crowd were suddenly concerned about valuation — not only for notoriously pricey PLTR but any company riding the AI wave. The S&P 500 ended the day down 1.2%, the Nasdaq 2%.

Going into this morning’s trade, it’s almost as if CNBC was disappointed that the sell-off ended nearly as soon as it began: “Stock futures are little changed, but AMD and some other tech stocks remain under pressure.”

Amid this backdrop we step back to see where the market is headed for the final 57 days of 2025.

“History would imply we have a great couple of months ahead of us,” says Paradigm trading pro Enrique Abeyta.

“History would imply we have a great couple of months ahead of us,” says Paradigm trading pro Enrique Abeyta.

Seasonality is part of it, for sure. “November is the best month of the year for the market, and December is another seasonally strong month.

“Taxes, year-end compensation for money managers and earnings all play a role. Whatever the reason, stocks often finish the year on a high note.”

But there’s another factor at work. Enrique calls it “situationality.”

“This is simply the effect of recent stock market performance on what happens next.”

Going into November, the S&P 500 logged six straight months of gains — and the Nasdaq, seven.

“So the question now is how does the market perform heading into year-end when it’s already running hot?” Enrique says.

“So the question now is how does the market perform heading into year-end when it’s already running hot?” Enrique says.

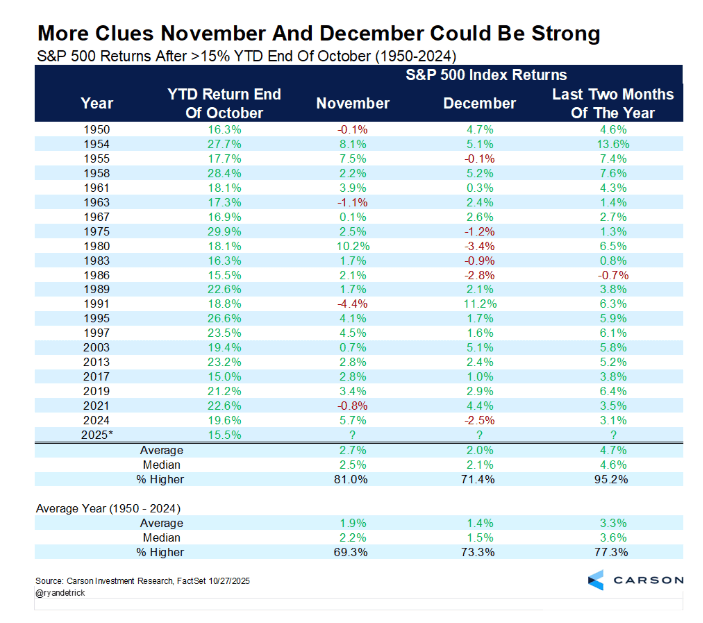

For answers, he directs our attention to a table of stock market performance in years when the S&P is already up 15% or more through the first 10 months of the year.

According to Carson Investment Research, this has happened 22 times since 1950 — including 2025.

In every instance but one, the index was higher on Dec. 31 than it was on Oct. 31. The lone exception is 1986.

That’s 95% odds of it happening again this year.

Carson’s number-crunching also turns up four instances since 1950 in which the S&P was up every month between May and October.

“Each of the previous three times this happened,” says Enrique, “the S&P has been up over the next two months with an average return of 6%.”

Bottom line: “The combination of seasonality and situationality has lined up perfectly this year — and history suggests it’s a powerful setup.”

![]() The Market Today: All Ears on D.C.

The Market Today: All Ears on D.C.

Rare is the day when investment professionals keep an eye on their screens while also keeping an ear on Supreme Court arguments… but today’s the day.

Rare is the day when investment professionals keep an eye on their screens while also keeping an ear on Supreme Court arguments… but today’s the day.

The Trump tariff regime is on the docket — in a case many 5 Bullets readers first learned about six months ago, well before the Supreme Court agreed to take the case.

It’s always dicey to make assumptions about how the justices will rule based on the questions they pose during oral arguments. But both conservative and liberal justices piled on Solicitor General John Sauer as he made the case for the Trump administration.

“You say tariffs are not taxes, but that’s exactly what they are,” said liberal justice Sonia Sotomayor.

