Who Says the Metaverse Is Dead?

![]() The Metaverse (Remember That?) Just Got Wild

The Metaverse (Remember That?) Just Got Wild

“Every technological revolution has two phases, the hype cycle and the build cycle,” says Paradigm’s James Altucher — who’s seen many startups come and go during his decades in venture capital and hedge funds.

“Every technological revolution has two phases, the hype cycle and the build cycle,” says Paradigm’s James Altucher — who’s seen many startups come and go during his decades in venture capital and hedge funds.

Case in point: “The dot-com bubble was the hype cycle for the internet. Internet stocks rocketed to record highs before losing momentum and coming back down to earth.”

Or disappearing entirely in the case of pets.com and most of the stocks that CNBC’s Jim Cramer touted at the very top of the tech bubble in early 2000.

But look what happened next: “Then the build cycle happened and we had companies like Facebook, Amazon and Google take over the internet.”

“Over the past few years, we’ve had the hype cycle for the metaverse,” James continues.

“Over the past few years, we’ve had the hype cycle for the metaverse,” James continues.

The metaverse. Remember that?

“Metaverse-based cryptocurrencies exploded in value in 2020/2021 before crashing back down to earth,” James reminds us. “Facebook famously rebranded as Meta during that time.

“Now it seems we’ve reached the build cycle. This month Apple released the Vision Pro, the best virtual-reality device on the market.

“Later this year Google, Samsung, Sony and others are expected to also release new virtual-reality devices that will try to match — or beat — the Vision Pro’s capabilities.”

But whiz-bang devices aren’t enough: “In order for the metaverse to be successful,” says James, “it will need some amazing content that draws in users.”

Which brings us to one metaverse project that has James especially excited.

Which brings us to one metaverse project that has James especially excited.

“Wilder World is a decentralized online gaming platform and universe,” he tells us.

Its first application is an online auto-racing platform, but that’s just the start: “Eventually, Wilder will expand to include a whole city with missions and battles similar to the popular game Grand Theft Auto.”

But the similarities end there: “Everything within the Wilder universe will be an NFT [non-fungible token], including the cars, the clothes, the real estate and more.

“Wilder will be 13 times larger than Grand Theft Auto and users will need to use Wilder’s cryptocurrency to buy gas to travel around the world and compete in races.”

Too, there’s a gambling aspect: “Users will be able to bet on races and receive cash prizes for winning races. While there are many metaverse platforms incorporating NFTs, what makes me most excited about Wilder is that they are putting the gaming element front and center.

“Game production will be led by a fellow whose resume includes Ubisoft, Warner Bros. and Rockstar Games. And Wilder’s investors include big-name crypto types like Animoca Brands, Anthony Pompliano and Digital Currency Group.

“The racing game is currently in testing to a select group of testers,” James says. “Wilder also let testers play the game at an event for Art Basel in December in Miami. I expect that some version of the racing game will be available to the public later this year.”

Bottom line: “We’re now moving from the hype phase of the metaverse into the build phase,” says James, “and I expect we’ll see some awesome applications come to market that will be the mega-platforms of tomorrow.”

How to invest? Well, the in-game currency ($WILD) can be had on Uniswap and other crypto exchanges. (Sorry, not Coinbase.) You’ll need some technical know-how. (There are YouTube videos, of course.)

Is crypto too out-there for your taste? Well, James is plenty excited about AI as well. And if you feel bad that you’ve already missed out on AI’s first wave, don’t: James says there’s $15.7 trillion up for grabs in the second wave — as long as you act within a brief “wealth window” over the next two and a half weeks. If you’re not already familiar with it, you can get a glimpse of James’ AI playbook at this link.

![]() Once More, Think Small

Once More, Think Small

You heard it here first: Small caps are on the move.

You heard it here first: Small caps are on the move.

“Small-cap stocks have been on my radar for some time,” Paradigm’s Zach Scheidt said here a week ago today. “This is a group of stocks that have been left behind as so many investors focus on the Magnificent Seven tech stocks.”

Sure enough, the iShares Russell 2000 ETF (IWM) rallied from about $194 to $204 in the following two days.

Yes, it’s pulled back just below $200 as we write this morning, but Zach thinks there’s more gas in the tank: “Small-cap stocks are now cheap compared with company earnings and likely to play catch-up to their large-cap counterparts.”

In The Income Alliance, Zach’s readers have already bagged handsome profits playing IWM call options — and they’re looking for more. [Editor’s note: Membership in The Income Alliance is open today and tomorrow after Zach’s colleague Jim Rickards urged us to make the service available to more readers: You can review Jim’s invitation here.]

As for the markets today, the tech-heavy Nasdaq is adding to Friday’s losses — and then some.

As for the markets today, the tech-heavy Nasdaq is adding to Friday’s losses — and then some.

The Nasdaq is down 1% to 15,606… while the S&P 500 is down about a half percent at 4,979 and the Dow is barely in the green at 38,648. Big movers include Discover Financial Services — up nearly 14% on a takeover by Capital One, which is flat on the day.

Gold is up nine bucks to $2,025 but silver is ruler-flat at $22.96. Crude is down about 1% to $78.40. Bitcoin once again poked its nose over the $52,000 mark a few hours ago, but once again the move couldn’t stick.

Yemen’s Houthi fighters are still disrupting shipping through the Red Sea — claiming they sank a British-owned bulk carrier, the Rubymar. The U.S. military says the crew escaped safely. The Houthis also shot down an American MQ-9 Reaper drone. U.S. officials will say only a drone crashed.

The Reaper costs about $30 million a pop. Whatever the Houthis used to knock it down cost much, much less.

![]() Ultimate Swamp Creature Returns to the White House

Ultimate Swamp Creature Returns to the White House

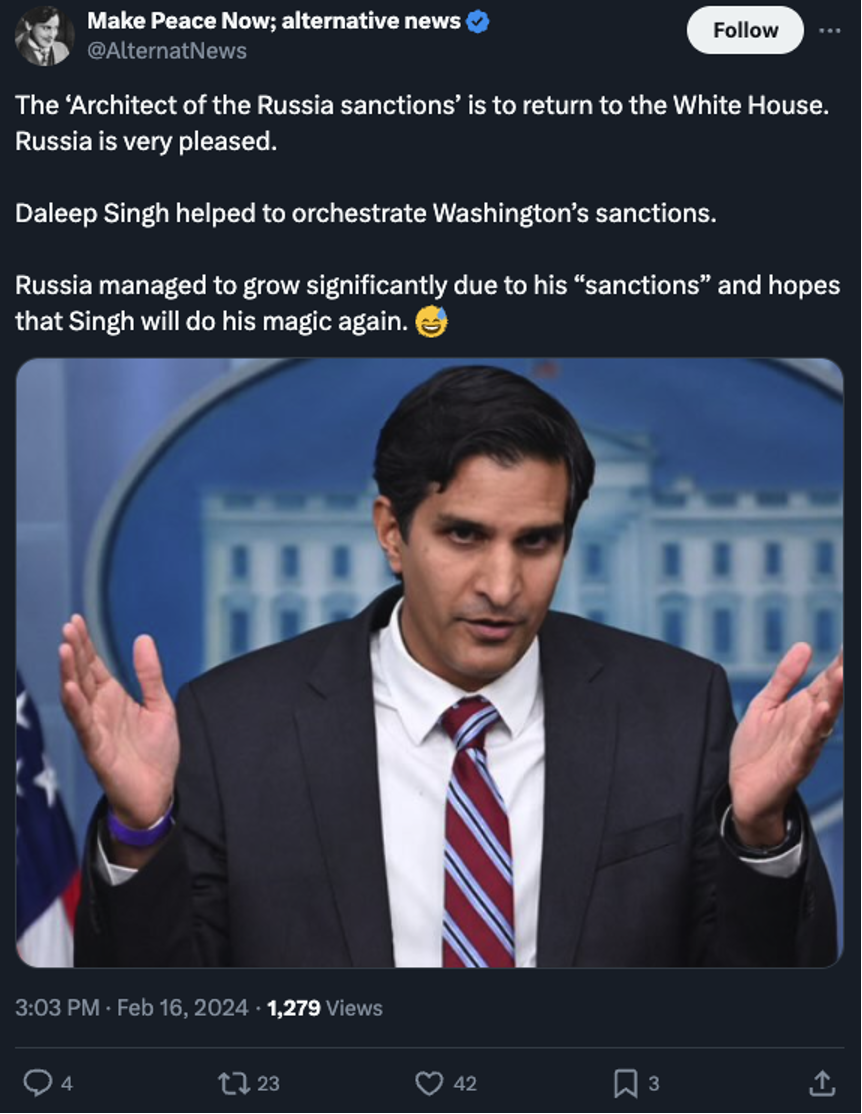

Uh-oh: The guy behind two of the Biden administration’s worst economic ideas is coming back to Washington.

Uh-oh: The guy behind two of the Biden administration’s worst economic ideas is coming back to Washington.

You’ve probably never heard of him. So let us introduce you to Daleep Singh…

Singh is a total creature of the power elite — a bachelor’s degree from Duke, followed by postgrad work at MIT and Harvard’s Kennedy School of Government.

Now 47 years old, Singh first came to the fore in the spring of 2020. As chief of the Markets Group at the Federal Reserve Bank of New York, he engineered the bailouts that kept the banking system afloat while the economy was locked down for COVID.

Then Singh took a post in the Biden administration as Deputy National Security Adviser. Along with his boss Jake Sullivan, Singh is widely credited as the architect of the sanctions targeting Russia after Russia’s invasion of Ukraine two years ago.

Except that, as we’ve chronicled the whole time since, the sanctions have backfired spectacularly.

China and India have been happy to buy the oil and natural gas that European leaders can’t buy anymore. Russia’s economic growth is on track to outpace that of the United States this year, according to the International Monetary Fund. And the unprecedented act of freezing $300 billion in assets held by Russia’s central bank is accelerating a global process of “de-dollarization” — undermining the dollar’s status as the world’s reserve currency.

Like many swamp creatures, Singh has also cashed in on Wall Street: Months after implementing the sanctions, he left the White House in June 2022 to become global chief economist at PGIM Fixed Income, one of world’s biggest bond trading firms.

Now with only 11 months remaining in Biden’s (first?) term, Singh is passing through the revolving door and returning to his old gig at the White House.

Now with only 11 months remaining in Biden’s (first?) term, Singh is passing through the revolving door and returning to his old gig at the White House.

According to the Axios site, which broke the story last week, Singh’s return “will allow him to pick up where he left off in April of 2022 — looking for innovative ways to punish Russia and help support Ukraine.”

The word “innovative” is doing some heavy lifting there. Maybe he’ll be the point person to outright confiscate Russia’s $300 billion to fund those preposterous “reparation bonds” that Emily mentioned here last week.

Singh’s return “could also be a sign that the Biden administration is planning further sanctions on China in the case of an expected conflict over Taiwan,” according to the Forward Observer private intelligence service — “including lessons learned from Russian sanctions to prevent China from overcoming a new sanctions regime.”

Gee, can’t wait to see how that will backfire, huh?

Then again, Singh might also be greasing the skids for a CBDC — that is, a central bank digital currency. Or in the parlance of our own Jim Rickards, “Biden Bucks.”

Then again, Singh might also be greasing the skids for a CBDC — that is, a central bank digital currency. Or in the parlance of our own Jim Rickards, “Biden Bucks.”

It was only a couple of weeks after the Russia sanctions that Biden issued his 2022 executive order laying the groundwork for a CBDC. It appears Singh had a hand in that order, because during his time in the “private sector” last year, Singh testified to Congress in very plain terms about the agenda.

The aim was nothing less than “trying to push our government to launch a digital dollar, which I think is the single best step that we could take because it would crowd out the ecosystem of crypto that allows national security adversaries like Russia to exploit our deficiencies, our weaknesses in terms of our critical infrastructure.” [Emphasis ours]

Hmmm… We’ll be keeping a close eye on Singh’s activities for however long he stays around Washington this time.

![]() U.S. Taxpayers Pay for Russian Oligarch’s Yacht

U.S. Taxpayers Pay for Russian Oligarch’s Yacht

OK, so there’s a bit of unfinished business from the sanctions that Mr. Singh is evidently so proud of.

OK, so there’s a bit of unfinished business from the sanctions that Mr. Singh is evidently so proud of.

One of the biggest publicity stunts surrounding the sanctions two years ago was the seizure of yachts belonging to Vladimir Putin’s wealthy cronies.

The problem — as we mentioned toward the end of 2022 — is that you, dear taxpayer, are now paying for the upkeep of these enormous vessels.

In the case of the Amadea, seized in Fiji and currently docked in San Diego, that’s $600,000 a month — more than $7 million a year.

That’s according to court papers filed by the feds this month. They’re in a pickle right now because they thought they seized the yacht from a Russian oligarch named Suleiman Kerimov, who’s been under U.S. sanctions since 2014.

But the former CEO of Russia’s state-owned oil company Rosneft, Eduard Khudainatov, says he’s the actual owner — and he’s not under U.S. sanctions.

Understandably, Khudainatov objects to U.S. plans to auction the yacht and send the proceeds to Ukraine.

The feds say he’s just a “straw owner” and they’re urging a judge to let the auction proceed immediately — not least because the maintenance costs are proving to be “excessive.”

Sheesh.

The case is on hold until Khudainatov’s lawyers can respond to the feds’ request by this Friday.

![]() Mailbag: The Great Migration and Toothflation

Mailbag: The Great Migration and Toothflation

“I think the migration from blue states to red states is a mix of factors, like you suggested,” writes a reader as our Great Migration (or Big Sort) mailbag extends into a new week.

“I think the migration from blue states to red states is a mix of factors, like you suggested,” writes a reader as our Great Migration (or Big Sort) mailbag extends into a new week.

“I'll also point out that the migration is a NET migration; there are still plenty of people moving to California, New York, Massachusetts and the like. The only thing that has changed in recent years is that those new arrivals are fewer in number than the ones leaving.

“I'm a blue-state native who now lives in Texas, but I got here over 15 years ago, long before there was such an obvious divide. I didn't know of anyone moving for political reasons at that time, but I think it is happening today.

“Some of the newcomers to Texas are leaving California precisely because they have had enough of liberal politics, others are just following a job or seeking a more affordable quality of life without directly considering politics, and I am sure there are others who don't expect to like a more conservative environment but are coming anyway, for the job or more affordable housing.

“Despite all these different reasons, I see that some people use it as evidence to support their pre-existing positions. For example, some will say that the growing population of Texas proves that conservative policies work and people are voting with their feet. But then you have others who are concerned that blue-state refugees will bring their politics with them and ‘ruin’ their new state. ‘Don't California my Texas’ is a common refrain. But that sort of contradicts the notion that people are moving here because it's ‘better.’

“And those who don't want their state to change, well, change always happens. I moved here before Ted Cruz was in office. Am I obligated to keep him in office this coming November because Texans vote traditionally Republican? Abortion was legal in this state 15 years ago, and now it's not. So I've seen changes happen, so it's not realistic to expect that things just stay the same forever.

“By the way, since I've been here a while, many who are moving here for a job will leave for another job opportunity if it presents itself. Some fall in love with Texas and stay, but others will leave after a year or two or three.

“I don't live in Florida, so I have no firsthand knowledge, but it was a swing state in my lifetime, and even went for Obama twice. Now that it looks like solidly red state more recently, I wonder if conservatives there have similar beliefs that one shouldn't move to Florida if they want to change it. But it has changed before our very eyes, so who gets to decide what is an acceptable change?”

After our Saturday edition spotlighting the tooth fairy leaving a little girl $100, a reader writes…

After our Saturday edition spotlighting the tooth fairy leaving a little girl $100, a reader writes…

“The child with the extravagant tooth fairy could start extracting additional teeth, if they are in need of additional funds. The parent may think twice if the child has access to pliers!!!!!”

Dave responds: It hurts just thinking about that!

I agree with Emily’s take, but I’ll add this: I think it’s all to the good that despite the relentless drive toward a cashless society (and, God help us, CBDCs), little kids still understand the appeal of physical cash.

Anything parents can do to instill that appreciation — even if they have more money than sense! — has to be a net plus.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. The day has arrived…

The Royal Courts of Justice in the U.K. are hearing what’s probably the final appeal of WikiLeaks founder Julian Assange against his extradition to the United States. His wife Stella Assange tells the BBC if he loses the appeal he will likely die: He’s in “a very difficult place” both physically and mentally.

The future of a free press in the United States hinges on this decision.

If that sounds like hyperbole, I assure you it’s not — for reasons I’ve spelled out several times in the last five years, most recently over the holidays.

The hearing continues through tomorrow; this X-formerly-Twitter account is providing extensive coverage.