“Biden’s Hail Mary”

- How Biden plans to save his presidency

- How NOT to read a stock chart

- The downside (and upside) to Biden’s AI regulations

- McDonald’s: Rising prices… or falling currency?

- Mailbag: The next Elizabeth Holmes… and the scourge of DST

![]() How Biden Plans to Save His Presidency

How Biden Plans to Save His Presidency

This morning, the oil price slipped below $80 for the first time since the Hamas attack in Israel — one month ago today.

This morning, the oil price slipped below $80 for the first time since the Hamas attack in Israel — one month ago today.

In fact, a barrel of West Texas Intermediate is the cheapest it’s been since late August. And at $3.41, the national average price for a gallon of regular unleaded is 40 cents lower than at this time a year ago.

Both of these numbers are a reflection of a mindset that’s settled into the markets the last couple of weeks: The conflict in the Middle East will not spread beyond Israel, Gaza and maybe the West Bank.

But in reality, “The conflict between Israel and Hamas is rapidly escalating across the region and risks dragging the United States directly into the fray,” writes Cato Institute foreign policy scholar Jonathan Hoffman.

But in reality, “The conflict between Israel and Hamas is rapidly escalating across the region and risks dragging the United States directly into the fray,” writes Cato Institute foreign policy scholar Jonathan Hoffman.

Since Oct. 17, various groups of guerrilla fighters across the Middle East have lashed out against Washington’s support for Israel by lobbing missiles and drones at U.S. forces in Iraq and Syria.

The number of such attacks totals 38; the Pentagon says at least 45 U.S. troops have been lightly wounded.

On Oct. 27, U.S. forces launched airstrikes in eastern Syria against Iranian-linked targets — supposedly to “deter” more attacks. But fully half of those 38 attacks have taken place since then.

We’ll pose the question once more: What earthly purpose does the presence of U.S. troops in Iraq and Syria serve — except as a tripwire for war with Iran?

“The United States,” writes Hoffman, “now finds itself on a new war footing with Iran and its regional partners, whom many in Congress have cast as part of a new ‘axis of evil’ that includes Russia and China.”

Less than a year before the U.S. election on Nov. 5, 2024… a war with Iran might be the only way Joe Biden thinks he can save his presidency.

Less than a year before the U.S. election on Nov. 5, 2024… a war with Iran might be the only way Joe Biden thinks he can save his presidency.

The numbers look bad in a new Siena College poll commissioned by The New York Times: Only a half dozen or so states will be competitive next year, and Biden is losing to Donald Trump in five of them. “His Bidenomics pitch hasn’t worked,” frets The Wall Street Journal, “as voters remain sore about rising prices and fall in real wages during his presidency.”

If the economy is sucking wind, it’s a reasonable bet Biden wants to distract the populace by becoming a “wartime president.”

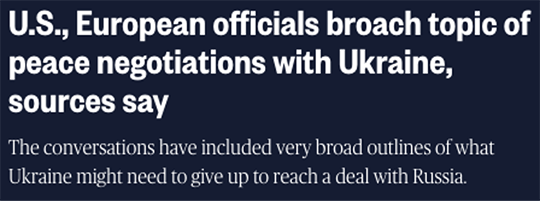

For a while, the war in Ukraine was supposed to serve that purpose — but it’s gone horribly awry.

For a while, the war in Ukraine was supposed to serve that purpose — but it’s gone horribly awry.

Of course, that’s what Paradigm’s Jim Rickards said would happen from the outset. But don’t take it from him, take it from the administration mouthpieces at NBC News. Look how the Ukraine-is-totally-winning narrative has turned on a dime.

“U.S. and European officials have begun quietly talking to the Ukrainian government,” reported the peacock network last Friday, “about what possible peace negotiations with Russia might entail to end the war, according to one current senior U.S. official and one former senior U.S. official familiar with the discussions.”

As Darryl Cooper, host of the brilliant MartyrMade podcast, tweeted, “Two years and hundreds of thousands of casualties later, Ukraine will now have to beg for a deal Russia would’ve gladly agreed to before the war.”

With looming failure in Ukraine, and Biden still desperate for a distraction from the economy, the administration surely sees a war against Iran as somehow more “doable.”

But for Americans, the consequences of war with Iran could be far more devastating than anything in Ukraine to date.

But for Americans, the consequences of war with Iran could be far more devastating than anything in Ukraine to date.

By one count, there are 73 U.S. warships assembling in the Eastern Mediterranean and other waters around the Middle East — including two aircraft carriers and two guided-missile destroyers.

As we’ve said before, they’re not there for Hamas — a guerrilla outfit with no navy or air force. They’re there for Iran and its assorted allies.

All it takes for the conflict to spread is the right spark. That’s why we’ve been warning you for the last several weeks about the possibility of a contrived incident analogous to the Gulf of Tonkin in 1964 — the phony “attack” on U.S. warships that Washington seized on to justify sending ground troops into Vietnam.

