The 401(k) Bait-and-Switch

![]() The 401(k) Bait-and-Switch

The 401(k) Bait-and-Switch

If you’re not already aware, allow us to be the first to tell you: The 2017 tax law — aka “the Trump tax cuts” — expire at the end of next year.

If you’re not already aware, allow us to be the first to tell you: The 2017 tax law — aka “the Trump tax cuts” — expire at the end of next year.

That’s a function of the byzantine budgetary logic under which Washington, D.C., operates. Everything has to pencil out (kinda, sorta) over a decade-long time horizon. So in this instance, the only way to “recover” the “lost” revenue from this tax law is to sunset the entirety of the law after eight years.

OK, here’s the good news: Unless you’re at the top end of the income scale, there’s no way in hell that your tax rates will rise come 2026.

OK, here’s the good news: Unless you’re at the top end of the income scale, there’s no way in hell that your tax rates will rise come 2026.

It makes no difference which party wins the White House or Congress this year.

Here’s why: If the Trump tax cuts are allowed to expire, everyone faces higher tax rates. For instance, if you’re in the 22% bracket now — a couple with taxable income this year between $94,301–201,050 — you’d find yourself back in the Obama-era 25% bracket.

No one in Washington, on either side of the aisle, would be willing to take ownership of that.

There’s precedent: The tax cuts signed into law by Dubya Bush were set to expire at the end of 2012. But at the last minute, Barack Obama and congressional Republicans struck a deal. Most of the Bush-era tax rates were made permanent — except for couples over $450,000 (and singles over $400,000), who went back to 1990s rates.

Still, there’s a problem. It’s not as if there’s any appetite among either Republicans or Democrats for spending cuts. So if the Trump tax cuts are to be made permanent for most of us, the politicos are gonna have to come up with more revenue from somewhere.

That’s the real reason for the revived chatter in Washington about eliminating the tax advantages that come with 401(k)s and IRAs.

That’s the real reason for the revived chatter in Washington about eliminating the tax advantages that come with 401(k)s and IRAs.

We first mentioned it last week. Call it the 401(k) bait-and-switch.

“Eliminating the favorable tax treatment of the 401(k) is much less painful politically than increasing taxes directly,” economist Allison Schrager writes in a Bloomberg opinion piece this week.

I’ve been following this story since the 2008 financial crisis. Back then, when the crash had already vaporized $2 trillion from Americans’ 401(k) and pension plans, I wrote at The Daily Reckoning’s website about a proposal in Congress to exclude “high income” earners from making tax-deferred 401(k) contributions.

Rep. George Miller, chair of the House Education and Labor Committee, was candid about the aim: “We’ve invested $80 billion into subsidizing this activity.” In other words, Uncle Sugar was “sacrificing” $80 billion in revenue every year for the sake of a “high-income” giveaway.

The idea never got out of committee… but it’s never gone away. Academics, think-tank types and investment bankers have all issued position papers on the topic in subsequent years — some of them suggesting that the tax breaks of a 401(k) be phased out for everyone, no matter their income.

During the early Trump years, there was serious discussion at the White House and on Capitol Hill about capping annual 401(k) contributions at the paltry sum of $2,400. (The cap for most people that year was $18,000.) Yes, Republicans were willing to entertain that idea to help “pay for” the Trump tax cuts.

So in that sense, there’s nothing altogether new about the proposal from the Center for Retirement Research at Boston College that Emily brought to your attention last week.

Still, it’s every bit as concerning as you’d think. The aforementioned Allison Schrager: “This doesn’t mean employer-sponsored retirement accounts — and even employer contributions to them — will go away. But no one will get any tax benefits.”

Still, it’s every bit as concerning as you’d think. The aforementioned Allison Schrager: “This doesn’t mean employer-sponsored retirement accounts — and even employer contributions to them — will go away. But no one will get any tax benefits.”

Alas, the Boston College proposal — you can read the whole thing here — raises more questions than it answers.

The authors are open to ideas other than eliminating the tax benefits altogether — perhaps a cap on annual contributions of $10,000–20,000. Or perhaps a cap on the size of your account at $500,000–1 million.

But what happens to existing account balances? And what happens to Roth accounts, where folks have already paid the taxes upfront in exchange for tax-free withdrawals?

I see nothing in the text addressing these basic questions. Maybe because the transition would be that messy and complicated?

What I do see is a truly alarming proposal to continue allowing tax-deferred contributions, “but then taxing the earnings on plan assets annually.”

Seriously? Depending on the level of this tax, your retirement money might be better off in a taxable account. At least there you don’t pay capital gains tax until you sell!

Oh, and what happens if your retirement portfolio has a bad year? Will Uncle Sam give you a tax credit? (Yeah, dream on.)

Enough questions for today. I just want to make sure this issue is on your radar — because you will be hearing more about it in the two years before the tax cuts expire. As always, we’ll aim to keep you ahead of the curve.

![]() The NVDA Hype Is Unbearable

The NVDA Hype Is Unbearable

Yeah, so this is a totally normal and healthy mindset for Wall Street and the financial media…

Yeah, so this is a totally normal and healthy mindset for Wall Street and the financial media…

Only one of the “Magnificent 7” companies has yet to report its quarterly numbers… and it’s the highest of the highflyers. Nvidia reports after the closing bell.

Contrary to that X account, we’re not so sure that the NVDA frenzy is “over.” But we are fairly sure of one thing: Whatever Nvidia reports, the reaction will not be a yawner.

“I really doubt we see anything but a strong reaction one way or the other,” says Paradigm trading pro Greg “Gunner” Guenthner. “Can NVDA do enough to impress shareholders following its monster breakout at $500? Or will we finally see some selling?”

Fact is, “the bulls have been dead right about NVDA (and other Big Tech/semiconductor plays),” says Gunner. “The early-2023 rally off the lows and subsequent breakout at $500 in January have added up to an astounding 380% rise.

“That said, I don’t think betting against this stock outright is a solid trading plan. We have to respect the trend — it’s one of the strongest on the market!

“At the same time, NVDA shares are technically overbought. At the very least, we should expect some retracement or longer consolidation period following the extension off the $500 breakout level. Again, this isn’t a call for an all-out crash. But a sharp move lower — even a temporary one — would help relieve some of the pressure.”

What, if anything, do NVDA’s fortunes mean for the broad market?

What, if anything, do NVDA’s fortunes mean for the broad market?

“My thoughts on market direction remain the same,” Gunner says. “I’m still on the lookout for signs of seasonal weakness.”

As a group, the semiconductors began to sputter late last week. The major averages all fell on Friday, and again yesterday after the long weekend.

“Let’s not fall into the trap of assuming stocks only go up,” Gunner advised his Trading Desk readers yesterday. “Instead, keep an open mind and be willing to bet against the weakest and/or most vulnerable names — while also keeping an eye out for anything bucking the trend and exploding higher.”

Early in the trading session, the major indexes are once again in the red — the S&P 500 down a quarter percent to 4,962.

Early in the trading session, the major indexes are once again in the red — the S&P 500 down a quarter percent to 4,962.

Across the board, markets are muted: Gold is little changed at $2,027. Likewise silver at $22.92. Crude sits squarely in the middle of its recent trading range at $77.35. Bitcoin is holding the line on $51,000, but $52,000 is looking like stubborn resistance for now.

Before Nvidia reports its numbers later this afternoon, the Federal Reserve will issue the minutes from its January meeting. It’s an opportunity for the Fed to refine its messaging after Fed chair Jerome Powell wrapped up the meeting by taking a March interest rate cut off the table — a proclamation that blindsided Mr. Market. We’ll follow up tomorrow…

![]() Bonkers Bankers

Bonkers Bankers

Gee, what was it that Paradigm’s macro maven Jim Rickards said last fall about a new wave of the bank crisis?

Gee, what was it that Paradigm’s macro maven Jim Rickards said last fall about a new wave of the bank crisis?

Oh yeah: “We find ourselves in the midst of yet another ‘Lehman’ moment. In 2008, I warned a senior member of Congress that a bomb was about to explode in the U.S. economy. Three weeks later, on Sept. 15, Lehman Bros. filed for bankruptcy — and the banking system imploded.”

In the context of 2023, that meant the failures of Silicon Valley Bank et al. were not a one-and-done proposition. More trouble would manifest itself, sooner or later.

From Jim’s lips to the front page of today’s Financial Times…

From Jim’s lips to the front page of today’s Financial Times…

The news is even worse than the headline lets on. Among the “Big Six” U.S. banks, average loss reserves “have fallen from $1.60 to 90 cents for every dollar of commercial real estate debt on which a borrower is at least 30 days late.”

That’s based on filings with the FDIC from JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley. Clearly, all that empty office space (and, to a lesser extent, empty retail space) is taking a toll. The story continues…

Michael Barr, who oversees bank supervision at the U.S. Federal Reserve, said on Friday that regulators “have been closely focused on banks’ CRE lending,” including “how they are reporting their risk” internally and whether they “provision appropriately and have sufficient capital to buffer against potential future CRE loan losses.”

OMG, Michael Barr is still the Fed’s “vice chair for supervision” despite his failure to rein in obvious abuses at Silicon Valley Bank before it went belly-up?

Meanwhile, the biggest of the Big Six banks has disclosed that its “trading venues” are in the crosshairs of three unnamed federal agencies.

Meanwhile, the biggest of the Big Six banks has disclosed that its “trading venues” are in the crosshairs of three unnamed federal agencies.

This tidbit turns up in JPMorgan Chase’s annual 10-K filing with the Securities and Exchange Commission. JPM let the news drop on Friday just before the long holiday weekend, in hopes no one would notice. But the intrepid Pam Martens and Russ Martens at the Wall Street on Parade site noticed anyway.

Note well: JPM copped to five criminal felony counts between 2014–2020… and three of them involved market-rigging. “The bank admitted to rigging foreign exchange markets in 2015,” write the Martenses, “and to rigging, for more than eight years, the precious metals and U.S. Treasury markets in an agreement with the U.S. Department of Justice in September 2020.”

Sheesh — this is also the same outfit that did business for years with Bernie Madoff and Jeffrey Epstein. And yet, Jamie Dimon is now in his 19th year as JPM’s CEO — even collecting a bonus in 2021 of $50 million in stock options.

Meanwhile, the CEO of another Big Six bank has mastered the art of failing upward…

Meanwhile, the CEO of another Big Six bank has mastered the art of failing upward…

As Jim Rickards reminded us three months ago, Citigroup CEO Jane Fraser has whiffed on all her goals since being promoted to the post in March 2021: She’s “failed to increase margins, hit profit targets or improve returns on capital… At this point, Fraser is reduced to doing what all CEOs do when everything else has failed — cut costs.”

Which she did in November — announcing the first round of job cuts that could total as many as 20,000 by 2026. “These job cuts will not be aimed at clerks and receptionists,” Jim said. “They’ll be aimed at investment bankers, senior account officers, regional managers and other senior staff positions.”

Now we learn that for this “performance”... the board rewarded Fraser with a 6% pay bump to $26 million for 2023.

Damn, it feels good to be a bankster…

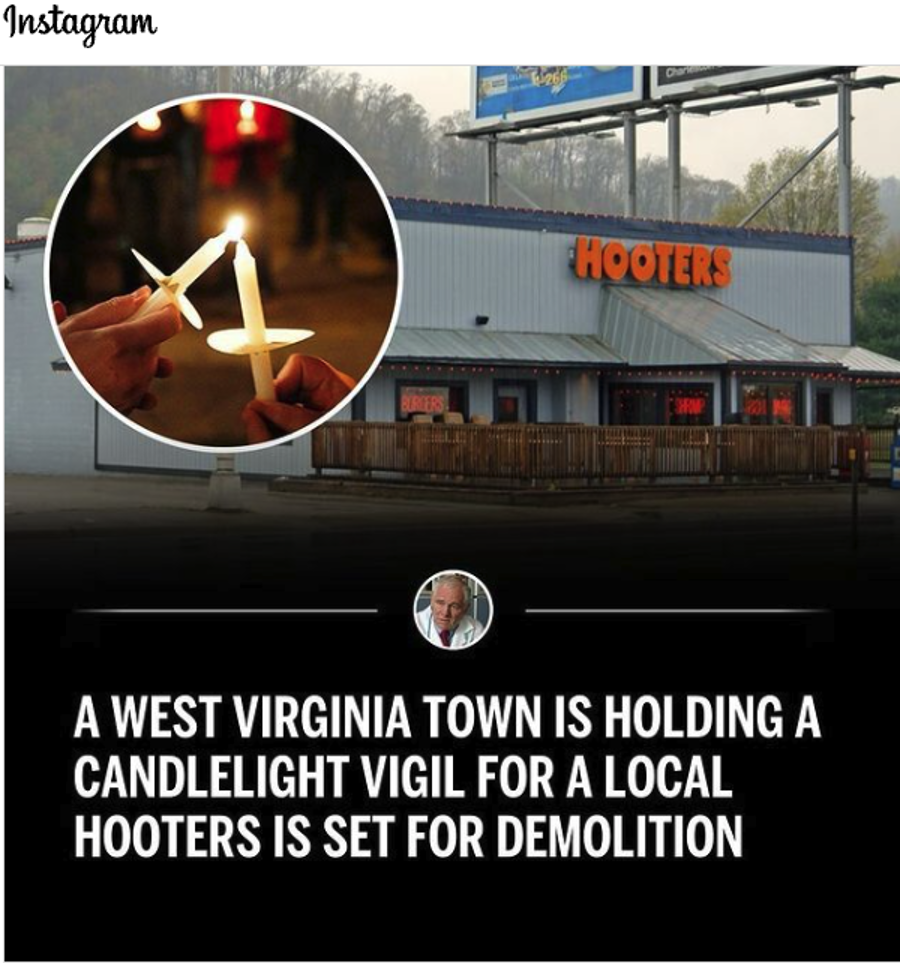

![]() Light a Candle for… Hooters?!

Light a Candle for… Hooters?!

Ordinarily, no one would give a “hoot” about the fate of a building that’s sat vacant since 2020. But…

Ordinarily, no one would give a “hoot” about the fate of a building that’s sat vacant since 2020. But…

The Hooters location in the Kanawha City neighborhood of Charleston, West Virginia, closed during lockdown in 2020 — and never reopened.

The building is now set for demolition next week — and crestfallen customers are planning a candlelight vigil for this Friday. “We will have Chicken wings with the traditional Hooters sauce on site,” says a Facebook announcement, “and a limited amount of the GOAT SANDWICH ‘The Strip Cheese.’”

“I used to live just a couple miles from that Hooters,” writes Aaron Ryan at the Whiskey Riff website. “It was recently announced that the Hooters building would be demolished to make room for a Sheetz gas station (which honestly, if you’re familiar with Sheetz, is still a win).”

Hmmm… Never been in a Hooters myself, and we in the Upper Midwest are mighty partial to our Kwik Trips. (Is there a cult-following convenience store in your neck of the woods? Let’s lighten things up in the mailbag later this week. Write here: feedback@paradigmpressroom.com)

![]() Mailbag: On Social Security…

Mailbag: On Social Security…

After Emily’s initial exploration of the latest 401(k) bait-and-switch last week, we heard from a reader who was incredulous at the proposal to funnel the additional revenue toward Social Security.

After Emily’s initial exploration of the latest 401(k) bait-and-switch last week, we heard from a reader who was incredulous at the proposal to funnel the additional revenue toward Social Security.

“So the same government that seems to feel we can send multiplied billions of dollars to fight a war in the Ukraine that we will never win, with very little, if any, accountability of how the money will be spent, is the same government that will be unable to keep Social Security solvent at its current levels.

“We the people should let that sink in.

“While we have been content to fund operations in undeclared wars since Vietnam we have allowed ourselves to be tricked into thinking that we have been doing something productive when in fact we have been seduced into destroying our country to help forward the agenda of billionaire owners of arms factories and oil producers who can’t wait to enslave us into their New World Order (One World Government).

“Let’s take away the tax breaks of the billionaire foundations. I hear those organizations launder huge sums of money to nefarious projects anyway — good luck tracking those funds through the shell companies, family members and phony businesses designed by the best lawyers money can buy. If those foundations paid taxes on their income then the middle class could keep well deserved tax breaks.

“Any politician who picks up this mantra will undoubtedly be made to look like another naive well-meaner who couldn’t possibly actually win an election. Besides we’re too busy watching Taylor Swift and professional sports to truly care.”

Dave responds: The notion that the 401(k)’s tax advantages should be zeroed out to rescue Social Security is beyond disingenuous.

Contrary to what you might think, the revenue taken in by Social Security last year amounted to 85% of the benefits paid out.

That’s not great… but as I’ve said for several years now, it’s fixable with some combination of higher taxes and a higher retirement age.

The Democrats have had a plan on the table for the last five years that doesn’t even raise the retirement age. The higher taxes aren’t particularly fair, but outside experts say the plan would keep the system permanently solvent.

To be sure, It would still be a Ponzi scheme in the sense of current revenues going out the door immediately to pay current benefits, but it would be a sustainable Ponzi scheme.

Anyone who proposes changing the rules of the 401(k) because Social Security is underfunded? They’ve got an agenda other than “saving Social Security.”

We’ll leave it there for today. Again, there will be much more to say about the 401(k) bait-and-switch, the Trump tax cuts and Social Security in the next couple years…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets