Biden Banks

- Another day, another account closed for wrongthink

- Whatever the Fed says, believe the opposite

- From the follow-up file

- The war on portable generators

- Profiles in cowardice (congressional stock trading)

![]() Another Day, Another Account Closed for Wrongthink

Another Day, Another Account Closed for Wrongthink

So the powers that be got tripped up in their efforts to “de-bank” the British ex-politician and pundit Nigel Farage… but by the same token, they never give up.

So the powers that be got tripped up in their efforts to “de-bank” the British ex-politician and pundit Nigel Farage… but by the same token, they never give up.

So… That’s Dr. Joseph Mercola, an osteopath from Florida who for many years has been a leading light in the alternative- and complementary-medicine field. In the 2020s, he’s been a leading critic of the COVID jabs.

There’s strong reason to believe this action is not a one-off — that it’s part of an orchestrated campaign that, in time, will also take aim at everyday Americans who express opinions outside the mainstream.

But we’re getting ahead of ourselves…

First, a quick 5 Bullets flashback: In 2021, White House Press Secretary Jen Psaki told reporters, “We are flagging problematic posts for Facebook that spread disinformation.” Days later, The New York Times did an extensive hit piece on Mercola — along with a documentary that aired on the FX channel labeling him a “misinformation superspreader.”

First, a quick 5 Bullets flashback: In 2021, White House Press Secretary Jen Psaki told reporters, “We are flagging problematic posts for Facebook that spread disinformation.” Days later, The New York Times did an extensive hit piece on Mercola — along with a documentary that aired on the FX channel labeling him a “misinformation superspreader.”

Mercola, seeing the censorship writing on the wall, told readers he was taking down large portions of his website. And his new articles would be removed after only 48 hours.

In spotlighting this development at the time, we were already apprehensive about the potential for people being “financially canceled” — and this was before the Canadian truckers protesting vaccine mandates had their bank accounts frozen.

JPMorgan Chase’s account closings were, well, sweeping.

JPMorgan Chase’s account closings were, well, sweeping.

Not only did they target Mercola’s supplement business, Mercola Market. They also hit the personal accounts of Mercola Market CEO Stephen Rye, a joint account held by CFO Amalia Legaspi and her husband… and even an account held by Legaspi’s college-age son.

Chase offered no explanation… but Rye thinks it’s obvious: “I believe they canceled all of the accounts because of Dr. Mercola’s opinions,” Rye tells the Florida’s Voice website. “He has carried a contradictory view throughout the COVID narrative.”

For its part, Chase tells the website that’s not true — but it won’t offer up further details. “For privacy reasons, we can’t discuss customer relationships, but we don’t close accounts because of political affiliations, and we didn’t do so in this case.”

Mercola Market’s financial cancellation comes nine months after JPM did the same to Kanye West.

Mercola Market’s financial cancellation comes nine months after JPM did the same to Kanye West.

➢ Once more, we’re floored by the irony: Mercola and Kanye are too disreputable for JPM to give them the time of day… but the bank had no problem doing business with a sexual predator like Jeffrey Epstein and an infamous fraudster like Bernie Madoff. (And there are new developments with JPM and Epstein — which, alas, will have to wait until tomorrow.)

More disturbing, perhaps, last year JPM also canceled the account of a conservative outfit called the National Committee for Religious Freedom. Then JPM offered to reopen the account if the organization handed over its donor list and a list of political candidates it planned to support.

As Paradigm’s Jim Rickards sees it, what’s happening is the next logical leap after “Biden Bucks” — or maybe even a fallback if plans for Biden Bucks fail.

As Paradigm’s Jim Rickards sees it, what’s happening is the next logical leap after “Biden Bucks” — or maybe even a fallback if plans for Biden Bucks fail.

As you’ll recall, “Biden Bucks” is Jim’s shorthand for a CBDC or central bank digital currency.

“We’ve been warning readers for over a year,” Jim reminded his Strategic Intelligence readers last week, “about the dangers of CBDCs that are being implemented by the Biden administration to control your money and take away your freedoms.”

As a refresher, CBDCs would potentially have the capability to…

- Monitor what you buy

- Create a profile of you based on what you buy

- Freeze or seize your money at will.

But as we documented last spring, there’s been backlash against CBDCs — brought about in large part by Jim’s awareness campaign. Republican lawmakers in Washington have introduced legislation barring the Fed from pursuing a consumer-level CBDC. And if that fails, governors like Florida’s Ron DeSantis are moving to bar the introduction of CBDCs within their states.

If “Biden Bucks” fail… “Biden Banks” could be an end-run to achieving a similar outcome. Dr. Mercola’s top lieutenants are learning that, right now, the hard way.

There’s another disturbing aspect to this phenomenon that came up in conversation with Jim earlier this week — one that has to do with the regional bank crisis that struck earlier this year.

We’ll start peeling that onion in the days and weeks to come…

![]() Whatever the Fed Says, Believe the Opposite

Whatever the Fed Says, Believe the Opposite

Well, a recession is a lead-pipe cinch certainty — now that the Federal Reserve says it won’t happen.

Well, a recession is a lead-pipe cinch certainty — now that the Federal Reserve says it won’t happen.

To no one’s surprise, the Fed boosted short-term interest rates by another quarter percentage point yesterday to 5.5%, the highest since 2001.

The real news was that the Fed staff has ruled out a recession in its medium-term outlook for the first time since last November.

“The staff now has a noticeable slowdown in growth starting later this year in the forecast,” said Fed chair Jerome Powell, “but given the resilience of the economy recently, they are no longer forecasting a recession.”

That means you can count on a recession sooner or later. “Major multilateral financial institutions and central banks have the worst forecasting track records in the financial world,” Jim Rickards said earlier this year. “The Federal Reserve, ECB and the IMF are among the worst.”

Meanwhile, the betting in the futures market is that the Fed is done with this rate-raising cycle: There’s only a 36% probability of another increase before year’s end. Three more meetings are scheduled, the next on Sept. 19–20.

Meanwhile, the betting in the futures market is that the Fed is done with this rate-raising cycle: There’s only a 36% probability of another increase before year’s end. Three more meetings are scheduled, the next on Sept. 19–20.

But that could change on a dime with a “hot” inflation or job number. As it happens, the Commerce Department issues the Fed’s preferred inflation gauge tomorrow; it’s been stuck for six months between 4.6–4.7%, nowhere near the Fed’s 2% target.

Speaking of hotter than expected, that’s how you can describe all of the day’s economic data — which happens to be plentiful.

Speaking of hotter than expected, that’s how you can describe all of the day’s economic data — which happens to be plentiful.

Start with the Commerce Department’s first guess at GDP growth for the second quarter. It comes in at an annualized 2.4%. Literally no one among dozens of Wall Street economists polled by Econoday was expecting a number that strong.

Then there are durable goods orders — up 4.7% in June, in contrast with the “expert consensus” looking for a mere 0.5%. Granted, that was skewed by a surge in orders for aircraft — but even if you back out aircraft and military hardware, the growth in “core capital goods” was 0.2%, in contrast with expectations for a 0.1% drop.

Finally we have first-time unemployment claims — 221,000 in the week gone by; the four-week average is now the lowest since May. The labor market remains tight.

The strongest market reaction to these numbers comes in the precious metals. They tanked big-time as soon as the data were issued in one fell swoop at 8:30 a.m. EDT.

The strongest market reaction to these numbers comes in the precious metals. They tanked big-time as soon as the data were issued in one fell swoop at 8:30 a.m. EDT.

At last check, gold is down $27 to $1,945. Silver is down 72 cents to $24.17. If you want to attribute the drop to an expectation the Fed will have to keep raising interest rates — making no-yield precious metals less attractive — you’re welcome to do so. But we’re of a mind to chalk it up to pure manipulation.

Oil, meanwhile, is up $1.32 — cresting the $80 level for the first time since mid-April. As it happens, $80 is the midpoint of crude’s $70–90 trading range going back to Labor Day last year; as Paradigm trading guru Alan Knuckman sees it, a break over $80 is a bullish sign indeed.

The major U.S. stock indexes are a mixed bag. The Dow’s streak of 13 straight trading sessions in the green (the most since 1987) is in danger, the Big Board up barely a point at 35,521. The S&P 500, meanwhile, is up 0.4% to 4,584; if that holds, the index will close today at a 17-month high.

The Nasdaq has sprinted nearly 1% higher to 14,255 on the back of another positive earnings report from a “Magnificent Seven” company. This time it’s Meta Platforms; shares of Mr. Zuckerberg’s firm are up 6.6% on the day.

➢ Speaking of Magnificent Seven earnings, we must pause to brag: On the heels of Google parent Alphabet’s positive numbers yesterday, members of Zach Scheidt’s Income Alliance pocketed 63% gains from GOOG options they held for less than a month. That’s the power of Zach’s income strategy. Here’s another chance to learn how it works, introduced by Jim Rickards.

![]() The Follow-Up File

The Follow-Up File

Mastercard is warning cannabis retailers to stop taking debit cards for payment. In other news, cannabis retailers have been taking debit cards for payment.

Mastercard is warning cannabis retailers to stop taking debit cards for payment. In other news, cannabis retailers have been taking debit cards for payment.

As we have occasion to mention now and then, canna-businesses are cash only — because weed is still illegal on the federal level and banks are federally regulated.

But it seems a handful of retailers have been accepting debit-card payments anyway — and Mastercard has caught on. “As we were made aware of this matter, we quickly investigated it,” says a statement from Mastercard.

“In accordance with our policies, we instructed the financial institutions that offer payment services to cannabis merchants and connects them to Mastercard to terminate the activity."

We understand Mastercard’s caution here… but for crying out loud, it’s long past time for Congress to open up canna-businesses to the banking system. There’s bipartisan legislation to do just that — but we’ve seen these bills before and they always end up dying in committee.

(More about good legislation dying in committee momentarily…)

Go figure: The part of the electric grid that’s most under stress right now is the one we thought would be safe this summer.

Go figure: The part of the electric grid that’s most under stress right now is the one we thought would be safe this summer.

PJM Interconnection — which serves a swath of 13 states from the East Coast stretching west to Illinois — is under an “Energy Emergency Alert Level 1” today. That means it has enough juice to keep meeting demand, but only by drawing on its “contingency reserves.”

That’s not an outcome we were expecting in May: Back then, the North American Electric Reliability Corporation warned that the highest risk of rolling outages due to heat was in the central and western reaches of the country. But so far, they’re holding up OK even amid record heat in Texas and Arizona.

![]() The War on Portable Generators

The War on Portable Generators

If the power does go out, the White House wants to make it harder for you to have a portable generator for backup.

If the power does go out, the White House wants to make it harder for you to have a portable generator for backup.

On the heels of its gas-stove gambit, the Biden administration is drawing up rules that would effectively ban the sale of almost all gasoline generators now on the market. Specifically, the Consumer Product Safety Commission is proposing steep curbs on the amount of carbon monoxide a unit can emit, citing the risk of death from CO exposure.

Of course, that risk is minimal provided you use common sense, read the prolific warnings and don’t use the unit indoors or in an enclosed garage, right?

The Portable Generator Manufacturers’ Association points out an unintended consequence of the proposal: To meet the new requirements, new generators would need fuel injection systems and catalysts — which would make them run much hotter and create a fire risk not present with current designs.

Team Biden snuck this one in; the public comment period is already over. We await the final edict…

![]() Profiles in Cowardice (Congressional Stock Trading)

Profiles in Cowardice (Congressional Stock Trading)

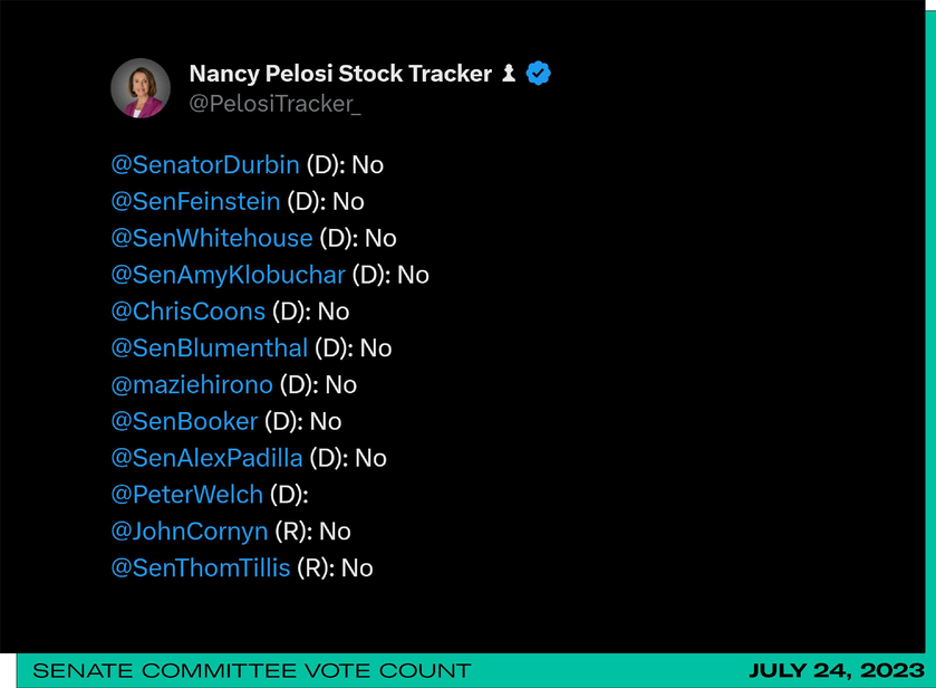

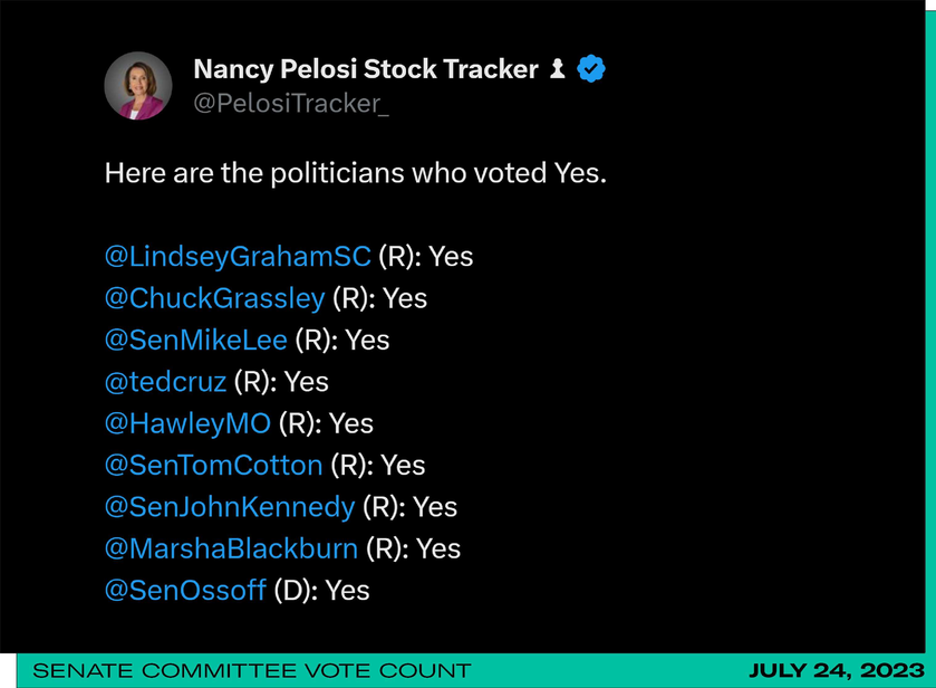

That swampwater in Washington is mighty deep: The Senate Judiciary Committee just killed a proposal to ban congressional stock trading, despite massive public support.

That swampwater in Washington is mighty deep: The Senate Judiciary Committee just killed a proposal to ban congressional stock trading, despite massive public support.

After a spate of negative publicity last year — much of it surrounding Nancy Pelosi when she was House speaker — a recent poll by Morning Consult and Politico finds 68% of registered voters supporting a ban on stock trading by members of Congress.

With that in mind, the Ban Stock Tracking for Government Officials Act was introduced by Sens. Josh Hawley (R-Missouri) and Kirsten Gillibrand (D-New York). It would apply not only to Congress but to the president, vice president and senior executive branch officials — as well as their spouses and dependents.

On Monday, the bill crashed and burned in committee by a vote of 9-12.

Here’s the thing: Most of those nine “yes” votes were cast after there were already enough “no” votes to assure the bill’s failure.

Here’s the thing: Most of those nine “yes” votes were cast after there were already enough “no” votes to assure the bill’s failure.

Democrats with safe seats lined up quickly to vote “no” — for example, Illinois’ Dick Durbin, Connecticut’s Richard Blumenthal and California’s fossilized Dianne Feinstein. They were joined by two Republicans, also with safe seats…

Once the bill was already dead, only then did the bulk of Republicans line up to cast their votes in favor…

On that “yes” list, we can safely assume Josh Hawley’s vote was heartfelt and genuine — seeing as he’s the bill’s sponsor.

Meanwhile, Georgia’s Jon Ossoff was the only Democrat to break ranks — and he’s shown an independent streak now and then — so his vote also seems like the real deal. Utah Republican Mike Lee also has an independent streak, so we’ll give him the benefit of the doubt, too.

Everyone else who voted “yes” gets the side-eye from us.

“These people waited to see who voted,” observed the tireless Glenn Greenwald on his nightly System Update webcast. “There were enough NO votes to ensure Sen. Hawley's bill failed and then they walked up and said, ‘I vote YES, let's ban stock trading!’”

To be sure, this isn’t the end of the story. On this occasion, the proposal was an amendment tacked on to another bill. Hawley is likely to reintroduce it as a stand-alone bill that would go before a different committee.

We’ll keep you abreast of its progress; but we figured you might like to know who the villains were in this chapter of the saga.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets