Media Claptrap vs. Making Money

![]() Think Small

Think Small

Mainstream financial media settled into its narrative for the day even before the market opened.

Mainstream financial media settled into its narrative for the day even before the market opened.

“S&P 500 futures slide 1% on Palantir decline, rising concerns about AI stock valuations,” said a CNBC alert on your editor’s iPad.

Palantir, the deep state-connected spyware giant, delivered blockbuster earnings numbers after the closing bell yesterday. But management left the outlook into the latter half of 2026 a little hazy.

PLTR shares were down 6.7% at midmorning. CEO Alex Karp went on CNBC to hit out at short sellers. “Honestly, I think what is going on here is market manipulation.”

The nervousness about PLTR’s nosebleed valuation (more than 200X forward earnings) is supposedly spilling into other AI-adjacent names, including “Magnificent 7” companies like Nvidia (down 3% as we write) and Google parent Alphabet (down 1.5%).

The media need narratives to attract eyeballs. But narratives don’t make you money.

The media need narratives to attract eyeballs. But narratives don’t make you money.

“The bull market is still in full force. In fact, I think we’re setting up for a strong year-end rally,” observes Chris Cimorelli.

Chris does make money, both for himself and his readers. He’s the leader of Paradigm’s 10X Trade Club and analyst for James Altucher’s Microcap Millionaire advisory.

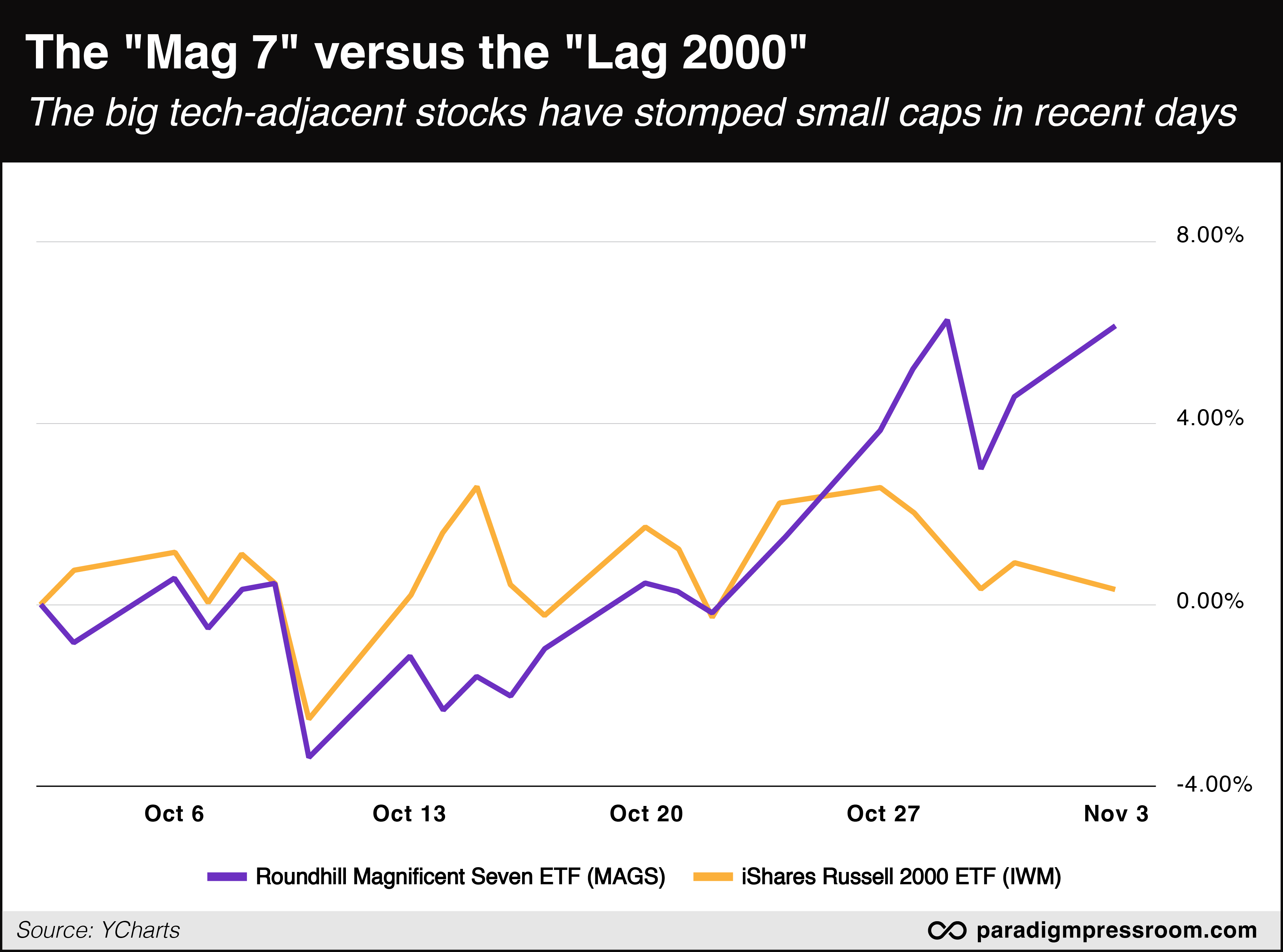

In a dispatch yesterday for Microcap Millionaire, Chris observed that in recent weeks, the Mag 7 names have done the heavy lifting for the stock market as a whole. Meanwhile, the small-cap Russell 2000 Index has been treading water.

Looking at a chart, “It’s pretty clear which is outperforming the other,” he says. “Microcaps have been moving mostly sideways, while Big Tech names have been moving up and to the right.”

As Chris sees it, this is a good thing for the market as a whole — and especially for the market’s smallest stocks.

As Chris sees it, this is a good thing for the market as a whole — and especially for the market’s smallest stocks.

“This looks like one of those classic ‘generals leading the troops’ situations,” he says. “The big names surge first, confidence builds, then the smaller names follow. It’s how bull markets strengthen and broaden out…

“Consolidations are normal. They let markets reset before the next leg higher. This just confirms that the bull market is still in full force.”

What’s more, “There are some major catalysts working in our favor right now.”

The Trump-Xi summit dialed down the trade-war tensions, at least for the time being. Meanwhile, there are rumblings from Washington that the “partial government shutdown” might come to an end in the next few days. (More about that shortly.)

“There’s one beaten-down sector James and I have had our eyes on lately that is set to benefit from both trade deals and an end to the government shutdown,” says Chris.

“There’s one beaten-down sector James and I have had our eyes on lately that is set to benefit from both trade deals and an end to the government shutdown,” says Chris.

“It’s also one of the most interest-rate sensitive areas of the market, and with the Fed finally cutting interest rates, this forgotten sector is finally starting to wake up.”

This is exactly the kind of setup Chris and James look for in Microcap Millionaire. “James and I have spent hours researching different plays, and we’ve finally pinpointed one that we think will explode as this sector comes roaring back to life.”

For the moment, the name and ticker is a closely guarded secret — even for Microcap Millionaire subscribers. Chris is performing some last-minute due diligence even as he’s on vacation in Japan. He’ll issue the recommendation Thursday morning as the market opens.

![]() Crude Awakening

Crude Awakening

The price of crude is sinking back toward $60 amid more noise and nonsense about Western sanctions and Russian oil.

The price of crude is sinking back toward $60 amid more noise and nonsense about Western sanctions and Russian oil.

“Russian Oil Finds Fewer Takes in China After Hit From Sanctions,” says a breathless Bloomberg headline.

“Chinese oil refiners, including state-owned giants and smaller private refiners, are shunning Russian shipments after the U.S. and others blacklisted Moscow’s top producers and some of its customers.”

As the veteran observer of energy markets Anas Alhajji observes on X, “We’ve heard similar stories so many times in the last two years, only to be proven wrong a few days later.”

Word. More than two years, in fact. The first round of sanctions after Russia invaded Ukraine in 2022 were supposed to choke off Russia’s energy revenue. Instead, China and India happily bought all the crude that Europeans decided to swear off.

Meanwhile, this morning’s Wall Street Journal informs us that “China has spent months building up its oil reserves. That might come in handy in the wake of the new sanctions the U.S. recently imposed on Russian crude.”

Chinese customs data reveal that during the first nine months of 2025, the Middle Kingdom imported an average 11 million barrels a day — an amount exceeding the daily production of Saudi Arabia. And over 10% of that total went into China’s strategic reserve.

Bottom line: Russian crude will continue to find willing buyers no matter what Joe Biden or Donald Trump have done. As long as Russian crude keeps reaching the market, there’s an effective ceiling on the oil price until some sort of supply shock comes along.

As the day wears on, the alleged Palantir-driven sell-off is looking more like… a humdrum day in which the major averages are in the red.

As the day wears on, the alleged Palantir-driven sell-off is looking more like… a humdrum day in which the major averages are in the red.

The S&P 500 is down about three-quarters of a percent, a hair’s breadth below 6,800. The Dow’s losses are narrower, the Nasdaq’s steeper.

Precious metals are taking it on the chin again, gold down $44 to $3,956 and silver off 62 cents to $47.40. For perspective we’ll remind you that $3,956 gold was a record high less than a month ago.

Digital nondollar assets continue to sell off — Bitcoin now approaching $103,000 (the lowest since late June) and Ethereum in danger of cracking beneath $3,500.

![]() Airspace Shutdown?

Airspace Shutdown?

Astonishingly, the airline stocks are holding up well this week despite two threats by Transportation Secretary Sean Duffy to close at least some U.S. airspace.

Astonishingly, the airline stocks are holding up well this week despite two threats by Transportation Secretary Sean Duffy to close at least some U.S. airspace.

Air traffic controllers are supposed to stay on the job despite the shutdown. But they’re not getting paid. And the promise of back pay once the shutdown is over? Not enough to keep some of them from calling in sick (and perhaps taking on other jobs to make ends meet). There’ve been ground stops at many U.S. airports in recent weeks.

“If we thought that it was unsafe… we’ll shut the whole airspace down,” Duffy told CNBC yesterday.

“You'll see mass cancellations, and you may see us close certain parts of the airspace, because we just cannot manage it," he said at a press conference today.

That’s no small thing considering that three weeks from tomorrow is the day before Thanksgiving.

Airline stocks rallied yesterday despite Duffy’s first threat. As he reiterated that threat today, the U.S. Global Jets ETF (JETS) is down about 1.9%. But it’s still no worse off than it was last Wednesday.

“We think that the government shutdown will end this week,” Paradigm trading pro Enrique Abeyta says on the daily-feed section of the Paradigm mobile app.

“We think that the government shutdown will end this week,” Paradigm trading pro Enrique Abeyta says on the daily-feed section of the Paradigm mobile app.

“Love them or hate them, The Washington Post is super-plugged into D.C. and this was one of their headlines last night.”

The governor’s elections in Virginia and New Jersey today amount to “the first report card on Trump,” says Sen. Mark Warner (D-Virginia). The Democratic candidates in both races are running against Trump as much as they’re touting state issues. Should they win, the thinking goes, Republicans will start to bend on Obamacare subsidies and other issues.

Republicans also see an end in sight, on the theory that Democrats simply needed to stand tall ahead of Election Day and they can stand down afterward.

In the meantime, today is Day 35 of the shutdown — equaling the length of the 2018–2019 shutdown, which set a record.

![]() Problems We Hadn’t Started Thinking About Yet

Problems We Hadn’t Started Thinking About Yet

It seems there’s a penny shortage.

It seems there’s a penny shortage.

Until yesterday your editor had forgotten that the Trump administration ordered an end to production of one-cent pieces in February.

It was a sensible decision, given the cost of production — 3.69 cents each. It was also a performative act of budgetary discipline at a time when DOGE was still making daily headlines. (Remember that?)

Production ended in May. The Treasury Department figured any shortages would be a 2026 thing — but the government isn’t issuing any pennies to the banks, so the banks are rationing the pennies they give to businesses.

Result? “We first heard about the issue in late August, early September," says Dylan Jeon of the National Retail Federation “It's really impacting any business that deals with cash payments,” he tells the BBC.

Solution? Many businesses are rounding the price of a sale at the cash register up or down to the nearest five-cent increment.

For the sake of customer goodwill, that usually means rounding down. The convenience store chain Kwik Trip — it has a fanatical following in the Upper Midwest like Wawa and Buc-ee’s elsewhere — started doing so a month ago. The family-owned firm estimates the move will cost up to $3 million in revenue by year-end.

In other lines of business, “Many stores are now urging customers to pay in exact change,” says the BBC. “Others are hosting promotions for customers to bring in extra pennies they have at home.”

As we mentioned at the time of the Trump administration’s announcement, the real outrage is that inflation is so out of control that there was a valid reason for the feds to stop minting pennies.

With that in mind, get this: It costs the U.S. Mint nearly 14 cents to make a nickel. Just sayin’.

![]() A Miscellaneous Mailbag

A Miscellaneous Mailbag

“Read Buck's article and found it interesting,” a reader writes after Buck Sexton’s guest essay last Thursday.

“Read Buck's article and found it interesting,” a reader writes after Buck Sexton’s guest essay last Thursday.

“I have always been a big Star Trek fan and this came to mind. In YouTube, search ‘Swarm ships tear the Enterprise apart, Star Trek Beyond.’ To me the Enterprise could be an aircraft carrier and the swarm are drones.

“There are other interesting episodes from the original Star Trek series in the ’60s that make you think. ‘A Taste of Armageddon’ and ‘The Ultimate Computer’ are two that come to mind. Again these are from the ’60s!

“Keep up the good work.”

“Samsung? Why would anyone want one?” a reader writes after our item last week about a “smart” refrigerator that serves up ads on its touchscreen.

“Samsung? Why would anyone want one?” a reader writes after our item last week about a “smart” refrigerator that serves up ads on its touchscreen.

“I have had the ‘pleasure’ of owning several Samsung refrigerators, sadly.

“None of them has performed as advertised, and all have had many service calls to get them to operate at all for roughly half the lifetime I expected. The last one I will ever own is currently in my kitchen, with its second nonfunctional ice and water dispenser. The cost to replace it is so high that the repair guy said he wouldn't do it, because it is not worth the price and it will only break down again anyway. Apparently, he spends a lot of time fixing Samsungs.

“Customer service is nonexistent, parts are very expensive and reliability is well below other brands. Now they want to add advertising to them! Why would anyone want one?”

Dave: Hmmm… There’s a circa-2021 Samsung microwave in your editor’s kitchen. In no way is it a “smart” microwave; indeed it’s so dumb I reset the clock when the power went out yesterday. (Which is fine by me.) We’ll see how durable it proves to be.

I can give a hearty endorsement to Samsung TVs. My wife and I have two 27-inch models purchased from Costco in 2011. Both remain in daily use as computer monitors, one of them for the preparation of these daily missives.

The power cords can be a little squirrelly, and I had to replace one of them a few years back — but otherwise, recommended!