Once a wider war breaks out, “America could be as few as 17 days from a complete catastrophe,” warns Jim Rickards.

Once a wider war breaks out, “America could be as few as 17 days from a complete catastrophe,” warns Jim Rickards.

Why 17 days? Given the fast pace at which developments are breaking, Jim has rearranged his schedule to conduct a LIVE briefing tonight at 7:00 p.m. EST. For a preview, check out this link.

“I believe that the decisions you make in the next few days could be what make or break your financial future for years to come,” Jim says. “I’ve even invested my own cold hard cash into a specific stock to prepare for this looming crisis… And I’m going to give you the name and ticker completely free of charge.”

Again, the event is at 7:00 p.m. EST tonight. You can even submit questions for Jim ahead of time — just click here for access.

![]() How NOT to Read a Stock Chart

How NOT to Read a Stock Chart

“Panicking while everyone else is panicking rarely pays,” writes Paradigm trading pro Greg Guenthner — with an object lesson about the stock market’s huge rebound in recent days.

“Panicking while everyone else is panicking rarely pays,” writes Paradigm trading pro Greg Guenthner — with an object lesson about the stock market’s huge rebound in recent days.

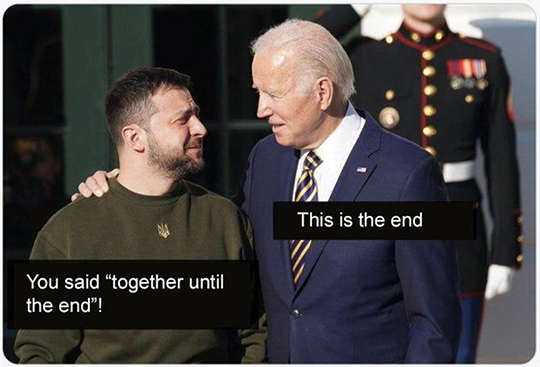

Recall: “It was looking bleak for the bulls heading into November. The major averages had just logged their third-straight monthly decline, with the S&P giving back every cent of its summer gains.” Between trouble in the Middle East and uncertainty about the Federal Reserve, “sentiment was in the gutter and the bulls were nowhere to be found.”

Result? “On Oct. 20, the S&P 500 closed below its 200-day moving average for the first time in seven months.”

Amateurs are quick to seize on such events as a put on your crash helmets moment. “But as any seasoned trader will tell you,” Greg continues, “a moving average isn’t a mystical line that releases some sort of stock-killing poison when price breaks beneath it. In reality, it’s simply a smoothing device that helps us identify the primary trend.

“More importantly, you tend to see longer-term buyers stepping in to buy when price moves below a rising 200-day moving average.” And looky here — the 200-day bottomed over the summer and has been rising since.

“Again, there are no guarantees in the market — and a breakdown from these levels was (and still is!) a possibility. But rushing to sell everything or short the market on this so-called breakdown would be a fool's errand.”

Especially when the market’s action so far this year lines up with the typical year before a presidential election — a bottom in October setting up a final year-end push.

“There are plenty of reasons to feel bearish about the market” Greg acknowledges. “But right now, price is telling you to hold your nose and buy into a potential year-end melt-up move.”

Sure enough, the rally that began at the end of October is carrying into today.

Sure enough, the rally that began at the end of October is carrying into today.

At last check, the S&P 500 is up a third of a percent to 4,380 — all told, a 6.4% jump that started a week ago Monday.

After a minor blip up yesterday, the yield on a 10-year Treasury note is headed back down — to 4.59%.

There’s no joy in precious metals — spot gold down to $1,964 and silver down 2% to $22.52. Bitcoin has slipped back below $35,000.

The aforementioned sell-off in crude has accelerated; the loss on the day is now 3% and a barrel of West Texas Intermediate fetches $78.36 — very near its 200-day moving average. Not that you should jump to conclusions — see above.

There are no economic numbers of note this week. The next “big” one on the calendar is the official inflation number due a week from today.

![]() The Downside — and the Upside — to Biden’s AI Regulations

The Downside — and the Upside — to Biden’s AI Regulations

The Biden administration’s executive order governing AI could be worse, in the estimation of Paradigm’s venture capital veteran James Altucher.

The Biden administration’s executive order governing AI could be worse, in the estimation of Paradigm’s venture capital veteran James Altucher.

James is quick to acknowledge the downsides, much as we did last week: “In a worst-case scenario,” he says, “the executive order could have negative impacts on American innovation and competitiveness.”

Specifically, progress could slow to the speed of molasses. “If the pace of AI reviews looks anything like approvals for new drugs, companies developing cutting-edge AI may find that they can't bring products to market as quickly as they are accustomed to.”

But it’s early days: “The rules are new, and it's unclear if the government even has the power (or ability) to regulate AI,” James says.

But it’s early days: “The rules are new, and it's unclear if the government even has the power (or ability) to regulate AI,” James says.

“I expect big companies like Microsoft and Google will pay a busload of expensive lawyers to fight any restrictions that will prevent them from remaining competitive.”

In addition, the speed factor mentioned above works both ways: “It will take months or even years before the rules are developed and finalized. In all likelihood, Biden will be living with the spirit in the sky by the time the rules are ready to be enforced.”

Meanwhile, “the rest of the executive order is generally positive for AI fans,” James allows. “It calls for increased research funding to develop AI for cybersecurity, protect privacy, transform education and improve health care.

“This is likely to be massively beneficial in the near term for our AI portfolio picks” — that is, the AI portfolio recommended in Altucher’s Investment Network. “An influx of government research funding into the development of AI is likely to feed their bottom lines for years to come.”

![]() McDonald’s: Rising Prices… or Falling Currency?

McDonald’s: Rising Prices… or Falling Currency?

We’re still not done with our musings about the recent price increases at McDonald’s.

We’re still not done with our musings about the recent price increases at McDonald’s.

In addition to the 1961 newspaper ad that says “Feed a family of five for $2.25” — yeah, good luck doing that on $23.24 if you’re going by the official inflation numbers — we stumbled on something else to chew on…

![]() Mailbag: The Next Elizabeth Holmes… and the Scourge of Daylight Saving Time

Mailbag: The Next Elizabeth Holmes… and the Scourge of Daylight Saving Time

A reader seeks to answer a question we posed yesterday: How many other Elizabeth Holmeses are out there and we just don’t know about it because, for the time being, they’re getting away with it?

A reader seeks to answer a question we posed yesterday: How many other Elizabeth Holmeses are out there and we just don’t know about it because, for the time being, they’re getting away with it?

“Practically every research lab at major universities and corporations,” he replies. “They may not be getting the hundreds of millions Lizzie got but they'll do anything to get their piece of the pie of research grants like fudging numbers on their research.

“Oh, and to get that money you have to mention the buzzwords like ‘climate change’ and ‘sustainability.’”

On the subject of daylight saving time, “My wife moved here from Asia where there is no daylight saving time in her home country.

On the subject of daylight saving time, “My wife moved here from Asia where there is no daylight saving time in her home country.

“She asked why we do it? It makes no sense? I agreed.

“Here in Alberta, we recently had a referendum and just like you said, they wanted to switch permanently to DST. How to get rid of a bad idea — make it permanent. The switch to DST fulltime was very narrowly defeated.”

“When ancient sages determined that the Earth fully rotates in 24 hours,” writes our final correspondent, “it led to dividing the world into 24 segments of longitude, called ‘time zones,’ where the sun would be roughly overhead at noon.

“When ancient sages determined that the Earth fully rotates in 24 hours,” writes our final correspondent, “it led to dividing the world into 24 segments of longitude, called ‘time zones,’ where the sun would be roughly overhead at noon.

“This has led to innumerable debates about adjusting working hours to be during the ‘day’. Clearly, people feel strongly about this even though these time considerations are mostly a bias of long habit and physical location (think ‘midnight sun’ in far-northern latitudes).

“I direct your attention to the U.S. Navy submarine force, where sailors go months without ever seeing the sun.

“In my Navy experience, as soon as my submarine set sail, the quartermaster reset all the ship's clocks to Zulu time (GMT for you landlubbers). This was a worldwide practice. In this way, if the Pentagon ordered something to be done at 0800Z, all the ships did it at the exact same time, no matter where they were physically located. Breakfast at 0600, lunch at 1200, dinner at 1800 and midnight rations at 0000, no matter what the sun or moon might be doing above the surface; and we got used to it rather quickly.

“I find it rather amusing to read about the acrimony that standard/daylight time is causing. Come on, is this the biggest thing people have to worry about?”

Dave responds: Well, it’s probably easier to make that adjustment if you don’t see the sun for an extended stretch of time.

The bigger point is that DST is one more example of government types who think they’ve got it all figured out and presume to dictate to the rest of us how we should live.

As with many bad ideas, this one started as a wartime measure — specifically with America’s misbegotten entry into World War I.

In other words, it was yet another “innovation” from the same world improvers and do-gooders who brought us the income tax, the Federal Reserve and popular election of U.S. senators. It can’t go into the rubbish bin fast enough…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. For all the warnings Jim Rickards has issued this year about the BRICS, the currency wars and CBDCs… the warning he’s issuing tonight takes precedence over all of those.

If Washington is going to allow itself to be sucked into yet another Middle East war — or, worse, if Joe Biden will deliberately get into a war as a Hail Mary to save his presidency — the consequences for the U.S. economy will be severe.

We’re talking 1970s-style gas lines — if there’s any gas to be had — and store shelves stripped bare as they were in the early days of COVID. And that’s the best-case scenario.

Jim believes there’s a slender 17-day margin between “normal” life and catastrophe — for reasons he’ll lay out tonight at 7:00 p.m. EST.

This event is available to watch FREE — no advance registration required. Follow this link for a preview.