Starting an AI Company From Scratch

![]() Musk’s Mission

Musk’s Mission

"I've come up with a set of rules that describe our reactions to technologies,” wrote the science-fiction legend Douglas Adams, in a collection of essays published shortly after his death in 2001.

"I've come up with a set of rules that describe our reactions to technologies,” wrote the science-fiction legend Douglas Adams, in a collection of essays published shortly after his death in 2001.

Adams’ rules go like this…

- “Anything that is in the world when you're born is normal and ordinary and is just a natural part of the way the world works.

- “Anything that's invented between when you're 15 and 35 is new and exciting and revolutionary and you can probably get a career in it.

- “Anything invented after you're 35 is against the natural order of things."

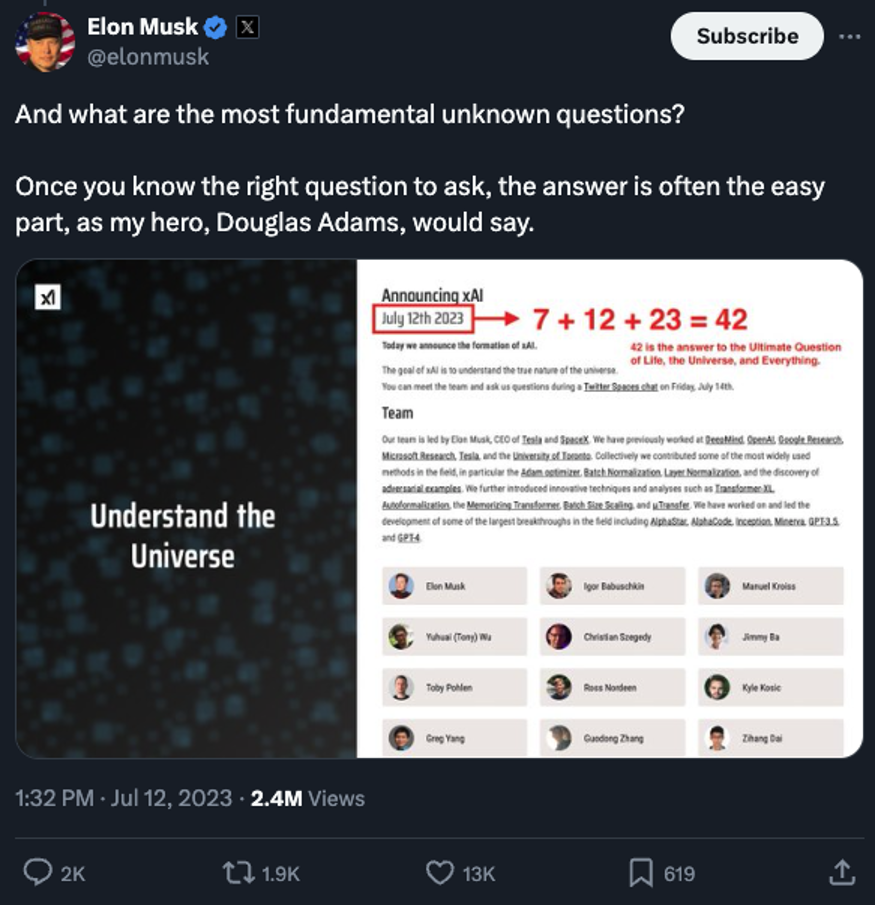

Adams is a hero of Elon Musk — now 53 years old. To hear Musk tell it, Adams’ The Hitchhiker’s Guide to the Galaxy helped him through an “existential crisis” at age 12.

More recently, Musk drew on the punchline to Hitchhiker’s plot — a supercomputer declaring that the answer to the meaning of life is the number 42 — when choosing the formal launch date of his AI company xAI last year.

"He's telling me, 'I'm gonna start from scratch an AI company 'cause I don't trust Sam Altman,'" recalls Musk biographer Walter Isaacson.

"He's telling me, 'I'm gonna start from scratch an AI company 'cause I don't trust Sam Altman,'" recalls Musk biographer Walter Isaacson.

Isaacson followed Musk around for two years in preparation for the book Elon Musk, published in 2023. He reflected on the experience a few days ago during an interview with CNBC.

As you might be aware, Musk had a hand in the founding of Altman’s OpenAI in 2015. They had a falling-out no later than 2020, when Musk hit out at what he thought was OpenAI’s lack of transparency. By last year, he sued OpenAI — accusing it of abandoning its mission to develop AI for the betterment of humanity.

Musk is on record asserting a 10–20% probability that AI could destroy humanity. To hear Isaacson tell it, Musk has taken it upon himself to “come in and save us from hostile AI.

“He read Isaac Asimov, he read the robot series, he thought the robots might turn on us" — a reference to Asimov’s collection of short stories I, Robot.

Hmmm…. it’s a little worrisome, this savior complex. It’s the same impulse that’s driven Bill Gates to muck up everything from public education to public health.

But let’s give Musk the benefit of the doubt here, especially ahead of Tesla’s AI-themed investor day event two days from now.

As we mentioned last week, the title is a nod to Asimov…

Musk is going all-out for this event — staging it not at a Tesla facility as he has in years gone by but on the Warner Bros. lot in Hollywood.

Paradigm’s AI authority James Altucher is convinced it will be revolutionary: “This has the potential to not only shake the markets,” he says, “but also transform the life of every man, woman and child in America.”

If you haven’t yet watched our interview with James’ No. 1 tech analyst Ray Blanco, you need to do so ahead of Musk’s announcement on Thursday. Click here to watch it right away.

![]() Resilient Stocks, Resilient Gold

Resilient Stocks, Resilient Gold

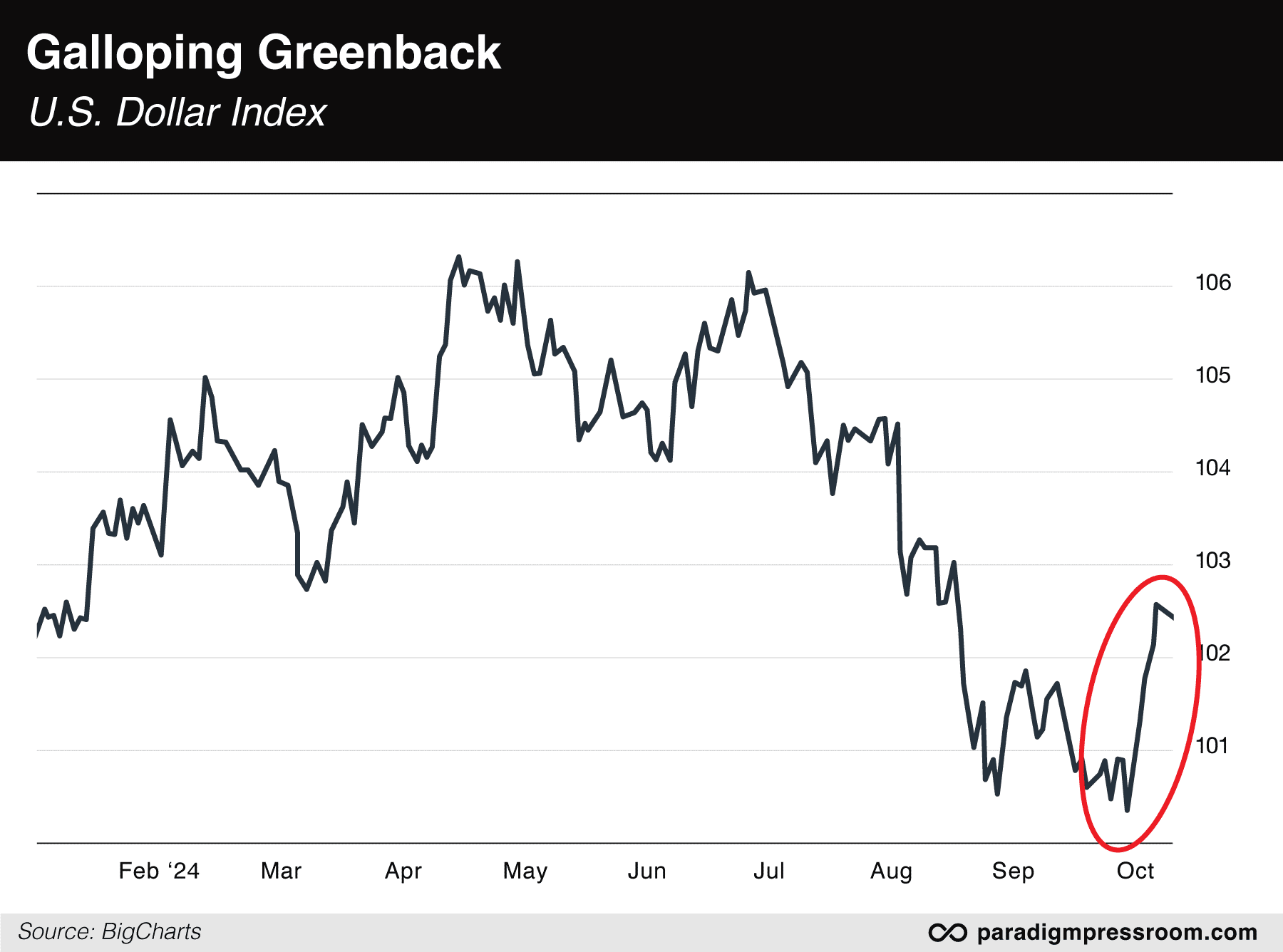

The resilience of the stock market and gold this month are remarkable in light of a strengthening dollar.

The resilience of the stock market and gold this month are remarkable in light of a strengthening dollar.

The U.S. dollar index has jumped 2% since the last day of September — a big jump in a short time when you’re talking about currencies.

A big driver of the move is a fall in the euro — which makes up 57% of the index.

All else being equal, a stronger dollar translates to weaker stocks and weaker gold. But not now.

The S&P 500’s record close on Sept. 30 more or less coincides with the start of the dollar rally spotlighted on the chart. But at 5,726, the index is barely two-thirds of a percent beneath that record. Gold, meanwhile, continues to hold the line on $2,600.

Elsewhere in the markets, Treasury yields continue to creep higher — the 10-year note now up to 4.05%. Bitcoin has sunk below $63,000. And silver is proving to be much more volatile than gold — well over $32 at one point on Friday, but well under $31 today.

But the real volatility is in crude — down $3.29 to $73.85.

There’s no obvious news catalyst. Near as we can tell, Mr. Market was anticipating Israel would attack Iran yesterday to coincide with the first anniversary of the Hamas attack inside Israel. When it didn’t happen, it was time to mash the “sell” button.

Not that the escalation risk has abated, of course…

“Small-business owners are feeling more uncertain than ever,” says Bill Dunkelberg, chief economist at the National Federation of Independent Business.

“Small-business owners are feeling more uncertain than ever,” says Bill Dunkelberg, chief economist at the National Federation of Independent Business.

The NFIB is out with its monthly Small Business Optimism Index. The headline number is up slightly to 91.5 — still well below the long-term average in this survey, which goes back 50 years now.

Looking under the hood, the number that really stands out is the uncertainty index — leaping 11 points to a record 103. (In this instance, higher numbers are bad.)

“The election will trigger adjustments to plans once the results are known,” write Dunkelberg and colleague Holly Wade. “The services sector is still holding up, while manufacturing and housing remain weak. In a few weeks, the picture will become much more certain for Main Street firms.”

But in the meantime, “uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines.”

On the part of the survey asking respondents to identify their single most important problem, inflation is tops, cited by 23%. But the labor shortage might be starting to ease, with 17% citing “quality of labor” as their biggest concern — down from 21% a month earlier.

![]() Gold Demand High, Gold Supply Low

Gold Demand High, Gold Supply Low

We’ve spent a lot of time in recent years underscoring the demand for gold — and not nearly enough about the supply.

We’ve spent a lot of time in recent years underscoring the demand for gold — and not nearly enough about the supply.

Demand for gold by central bankers is off the charts ever since Washington hit Moscow with unprecedented sanctions after the Russian invasion of Ukraine. For any country not on friendly terms with Washington, gold is an insurance policy.

As for supply… S&P Global is out with a revealing report about recent gold discoveries. It finds there’ve been only five of them since 2020, totaling 17 million ounces.

That’s a drop in the proverbial bucket considering 350 deposits were discovered from 1990–2023 — totaling 2.9 billion ounces of gold, including past production.

The newer discoveries “are scarce and smaller in size,” writes S&P’s Paul Manalo. “None of the discoveries made in the last 10 years have entered the list of the largest 30 gold discoveries, supporting our long-held view that the decade-long focus on older and known deposits limits the chance of finding huge discoveries in early-stage prospects.”

His conclusion: “The lack of quality discoveries in the recent decade does not bode well for the gold supply.”

For years, Paradigm macroeconomics maven Jim Rickards has advised keeping a 10% gold allocation in your portfolio — preferably in your personal possession, and definitely not in a bank’s safe-deposit box.

If you’re already there, the next step is a well-chosen speculation in gold mining stocks. And now is an especially good time, since the stocks are lagging the metal and they’re poised to play catch-up.

More about that tomorrow…

![]() Malice, Apathy… or Both?

Malice, Apathy… or Both?

“I've quite a while ago arrived at the expectation that the government is completely apathetic to the suffering of its citizens,” a reader writes… “but after seeing the responses to Palestine, Ohio; Lahaina, Hawaii; and now the Carolinas in the wake of Helene I can't help but ask myself, does the current administration actually wish pain and suffering onto the victims of these disasters?

“I've quite a while ago arrived at the expectation that the government is completely apathetic to the suffering of its citizens,” a reader writes… “but after seeing the responses to Palestine, Ohio; Lahaina, Hawaii; and now the Carolinas in the wake of Helene I can't help but ask myself, does the current administration actually wish pain and suffering onto the victims of these disasters?

“I would have thought this close to an election that now there is a good excuse to spend more money to try to win over the hearts of voters and there would be a concerted effort to combine disaster aid with campaigning. Instead, I hear that the aid money amounts to the pocket lint of the government checkbook, and now there seem to be efforts to stop rescuers from saving people. As if all that weren't enough, I'm hearing Florida is also about to get hit with a massive storm and I can't imagine the quality of the federal aid improving any between now and then.

“I know it's said not to attribute to malice that which can be attributed to stupidity, but I don't see why it can't simply be both, especially with how consistent the government responses have been. Why do you think it is that this is what happens every time?”

Dave responds: Beats me. To be sure, “DEI” figures into the equation. Too, a lot of knowledgeable and experienced boomers are retiring — and there aren’t enough Gen-Xers coming up to take their place.

I can say with certainty it’s not the government steering hurricanes in the direction of “red” enclaves.

Meanwhile, Milton continues to make a beeline for the Tampa Bay area, which your editor called home for about three years in the ’90s. Even if the winds diminish, the surge is shaping up to be fearsome. Godspeed to anyone trying to get out of harm’s way…

![]() Vote “Awake”

Vote “Awake”

On the subject of politics, a reader writes: “Us? We're proudly displaying our ‘Giant Comet 2024’ sign in the front yard.”

On the subject of politics, a reader writes: “Us? We're proudly displaying our ‘Giant Comet 2024’ sign in the front yard.”

Heh — I invoked that one in bumper sticker form over the summer. I like this one too…

Meanwhile, after I took incoming flak from anti-Trumpers in recent days, the pro-Trumpers have to weigh in following the mailbag in yesterday’s edition.

Meanwhile, after I took incoming flak from anti-Trumpers in recent days, the pro-Trumpers have to weigh in following the mailbag in yesterday’s edition.

“How many wars happened during Trump's administration?” asks one. Another vouches for Trump’s “antiwar” bonafides by saying “when necessary, the decision is made without pre-disclosure and firmly.” Meanwhile, one of our regulars ventures that Trump’s approach to war and peace is “peace through strength.”

Maybe it’s just me, but “peace through strength” does not entail 750 military bases in over 80 countries. Donald Trump did nothing to dismantle that apparatus during his first term, and he’s made no promises to do so during his second.

Meanwhile, this “he didn’t start any new wars!” thing is so tiresome.

He tore up arms control treaties with Moscow. He permanently stationed U.S. troops on Russia’s borders. He sent lethal weaponry to Ukraine — a reckless step Barack Obama refused to take.

In the Middle East, he carried on Obama’s policy of supporting Saudi Arabia’s genocidal war in Yemen — directly with targeting assistance from the U.S military and indirectly with weapons sales.

I could go on, but you get the idea. I hope.

A final thought, adding to yesterday’s Bullet No. 1 about the “counter-elites” who are gathering around Trump…

A final thought, adding to yesterday’s Bullet No. 1 about the “counter-elites” who are gathering around Trump…

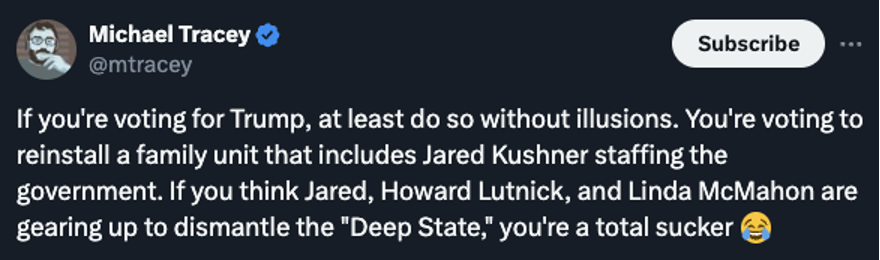

The co-chair of Trump’s transition team, named by Trump in August, is Howard Lutnick — CEO of the Wall Street firm Cantor Fitzgerald. From the Financial Times…

Lutnick said he had given more than $10 million to Trump’s 2024 effort and another $500,000 for the transition, and had raised about $75 million for the campaign overall.

The investor, who has known the Republican nominee for years and even appeared in 2008 on Trump’s NBC show The Celebrity Apprentice, previously donated to Democrats, including Hillary Clinton.

So like Marc Andreessen, here’s someone else who supported Clinton only eight years ago but has decided to glom onto Trump because that’s where he sees his bread buttered now.

And Trump is perfectly fine with that arrangement. He welcomes anyone into his circle who engages in enough flattery.

Interviewed last week by our favorite political reporter Michael Tracey, Lutnick said he’s building a roster of potential appointees with “deep, deep national security experience” and “deep, deep defense experience.” He also confirmed that Jared Kushner is “actively helping” him to find “talent.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets