Unprecedented

![]() Uncle Sam’s Unprecedented Budget Gap

Uncle Sam’s Unprecedented Budget Gap

For the record: Uncle Sam just racked up an annual budget deficit of $1.8 trillion.

For the record: Uncle Sam just racked up an annual budget deficit of $1.8 trillion.

As the week winds down, we have several loose ends to wrap up — none more important to your financial future than this one.

For the fiscal year ended Sept. 30, the government spent $6.75 trillion — while collecting only $4.92 trillion in revenue. That’s according to estimates from the Congressional Budget Office; final figures will come from the White House later this month.

“Despite steady economic growth and low unemployment, annual deficits are growing again after declining from pandemic-era highs,” says The New York Times.

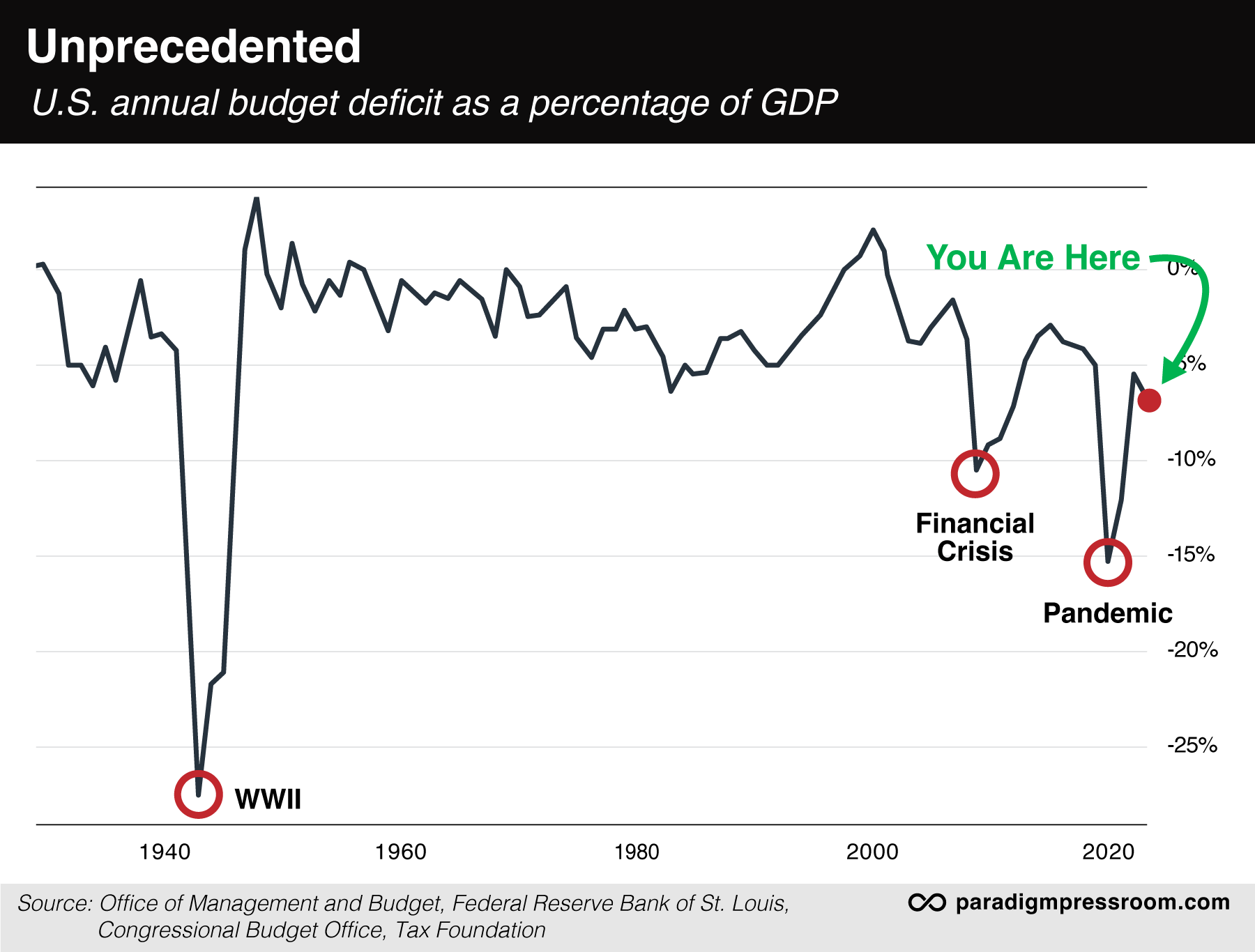

It’s worse than the mainstream lets on. The deficit for fiscal 2024 amounts to 6.4% of America’s annual economic output as measured by GDP.

It’s worse than the mainstream lets on. The deficit for fiscal 2024 amounts to 6.4% of America’s annual economic output as measured by GDP.

In records going back nearly a century, there are only three times this number has been worse — World War II, the aftermath of the 2008 financial crisis and the 2020 pandemic.

You’ll notice none of those conditions are present now: No WWII-scale conflict, no financial crisis, no pandemic.

“A [nearly] $2 trillion deficit is bad news during a recession and war, but completely unprecedented during peace and prosperity,” the Manhattan Institute’s Brian Riedl tells The Washington Post.

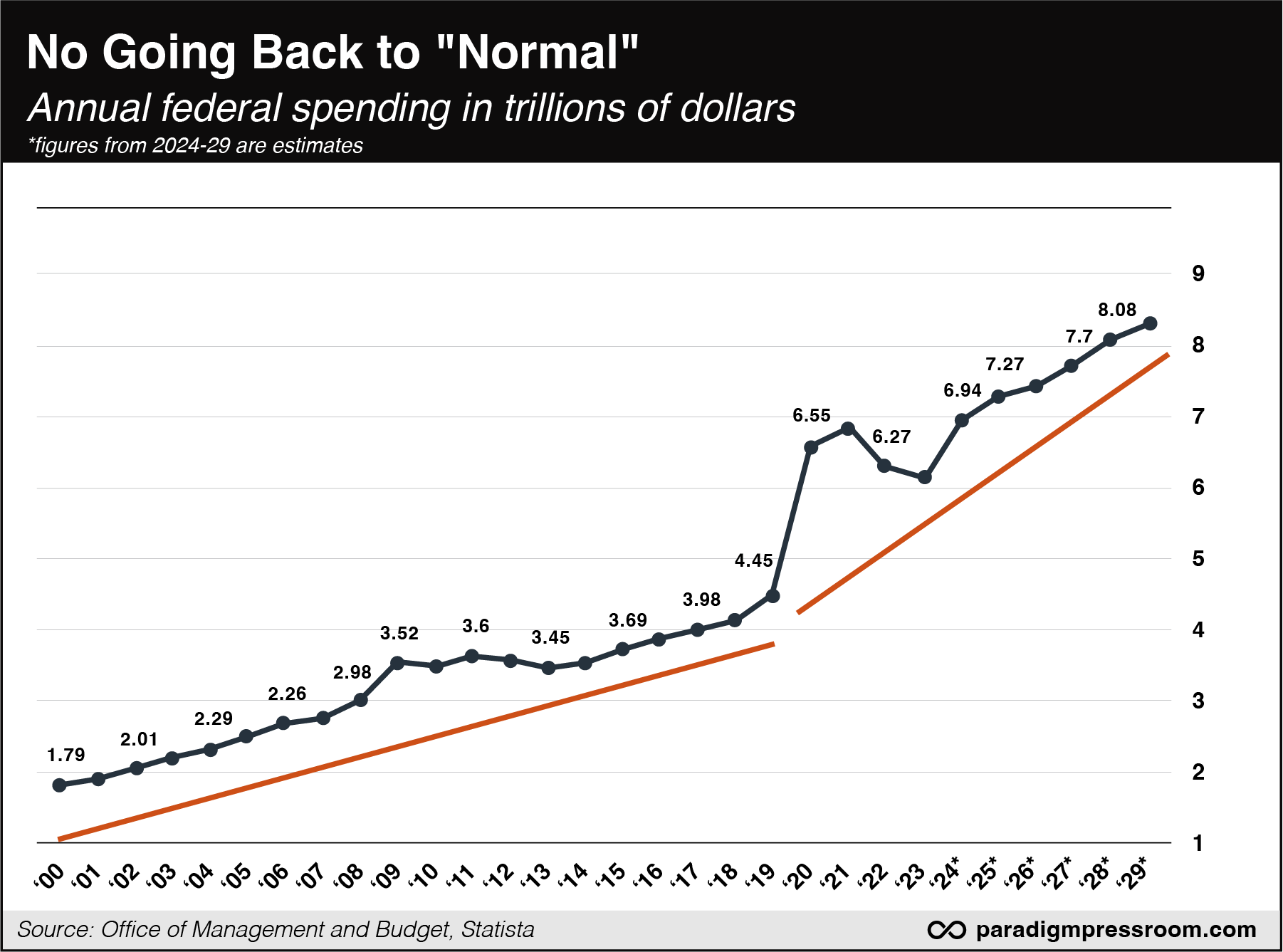

As we mentioned last month, the pandemic set the federal government on a permanently higher trajectory of spending. This chart makes it obvious there’s no going back to a pre-pandemic “normal.”

Now… imagine how much worse both of these charts will look in the event of war or financial crisis or another pandemic.

(Or maybe all three, seeing as our presumed overlords at the World Economic Forum are entertaining the likelihood of a “polycrisis.”)

Still worse is this: “Neither candidate for the nation’s highest office has offered any hint of understanding the problem, let alone doing anything about it,” writes Bill Bonner, the founder of Paradigm’s parent company.

Still worse is this: “Neither candidate for the nation’s highest office has offered any hint of understanding the problem, let alone doing anything about it,” writes Bill Bonner, the founder of Paradigm’s parent company.

“To the contrary, each aims to make it worse with some combination of tax cuts and spending increases…

“In the broadest and simplest analysis... a nation should seek peace and prosperity. Then, citizens are able to pursue happiness however they choose. But to have peace and prosperity, the feds have to eschew war and inflation. Instead, America’s elites — the people who control the government — are choosing bombs, boondoggles and B.S. on a scale never before seen in the history of man.”

A reckoning is inevitable. Our guidance today is the same as it was yesterday in anticipation of the “dollar demolition summit” in Russia later this month: As Jim Rickards has long recommended, a 10% gold allocation in your portfolio will cover your bases for any eventuality.

Adds Paradigm’s recovering investment banker Sean Ring: “While tech has provided gobsmacking returns in recent years, precious metals now offer a compelling alternative.”

Sean just wrapped up a “Gold Week” at our sister e-letter, the Rude Awakening: We encourage you to check out his article archive here.

![]() Attack on Iran: Inevitable but Not Imminent

Attack on Iran: Inevitable but Not Imminent

The oil market ends the week on tenterhooks, as a U.S.-Israeli attack on Iran seems inevitable but not necessarily imminent.

The oil market ends the week on tenterhooks, as a U.S.-Israeli attack on Iran seems inevitable but not necessarily imminent.

The drip-drip-drip of hints has come all week. On Tuesday, NBC reported that Washington is considering its own airstrikes on Iran in addition to those by Tel Aviv. Yesterday, Axios reported that Joe Biden and Benjamin Netanyahu “moved closer to an understanding on the scope of Israel's planned retaliation against Iran.”

That said, the Times of Israel reports that the discussions “will continue in the days ahead.”

How many days, no one is specifying. In case you’re keeping count, 25 days remain before U.S. Election Day. If an attack on Iran is this year’s “October surprise,” it will be the most telegraphed October surprise in decades.

In the meantime, a barrel of West Texas Intermediate is little changed from yesterday’s close at $75.67. Since Wednesday it’s traded both below $72 and above $78.

Meanwhile, the Dow and the S&P 500 are on track to end the week at record levels. At last check the S&P has crested 5,800 for the first time.

Meanwhile, the Dow and the S&P 500 are on track to end the week at record levels. At last check the S&P has crested 5,800 for the first time.

Yes, the tech-heavy Nasdaq is lagging — having gone three months without reclaiming its July record. But Paradigm’s floor-trading veteran Alan Knuckman believes it will play catch-up soon enough.

“The Nasdaq right now is 2% off the all-time forever highs, but it's still up 35% in the last 52 weeks,” Alan tells readers of The Profit Wire. “Forty times the Nasdaq has set new records in 2024 alone and it shouldn't be long for that to happen once again.”

Big movers today include Tesla — down 8% after Elon Musk’s big reveal of a “Cybercab” last night.

➢ If you’re a Paradigm Mastermind Group member, keep an eye on your inbox today for follow-up coverage about the tiny company that our team believes will be key to making Musk’s plans a reality.

Meanwhile, earnings season is underway with a “beat” by JPMorgan Chase on both revenue and profits; checking our screens, JPM is up 4.5% from yesterday’s close.

The big economic number of the day is the producer price index. The month-to-month change was flat. But the year-over-year change is a 1.8% increase — up from 1.7% the month earlier.

Thus, inflation at the wholesale level is moving in the wrong direction. It will reach the consumer level sooner or later…

![]() Not Nearly Enough Nukes

Not Nearly Enough Nukes

It’s not exactly a surprise, but “the Biden administration is working on plans to bring additional decommissioned nuclear power reactors back online to help meet soaring demand for emissions-free electricity,” says the Reuters newswire.

It’s not exactly a surprise, but “the Biden administration is working on plans to bring additional decommissioned nuclear power reactors back online to help meet soaring demand for emissions-free electricity,” says the Reuters newswire.

Plans are already underway to restart two mothballed nuclear plants — the undamaged unit at Three Mile Island in Pennsylvania and the Palisades plant in Michigan.

Asked at a Reuters conference in New York whether additional plants could be restarted, White House climate adviser Ali Zaidi said, “We’re working on it in a very concrete way. There are two I can think of” — although he wouldn’t say where they are.

But there’s an elephant in the room. It takes years to spin up shuttered nuclear reactors — perhaps not enough time to avert rolling blackouts.

But there’s an elephant in the room. It takes years to spin up shuttered nuclear reactors — perhaps not enough time to avert rolling blackouts.

Bank of America researchers issued a report this month forecasting an explosion in demand for electricity — “driven by the re-shoring of industry, the development of data and crypto mining centers and the electrification of buildings, transportation, and infrastructure.”

We’ll remind you once more of the prodigious demands that AI places on the power grid: The restarted Three Mile Island reactor will be used by only one customer — Microsoft.

The Bank of America analysts project the need for an additional 100 gigawatts of capacity by 2035 — and perhaps as much as 300 gigawatts.

The amount of juice that will be generated by these revived nuke plants? About one gigawatt each.

Bonus points: Palisades won’t be up and running for another two years, and TMI Unit 1 won’t be ready again until 2028.

![]() Update: The Nord Stream Whodunit

Update: The Nord Stream Whodunit

There’s now an eyewitness account that U.S. Navy ships were in the vicinity of the Nord Stream 2 pipeline shortly before it was sabotaged in September 2022.

There’s now an eyewitness account that U.S. Navy ships were in the vicinity of the Nord Stream 2 pipeline shortly before it was sabotaged in September 2022.

As you might recall, the mainstream immediately latched onto a narrative that the attack was ordered by Russian President Vladimir Putin — even though there was zero incentive for him to do so. After all, Russia needed the revenue from its natural gas customers in Germany and elsewhere in Europe.

The narrative fell apart over time and by this summer, the mainstream settled on the story that it was Ukrainian saboteurs — never mind that they likely lacked the skill and materiel to pull it off.

Our own Jim Rickards stuck his neck out in January 2023 when he said President Biden ordered the attack. Days later, an article by the legendary investigative reporter Seymour Hersh corroborated that assessment.

Late last month, the Danish newspaper Politiken published an interview with John Anker Nielsen, the harbormaster at Denmark’s Christiansø Island — not far from where Nord Stream 2 runs under the Baltic Sea.

He says in the days before the attack, he noticed some ships in the distance. Their transponders had been turned off. He suspected there’d been an accident. There was not.

“Four or five days before the Nord Stream explosions,” reports Politiken, “he was with the rescue service from Christiansø because there were some ships with their radios turned off. It turned out they were U.S. Navy ships. When the rescue service approached them, he was asked by the naval command to turn back.”

No, the ironclad proof still isn’t there. But when examining means, motive and opportunity, the most likely suspect is — well, we even ran a meme about it the week it happened…

![]() Mailbag: Dems Throw the Race?

Mailbag: Dems Throw the Race?

In light of the botched federal response to recent natural disasters, a reader writes: “Is it possible the Democratic leadership knows they are going to lose and lose badly?

In light of the botched federal response to recent natural disasters, a reader writes: “Is it possible the Democratic leadership knows they are going to lose and lose badly?

“Just look at all the poor choices they are making — especially those they are promoting to be head of the country, plus many other things of note.

“Why not do as much damage as possible in the time they have left, give the election to Trump and then see him and Republicans flounder trying to resolve all the complexities that were left to resolve in four short years, and when Americans see that he couldn't do it, the next election leaves the Democrats with the best chance to retake office in a big way. What's four years to a politician?”

Dave: You’re articulating something that sprang to my mind after the first attempt on Trump’s life, when it seemed he might coast to an easy victory.

So yeah: For all their hand-wringing about Trump’s threat to “our democracy,” it’s at least conceivable that Democrats would be content to leave him in charge of a rapidly spreading dumpster fire. Then they can “ride to the rescue” in 2028 and dominate both the White House and Congress — as they did for 14 years after FDR’s election in 1932.

Maybe there’s something to it, maybe not.

People who follow such matters more closely than I say Kamala Harris needs at least a 3 percentage-point margin in the national popular vote to overcome Trump’s advantage in the Electoral College tally. (Biden’s margin in 2020 was 4.5 points.)

For the moment that looks like a steep climb.

There is one compelling item of anecdotal evidence to support the Dems-have-given-up thesis: Saturday Night Live has taken to roasting Kamala Harris.

This is the same SNL that during the Trump administration did a cringeworthy chorus-line paean to the Russiagate special counsel called “All I Want for Christmas Is Mueller.”

Go figure, huh?

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets