The Next Nvidia

![]() NVDA Is Yesterday’s News (Seriously, Hear Us Out…)

NVDA Is Yesterday’s News (Seriously, Hear Us Out…)

Ah, to have bought Nvidia way back when…

Ah, to have bought Nvidia way back when…

For the record, NVDA ended the month of June 1999 at a split-adjusted 4 cents a share. Checking our screens this morning? $123.34. That $100 investment would be worth $308,350.

But forget 25 years ago — try even five years ago. NVDA ended the month of June 2019 at a split-adjusted $4.11 a share. A $100 investment five years ago would be $3,000 now. That won’t sustain a lavish lifestyle for long, but it’s certainly enough for a very nice night on the town.

As I said a month ago, Nvidia generates at least as much buzz if not more than any company across the last 40 years.

But — not surprisingly — that buzz comes with NVDA trading near all-time highs.

But — not surprisingly — that buzz comes with NVDA trading near all-time highs.

Realistically, what’s the likelihood that NVDA will appreciate another 30X over the next five years?

At various times this year, Nvidia has been part of a Dynamic Duo (along with Facebook parent Meta) or a Fabulous Four (also joined by Amazon and Google parent Alphabet) propping up the rest of the S&P 500 and the Nasdaq.

The present moment is reminiscent of 1999 — when the major averages were propped up by Microsoft, Cisco, Dell and Intel, just before the dot-com bubble began to burst.

It was that year the journalist Edward Chancellor published one of the definitive books about market manias — Devil Take the Hindmost.

But it’s an earlier episode in market history that’s on Mr. Chancellor’s mind these days — the 1970s.

But it’s an earlier episode in market history that’s on Mr. Chancellor’s mind these days — the 1970s.

“Just as in the early 1970s,” he writes in a guest column for Reuters, “the market depends on a select group of companies that everyone wants to own.

“The 40 largest stocks in the S&P 500 currently account for 56% of the index, compared to around 60% in 1973, according to Ned Davis Research.”

Back in 1973, the buzz was all about the “Nifty Fifty” — a group comprising everything from stalwarts like General Electric, Coca-Cola and IBM to relics like Eastman Kodak, Polaroid and Xerox.

So heady was the atmosphere that one institutional investor told The New York Times that “too many analysts spend too much time worrying about these multiples and not enough time examining the uniqueness of the company... we’re talking about companies where the ability to create and innovate is of a more permanent nature... Go with the best.”

Which sounds an awful lot like the present day, or for that matter, 1999.

The rest was history. During a hard sell-off in 1973-74, “the Nifty Fifty underperformed,” writes Chancellor — “declining by 60% according to Ned Davis Research.

The rest was history. During a hard sell-off in 1973-74, “the Nifty Fifty underperformed,” writes Chancellor — “declining by 60% according to Ned Davis Research.

“As one commentator famously put it, they were taken out and shot one by one. Shares in Polaroid and Avon, which suffered specific problems, fell respectively by 90% and 86% from their peaks. But most of the other growth stocks cratered without any serious earnings disappointments. For instance, McDonald’s and Xerox both declined 72%.”

To be clear, our purpose today is not to forecast an imminent collapse in NVDA or its peers.

But if you’re looking to put money to work right now — with a mind toward building substantial wealth for the rest of the 2020s — the tech-adjacent megacap names are not where you want to be, simply because of the meteoric rise they’ve already experienced. Most of the good meat has already been gnawed off the bone, as it were.

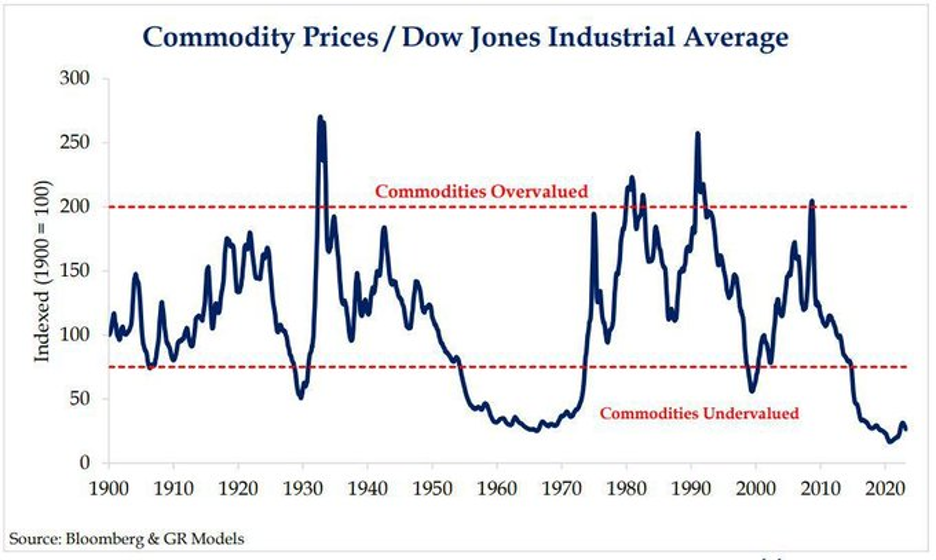

Which brings us back to the charts we shared in yesterday’s edition — especially this one.

Which brings us back to the charts we shared in yesterday’s edition — especially this one.

Commodities — the real stuff of material wealth like metals, energy and food — are historically undervalued relative to stocks right now.

They’re even more undervalued than they were amid the Nifty Fifty frenzy of the early 70s… or the dot-com mania of the late 90s. That means they’re setting up for a period of epic outperformance.

During the 1970s episode, one of the world’s smartest traders used commodities to turn $400 into $350 million — in only six years.

That’s an exceptional figure for sure. But it’s also a much shorter timeframe and a much bigger gain than if you’d bought Nvidia in 1999. Just sayin’!

That’s the potential that comes from the commodities supercycle — a market setup that comes along only three or maybe four times in a lifetime.

We want to help position you to take full advantage of the commodities supercycle. Especially now, because we’re seeing a setup in gold that could deliver once-in-a-lifetime gains. We’re talking 5,000% profit potential in the next six–nine months.

In this presentation, Jim Rickards will tell you all about it… and introduce you to the man who spotted this enormous opportunity. Click here to watch immediately.

![]() So Far in the First Half of 2024…

So Far in the First Half of 2024…

“Barring a huge move in either direction this week, the Nasdaq Composite will finish the first half of the year sitting pretty with a gain of almost 20%,” says Greg Guenthner, editor of The Trading Desk.

“Barring a huge move in either direction this week, the Nasdaq Composite will finish the first half of the year sitting pretty with a gain of almost 20%,” says Greg Guenthner, editor of The Trading Desk.

“The S&P isn’t too far behind, clocking a year-to-date gain of more than 15%.”

That said, “Summer is here — a time when more difficult market conditions could prevail,” Greg cautions. “That doesn’t necessarily mean we’re going to see a big move lower. But I expect choppy action at the very least.”

If Nvidia and its tech compatriots are due for a short-term rest — NVDA’s action the last week suggests that’s at least possible — Greg sees money moving into other sectors that have been unloved of late. “Financials and industrials — two groups that have not posted new highs this month — continue to firm up…

“Energy is another strong contender for a summer rotation play. Crude has retaken $80 and the big oil and gas companies posted market-leading moves to kick off the trading week. You might recall that the energy sector posted a huge breakout move in April. XLE rallied double-digits, only to run into trouble in early April — and it’s faded ever since.”

As for today’s action, it’s a more muted version of yesterday’s tech-driven rally.

As for today’s action, it’s a more muted version of yesterday’s tech-driven rally.

At last check, the Nasdaq was up more than a third of a percent at 17,785 while the S&P 500 was nearly flat at 5,472. The Dow is slightly in the green at 39,149.

Gold took another hit and is hovering around the $2,300 level. Silver is looking a little more resilient at $28.86.

Oil is taking a moment’s rest at $80.87 after the Energy Department’s weekly inventory numbers showed growing stockpiles of both crude and gasoline.

Bitcoin remains stuck in the mud at $61,637.

The lone economic number of the day is another sign of a housing market nearly frozen in amber: New home sales rang in lower than the lowest guess among dozens of Wall Street economists — down 11.3% from April to May and down 16.5% year-over-year.

The lone economic number of the day is another sign of a housing market nearly frozen in amber: New home sales rang in lower than the lowest guess among dozens of Wall Street economists — down 11.3% from April to May and down 16.5% year-over-year.

At $417,400, the median price of new single-family construction is down less than 1% from a year earlier. And that’s despite 9.3 months of inventory, the highest since late 2022. “Homebuilders are likely to respond by cutting back on new construction projects until current inventories are lower,” says an Econoday summary belaboring the obvious.

![]() Supply Chain Risk: Dockworker Strike

Supply Chain Risk: Dockworker Strike

Industry is circling the wagons, hoping to avert a dockworker strike along the Eastern Seaboard and Gulf Coast this fall.

Industry is circling the wagons, hoping to avert a dockworker strike along the Eastern Seaboard and Gulf Coast this fall.

As we mentioned earlier this month, the International Longshoremen’s Association canceled scheduled talks with the U.S. Maritime Alliance to protest the use of automated machinery. The contract expires Sept. 30.

Yesterday 147 trade associations led by the U.S. Chamber of Commerce, National Association of Manufacturers and the National Retail Federation fired off a letter to the White House. “The last thing the supply chain, companies and employees need is a strike or other disruptions because of an ongoing labor negotiation,” it said.

To be sure, the trade groups’ interests are aligned with that of the White House. The last thing the Biden campaign wants is a strike shutting down the six biggest East Coast ports only weeks before Election Day.

That’s especially the case with supply chains under threat and shipping costs soaring as Yemen’s Houthi faction continues to harass U.S., British and Israeli-linked shipping through the Red Sea.

That’s especially the case with supply chains under threat and shipping costs soaring as Yemen’s Houthi faction continues to harass U.S., British and Israeli-linked shipping through the Red Sea.

Already some industry experts are predicting a return to shipping rates approaching those seen during the worst of the COVID disruptions.

Then, the price of shipping a 40-foot container pushed past $20,000. At the moment, it’s a much more reasonable $4,119 — but that’s triple the rate of a year ago. And peak shipping season is just around the corner…

![]() Water Wars: Federal Power Grab

Water Wars: Federal Power Grab

The Supreme Court recently issued a disturbing ruling about a commodity that doesn’t get much attention — water.

The Supreme Court recently issued a disturbing ruling about a commodity that doesn’t get much attention — water.

In a 5-4 decision, the court nixed an agreement called the Rio Grande Compact — a deal that settled a long-standing dispute among the states of Texas, New Mexico and Colorado. The federal government said the agreement didn’t take the feds’ interests into account.

“The United States just picked up a lot of power,” USC law professor Robin Kundis Craig tells Bloomberg Law.

The four dissenting justices decried the federal power grab: “It is hard to imagine anything that might do more to expand the scope of this dispute than forcing the states to continue to litigate when they have already resolved their differences,” wrote Justice Neil Gorsuch — who continues to demonstrate he’s the least worst of the nine robed cretins.

State-level officials, Republicans and Democrats alike, are beside themselves. “It’s a sad day,” says New Mexico’s Democratic attorney general Raul Torrez, “when… western states are able to resolve a generational dispute over water only to have that deal undermined by lawyers and bureaucrats in Washington, D.C.”

The ruling also sets a disturbing precedent: It could easily blow up another multistate agreement called the Colorado River Basin Compact, up for renewal in 2026.

The ruling also sets a disturbing precedent: It could easily blow up another multistate agreement called the Colorado River Basin Compact, up for renewal in 2026.

Longer term, those of us who live in the Great Lakes region have new reason to worry about thirsty western states commandeering the world’s biggest source of fresh water.

“Fifty years from now there might actually be a pipeline that brings water from the Great Lakes to Phoenix,” mused NASA hydrologist Jay Famiglietti to USA Today last year.

The Supreme Court just made that possibility much more real.

Water is a notoriously tricky sector to invest in. The big ETF is the Invesco Water Resources ETF (PHO). Its performance more or less tracks that of the S&P 500 over the last three years. That said, it’s lagged badly here in the month of June — which might make it a short-term buy.

![]() Robot Suicide

Robot Suicide

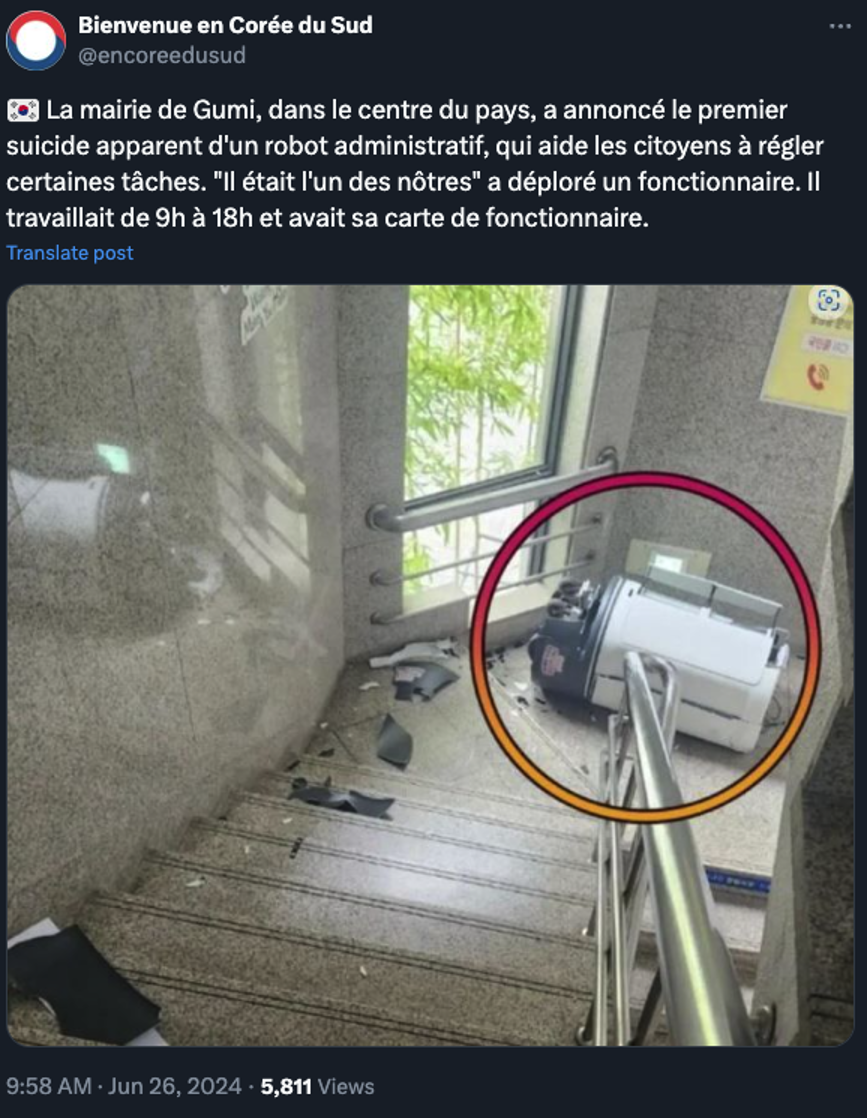

After less than one year of service, a robot serving the city government of Gumi, South Korea — population 408,000 — has apparently offed itself.

After less than one year of service, a robot serving the city government of Gumi, South Korea — population 408,000 — has apparently offed itself.

The Gumi city council took delivery of its first administrative officer robot last August. It was made by a California robot-waiter startup called Bear Robotics. A city council official tells the AFP newswire that the robot "helped with daily document deliveries, city promotion and delivered information" to residents.

All seemed well until a few days ago when, as the official describes it, witnesses saw the robot “circling in one spot as if something was there” — and then flinging itself down a flight of stairs.

Resuscitation efforts were unsuccessful. "Pieces have been collected and will be analyzed by the company," the official reports.

Remembrances have been heartfelt: "It was officially a part of the city hall, one of us," said another official. "It worked diligently."

The local media have approached the story less reverently: "Why did the diligent civil officer do it?" was one hot take. “Was work too hard?” said another.

Hmmm… Will it be long before we see headlines in U.S. media about a mental health crisis among “administrative robots”?

Given everything else that’s happened in the first half of 2024, we rule nothing out!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. The Supreme Court ruled 6-3 this morning to shred the First Amendment and keep the censorship-industrial complex in business — a case I’ve been writing about for the last two years.

The outcome is as unsurprising as it is disappointing.

We’ll be devoting much of tomorrow’s edition to this travesty — and what it means going forward.