No timetable for the court to issue an opinion. But it’s a safe bet a ruling will come sometime before the flurry of decisions that usually takes place at the end of the court’s term in June.

In the meantime, the major U.S. stock indexes are clawing back some of yesterday’s losses.

In the meantime, the major U.S. stock indexes are clawing back some of yesterday’s losses.

The S&P 500 is up over half a percent at last check — back over 6,800. The Nasdaq’s gain is stronger, the Dow’s weaker. That said, “I think it's a bit premature to call ‘the low’ on this pullback right here,” Greg Guenthner tells his Trading Desk readers.

The big economic number of the day is the monthly jobs report from ADP, the big payroll firm — which takes on outsized significance this month while the government shutdown is ongoing and there will be no report from the Bureau of Labor Statistics come Friday.

ADP reports 42,000 new jobs for the month — more than expected, and the first gain after two months of job losses. Alas, most of that hiring came at big firms; small and medium-sized businesses continue to cut personnel.

Elsewhere, crude has slipped under $60 a barrel. Crypto is stabilizing for the moment, Bitcoin at $103,453 and Ethereum at $3,420.

![]() Central Banks and Gold: Still Stacking

Central Banks and Gold: Still Stacking

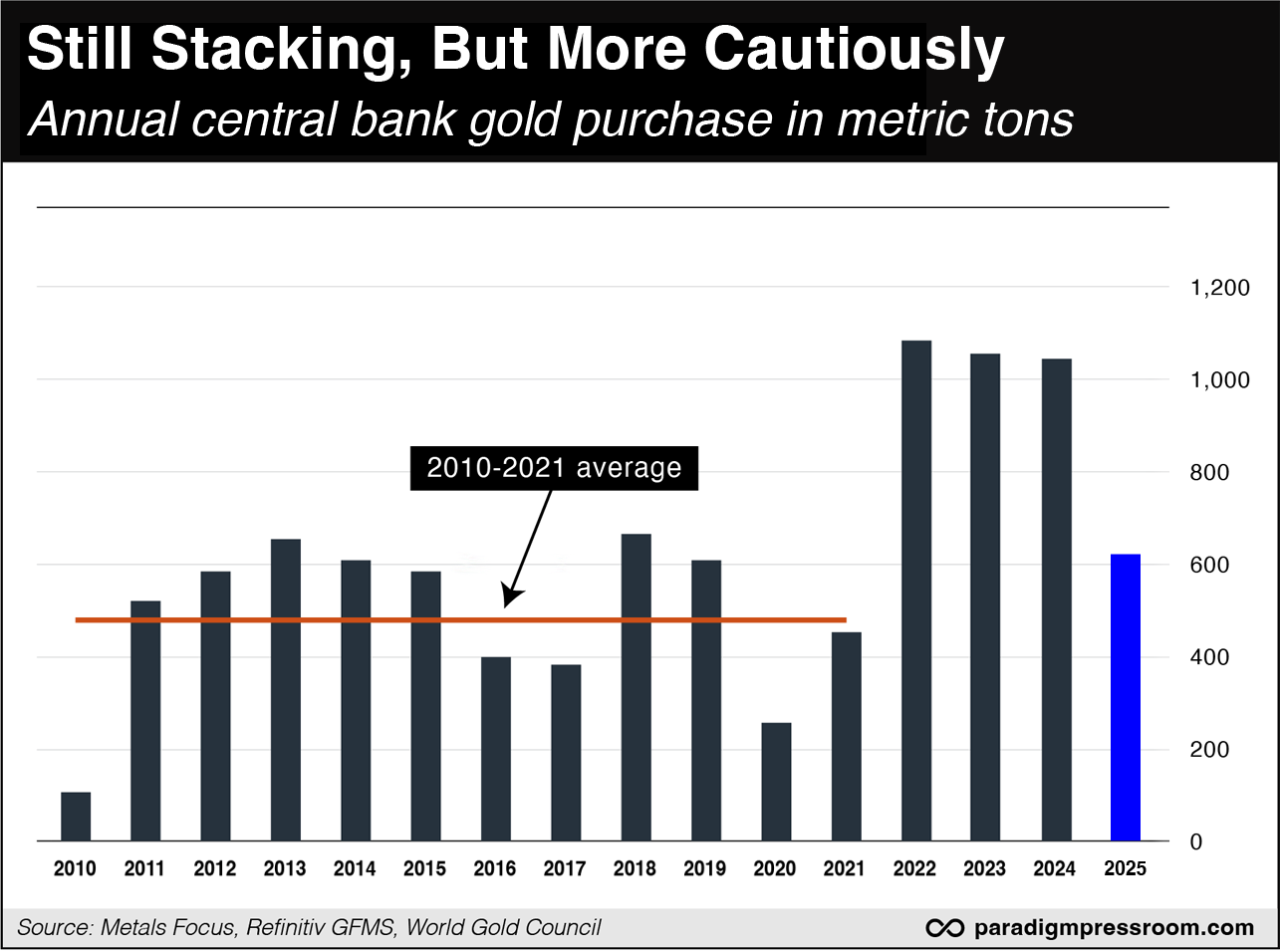

It looks as if the gold-buying binge by central banks is easing — if only a bit.

It looks as if the gold-buying binge by central banks is easing — if only a bit.

The World Gold Council is out with its quarterly figures of gold purchases by central banks. Here’s the background: The world’s central banks have helped propel gold prices higher every year since 2022. That’s when Russia invaded Ukraine and the U.S. government imposed draconian sanctions on Russia, seizing the dollar-based assets of Russia’s central bank.

Other governments on less-than-friendly terms with Washington wondered if they might be next — and they opted to start stacking gold rather than U.S. Treasuries. As Paradigm’s Jim Rickards is fond of reminding us, “Gold is a physical nondigital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

So there’s the context for this chart. Through the first three quarters of 2025, central banks have purchased 634 metric tons of gold.

Assuming the buying during the current quarter continues at the pace of the previous three, the year-end total for 2025 would be just shy of 850 metric tons. That’s lower than the total in each of the last three years, but still substantially higher than anytime in the decade before 2022.

“This persistent official demand continues to limit downside volatility,” observes Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank, and one of the smartest commodities minds outside of Paradigm.

“This persistent official demand continues to limit downside volatility,” observes Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank, and one of the smartest commodities minds outside of Paradigm.

Like every other observer of the precious metals space, Hansen said gold raced up too far too fast in October.

The mood now, he tells Kitco News, “has shifted from exuberance to reflection, with traders reassessing how much of the 2025 narrative — rate cuts, fiscal stress, geopolitical hedging and central bank demand — has already been priced in…

“Once this corrective phase runs its course, the same forces that fuelled this year’s rally — debt, inflation, and diversification demand—are likely to reassert themselves, making the next meaningful leg higher a 2026 story.”

In the meantime, gold is climbing back toward the $4,000 mark — the bid up $52 to $3,983. And silver’s up a buck, back over $48 again.

![]() Triumph of “the CIA Democrats”

Triumph of “the CIA Democrats”

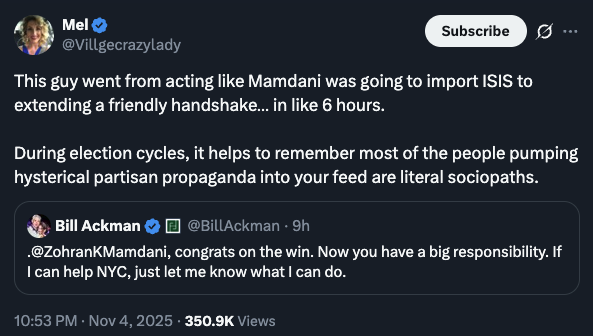

After dropping seven figures of his personal fortune trying to defeat Zohran Mamdani’s bid for mayor of New York, hedge fund bigwig Bill Ackman seems oddly… at peace?

After dropping seven figures of his personal fortune trying to defeat Zohran Mamdani’s bid for mayor of New York, hedge fund bigwig Bill Ackman seems oddly… at peace?

Mamdani’s win is no surprise. “Pass the popcorn,” a reader wrote us ahead of Election Day.

In yesterday’s Rude Awakening, Sean Ring did a lovely job elaborating on a brief comment of mine last week: What’s so bad about Mamdani becoming mayor? Let him proceed with his crackpot schemes so the rest of the world can see how badly they fail.

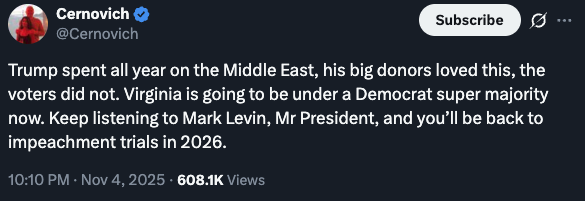

Meanwhile, “the CIA Democrats” won both governorships up for grabs yesterday.

Meanwhile, “the CIA Democrats” won both governorships up for grabs yesterday.

Rewind to the 2018 midterm elections: Journalist Patrick Martin noticed an unusual number of U.S. House candidates with backgrounds in intelligence, the military or national security — all running as Democrats in competitive districts.

In a series of deeply researched articles for the World Socialist Web Site — you never know where you’ll find quality news analysis! — Martin counted 46 such candidates he dubbed “the CIA Democrats.” Of those 46 candidates, 30 won their primaries and 11 won in the general election — the critical margin that handed Democrats control of the House for the latter half of Donald Trump’s first term.

Were it not for the CIA Democrats, Trump’s first impeachment might have never happened. House Speaker Nancy Pelosi was cool to the idea throughout 2019 — until seven of the 11 CIA Democrats signed an open letter calling for proceedings to begin.

And now two of the letter’s seven signatories are ascending to the governor’s office — having campaigned against Trump as much as against their Republican opponents.

And now two of the letter’s seven signatories are ascending to the governor’s office — having campaigned against Trump as much as against their Republican opponents.

Former CIA officer Abigail Spanberger won Virginia by 16 percentage points. And in New Jersey, Mikie Sherrill — a former Navy helicopter pilot fluent in Russian and Arabic — won by a 13-point margin.

The outcome in the Garden State is stunning. The Republican candidate, Jack Ciattarelli, nearly won four years ago over incumbent Democrat (and Goldman Sachs alum) Phil Murphy. Even in deep-blue New Jersey, voters were fed up with COVID lockdowns, restrictions and mandates.

That was then and this is now. Supposedly the lesson for Democrats in 2024 was that they had to be for something and not just against Trump. But after nine months of Trump 47, maybe “against Trump” is enough after all.

Where from here? The past is prologue…

![]() Mailbag: Pennies, Samsungs, Mamdani

Mailbag: Pennies, Samsungs, Mamdani

“Canada ended penny production years ago,” a reader writes from the Great White North after yesterday’s edition. “They did just as you said and rounded up or down.

“Canada ended penny production years ago,” a reader writes from the Great White North after yesterday’s edition. “They did just as you said and rounded up or down.

“I never heard the obvious stated once: The govt of Canada inflated the currency so much that the penny was near worthless.

“Glad to hear you had luck with your Samsung TVs. The only Samsung I would buy is a phone. Low-end Samsung appliances are poor quality. High-end Samsung appliances are worse.”

“Indeed, the point of your Mamdani piece seems to have been missed,” a reader writes after last Tuesday’s edition and Monday’s mailbag.

“Indeed, the point of your Mamdani piece seems to have been missed,” a reader writes after last Tuesday’s edition and Monday’s mailbag.

“I shared it with a friend who also said, ‘What’s your point?’ (Funny thing is that he has lived in the NYC region since the early ’80s.)

“For me, it was a great recap and contextualizing of how and why we have the candidacy of Mamdani.

“My parents came to New York in the mid-’50s and that’s where I grew up. (I left ‘The City’ back in the ’80s.)

“So I much appreciated the memory jog. For sadly, memory appears to be vestigial for most Americans. One reason they can run the same plays on us over and over.”

Dave responds: The point of the piece was right there toward the end: Mamdani’s rise is about more than the simple but alluring narrative of “free stuff” and “tax the rich.” It’s about the decades-long dispossession of the middle and working classes by connected elites. Anyone who didn’t see the point didn’t want to see the point.

In any event, it’s hilarious to watch Bill Ackman suddenly find his Zen about Mamdani. Perhaps he’s come to the same realization as our favorite political reporter Michael Tracey.

We give Tracey the last word today: “The polls in NJ were catastrophically bad! Enough polls already! Parasitic industry.”