AI: Say “Ahh”

![]() The (AI) Doctor Will See You Now

The (AI) Doctor Will See You Now

The promise sounds too good to be true… but let’s just run with it for a few moments.

The promise sounds too good to be true… but let’s just run with it for a few moments.

“Researchers in Iraq and Australia say they have developed a computer algorithm that can analyze the color of a person’s tongue to detect their medical condition in real-time,” reports the New York Post — “with 98% accuracy.”

Published in the journal Technologies, the researchers’ study draws on the practice in traditional Chinese medicine of evaluating the tongue for evidence of disease.

Published in the journal Technologies, the researchers’ study draws on the practice in traditional Chinese medicine of evaluating the tongue for evidence of disease.

With a high-resolution camera and a properly trained AI model, the scientists claim they can detect all manner of maladies. The camera is mounted in a black box connected to a laptop.

Sit forward and open wide…

[Images as seen in the journal article]

“Typically, people with diabetes have a yellow tongue;” says the senior study author Ali Al-Naji; “cancer patients a purple tongue with a thick greasy coating; and acute stroke patients present with an unusually shaped red tongue.

“A white tongue can indicate anemia; people with severe cases of COVID-19 are likely to have a deep-red tongue. An indigo or violet-colored tongue indicates vascular and gastrointestinal issues or asthma…”

You get the idea.

To be sure, it’s early days. That 98% accuracy rate is from a grand total of 60 tongue pictures drawn from two teaching hospitals. Near as we can tell, the study hasn’t been peer-reviewed.

To be sure, it’s early days. That 98% accuracy rate is from a grand total of 60 tongue pictures drawn from two teaching hospitals. Near as we can tell, the study hasn’t been peer-reviewed.

Too, there’s a very uncomfortable precedent from recent history. A device about the size of a breadbox that can detect hundreds of diseases — where have we heard that one before?

Oh, that’s right — Elizabeth Holmes of Theranos infamy is doing 11 years in Club Fed for misleading her investors about a device that could supposedly diagnose diseases from a drop of blood.

Who knows, maybe this one will pan out — but not for a long time yet. If it’s something investable in the AI space that you’re looking for, you’ll need to look elsewhere.

![]() Mr. Market Dodges a Bullet

Mr. Market Dodges a Bullet

Mr. Market has dodged his first bullet in the run-up to the next Federal Reserve meeting in five weeks.

Mr. Market has dodged his first bullet in the run-up to the next Federal Reserve meeting in five weeks.

At this time, the Wall Street consensus is dead certain the Fed will embark on interest rate cuts next month — an initial cut on Sept. 18, and at least one or maybe two more before year-end.

But that assessment, like Fed policy itself, is “data-dependent.” If inflation starts taking off again, those rate cuts might be in jeopardy.

So far, so good: The Labor Department is out this morning with its read on wholesale inflation for July. The month-over-month jump was 0.1%, compared with Wall Street expectations for 0.2%. Wholesale inflation in the services sector — so stubborn for so long — is starting to ease, if these numbers are to be believed.

But when it comes to dodging bullets, today’s incoming fire was minor — a .22 compared with the .357 that’s on the way tomorrow with the closely watched consumer inflation numbers. Stay tuned.

With today’s bullet dodged, the major U.S. stock indexes are all firmly in the green.

With today’s bullet dodged, the major U.S. stock indexes are all firmly in the green.

The S&P 500 is up nearly 1.2% to 5,407 — not far from the target that Paradigm options authority Alan Knuckman described in this space yesterday. If the S&P can make it to 5,420, then he says a return to July’s record high of 5,667 is in the bag. (Why 5,420? That’s the midpoint between the July high and the early-August low.)

As for the other major indexes, the Nasdaq is notching even bigger gains than the S&P. The Dow’s gains are more modest.

Gold is hovering near record territory at $2,468, but silver is backsliding to $27.59. Bitcoin is little changed from this time 24 hours ago, just under $60,000.

Crude is backing off of yesterday’s gains as the long-awaited Iranian reprisal attack on Israel is taking still longer to materialize. A barrel of West Texas Intermediate is down $1.56 to $78.50. Copper sits just over $4 a pound.

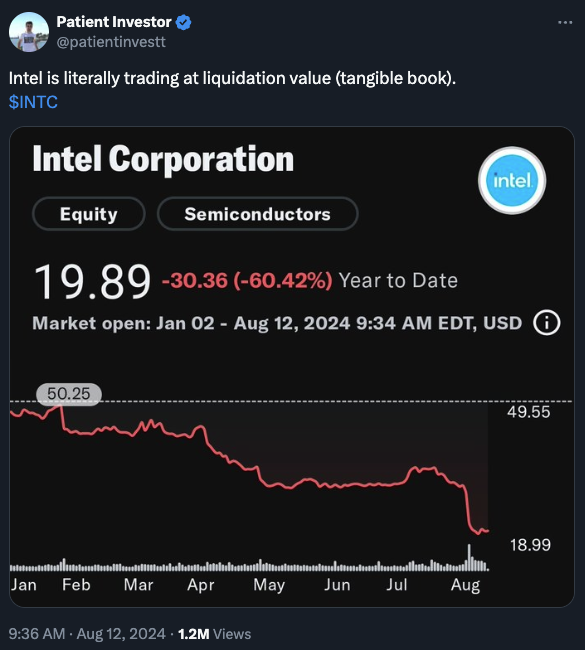

Before we move on, one note about Intel (INTC) in light of James Altucher’s remarks in this space on Friday…

Before we move on, one note about Intel (INTC) in light of James Altucher’s remarks in this space on Friday…

As a reminder, James believes Intel will be a $1 trillion company by 2030. Considering its market cap this morning is barely $86 billion, that’s an 11.6X gain.

![]() Small Business Is Smiling (Well, It WAS…)

Small Business Is Smiling (Well, It WAS…)

Small-business owners haven’t felt this optimistic in well over two years — but there’s a caveat.

Small-business owners haven’t felt this optimistic in well over two years — but there’s a caveat.

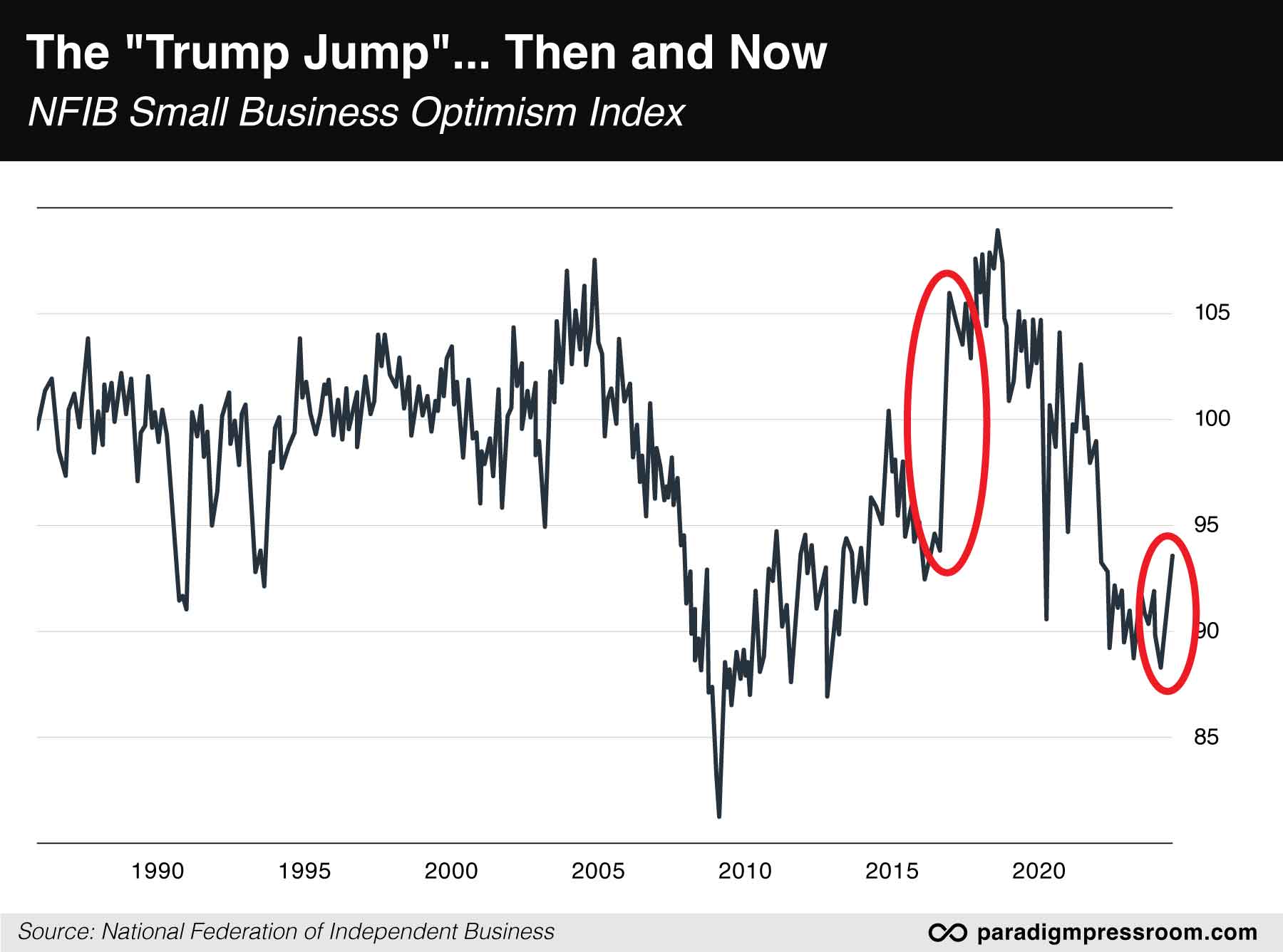

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. It popped big in July from 91.5 to 93.7 — the highest since February 2022. (That said, the number remains mired below its 50-year average.)

NFIB economists Bill Dunkelberg and Holly Wade say the one-month jump can be chalked up to a single question on the 10-question survey — about whether they expect the economy to improve.

In an independent analysis and summary of the index, Econoday infers that the jump is likely in anticipation of the Federal Reserve cutting interest rates.

C’mon, people. The NFIB is a nonpartisan organization, but it’s a fair assessment to say its membership leans Republican. The Optimism Index shot dramatically higher with Trump’s shock victory in November 2016 — an unprecedented one-month jump, in fact.

The NFIB says the current survey was conducted last month. It does not specify exactly when. But it’s a safe bet that most of the respondents filled out the survey at a time when it seemed Trump’s reelection was inevitable.

Not that there’s anything wrong with any of that, if we may paraphrase Jerry Seinfeld. But don’t be surprised if the August survey, due for release four weeks from today, shows a reversal to the July jump.

Typically there’s more insight to be had from the portion of the survey where respondents are asked to identify their single most important problem. Here, inflation is in the clear lead — cited by 25%.

Finding qualified help comes in second at 19%, followed by taxes at 15%. Everything else is in single digits.

![]() De-Dollarization in Slow Motion

De-Dollarization in Slow Motion

Even the International Monetary Fund — long a creature of Washington’s influence — has to acknowledge that de-dollarization is a thing.

Even the International Monetary Fund — long a creature of Washington’s influence — has to acknowledge that de-dollarization is a thing.

The IMF is out with quarterly stats about foreign exchange reserves held by governments around the world. The total stands at $12.35 trillion and the dollar accounts for 58.9% of that total. That’s down from over 70% in the early 2000s.

As Japan’s Nikkei news service reports, “In response to Russia's invasion of Ukraine, the U.S., Europe and Japan have sought to exclude Russia from dollar settlement networks and have frozen the Russian central bank's foreign reserves deposited in central banks of other countries. This has effectively weaponized access to currency trading.”

So Nikkei is the latest global news outlet to affirm what we’ve said from the get-go when Russia invaded Ukraine 30 months ago: The sanctions will inevitably make leaders around the world think twice: If they can do it to Russia, they can do it to us.

And as Nikkei acknowledges, the sanctions are “persuading emerging economies to accumulate gold, which is not tied to any specific country.”

Little wonder the dollar price of gold is up by one-third since the invasion. It’s a powerful tool to preserve your purchasing power.

![]() Mailbag: On Our New Policy

Mailbag: On Our New Policy

“Good policy — I am tired of the pugilism in all of the media,” a reader writes after I declared a new policy for these virtual pages last week. For the duration of election season we’ll refrain from topics that entail bashing a single presidential or vice presidential candidate.

“Good policy — I am tired of the pugilism in all of the media,” a reader writes after I declared a new policy for these virtual pages last week. For the duration of election season we’ll refrain from topics that entail bashing a single presidential or vice presidential candidate.

“Raised as a ‘Kennedy Democrat’ in the early 1960s in a strictly Republican area of Delaware County, Pennsylvania,” the reader goes on, “I have never changed most of my viewpoints even after graduating with a B.S. in economics, having my own business and continuing to work in my 65th year.

“So today, I find myself as a pro-business, faith-based person that believes that with a safety net for our most vulnerable citizens in place, and a regulatory environment that should protect but not inhibit, the market should be able to work. The press should be free and express the real policy views of the different philosophies. The editorial page is where the news media should comment.

“The choices seem pretty clear this election year: We have arguably the most left ticket offered by the Dems and the most populist ticket offered by the Reps. I would really appreciate both campaigns focusing on the factual record of the candidates and their policies.

“Thanks again for the facts first and then editorial, if any, at the end of the newsletter.”

“My expertise is in the medical field, and I do not have the time or the resources to sift through the propaganda that passes for news these days,” another reader adds.

“My expertise is in the medical field, and I do not have the time or the resources to sift through the propaganda that passes for news these days,” another reader adds.

“I rely on you, Byron King, Jim Rickards (although I disagree profoundly with him on several subjects) and Sean Ring (an entertaining hothead with a talent for explaining financial subjects) to shine the spotlight on what is really happening in the world.

“Your newsletter, and your balanced, thoughtful explanations and analysis, has been an unexpected bonus attached to my subscription to The Situation Report. I value it as much as the financial advice. You are a talented writer with a knack for bringing disparate information together into a cohesive whole. Witness your analysis of the JFK assassination.

“If you really feel that you cannot continue to write as you always do because of hostile readership (I don't know if you've received threats in addition to criticism), perhaps you would consider a paid subscription on Substack for those of us who would like to continue reading the uncensored Dave Gonigam. I, for one, would buy a subscription.”

Dave responds: I think the new policy is pretty-well circumscribed. Again, the idea is to make sure that casual readers don’t get the idea that I’m a Democrat if I knock a Republican at length or I’m a Republican if I knock a Democrat at length. It’s hard to be an equal-opportunity hater these days!

That said, the new policy still isn’t enough for someone who wrote in after yesterday’s edition to knock “persistent political remarks” that demonstrate “a glaring lack of professionalism.”

For the life of me, I can’t figure out what upset her so. Then again, in 2024 America, it seems some people spend much of their existence just looking around for opportunities to be offended…