Crussia

![]() Everything’s Fine (Part 1)

Everything’s Fine (Part 1)

On the occasion of President Vladimir Putin’s election to a fifth term in office, President Xi Jinping welcomed his “good neighbor, friend and partner” to Beijing this week.

On the occasion of President Vladimir Putin’s election to a fifth term in office, President Xi Jinping welcomed his “good neighbor, friend and partner” to Beijing this week.

“[They] pledged to intensify cooperation against U.S. ‘containment’ of their countries, as they warned of growing nuclear tensions between rival powers,” Bloomberg says.

If you ask the question, you already know the answer…

“In a joint declaration after more than two hours of talks in Beijing on Thursday,” Bloomberg continues, “Putin and Xi accused the U.S. of planning to station missile systems around the world that ‘pose a direct threat to the security of Russia and China.’”

Then there’s this de-dollarization nugget…

“Putin noted that 90% of trade between Russia and China was settled in yuan and rubles,” Bloomberg reports. “This means we can say our trade and investments are effectively safeguarded from the influence of third countries,” Putin jabbed.

“Putin noted that 90% of trade between Russia and China was settled in yuan and rubles,” Bloomberg reports. “This means we can say our trade and investments are effectively safeguarded from the influence of third countries,” Putin jabbed.

As for trade between the two countries: “Driven by Russian oil and gas sales and purchases of electronics, industrial equipment and cars, Moscow’s trade with China hit a record $240 billion in 2023.” Or its equivalent in yuan and rubles…

“Despite that, China’s exports to Russia have dipped for the past two months,” says Bloomberg. “The U.S. has warned China over its trade with Russia, threatening to sanction banks that prop up the Kremlin’s war machine.”

In case, however, you need further proof that U.S. sanctions are misfiring: “Putin added that Moscow and Beijing had agreed to step up banking ties and increase the use of national payment systems.

“Details of those agreements and the ones signed before cameras were not released.”

Not that our firm hasn’t warned about the dollar’s reserve-currency demise for years… As we’ve said on more than one occasion: It’s a process, not an event.

Not that our firm hasn’t warned about the dollar’s reserve-currency demise for years… As we’ve said on more than one occasion: It’s a process, not an event.

For further edification, we include something Dave wrote last year: “While the trend has been taking shape for nearly a decade, Washington crossed a Rubicon in its weaponization of the dollar [after] Russia invaded Ukraine — freezing all of the Russian central bank’s dollar-denominated assets.

“Now the blowback is inevitable — and irreversible.”

And today? Imagine if the U.S. and its Western allies cross another Rubicon: liquidating aforementioned Russian assets to fund Ukraine’s war effort. An idea Jim Rickards calls “the dumbest ever.”

In light of which, Russian economist Alex Isakov says: “Putin will continue to press his ultimate goal of seeing China fully replace Europe in terms of energy trade, technology transfer and financial markets.

“A ‘Crussia’ plan would take years and billions of dollars to execute,” he says, “but may be Russia’s only rational option.” We only hope it’s not Russia’s nuclear option.

![]() Everything’s Fine (Part 2)

Everything’s Fine (Part 2)

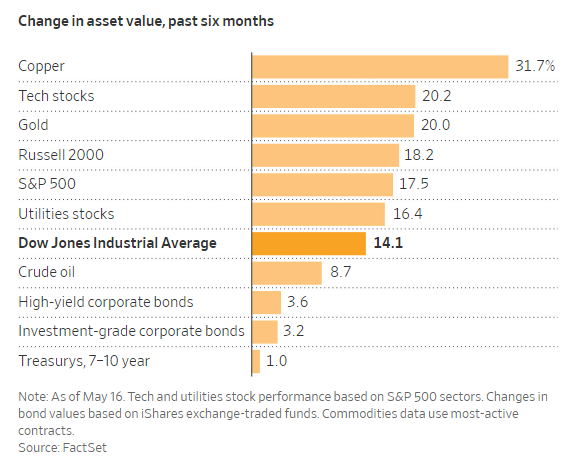

“Investors are striking gold in most every market,” The Wall Street Journal trumpets today.

“Investors are striking gold in most every market,” The Wall Street Journal trumpets today.

“The Dow Jones Industrial Average crossed the 40,000 mark for the first time Thursday amid an almost picture-perfect investing environment featuring resilient corporate profits, low unemployment and easing inflation.”

Wait, what?

“Although many Americans have a negative view of the overall economy, partly due to persistently high prices, they are more upbeat when it comes to stocks,” WSJ says.

Not to mention that two of the top three best-performing assets are commodities, but OK…

Source: FactSet, WSJ

More on copper and gold in a moment. But taking a look at stocks, the S&P 500 and tech-heavy Nasdaq are both hanging out in the red today, down 0.05% and 0.10% respectively. The Big Board, on the other hand, has gained about 0.10% market cap — still 85 points under Thursday’s record-breaking 40,000.

Back on the commodities beat, crude is up 0.35% to $79.52 for a barrel of West Texas Intermediate. Meanwhile, metals — across the board — are catching a bid.

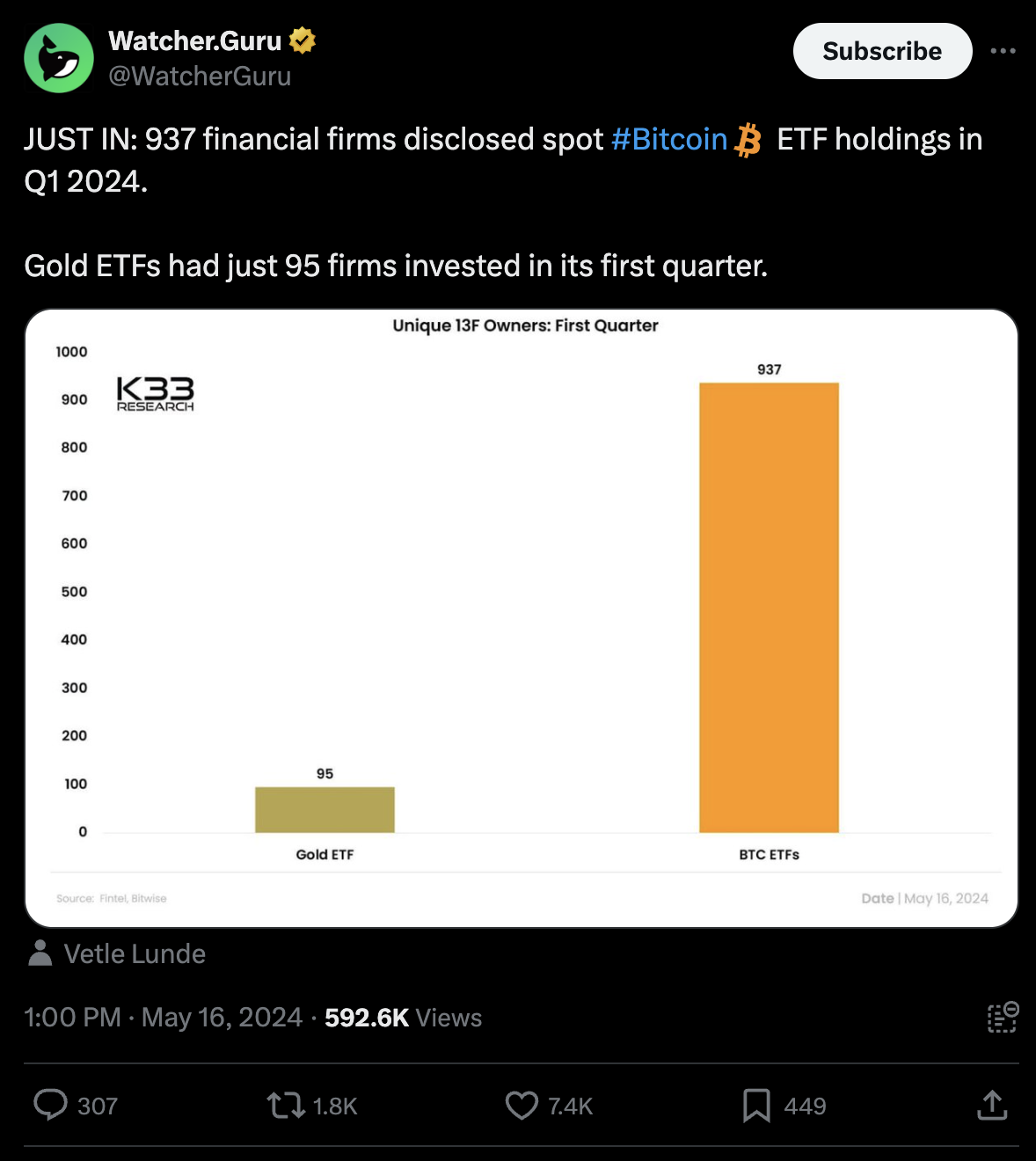

It feels like it was just yesterday: “Most Registered Investment Advisors (RIAs) still don’t have much of an allocation to gold,” said Paradigm’s income-investing ace, Zach Scheidt.

It feels like it was just yesterday: “Most Registered Investment Advisors (RIAs) still don’t have much of an allocation to gold,” said Paradigm’s income-investing ace, Zach Scheidt.

Here’s a comparison to Bitcoin…

“So those professional investors continue to be a big source of demand as their high-net-worth customers request more exposure [to gold] from their advisors,” Zach repeats. All to say, that’s a lot of runway for gold’s take-off.

Today?

- Gold: Up 1.20% to $2,413.80 per ounce

- Silver: Up 3.75%, a penny under $31

- Copper: Up 3.25%, over $5

- Platinum: Up 1.70%

- Palladium: Up 1.25%

Crypto is getting some love too. Bitcoin is up 2.6%, just a few dollars away from $67,000. And Ethereum is really rallying: up 5% to $3,100.

For more on Ethereum…

The DOJ busted two MIT graduates for pulling off a $25 million cryptocurrency heist.

The DOJ busted two MIT graduates for pulling off a $25 million cryptocurrency heist.

The Justice Department alleges it’s the first crime of its kind: Brothers Anton and James Peraire-Bueno, who studied mathematics and computer science, took months to plan what they called “The Exploit.”

Namely: “[The brothers] were able to successfully exploit a vulnerability in the MEV-boost software used by the Ethereum blockchain to validate transactions before adding them,” says GovTech.

“This allowed them to redirect the flow of the cryptocurrency on pending transactions, sending it to them instead of the intended recipient.”

In a matter of 12 seconds.

When an Ethereum representative confronted the brothers, they tried to cover their tracks via money laundering and wire fraud.

If convicted, the Peraire-Bueno brothers face sentences up to 20 years. No bueno.

Of course, crime doesn’t pay, but… do you think the feds will Frank Abagnale their asses? As our colleague Sean Ring puts it: “Ethereum should immediately hire them and call the theft a sign-on bonus.”

![]() Boeing’s in the (Alphabet) Soup

Boeing’s in the (Alphabet) Soup

U.S. prosecutors have determined that Boeing Co. (BA) violated the terms of a 2021 agreement related to the two 737 MAX crashes that killed 346 people.

U.S. prosecutors have determined that Boeing Co. (BA) violated the terms of a 2021 agreement related to the two 737 MAX crashes that killed 346 people.

The agreement, which included a $2.5 billion settlement, required Boeing to design and enforce a compliance program to prevent future violations of fraud laws.

The DOJ, however, believes Boeing breached its obligations under the agreement and will attempt to prove that these violations were committed knowingly.

The Justice Department’s decision comes after a recent incident involving an Alaska Airlines 737-9, where investigators found missing bolts in the aircraft's door, suggesting manufacturing issues at Boeing and its supplier Spirit AeroSystems Holdings Inc. (SPR).

Boeing has until June 13 to respond to the DOJ's decision.

Separately, Boeing agreed to pay $200 million to settle charges with the SEC related to misleading claims about the crashes. The SEC is also investigating whether Boeing misled investors after the Alaska Airlines incident.

Also? The Federal Aviation Administration (FAA) has set a deadline for Boeing to address systemic quality control issues in its commercial aircraft manufacturing operations and is looking into falsified production records for the 787 Dreamliner.

DOJ… SEC… FAA.

BA? OMG!

![]() Gimme Space!

Gimme Space!

“Elon Musk’s Starlink IPO is making serious progress,” says Paradigm’s science-and-technology expert, Ray Blanco.

“Elon Musk’s Starlink IPO is making serious progress,” says Paradigm’s science-and-technology expert, Ray Blanco.

“In 2019, Starlink launched its first 60 satellites into orbit,” he notes. “The company has since increased that number by 100x with nearly 6,000 satellites today.”

When complete, Starlink is expected to consist of a constellation of 40,000 satellites delivering high-bandwidth, low-latency internet access anywhere on Earth.

Ray adds: “Elon Musk has said that he’ll take Starlink public once they can predict its cash flow reasonably well. And it looks like he’s finally approaching that goal.

“Last year, Starlink achieved breakeven cash flow. Based on the new revenue projections for 2024” — $6.6 billion, according to research firm Quilty Space — “it's now expected to achieve positive free cash flow this year.

“This will be a major milestone for the inevitable IPO,” Ray says. “Whenever the company goes public, early investors stand to win big.”

You don’t have to wait until Starlink’s IPO to make moves. Ray’s already identified a Starlink-partner stock you can buy today. Check out his FREE report: “The $50 ‘Hidden Backdoor’ to Elon’s Next Billion-Dollar IPO.”

![]() Copper Thieves Target Tesla

Copper Thieves Target Tesla

“More than half a dozen Tesla Supercharger nozzles were cut and stolen at a charging station outside the Vallejo Target this past weekend,” reports a Bay Area ABC affiliate.

“More than half a dozen Tesla Supercharger nozzles were cut and stolen at a charging station outside the Vallejo Target this past weekend,” reports a Bay Area ABC affiliate.

“Nine charger nozzles were cut and stolen, nine others untouched, along with generators that were untouched.”

TikToker Josua Beckler says: “There is a ton of copper in those cables and seeing that they had removed the cables and taken them with them as well as the junction block that had a ton of copper in it, then it's pretty obvious that they went to go scrap it.”

Courtesy: ABC7, X

Here’s a closeup of vandals’ handiwork, this time in Houston…

Courtesy: KPRC 2 Click2Houston on YouTube, Autoevolution (Edited)

“One of the main reasons electric vehicle stations might be targeted is due to their locations,” says an article at InsideEVs. “Chargers are typically installed in areas with convenient public access. These areas have a lot of foot traffic during the day but are practically deserted at night.”

South of the Bay Area, the city of Fresno has also been targeted by vandals: 50 of the city’s 88 charging stations have been mangled.

“So by the end of the summer, they will be installing new custom cabinets around each of the units,” the article notes. “These cabinets can be secured during off-peak hours.

“The purchase and installation of 88 custom cabinets will cost around $176,000. Whereas the raw materials from all 88 stations combined would probably be worth only $500-$750.”

Hmm… Desperate times.

On that grim note, touch grass this weekend, as the kids say.

Take care.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets