End-Run Around the U.S. Dollar

- BRICS vs. the dollar: The next chapter

- Magnificent Seven: Even good names get punished

- Magazine covers are often wrong (Just not right away!)

- Load shedding: Still a high-probability risk

- The Mailbag: EVs and BS

![]() BRICS vs. the Dollar: The Next Chapter

BRICS vs. the Dollar: The Next Chapter

Quietly, the BRICS nations just fired a new volley in the global currency wars.

Quietly, the BRICS nations just fired a new volley in the global currency wars.

Last week, the quintet of Brazil, Russia, India, China and South Africa rolled out BRICS Pay — a new financial settlement platform for its member countries, and another end-run around the dollar.

As a reminder — and as Paradigm’s Jim Rickards predicted over the summer — the BRICS are adding six new member states as of Jan. 1. Former arch-rivals Iran and Saudi Arabia are coming under the BRICS umbrella, along with the United Arab Emirates, Egypt, Ethiopia and Argentina.

BRICS Pay is not a new currency per se. And while it’s blockchain-based, it’s not a cryptocurrency or a CBDC either. But it will smooth the way for cross-border transactions.

“It is designed as a digital service that does not have a single acceptable currency — it is designed so that any of the BRICS member currencies can be used,” writes Paul Goncharoff at the Silk Road Briefing website. “The main goal is to enable trade and financial transactions between the BRICS countries by bypassing the United States dollar and euro, and reducing dependency on Western financial systems such as SWIFT.

“Two of the BRICS members — Russia — and Iran have already been disconnected from the SWIFT network, and had overseas financial assets frozen, while threats to do so have also occasionally been made to some of the others, including China. That has placed a greater urgency in developing an alternative system, while planning to counter future potential political financial sanctioning.”

Now get this: A major Western bank has already integrated BRICS Pay into its digital payment platforms.

Now get this: A major Western bank has already integrated BRICS Pay into its digital payment platforms.

London-based Standard Chartered is part of BRICS Pay along with BRICS-based banks like China’s ICBC, Russia’s Sberbank and the State Bank of India.

Is BRICS Pay an instant death blow to the dollar? No. But as I said a few moments ago, it’s the latest volley in the global currency wars that Washington launched in 2010.

The next volley is set for later this week — when the Federal Reserve issues its latest proclamation on interest rates.

What’s the connection? And how does the latest conflict in the Middle East fit in?

Jim Rickards laid out the answers last night in his exclusive briefing titled Rickards War Forum: The Next Shots Fired.

If you missed it, it gets off to a fast start: At only 1:17 in, he’ll tell you why a secret global financial war is coming to a head. And at only five minutes in, he’ll lay out a strategy that could allow you to take home returns of 616%... $1,300%... and $1,900% as the turmoil plays out.

Click here for the replay of the event — and don’t wait, because once the Fed makes its move on Wednesday, it could be too late to act.

![]() Magnificent Seven: Even Good Names Getting Punished

Magnificent Seven: Even Good Names Getting Punished

Apple divulges its earnings later this week — the sixth of the Magnificent Seven companies to report this quarter.

Apple divulges its earnings later this week — the sixth of the Magnificent Seven companies to report this quarter.

Going into last week’s reports we told you how Paradigm’s retirement specialist Zach Scheidt was keen on both Google parent Alphabet and Facebook parent Meta — both profitable blue chip tech names, both generating lots of AI buzz.

Both delivered fine numbers — but both saw their share prices punished.

Meta “came in with profits that were very strong, but they're forecasting a slowdown in their advertising revenue as we become more worried about a potential recession,” says Zach. Another factor: “A lot of times advertisers don't like to spend as much during wartime.” Bad optics.

The Alphabet report stung more, seeing as Zach has a GOOG trade in his Income Alliance trading advisory. “Alphabet talked about their cloud business being softer than expected, and this is an area where investors were excited about Google's growth. I do still think that Google's parent, Alphabet, they're going to be OK.”

But in the meantime, “Google may have gotten ahead of itself a bit. And this pullback, I'm watching it carefully to see if we can find support or not. If we can find support, then we may be able to adjust our positions and really profit from a rebound. If Google continues to be weak and if the overall market continues to be weak, then we may need to just cut bait and run with that one.”

Easing the sting is a 188% gain Income Alliance members booked last week playing put options on Align Technology, a maker of orthodontics devices. “That's just proof of our balanced approach,” Zach says, “and why that makes sense for us as investors, because we are able to make profits on stocks that pull back, and that can help offset some of our losses.”

The U.S. stock market is starting the new week with a modest rally.

The U.S. stock market is starting the new week with a modest rally.

After sinking into “correction” territory on Friday — that is, a 10% drop from its late-July peak — the S&P 500 is up two-thirds of a percent as we write to 4,143.

The other major indexes are up stronger — the Nasdaq three-quarters of a percent at 12,731 and the Dow a little less than 1% at 32,704. Treasury yields are moving back up, the 10-year note at 4.91%.

The spot price of gold jumped over $2,000 late on Friday — a geopolitical risk hedge as Israel sent ground forces into Gaza — but at last check the bid was $1,997. Silver is up a bit to $23.26. For no obvious reason, crude is down $2.50 to $83.11, on the low end of its October trading range.

Among the market-moving stories in play is an impending end to the autoworkers strike; the UAW and General Motors came to terms this morning after reaching an agreement over the weekend with Stellantis and Ford last week.

![]() Magazine Covers Are Often Wrong — Just Not Right Away!

Magazine Covers Are Often Wrong — Just Not Right Away!

Is this another case of “the magazine cover indicator”?

Is this another case of “the magazine cover indicator”?

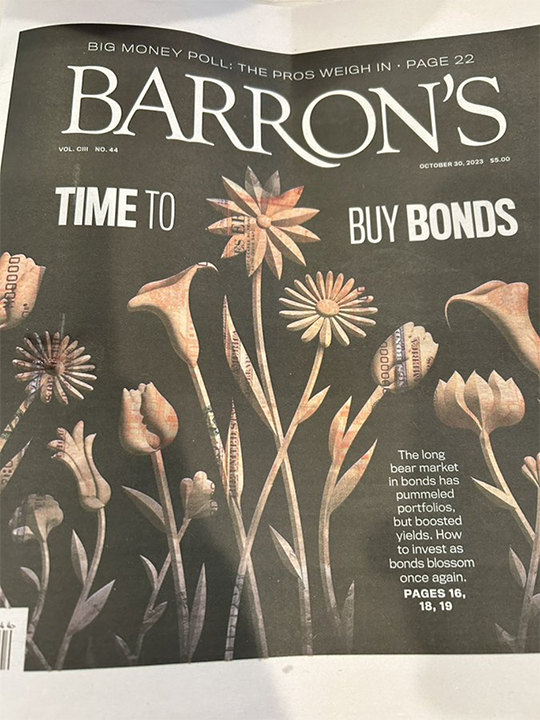

In financial lore, “the magazine cover indicator” says that whenever a major periodical like Barron’s or Fortune makes a big, bold pronouncement… it’s a reflection of conventional wisdom, and conventional wisdom is about to be proven wrong.

The gist of this week’s Barron’s cover is that after two or three horrid years for bonds — falling prices, rising yields — the market is about to turn.

As we mentioned in real-time, the bond market reached a grim milestone last week — with the yield on a 10-year U.S. Treasury note topping 5% for the first time since 2007. The article’s conclusion — “the end of the bond bear market” is nigh.

Skeptics have been quick to pile onto the Barron’s cover. And while the skeptics are probably onto something… they might also be early.

Skeptics have been quick to pile onto the Barron’s cover. And while the skeptics are probably onto something… they might also be early.

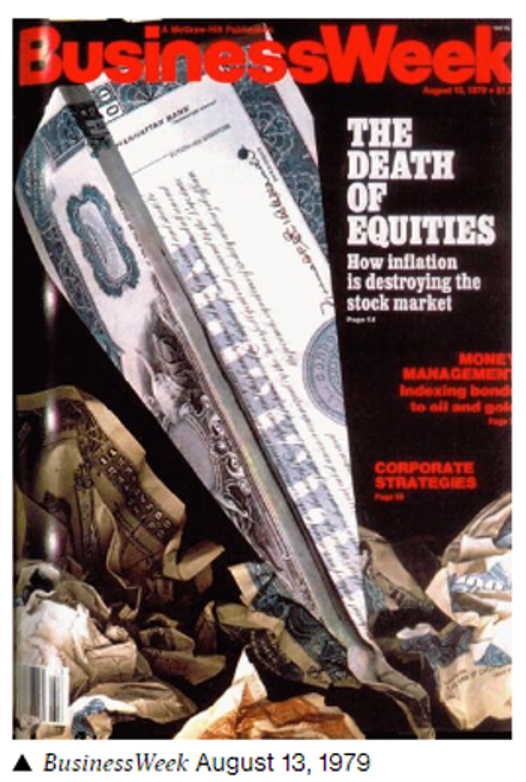

On Xwitter, goldbug Lawrence Lepard says the Barron’s cover will age as badly as “The Death of Equities” — the iconic cover story in BusinessWeek over four decades ago. It’s the original example of the magazine cover indicator.

Dated Aug. 13, 1979, the cover and article reflected the zeitgeist at the end of the inflationary ’70s. Stocks had been beaten down for so long that the investing public had left them for dead. There was no hope.

Here’s the thing: It is absolutely true that the stock market embarked on an epic bull run in the 1980s and ’90s. But that bull run didn’t get underway in earnest until August 1982 — a full three years after that magazine cover.

We suspect Barron’s will likewise be proven wrong — just not right away. Long-term interest rates move in decades-long cycles, and the lows probably came in 2020 when the yield on the 10-year Treasury hit 0.5%. In all likelihood, we’re in for three or four decades of rising rates — and falling bond prices.

But long term that trend won’t move in a straight line. If the economy is on the verge of rolling over… and/or if a metastasizing Middle East war sparks a flight to safety… it’s entirely plausible that the 10-year yield will pull back from the current 5% levels to maybe 3.5% next year.

The aforementioned Zach Scheidt has been talking up TLT — the 20+-year T-bond ETF — to readers of his Rich Retirement Report e-letter. And he’s recommended TLT call options to readers of Rickards’ Insider Intel.

“Considering how oversold this market has become,” he wrote earlier this month, “bonds could rebound quite a bit very soon.”

![]() Load Shedding: Still a High-Probability Risk

Load Shedding: Still a High-Probability Risk

This is a reminder that even though the country got through the summer without planned electricity blackouts… the risk remains.

This is a reminder that even though the country got through the summer without planned electricity blackouts… the risk remains.

“Policymakers on both sides of the aisle agree that the American power grid isn’t equipped to meet the surging electricity demand of the future,” Politico reports after the news site hosted a “grid reliability” panel on Wednesday.

“Lawmakers and industry officials debated the Environmental Protection Agency’s controversial proposed power plant rule to curb greenhouse gas emissions, the role of natural gas in future electricity generation and permitting reform needed to expand the electricity network.”

One of the more interesting comments came from Jim Matheson, CEO of the National Rural Electric Cooperative Association. “Demand is going up. Supply is not keeping up with it. And so our margins are getting thin.”

That was affirmed by Heather Teilhet of the Oglethorpe Power Corp. in Georgia: “There’s a misconception out there that because we just brought on a giant new nuclear reactor on our system that we’re flush with energy and the truth is we need to add capacity already again.”

The good news is that even Democrats are willing to revisit the National Environmental Policy Act to speed up the permitting of permitting new plants. “We have to turn over every rock in all the environmental laws that are taking up time and figure out how to get the results we need in a much faster way,” says Rep. Scott Peters (D-California).

For now, however, it’s only Republicans questioning the Biden administration’s proposed carbon regulations for power plants: Most plants fired by fossil fuels would have to slash their carbon emissions by 90% by 2040, a rule that would effectively force the plants’ shutdown.

As a reminder, America’s power generation capacity hasn’t grown meaningfully since 2011 — and electric vehicles are sure to put additional stress on the grid.

Going into this summer, two-thirds of the country was at risk of “load shedding” — planned blackouts to ensure the power grid wouldn’t collapse altogether. That risk did not pan out — but it’s also not going away.

![]() The Mailbag: EVs and BS

The Mailbag: EVs and BS

“Stop the BS,” demands a reader after we spotlighted a study on Saturday saying the real cost of driving an electric vehicle works out to the equivalent of a gallon of gasoline costing $17.33.

“Stop the BS,” demands a reader after we spotlighted a study on Saturday saying the real cost of driving an electric vehicle works out to the equivalent of a gallon of gasoline costing $17.33.

“Most people with electric cars charge at home and even in Southern California my San Diego Gas & Electric cost to charge my Tesla is $0.10 a kilowatt hour and that equates to $1 to drive 30 miles. Your $17 a gallon is BS.

“Stop doing what our corrupt government does, manipulating. Also, you remind me of the medical industry manipulating benefits. If you continue to do this you are no better than the globalist left.”

Dave responds: Where’s the manipulation?

All we’re saying is that your $1-per-30-mile equivalent doesn’t begin to cover the actual cost. Most of it is coming out of the hide of the taxpayer.

That includes your own hide; you just don’t notice it because there’s no line item for EV subsidies on your tax forms.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets