Stack the Odds in Your Favor

- 73 days… $10K

- Tech stocks stumble

- The Fed’s “skip” was not a “pause”

- Nigel Farage’s first rule of banking

- A (solar) match made in heaven

![]() Seventy-three days… $10K

Seventy-three days… $10K

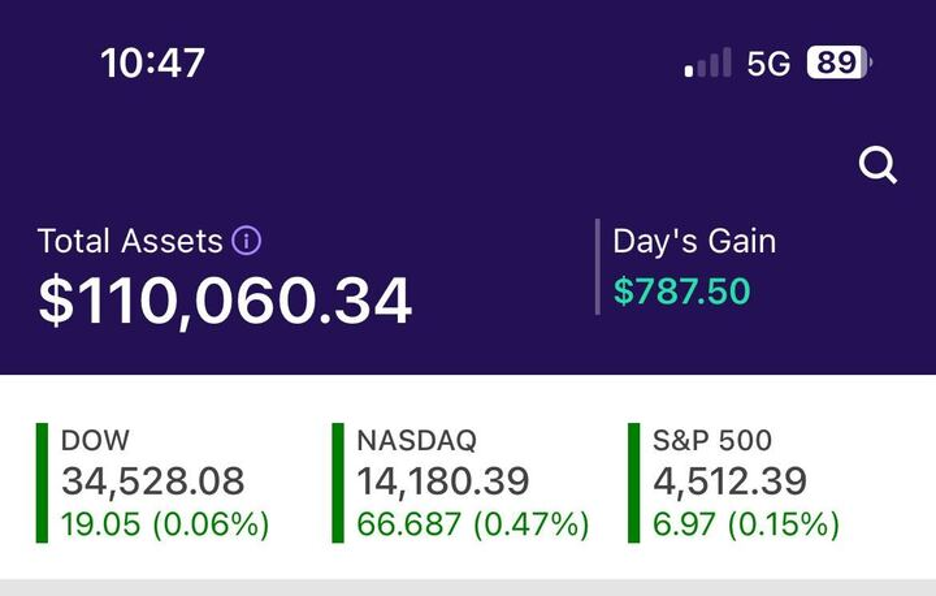

“Over the last 73 calendar days, I've been able to generate gains of more than $10,000 in a model account I set up for my Income Alliance subscribers,” says Paradigm’s income-investing ace Zach Scheidt.

“Over the last 73 calendar days, I've been able to generate gains of more than $10,000 in a model account I set up for my Income Alliance subscribers,” says Paradigm’s income-investing ace Zach Scheidt.

In the past, for legal reasons, Paradigm editors were barred from investing their own money in their own recommendations. But legal revamped the rules in 2023, and Zach has taken full advantage of it, putting a not-so-small sum of his own money on the line.

“On May 4, I started trading this account with a balance of $100K of my own family's money,” he says. “And now that the market is building momentum, the profits in this account are accumulating quickly.

“Here's a quick screenshot of my recent account value…

“Today, I want to show you a bit of the ‘behind the scenes’ action so you understand how these Income Alliance trades balance risk and potential returns to give us these returns.

“For my most aggressive income trades, I've been buying ‘in-the-money’ option contracts,” says Zach. “These contracts give us some of the best statistical advantages you could hope for as a trader.

“For my most aggressive income trades, I've been buying ‘in-the-money’ option contracts,” says Zach. “These contracts give us some of the best statistical advantages you could hope for as a trader.

“Here's an example of how these contracts work: On July 5, I sent an alert to members of my Income Alliance, recommending Costco Wholesale Corp. (COST) August $520 call contracts. And as with all trades in the Income Alliance, I put the trade in my own real-money account.

“A call contract gives you the right (but not the obligation) to buy shares of stock at a specific price. In this case, we have the right to buy shares of COST at $520,” Zach notes.

“Shares of COST were trading near $537 when the alert went out. So having the right to buy shares at a cheaper price is a great advantage — and these type of options are considered ‘in-the-money.’”

[For your enrichment, Zach says: “The alternative is to buy ‘out-of-the-money’ option contracts. An example would be the August $600 call contracts,” he says. “There is no advantage to buying COST at $600 when the stock is trading below that price. So these ‘out-of-the-money’ option contracts are cheaper — but may be worth more if COST trades above $600 in the future.”]

“Shares of COST traded sharply higher a few days after my recommendation,” Zach continues. “And as the shares traded higher, our ‘in-the-money’ options also increased in value.

“Shares of COST traded sharply higher a few days after my recommendation,” Zach continues. “And as the shares traded higher, our ‘in-the-money’ options also increased in value.

“Typically ‘in-the-money’ option contracts gain close to a full dollar for every dollar the stock trades higher. (On the other hand, ‘out-of-the-money’ option contracts don't rise as much for every dollar the stock trades higher.)

“So our ‘in-the-money’ contract for COST — using a starting stake of $5,261 — increased in value, allowing us to lock in a profit of $1,720 in just 12 days… Not a bad result!

“One reason I love ‘in-the-money’ option contracts is the protection we have if a trade moves against us,” Zach says.

“One reason I love ‘in-the-money’ option contracts is the protection we have if a trade moves against us,” Zach says.

“No trader gets every call right. And your editor is no exception,” he admits. “Sometimes we all have stocks that move against us so it's important to manage our risk for every trade.

“When a stock falls and we own ‘in-the-money’ call contracts, the price for our call contracts tends to fall a bit less than the price of the stock.

“And the closer the stock gets to our ‘strike price’” — the price both parties agree to use when buying or selling the underlying stock — “the less value we lose for every dollar the stock moves against us.

“I love this feature because it helps us lose less money when we're wrong — and make more profit when we're right!” Zach says.

“As an active income trader, ‘in-the-money’ option contracts are the best way I've found to skew the odds in my favor,” he notes.

“As an active income trader, ‘in-the-money’ option contracts are the best way I've found to skew the odds in my favor,” he notes.

“I realize not everyone wants to learn about the inner workings of different option contracts… It’s a bit more technical than the topics I often cover.

“But I wanted to make sure you understand the basics of how these contracts work — and the strategy behind my Income Alliance real-money portfolio,” says Zach.

“Of course, you don't have to understand the ‘why’ behind these specific trades,” he concludes. “Many members of the Alliance simply follow my step-by-step instructions to lock in their own profits — without looking at the statistical advantages of these contracts.

“I've heard from many of our Income Alliance members who have been locking in gains,” Zach adds.. “Some have been taking larger positions so they're collecting even more income than I've received in my own account. And that’s great news!”

[What Zach failed to mention: His friend and colleague Jim Rickards calls Zach one of his “most trusted contacts.” Which is why Jim’s issuing a special invitation to secure a spot to view the ins and outs of Zach’s strategy — a strategy so lucrative that Zach posted a 190% gain in his personal model portfolio last year. Perhaps the best part? This strategy works in up and down markets.]

![]() Tech Stocks Stumble

Tech Stocks Stumble

“Many of the newly dubbed Magnificent Seven mega-caps have stopped posting new all-time highs and are now beginning to churn,” says Paradigm’s charthound Greg Guenthner.

“Many of the newly dubbed Magnificent Seven mega-caps have stopped posting new all-time highs and are now beginning to churn,” says Paradigm’s charthound Greg Guenthner.

“The market-leading semiconductors have slipped from their highs. Even the tech growth names are faltering as Cathie Wood’s ARK Innovation ETF (ARKK) dropped more than 6% in just three trading days.”

Although Greg isn’t entirely bearish. “If you missed out on the bigger rallies during the first half of the year,” he says, “an orderly pullback or extended sideways consolidation could make a great entry point for new positions.

“Riding the tech snapbacks has been a great way to make money in 2023. But as some of these leaders become more overbought, I’ve been patiently waiting for some other strong trades to begin bubbling to the surface.

“A little market rotation would be a healthy development for the new bull market,” says Greg. “We might be witnessing the early stages of this phenomenon.”

While we’re talking tech: Google’s parent company Alphabet reported strong Q2 earnings, particularly from its cloud-computing sector. On the news, Google shares popped about 6%.

While we’re talking tech: Google’s parent company Alphabet reported strong Q2 earnings, particularly from its cloud-computing sector. On the news, Google shares popped about 6%.

But Microsoft (MSFT) shares have ticked down about 4% after the company reported slowing growth from its own cloud-computing segment. Nevertheless, MSFT did beat Wall Street’s earnings-per-share estimate — $2.69 versus $2.55.

Taking a look at the market today, the S&P 500 and Nasdaq are both in the red: down 0.20% and 0.40% respectively. But the Dow is struggling to stay in the green, hanging tough at 35,460.

As for the commodities complex, oil’s up a fraction to $79.67 for a barrel of West Texas crude. Precious metals? The yellow metal is up 0.60% to $1,975.10 per ounce and silver is likewise up 1.20%, above $25.

Things are picking up for crypto as the day goes on: Bitcoin is up 0.25% to $29,300 while Ethereum is up just 0.10% to $1,960.

And after we went to virtual press yesterday, the Teamsters reached a tentative agreement with UPS. “Existing part-time workers will get a raise to at least $21 an hour, if workers approve the new contract… Part-time pay was a sticking point in negotiations,” CNBC notes. “Full-time workers will average $49 an hour.”

Keep in mind, the deal must still be ratified by some 340,000 union members, with voting open from Aug. 3–22.

Nasdaq-listed PacWest Bancorp (PACW) is back in the news today.

Nasdaq-listed PacWest Bancorp (PACW) is back in the news today.

If you recall, the banking meltdown earlier this year started with California’s crypto-centric Silvergate Bank, spread to Silicon Valley Bank, extended to New York’s Signature Bank and bounced back to San Francisco regional bank First Republic.

And despite claims to the contrary, the banking malady spread to Beverly Hills-based PacWest when, in early May, the bank disclosed it had lost 9.5% of total deposits in the space of one week, causing PACW shares to slide over 20%. (In total, according to TheWall Street Journal, the bank lost 18% of deposits in the first half of 2023.)

Yesterday, the Banc of California — with $9.4 billion in assets — announced it will acquire PacWest (the combined banks valued at $36 billion) in an all-stock deal. Today, PACW shares are up almost 30%.

Not that everything is sunshine and lollipops. “Underscoring the challenges the banks face,” WSJ notes, “PacWest on Tuesday reported a loss of $197 million for the second quarter, while Banc of California’s profit fell by a third.”

But private equity will purportedly plug the “capital hole” — “Warburg Pincus and Centerbridge plan to invest a total of $400 million in newly issued equity, giving them about a 19% stake in the combined business.”

![]() The Fed’s “Skip” Was Not a “Pause”

The Fed’s “Skip” Was Not a “Pause”

“The Fed skipped a rate hike in June. But they made it clear that this was not a ‘pause’ (the end of rate hikes),” says Paradigm’s macro expert Jim Rickards.

“The Fed skipped a rate hike in June. But they made it clear that this was not a ‘pause’ (the end of rate hikes),” says Paradigm’s macro expert Jim Rickards.

For the fifth time this year, the Federal Open Market Committee (FOMC) will meet this afternoon to determine whether a rate hike is in order. Jim believes that’s a foregone conclusion.

“The Fed will raise its target rate for fed funds by 0.25%,” he predicts. “That increase will raise the federal funds target to 5.50%.”

He continues: “Over the course of 11 FOMC meetings — beginning March 16, 2022 — we’ve been correct in all of our forecasts including the ‘skipped’ rate hike in June. From there,” Jim says, “the forecasting remains uncertain.

“On the one hand, there has been undeniable progress against inflation. Inflation has

cooled off considerably since the peak of 9.1% in June 2022.” As of last month, annualized inflation is down to 3%.

“On the other hand, 3.0% is not 2.0%,” says Jim. “The Fed has not yet achieved its goal.”

The dilemma? “By continuing to raise rates, the Fed may trigger a recession and higher unemployment. But the Fed has internalized that risk; they don’t really care. Inflation has been Job One since March 2022, and the Fed has said repeatedly that they will accept a recession if that’s what it takes.”

That “soft landing” be damned.

![]() First Rule of Banking?

First Rule of Banking?

“NatWest boss Dame Alison Rose has resigned hours after admitting she had made a mistake in speaking about Nigel Farage's relationship with the bank,” says an article at the BBC.

“NatWest boss Dame Alison Rose has resigned hours after admitting she had made a mistake in speaking about Nigel Farage's relationship with the bank,” says an article at the BBC.

The plot thickens as we follow Nigel Farage’s attempted financial cancellation by Britain’s prestigious Coutts & Co.

Now, Coutts’ parent company NatWest Group’s CEO Dame Alison Rose has been outed as the BBC’s “source familiar with the matter” indicating that Farage’s account “no longer met the wealth threshold for Coutts.” The BBC has since recanted and apologized for publishing the inaccuracy.

Farage: “The first rule of banking is client confidentiality. She [Dame Alison] clearly broke that.”

Farage: “The first rule of banking is client confidentiality. She [Dame Alison] clearly broke that.”

“Dame Alison had come under mounting pressure from Downing Street, the chancellor and other senior cabinet ministers to resign, with the BBC told there were ‘significant concerns’ over her conduct.”

And talk about getting canceled! Rose has been stripped of several roles in the U.K. government, including from the prime minister’s business council, an energy efficiency taskforce and the net-zero council.

No word if she’ll be stripped of, er, Damehood.

[This just in: Meanwhile in the United States, we’re seeing buzz that JPMorgan Chase has canceled several accounts linked to Dr. Joseph Mercola, the Florida osteopath and alternative-health guru. We’ll follow up tomorrow.]

![]() A (Solar) Match Made in Heaven

A (Solar) Match Made in Heaven

“In the past couple of decades, many Amish have embraced solar power, which can be permitted because stand-alone systems are ‘off-grid,’” says Anabaptist World.

“In the past couple of decades, many Amish have embraced solar power, which can be permitted because stand-alone systems are ‘off-grid,’” says Anabaptist World.

“Rules against worldly vices do not ban electricity or prohibit convenience but are intended to avoid connection to and reliance on the outside world.”

And some enterprising Amish are capitalizing on the loophole. Old Order Amish-owned Wellspring Components of Shipshewana, Indiana, has repaired buggies and manufactured buggy springs since the 1950s. “It branched out into solar about 27 years ago, installing solitary solar panels to power well pumps or refrigerators.”

Photo courtesy: Amish 365

Photo courtesy: Amish 365

Although the rules differ among the Amish orders, solar power has become more acceptable in Amish communities. “Restrictions are more on the loads than the solar systems,” notes James Mast of ARK Battery in Sugarcreek, Ohio.

“You need to stick with direct-current lighting, no more than 12 volts or no electric lights on the main floor,” he said. “There are churches with restrictions on air conditioners, microwaves, dishwashers — you name the appliance, somewhere there’s a rule on it,” he says.

But solar power and the Amish seem to be a match made in heaven because, you know, they’re all about the shun. (We assume no Amish are reading this.)

Take care, and we’ll be back with more 5 Bullets tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets